Montes-Bradley/E+ via Getty Images

Thesis

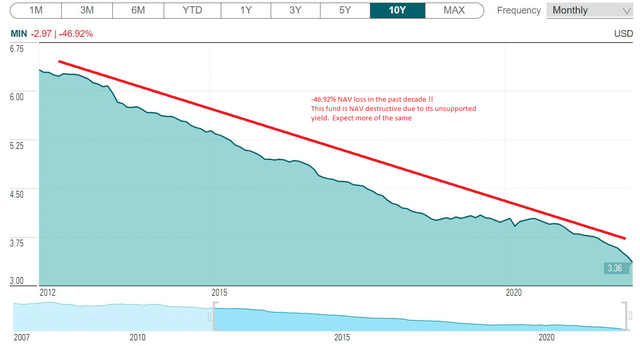

The MFS Intermediate Income Trust (NYSE:MIN) is a closed end fund that invests in Treasuries and investment-grade bonds. The vehicle’s dollar-weighted average life will normally be between three and ten years. The fund currently has an eye-popping 9.47% yield that is unsupported by the underlying securities cash flows. Unlike other CEFs, this vehicle does not employ leverage, hence the net cash provided by the portfolio is even lower than a vehicle with 2-3x leverage on this asset class. The vehicle pays the respective yield from the fund’s “principal” via return-of-capital distributions, which have resulted in an astounding -5% annual NAV give-ups, basically halving the NAV of the fund in the past decade.

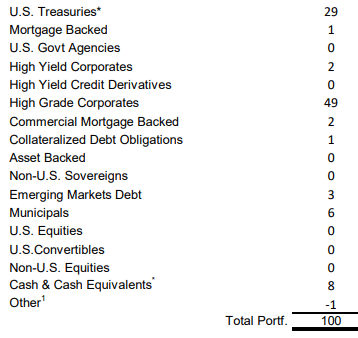

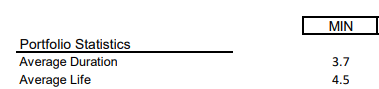

MIN’s true total returns lie around the 2% mark, as seen in its trailing 5- and 10-year total returns which sit at 2.6% and 1.7% respectively. The fund runs a 3.7 years duration and has been impacted this year by the rising rates environment, being down more than -11%. The fund invests in Treasuries (29% of portfolio) and investment-grade bonds (49% of portfolio) mainly and has a good credit quality portfolio, insulated from credit defaults. However given the fund composition the vehicle is susceptible to rising rates, in particular, losing value as 5-year yields keep increasing. The vehicle is currently trading at a -7% discount to NAV but there is not much to like here.

The underlying NAV will be further negatively impacted by rising rates, the fund will keep shrinking as it pays an astounding ~5% return of capital, and an informed investor should expect around a 2% annual total return as a buy and hold retail holder. We do not like this fund, we do not like its metrics or the current set-up with a high ROC. We do not feel this is a good proposal for a buy-and-hold retail investor with plenty of other good opportunities around. We rate it Sell.

Holdings

The fund mainly holds Treasuries and investment-grade bonds:

Holdings (Fund Fact Sheet)

The fund also has small buckets for emerging market debt, municipals and CMBSs, but they are all very small in comparison with the main factors that drive the fund performance.

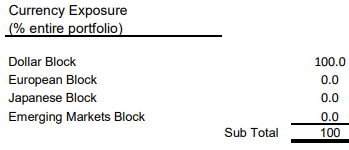

The fund is entirely dollar based:

Currency Exposure (Fund Fact Sheet)

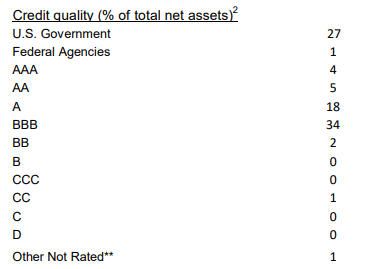

On the investment-grade portfolio the fund is overweight BBB credits:

Ratings (Fund Fact Sheet)

We do not specifically like when managers barbell the credit exposure towards BBBs, because although indeed they will yield more, they are also much riskier in the investment-grade universe than single-A or double-AA credits and are a hidden way of gaining yield. A ratings transition matrix will show how these credits many times fall in the “fallen angel” bucket when they get downgraded to junk.

Market Risk

The fund runs a 3.7 years duration profile through its portfolio:

Duration (Fund Fact Sheet)

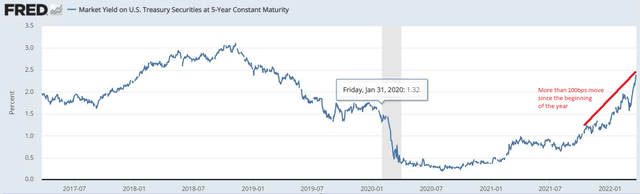

This metric is on the low side but was not able to escape this year’s tremendous rate rise:

We have seen 5-year yields rise more than 1% this year on the back of a rampant inflation picture and a Federal Reserve that needs to act aggressively in order to address the second vector of its mandate, namely price stability. We believe 5-year rates are headed to 3% with a flat yield curve out the maturity ladder that indicates the fact that the market thinks 2023 might actually bring rate cuts.

NAV Performance

Due to the fact that the fund distributes a 9%+ yield that is unsupported by the received cash in the portfolio, what it ends up doing is paying that yield from NAV:

We do not like any NAV give-up above -1% since it represents a destructive management behavior and is not reflective of actual underlying assets performance or risk. In our mind, such a large discrepancy between yield and assets cash flows constitutes a marketing gimmick purely and is there to attract AUM rather than anything else. We are understanding in certain circumstances where on odd years a fund has to make a larger than normal ROC distribution due to timing issues, but on a 10-year basis, we do not want to see an annual NAV give-up above -1%. Investing in this fund means that every year 2/3rds of what you are getting is actually your own cashback.

Conclusion

The MFS Intermediate Income Trust is a closed end fund focusing on Treasuries and investment-grade bonds. The fund is not leveraged but somehow pays a yield of 9%+. The math behind that yield reveals a very substantial 5% annual ROC, which is astounding given the NAV erosion it generates. The fund has been affected from a NAV perspective by the rising rates environment as well, and we expect further weakness as 5-year yields move to our target of 3%. We do not like this fund, we do not like its metrics or the current set-up with a high ROC. We do not feel this is a good proposal for a buy-and-hold retail investor with plenty of other good opportunities around. We rate it Sell.

Be the first to comment