Design Cells/iStock via Getty Images

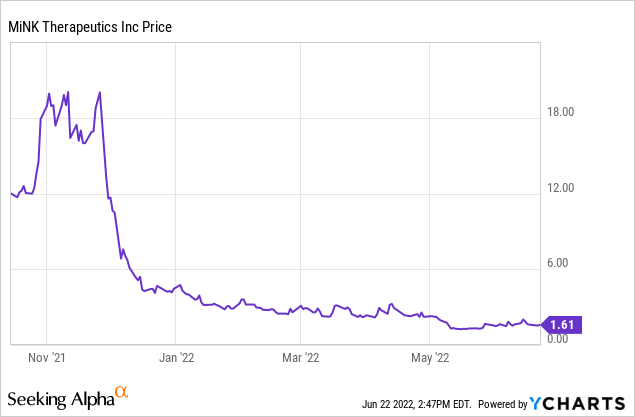

MiNK Therapeutics (NASDAQ:INKT) is a clinical-stage biotechnology company specializing in engineering immune system cells to provide therapies for cancers and other diseases. Initial enthusiasm for the stock, which had its IPO in October 2021 at $12 per share and which then peaked at $22.16 per share, has turned to deep gloom. It traded at $1.61 per share at the close on June 17, 2021. The IPO was a spinoff of a division of Agenus (AGEN), which remains a shareholder. The CEO, Jennifer Buell, was previously President of Agenus. I believe that, given the platform and achievement to date, the IPO price is more appropriate than the current price.

Engineering immune system cells now has a track record going back at least as far as Dendreon’s Provenge therapy for prostate cancer, approved by the FDA in 2010. CAR-T therapies now generate hundreds of millions of dollars in revenue each year with continued rapid growth. Several biotech companies are in various stages of novel cell engineering, including Fate Therapeutics (FATE) and Sana Biotechnology (SANA). This article will focus on MiNK’s platform and potential value.

Science Background

T cells are white blood cells, or lymphocytes, that have receptors that are specific to various antigens and when activated release cytokines. NKT, or natural killer T cells are subgroup that share some properties with natural killer cells. Invariant NKT cells, or iNKT, express an invariant T-cell receptor chain. These cells respond rapidly to their specific antigens and to pro-inflammatory cytokines. Activated they can have broad effects on T cell proliferation, B cell activation, and activation of macrophages and dendritic cells. While important for controlling diseases, they can also promote inflammatory diseases. Another notable property is their ability to modulate both innate and adaptive immune responses.

MiNK has learned to engineer iNKT cells. This allows the cells to be targeted and grown in bulk. Engineered cells have been shown to have no neurotoxicity or cytokine release syndrome at therapeutic doses. Nor do the cells need to be taken from a specific patient, engineered, and then injected back into the same patient. This may offer many advantages over other forms of cell therapy.

INKT Q1 Results & Cash Balance

MiNK was spun off from Agenus in October 2021. In Q1 2022, MiNK reported no revenue and a net loss of about $7.8 million. The main expense was R&D at $5.3 million. The company ended the quarter with $34.7 million in cash and equivalents. While the low spend rate may seem like it could allow the cash to last for another 4 or so quarters, I expect the spend rate to increase as clinical trials progress. We could see at least one top-line Phase 1 readout in 2022, which could mean starting a Phase 2 trial some time in 2023. Clearly much more cash will need to be raised for Phase 2 and 3 trials and then, with luck, commercialization. Strong Phase 1 results might boost investor interest and the stock price, making it easier to raise funds. In any case, there will be dilution, the extent of which is hard to predict since it depends on both trial results and market conditions.

AGENT-797 pipeline

AGENT-797 is currently in Phase 1 trials for three indications and should start a fourth this year. Combined with checkpoint inhibitors it is being tested on patients with solid tumors. As a monotherapy it is being tested for Multiple Myeloma; GvHD (graft versus host disease); and ARDS (acute respiratory distress syndrome) resulting from viral infections. Both the solid cancer and Multiple Myeloma trials should have some data readout this year.

Data so far are very preliminary, but MiNK reported in March that AGENT-797 could be dosed in solid cancer patients at up to 1 billion cells without lymphodepletion, neurotoxicity, or cytokine release syndrome. The hope is that, at this dose, the ongoing Phase 1 trial will also show the same anti-cancer activity seen in preclinical studies.

Pre-Clinical Pipeline

MiNK’s pipeline page characterizes AGENT-797 as native iNKT cells, which I interpret as un-engineered except for creating large numbers in a manufacturing facility. The next round of iNKT oncology therapies is characterized as targeted. These are all preclinical at this point, though one is characterized as IND-ready (ready to ask the FDA permission to proceed to a human trial). These four therapies are: BCMA-CAR-iNKT; Stromal Target CAR iNKT; NY-ESO-TCR; and iNKT Cell Engager. Actual target diseases have not been announced, but BCMA is a common blood target, and CAR-T and TCR therapies are well known to biotechnology investors.

The Long March To Revenue

While on occasion the FDA approves therapies based on Phase 2 data, in almost all cases at least one large, randomized, blinded Phase 3 trial is necessary. MiNK is just getting started. Cancer trials, in particular, can take years. Even if a Phase 2 trial gets started in 2023, it is hard to imagine a therapy approval before 2028. However, investors may not have to wait that long for a good return on initial investment. Good clinical data tends to drive biotech stocks higher. That possibility has to be weighed against potential stock dilution, as mentioned above, and possible bad data reports.

Conclusion

Clearly, even as small-cap biotechnology companies go, MiNK is quite speculative. We should know a lot more about its therapies by the end of this year, but even good, full Phase 1 data does not guarantee success in Phase 2 and Phase 3 trials. I would not recommend this stock to anyone who is at all risk adverse. On the other hand, the upside is tremendous. The current market capitalization of the stock is just $54 million. One company with a CAR-T pipeline, Juno Therapeutics, was sold to Celgene in 2018 for $9 billion, and it did not get its first therapy approved by the FDA until February 2021. If, like me, you like the science, and appreciate just how cheap the company is to buy now compared to the IPO price, and can afford the risk and be patient, you might want to put this stock on your watch list, or even buy some while it is cheap.

Be the first to comment