iantfoto/E+ via Getty Images

Introduction

My thesis is that Berkshire Hathaway Energy (“BHE”) is thriving given that there are advantages in having Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) as a parent.

Getting Clean And Increasing Value

In a recent article, the Financial Times says the Berkshire parent remains lowly rated on climate action. However, BHE’s MidAmerican subsidiary is doing well in this regard as they have a parent who is a full taxpayer such that they can wholly participate in green energy tax programs. The specifics of BHE’s tax advantages can be abstruse but we got an introduction about them in the Spring 2012 meeting when an audience member from Kansas asked about MidAmerican’s wind and solar investments. Vice Chairman Greg Abel wasn’t yet in that position back in 2012, but they found him in the audience and got a mic to him such that he was able to provide insight. CEO Warren Buffett said the federal wind subsidy is 2.2 cents for ten years per kilowatt hour. Vice Chairman Abel chimed in noting that the Berkshire parent is advantaged as a full taxpayer:

Significant advantage there, relative to Berkshire being a full taxpayer, where a lot of other entities in the U.S. are not – or the corporate entities that are competing for those projects relative to ourselves often don’t have the tax appetite for those type of assets.

CEO Buffett repeated Vice Chairman Abel’s point that Berkshire has a competitive advantage because they pay tremendous amounts in federal taxes such that they are able to get a dollar-for-dollar benefit that eludes other utilities. CEO Buffett then guessed that 80% of the utilities in the US can’t reap the full tax benefits as they pay little or no federal taxes. He clarifies that this is because these other utilities tend to wipe out their taxable income with bonus depreciation.

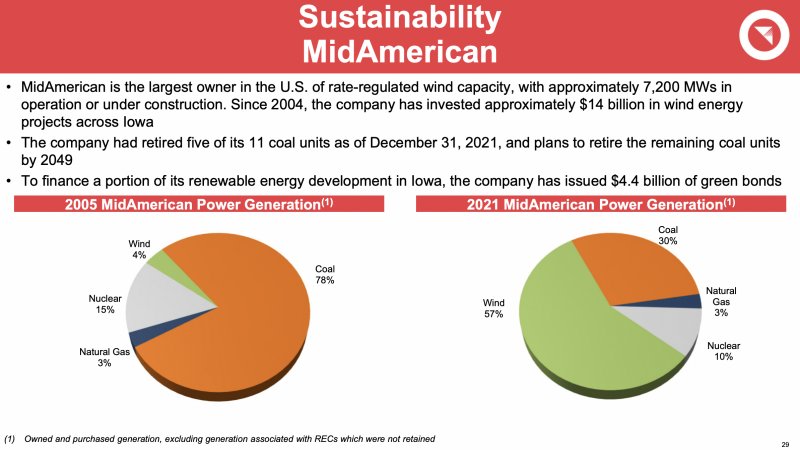

BHE’s 2022 Fixed Income Presentation reveals that MidAmerican’s power generation has gone from 78% coal in 2005 down to 30% in 2021. Picking up the slack, their wind generation has gone from 4% up to 57% because of investments driven by tax incentives:

MidAmerican Wind Energy (BHE 2022 Fixed Income Presentation)

The wind performance at MidAmerican has risen steadily from 2011 to 2021:

MidAmerican Wind Performance (BHE 2022 Fixed Income Presentation)

