peshkov

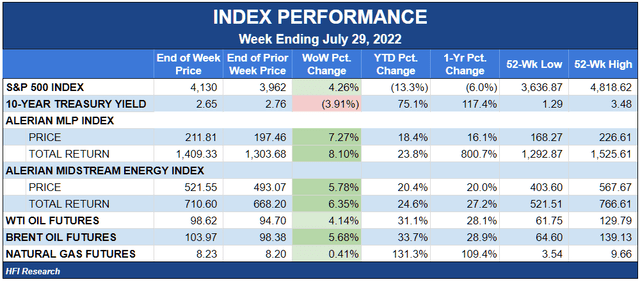

Midstream Sector Performance

The energy sector was on fire this week, and midstream was no exception. The sector gained 7.3% during a week that saw WTI jump 4.1% and natural gas close largely flat at $8.23 per Mcf.

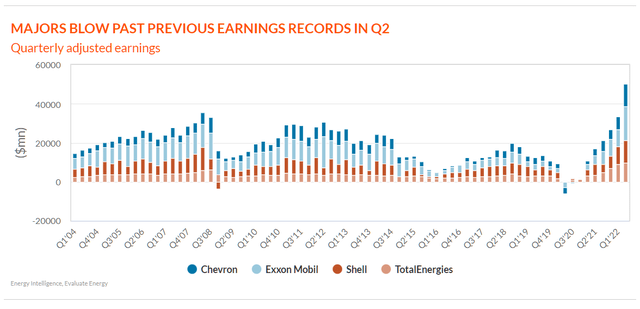

Second-quarter E&P and refiner earnings reported during the week have been some of the strongest in history, as upstream capitalized on high commodity prices and downstream benefited from record-high refining margins.

The oil and gas majors’ second-quarter earnings blew past analyst estimates. The four that reported so far earned more than $50 billion of adjusted earnings during the quarter, more than they earned over the entirety of 2019.

Midstream, which generally operates on a fee-based model, has reported good second-quarter results so far but nowhere near as historic as the other energy sub-sectors. Still, the rising tide of energy sector equities drove every equity in our coverage universe higher during the week.

Enbridge (ENB) was the big midstream earnings reporter this week. As usual with ENB, the results were unexciting but solid. The company met analyst estimates and reiterated its full-year guidance. ENB jumped further onto the LNG bandwagon by partnering with Pacific Energy Corp. to spend $4 billion on the Woodfibre LNG project in British Columbia. ENB will own 30% of the project and contribute $1.5 billion to the project.

Next week will bring more earnings from major midstream operators, which we’ll be following closely.

The “Inflation Reduction” Act Likely to Pass Congress Next Week

The Inflation Reduction Act gained the support of Senator Joe Manchin and is likely to pass Congress next week. The bill is packed with $370 billion of handouts to the environmental lobby under the guise of reducing greenhouse gas emissions by 40% by 2030. No doubt the bill’s stated goal will never be reached, its backers will consider its funding to be insufficient, and soon they’ll be clamoring for more climate-related money.

In its current form, the bill doesn’t have much impact on oil and gas midstream. It contains no language pertaining to the tax-favored status of MLPs. One provision requires the federal government to hold oil and gas lease sales in the Gulf of Mexico and Alaska. The news isn’t particularly impactful for midstream but will be good for the long-term prospects of offshore gathering and processing operations such as those of Genesis Energy (GEL). The bill isn’t all good news for Gulf producers, as it would hike federal royalty rates and minimum lease bids and create a specific royalty for the flaring of methane.

The bill includes a methane fee, albeit reduced from an earlier proposal that was opposed by Senator Manchin. It charges a fee of $900 per ton of methane over a 25,000-ton threshold. The fee would begin in 2024 and escalate in the years thereafter. The regulations will likely saddle gathering systems with more costs aimed at containing methane emissions, but it will also create the opportunity to increase volumes of captured gas. Midstream G&Ps such as Hess Midstream (HESM) and Targa Resources (TRGP) have improved their volumes by emphasizing gas capture, and if the bill becomes law, we expect other G&Ps to follow suit.

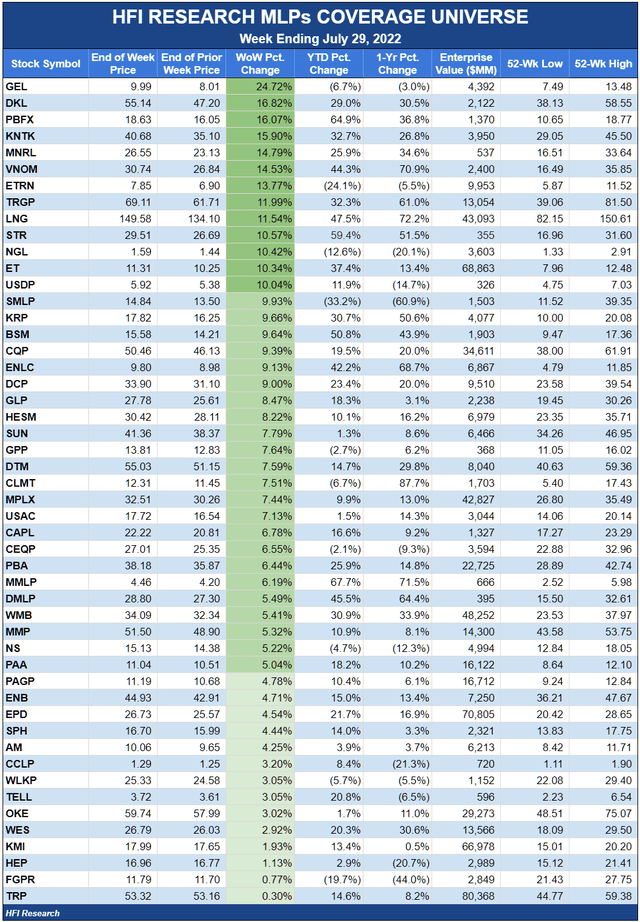

In company-specific news, Genesis Energy (GEL) was the week’s biggest gainer, up 24.7% during the week on second-quarter results that blew past analyst estimates and exceeded management’s previous guidance by 20%. GEL raised its full-year Adjusted EBITDA guidance by $100 million, or 17.3%. The news is undoubtedly good for GEL’s outlook, but we don’t rate the units as a Buy primarily due to management’s poor capital allocation track record. We rate GEL as a Hold.

Equitrans Midstream (ETRN) was among the week’s top performers, up 13.8%, as the Inflation Reduction Act includes permitting reforms that would advance the Mountain Valley Pipeline toward completion. We’ve long believed the MVP would be completed, and ETRN shares are likely to do well from their current price of $7.85 if it is. However, since we can’t quantify the project’s ultimate cost, we can’t estimate its financial impact on ETRN. We’re therefore avoiding ETRN, though it may be an attractive speculation for investors who believe an MVP is imminent.

Weekly HFI Research MLPs Portfolio Recap

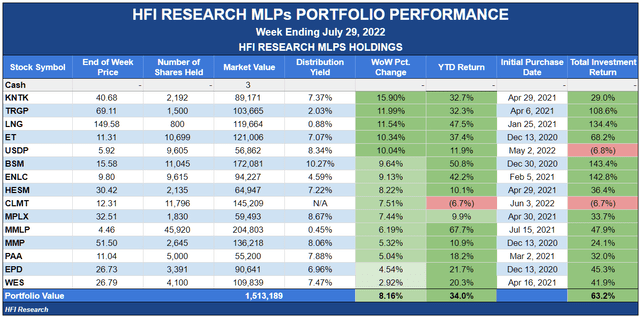

Our portfolio rose 8.2%, outperforming its benchmark, the Alerian MLP Index, by 0.9% during the week.

Our portfolio’s return was driven by gathering and processing (G&P) operators like Kinetic (KNTK) and Targa Resources (TRGP). Neither company had any news, though their units were sent higher from their high commodity exposure relative to the midstream sector.

Cheniere (LNG) had another strong week after leading the sector the prior week. Cheniere signed another sale and purchase agreement, this time with Thailand’s PTT. The deal begins in 2026 and helps Cheniere contract its Corpus Christi production capacity.

Energy Transfer (ET) units got a boost after the company announced a hike in its quarterly distribution from $0.20 to $0.23. We believe the distribution is on its way back to management’s target of $0.305 per quarter and that the units remain a Buy until they reflect this likelihood.

Our laggards, Plains All American (PAA), Enterprise Products Partners (EPD), and Western Midstream Partners (WES) all traded higher on no news. WES units, in particular, still have catching up to do to match the performance of peers. The company is one of the highest-quality G&Ps, and we recommend the units as a Buy.

News of the Week

July 25. Shell (SHEL) reached a deal with Shell Midstream (SHLX) to acquire the 31.5% of units it doesn’t already own for $15.85 per unit. SHEL’s original offer came in February for $12.89 per unit but was subsequently sweetened. SHLX follows Phillips 66 Partners and BP Midstream in being bought by its sponsor. Of all sponsored MLPs, Holly Energy Partners (HEP) would logically be on deck as the next to be acquired by its sponsor, HF Sinclair (DINO).

July 28. PBF Energy (PBF) reached an agreement with its sponsored MLP, PBF Logistics (PBFX), to acquire the 52% of outstanding common units it doesn’t already own for 0.27 shares of PBF and $9.50 in cash, which amounts to $18.48 per PBFX unit as of Friday’s close. The offer is at a mid-single-digit premium to PBFX units before the announcement, but the units had already run higher after PBF management mentioned it might make a bid. The deal is a good one for PBF shareholders because it acquires undervalued PBFX assets. But we think the undervaluation makes the bid unattractive for PBFX unitholders, who should not vote for this deal and wait for a sweetened bid. BP and SHEL sweetened their bids in pursuit of their sponsored MLPs, and we would expect the same from PBF, particularly because of its relatively low percentage of unit ownership. And even with a sweetened deal, PBF is buying PBFX’s attractive assets on the cheap.

Capital Markets Activity

None.

Be the first to comment