JHVEPhoto/iStock Editorial via Getty Images

Enbridge (NYSE:ENB), with its market capitalization of more than $90 billion, and its 6% dividend yield, still remains below its mid-2014 highs. Despite the company’s struggle to outperform, as we’ll see throughout this article, the company’s impressive portfolio makes it a valuable long-term investment opportunity.

Enbridge 2021 Performance

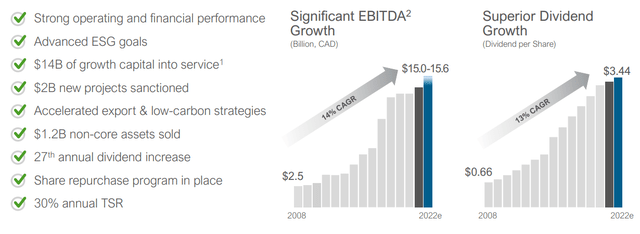

Enbridge had incredibly strong 2021 performance, showing the strength of the company’s business portfolio.

Enbridge grew its EBITDA to more than $12 billion (USD) with continued dividend growth. The company put a massive $14 billion of growth capital into service with $2 billion in new projects sanctioned and $1.2 billion in non-core assets sold. The company’s growth capital put into service means the ability for continued earnings growth.

The company has continued its 27th annual dividend increase. The company has received approval to repurchase roughly 1.5% of its outstanding shares for roughly $1.2 billion. Those repurchases will enable additional shareholder rewards, on top of the company’s dividend, and are a sign of the company’s financial strength.

Enbridge Organic Growth Potential

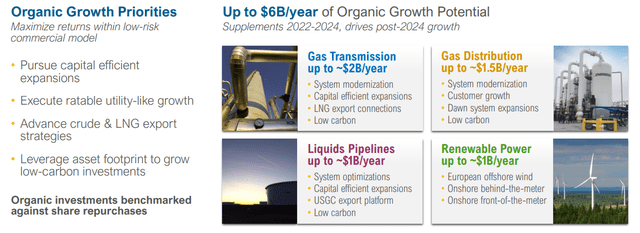

On top of the company’s strong 2021 performance, the company has substantial continued growth potential and capital deployment.

Enbridge has up to $6 billion / year in organic growth potential. The company sees this as supplementing 2022-2024 growth and driving growth past that point. The company is spending heavily on gas ($3.5 billion in transmission / distribution) along with $1 billion / year in liquids spending. The company also has up to $1 billion / year in renewable power spending.

That renewable spending will help the company to hedge the business. We’ve discussed in the past how we’re less of a fan of the company using debt for growth, however, despite that, the company has continued to earn strong margins which will support more substantial shareholder returns for investors. That makes the company a valuable investment, but adds to the risk.

One other thing we want to highlight here is the impact of the Russian – Ukraine War. LNG natural gas imports to Europe are maximized, and Europe is looking to move away from Russian oil and gas. Enbridge is spending $6 billion to build out US LNG exports and $2.5 billion to build out crude exports, mostly from the Gulf Coast, and we expect more opportunities here.

Enbridge 2022 Financial Outlook

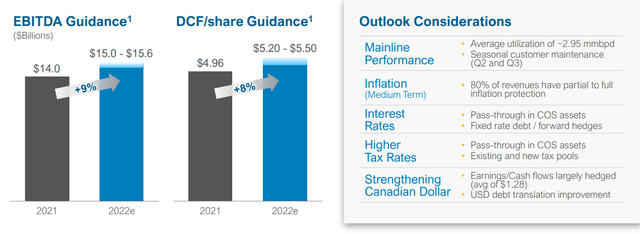

Year over year, Enbridge has strong 2022 financial strength.

Enbridge’s 2022 DCF / share guidance is for $5.35 / share. That’s $4.28 / share (USD), implying a 9.5% DCF yield. From that yield, the company will pay its 6% dividend. Presuming it uses 1.5% to maximize its 2022 share buybacks, that leaves 3% leftover that the company can utilize however it chooses to do so.

It’s also worth noting the company has had strong Mainline performance, which represents a major source of its financial success. However, Mainline repairs continue to come under protests, which could hurt the company’s ability to improve its shareholder returns.

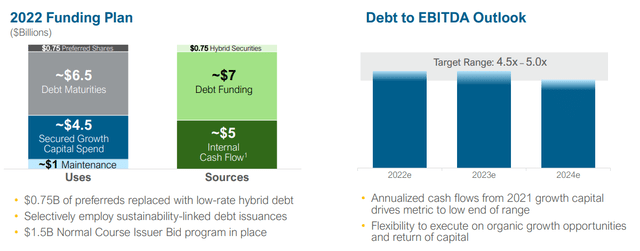

As we’ve discussed before, Enbridge is no stranger to the debt markets and takes full advantage of them. The company is spending $5.5 billion on growth capital spending and maintenance, with $5 billion in excess internal cash flow. The company is still using $7 billion in debt funding, $0.5 billion more than maturities.

The company’s capital program is still smaller than it has been in recent years. While we expect the company to take advantage of opportunities for growth, it still expects to stay below its target range for Debt to EBITDA outlook. That shows a continued and intelligent perspective to investments.

Enbridge continues to expect 5-7% annualized DCF growth through 2024e. That means roughly 19% growth pointing to a 2024e DCF yield of almost 12%.

Enbridge Shareholder Return Potential

Overall, Enbridge has the potential to drive substantial rewards for shareholders, helping to highlight the company as a valuable investment.

The company currently has a 9.5% dividend yield. Presuming it completes its share buyback in 1 year, it’ll generate a 7.5% shareholder yield while leaving 2%. The company is continuing to invest in its business heavily, with expected 6% annualized DCF growth, without its overall debt ratio to EBITDA increasing.

We expect the company to continue modestly increasing its dividend as it has for 27-years. We expect annualized increases to be roughly 3-4%. After that we expect the company to both invest in growth and modestly utilize share buybacks. That combination will enable high single digit shareholder rewards, with additional leftover capital.

That shareholder return potential helps highlight how Enbridge is a valuable investment.

Thesis Risk

One of the unique reasons for investing in Enbridge was the decrease in the thesis risk that the company has seen over the past several months.

The company’s thesis has two primary risks. First, political risk. Oil pipelines have become increasingly unpopular, and the company’s Line 5 pipeline remodel has seen significant protests. However, with the increased need for U.S oil and gas to replace Russian gas in Europe, and the potential for increased deals in this realm, we expect pressure to decrease.

The second risk is capital risk. Enbridge is a massive investor and the company hasn’t been shy about its strategy to utilize debt to continue its growth. The company is investing here in multi-decade projects, and it needs that strategy to payout, which has no guarantee. Part of the company’s success is based on its continued earnings growth.

Conclusion

Enbridge has a premium, with many other midstream companies trading at a double-digit DCF yield. However, the company has an incredibly unique portfolio of assets, essential to our standard of living. More importantly, as U.S. oil and natural gas grows in importance, we expect the demand for the company’s assets to increase.

Enbridge is continuing to invest massively in a diverse portfolio. That means DCF is expected to increase at the high single-digits annually. The company is committed to using this DCF for both dividends and share buybacks, and that continued growth means double-digit shareholder returns for those who invest in the company today.

Be the first to comment