Editor’s note: Seeking Alpha is proud to welcome Woodforde Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Trevor Williams/DigitalVision via Getty Images

Investment Thesis

At Woodforde Investments we follow a long-term and value-oriented approach of looking for investment opportunities that we think give us a high chance of safely covering our capital outlay with future earnings as soon as possible.

We have been watching Mitsubishi Corporation (OTCPK:MSBHF) due to its track record of strong earnings, individual performances of its diversified business segments, and a number of potential tailwinds in the economic outlook. At attractive valuation levels, we believe the Mitsubishi stock would be a good addition to a value-focused portfolio.

The Company

Mitsubishi Corporation is one of the “Big 5” Japanese trading companies, which are unique and complex organizations that have strong historic roots in and business links to Japan, but now run more diversified operations across the globe. Mitsubishi’s operations are divided into 10 groups, which are concentrated in industrial businesses.

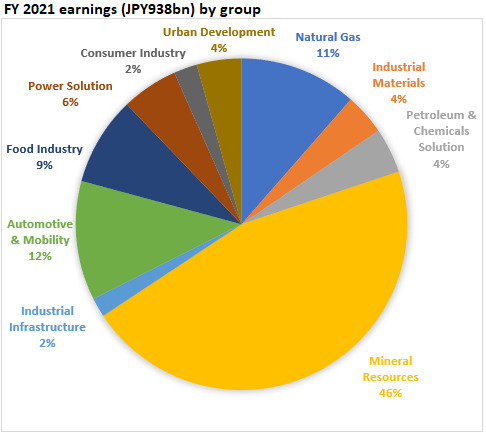

Record earnings in 2021 driven by the Mineral Resources group (compiled from financial results presentation)

The company announced record earnings in Financial Year 2021 of JPY938bn. A breakdown shows that almost half of its earnings came from the Mineral Resources group, buoyed by its exposure to metallurgical coal which enjoyed significant price gains. We also saw balanced, profitable returns from the other nine groups in the company.

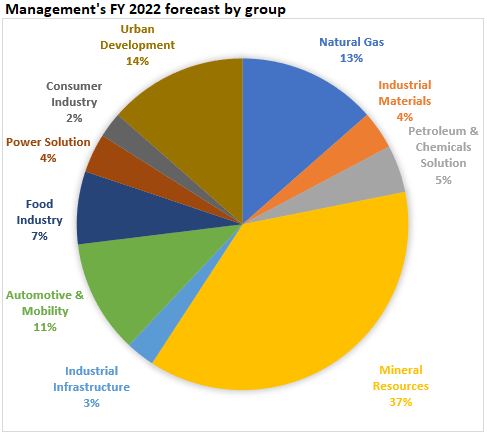

Management’s expectations of more balanced returns across segments (compiled from financial results presentation)

Lower earnings (JPY850bn) were forecast for FY2022, as we noted management’s expectation of lower commodity prices weighing on Mineral Resources performance, offset by remaining areas to provide a larger proportion of the company’s profits (JPY556bn).

Reported Q1 2022 earnings of JPY534bn achieved 63% of FY forecasts, and again driven by a substantial contribution from the Mineral Resources group as coal price weakness did not eventuate. Drilling down further we saw that almost all groups are on track to exceed earnings forecasts for the full year. The exception being Natural Gas’ subdued results, which are notable considering LNG price strength (management attributed this to trading losses).

Continued oversized contribution from Mineral Resources, but strong performance across business groups (compiled from financial results presentation))

It is notable that management did not revise their full-year outlook after the Q1 results although there is precedence of conservative expectations from management in recent years. Overall, we concluded that performance across the board is strong, and we expect full-year earnings to significantly exceed levels currently communicated.

Valuation

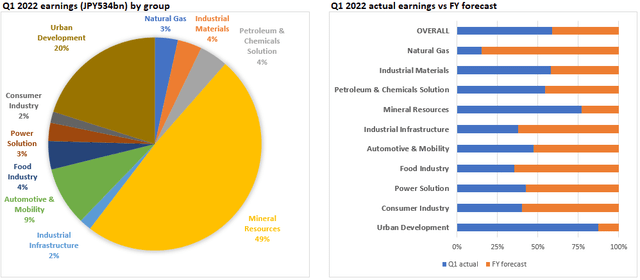

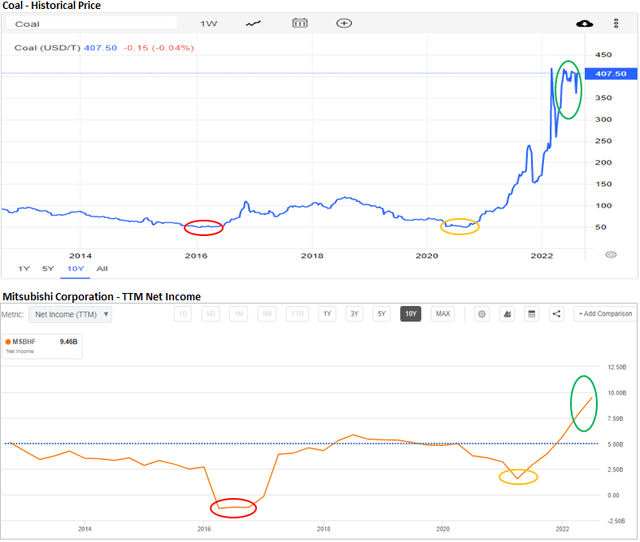

High coal prices in the last year contributed significantly to Mitsubishi Corporation’s TTM revenue of JPY1,273bn. Looking back at historical performance, we found it interesting that the price of coal and the earnings of Mitsubishi Corporation show strong correlation, with coinciding troughs in 2016 and 2020, and the upward trajectory since 2021. We paid attention to the JPY600bn/year ($5bn/year, USDJPY=120) earnings levels it roughly achieved in the prior decade when coal was around $100/T.

The correlation between coal prices and company earnings. We look to build a base-case around sustained future earnings of JPY600bn ($5bn) (above: tradingeconomics.com; below: Seeking Alpha)

At the time of writing, the MSBHF stock was trading at a price/earnings ratio of 5 which by value standards is attractive, especially considering that this is lower than the norm of 7-9x in recent history.

We think that a full-year earnings expectation beat is not currently priced in, and coupled with a normalization of P/E back to 7x, we calculated the fair value of the stock to be closer to $50.

In trying to estimate a conservative forward earnings level, we looked to exclude commodity exposure volatility from our calculation and settled on the above-mentioned JPY600bn/year as a base case. This also approximates to current earnings of the company ex. Mineral Resources group, and a ROE of below 10%. At this level, this equates to an implied forward P/E ratio of 10x.

Mitsubishi Peer Comparison

Mitsubishi Corporation is joined in the “Big 5” by Mitsui & Co. (OTCPK:MITSY), ITOCHU Corporation (OTCPK:ITOCF), Marubeni Corporation (OTCPK:MARUY), and Sumitomo Corporation (OTCPK:SSUMF).

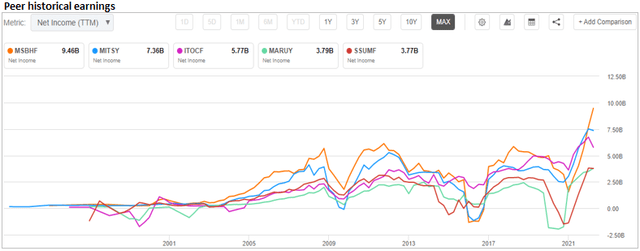

A comparison of these companies’ historical earnings shows that it has grown largely in lockstep with each other, and also their relative standing among each other has been largely unchanged. This is a reflection of each of these companies’ track record in (1) protecting themselves from competition by developing strengths in certain areas and geographies, (2) finding ways to adapt and adjust in an everchanging economic landscape, and (3) seeking out untapped business opportunities globally where their know-how and networks are of value.

Earnings among the Big 5 have ebbed and flowed together over the years (Seeking Alpha)

In our view, all 5 companies will continue to maintain their individual competitive advantages over each other, and protect themselves from being disrupted materially by foreign competition or innovative technology in the foreseeable future.

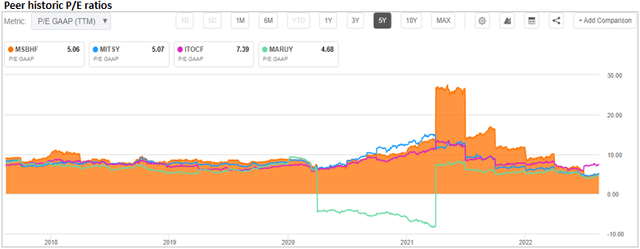

From a valuations standpoint, MSBHF’s current P/E multiple is comparable to its peers.

Mitsubishi Corporation’s P/E multiple is comparable to peers, but visibly lower compared to its own historic levels. (Seeking Alpha)

Upside Risks

We considered the following themes to have the potential to positively impact our base-case:

Relative strength of the Japanese economy: Although much more global than in earlier years, Japanese trading companies perform integral roles in the Japanese economy. Japanese GDP is positive and is expected to remain so in the coming years, which differs from that of the country’s many western counterparts. A strong Japanese economy is expected to support business volumes for Mitsubishi Corporation.

Trend towards onshoring/global supply-chain reform: Intentions of companies from Japan and like-minded countries to reform their global supply-chains means that Mitsubishi Corporation will stand to benefit as clients restructure their operations and re-route existing business flows.

Trend towards sustainability/carbon neutrality: Areas such as Natural Gas, Mineral Resources, and Power Solutions are structured to benefit as the transition towards sustainability gathers speed, and payoffs for these businesses are expected to be fully realized in the medium to long term.

Near-term continued tailwinds from commodity prices: Our base case attempted to look past volatility in commodity-exposed businesses; however, current strong prices are undeniably providing a boost to earnings. A prolonged continuation of this environment will be a meaningful windfall for company earnings. Likewise can be said for weaker JPY levels, which benefits a Japanese company with substantial earnings in foreign currencies.

Diversified product mix: All 10 business areas are performing strongly, which gives multiple streams of potential future growth, and protection against isolated underperformance of certain businesses.

Shareholder returns: The company is buying back shares, and in its mid-term strategy pledged a target total payout ratio of 30-40% of earnings by 2024.

History of earnings growth: Based on historical data on hand, Mitsubishi Corporation shows a trend of long-term earnings growth, giving confidence that this can be sustained.

Track record of long-term earnings growth, although punctuated by rough periods during economic downturns (Seeking Alpha)

Downside Risks

Limited recessionary resilience: The above graph also clearly shows downturns in earnings coinciding with periods of adverse economic conditions (2009: Global Financial Crisis; 2016: commodity price collapse; 2021 pandemic-driven recession). An occurrence of a similar period again can be expected to curtail the company’s earnings.

Overreliance on commodities: The company’s losses in 2016, and the oversized contribution of Mineral Resources currently raises concerns on the negative impacts a commodities market collapse would have on earnings. Although our base case effectively looked to zero-ize Mineral Resource earnings, our bear case is prolonged periods of negative corporate earnings because of excessive commodity exposure.

Geopolitical risks: Mitsubishi Corporation operates globally and cooperates with clients from across the globe, which leaves its businesses exposed should geopolitical hostilities escalate. The write-down of Russian assets in Q1 2022 is a recent reminder of this.

Conclusion

An estimated forward P/E of 10x loosely aligns with the coverage of the initial capital outlay within 10 years in our thinking. Combined with a strong earnings track record, a resilient business model, durable competitive standing, and an imbalance of macroeconomic factors weighted to the upside, we estimate capital coverage can be achieved in the ballpark of 6-9 years – a duration that makes Mitsubishi Corporation an attractive value investment opportunity.

Near term, we are looking for the stock price to converge towards $50. We would keep an eye on coal prices as a proxy to company earnings, and would look to take advantage if an evident decoupling with the share price occurs.

Be the first to comment