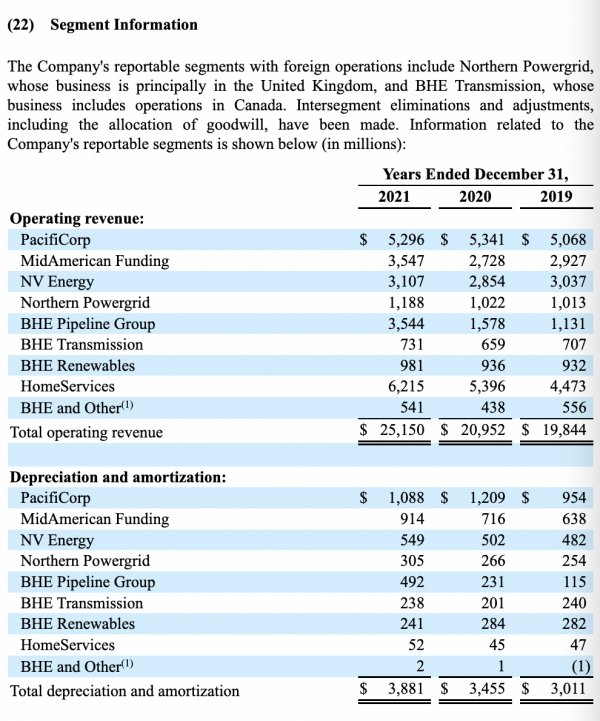

Putting things into perspective, MidAmerican generated $3,547 million of BHE’s $25,150 million operating revenue in 2021 per the 10-K:

BHE Segment Information (10-K)

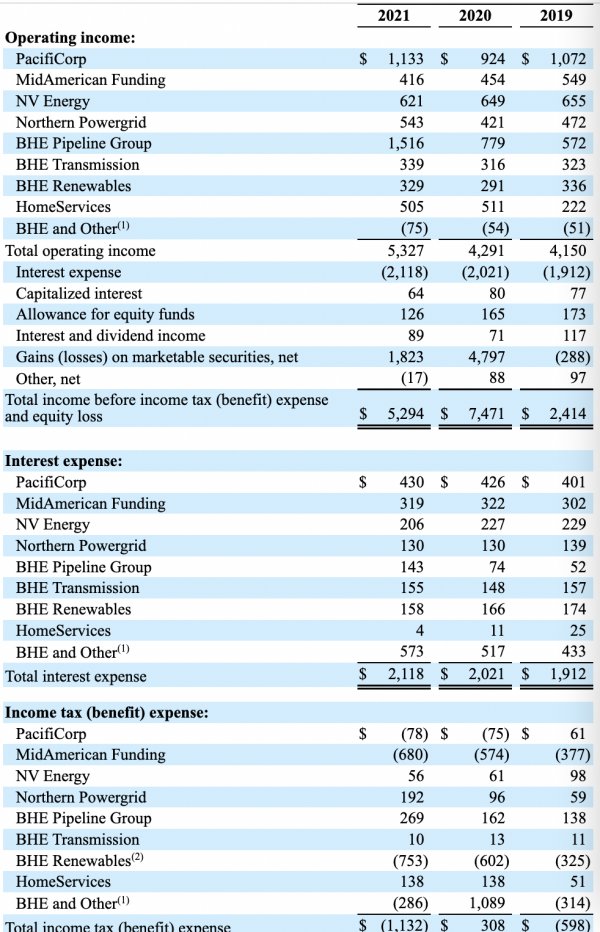

The tax benefits for MidAmerican and BHE Renewables stand out as $680 million and $753 million, respectively, for 2021:

MidAmerican tax benefits (BHE 10-K)

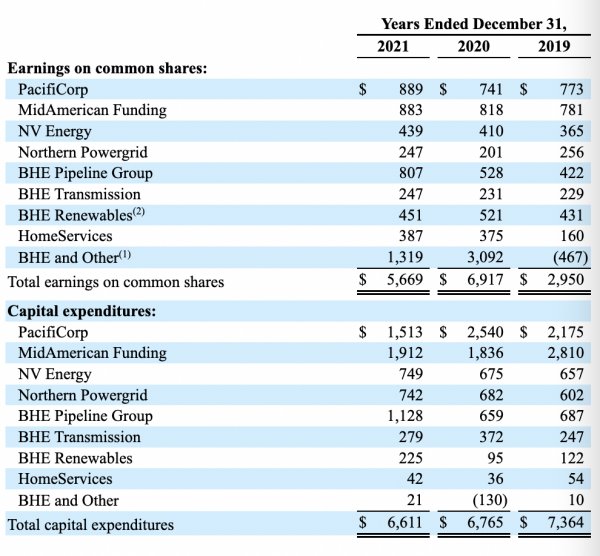

Due to large growth capex investments, MidAmerican tends to be high in overall capex relative to other segments:

MidAmerican capex (BHE 10-K)

It isn’t just at MidAmerican where tax benefits arise, BHE’s 2022 Fixed Income Presentation talks about the numbers in aggregate:

Tax appetite of Berkshire Hathaway has allowed us to receive significant cash tax benefits from our parent of $1.4 billion and $1.5 billion in 2021 and 2020, respectively.

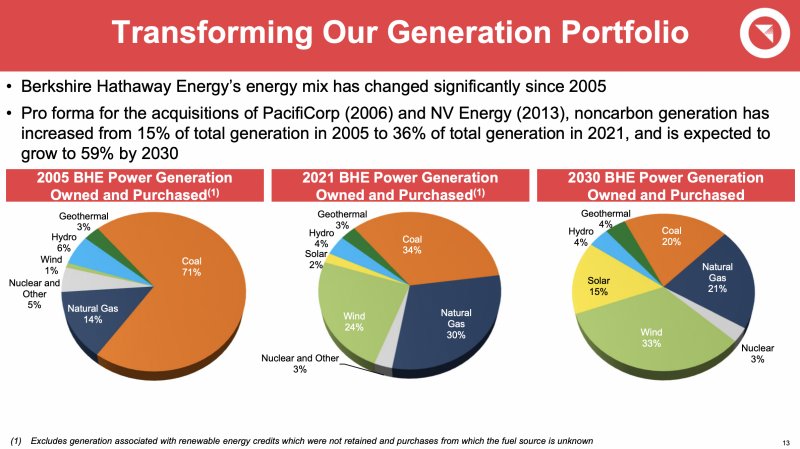

Overall, BHE has seen coal drop from 71% of generation in 2005 down to 34% in 2021 and they expect it to fall to 20% by 2030:

BHE Generation Portfolio (BHE 2022 Fixed Income Presentation)

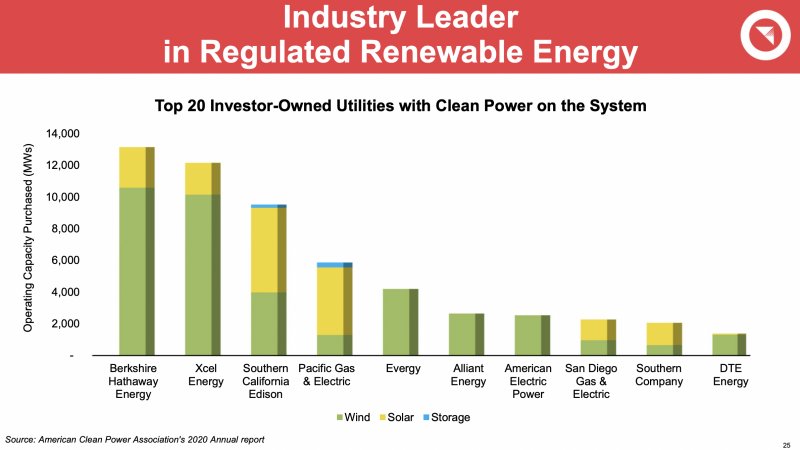

By participating heavily in tax incentives, BHE has become an industry leader with renewable energy:

BHE Industry Leader (BHE 2022 Fixed Income Presentation)

Parent Implications

Identified as one of the “Big Four” giants of Berkshire’s empire in CEO Buffett’s 2021 annual report letter, BHE is extremely important and the tax implications are key for long-run planning. Later in the parent annual report, Vice Chairman Abel has his own mini letter/summary on pages A-3 and A-4 in which he focuses on sustainability for BHE and another of Berkshire’s giants, BNSF:

BHE, through its Iowa utility MidAmerican Energy, began construction of its first wind turbines in 2004, investing a little over $300 million in these assets. Today, MidAmerican has over 3,400 turbines in operation and has invested $13.6 billion in wind production. This incredible expenditure helps MidAmerican to produce renewable energy equivalent to 88% of its Iowa customers’ annual energy needs. It is attracting new customers too – data center activity is growing exponentially throughout Iowa, driven by MidAmerican’s combination of low cost and clean power. This is not the end of MidAmerican’s journey – just last month, the company announced plans for a new $3.9 billion wind and solar project, which will enable renewable generation in excess of its customers’ annual usage in Iowa by 2025. The commitment to renewables goes beyond Iowa. In addition to the $13.6 billion invested in wind at MidAmerican, BHE has invested $16.5 billion in other wind, solar and geothermal energy projects that it operates and has financed an additional $6.9 billion for other operators.

Vice Chairman Abel goes on to remind readers that BHE plans to invest heavily in new transmission lines in the West to connect remote non-carbon resources as told in Berkshire’s 2020 annual report.

Although CEO Buffett is irreplaceable, these “Big Four” giants show that Berkshire is well set up for the future when he eventually steps down as Chairman and CEO. Much like the way Apple continued to grow when Steve Jobs handed the reins to Tim Cook, I am optimistic that Berkshire will continue to do well when Vice Chairman Greg Abel takes over. He knows that the first giant, the insurance business, is in good hands with Vice Chairman Ajit Jain. The second giant, Apple, is obviously not impacted by changes at Berkshire. Vice Chairman Abel is already writing about the last 2 giants, BNSF and BHE, in the annual report.

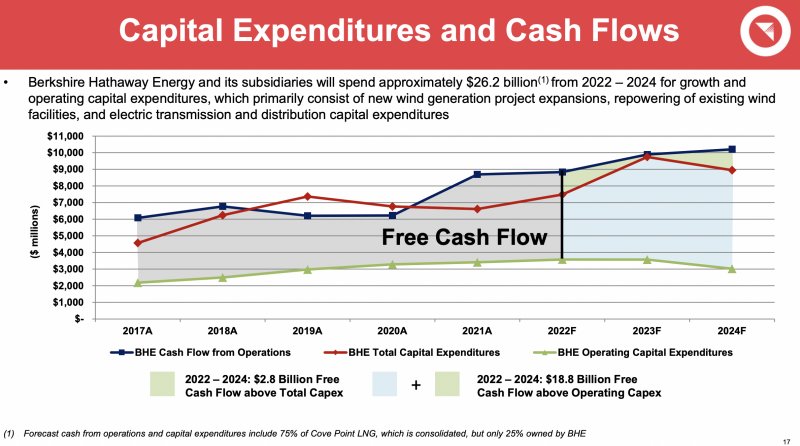

Valuation

Investments based on tax incentives have helped to power growth such that the 2017 operating cash flow level of $6 billion looks paltry relative to the estimated level of $10 billion for 2024. The 2022 Fixed Income Presentation shows that by 2024, we should see operating capex of $3 billion and total capex of about $9 billion with the implication that $6 billion of the capex will be for growth. Subtracting the $3 billion operating capex from the $10 billion cash flow from operations means that free cash flow (“FCF”) should be $7 billion in 2024.

BHE FCF (BHE 2022 Fixed Income Presentation)

If the market values BHE at 12 to 15 times FCF in 2024 then its valuation should be in the range of $84 to $105 billion. We have to do some discounting to get down to today’s dollars but it is still worth more than the $53.4 billion figure from my February article. This $53.4 billion figure came from the 2020 repurchases of 180,358 shares for $126 million extrapolated out over the 76,368,874 shares outstanding as of November 4, 2021. Note that the Berkshire parent only owns 91% of BHE.

As for the Berkshire parent’s valuation, the stock price has come up since my February article but I still think there is room for growth before the stock price reaches intrinsic value.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment