David Ramos

Earnings season really kicks off this week with a number of large tech companies reporting results that could move markets sharply. A number of these names we have covered recently, but Microsoft (NASDAQ:MSFT), which will report after the close on Tuesday, October 25th, is a name we have not discussed in a while. We continue to hold only what we need to hold in this name and are certainly not overweight the stock – however, we are buying it when necessary for portfolios that need exposure.

Our thesis on the name remains intact, and we think that Big Tech as a whole will underperform eventually; either because the bear market gets worse and some of these names will be the last shoe to drop, or a new bull market is born, but investors find better value in other growth names. We are not sure which outcome it will be, but we are pretty confident that eventually the rest of the market either needs to catch up to some of these names, or some of these Big Tech names will have to fall in order to come in line with the market.

Even with that somewhat pessimistic view, we think that Microsoft is a Hold for those who currently own shares and for those who need to gain something similar to market weight exposure to the company.

So What About Earnings?

Microsoft reports after the close on Tuesday, and we think investors can use their current positions to trade around the news. As many of our readers know, we like to try and pick up additional returns by utilizing the options market to generate options premiums. However, before we look at options, we think it is important to first look at how Microsoft has traded after earnings announcements in recent quarters.

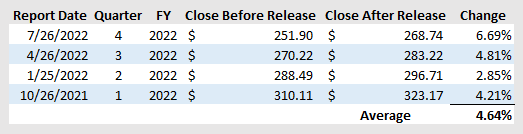

In fiscal year 2022, Microsoft saw the following price action the following day after each quarterly results announcement:

Author

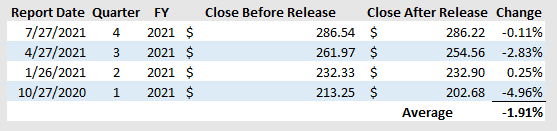

Looking at fiscal year 2021, Microsoft saw the following price action the following day after each quarterly results announcement:

Author

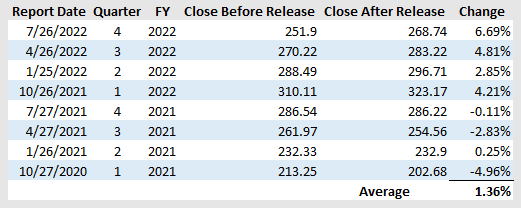

As one can see, Microsoft shares were basically unchanged to down when reporting 2021 results, however over the last year when reporting their 2022 FY results shares have risen at a decent rate, and on average at larger price changes.

If you look at the last two years, one can see that the shares, on average, move 1.36% the following day after the release:

Author

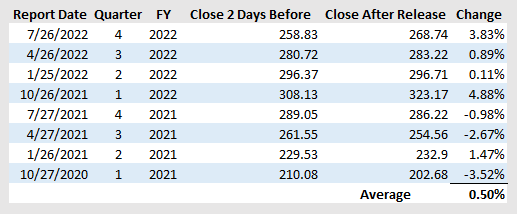

If you take the close from the day before the release and look at the change after the release, the data shows even less of a move:

Author

We include this data set (in the last chart) for those who may want to set up trades closer to the close today.

So What Does This Tell Us?

In our view, this shows that investors who hold shares in Microsoft could very well sell covered calls and generate a decent profit. With shares moving higher today, it could also mute the reaction to decent numbers after the close on Tuesday – which is something that one would want to weigh when mapping out their trade here.

So if we look at the recent history, and say that the stock had only one instance over the last two years where it rose or fell by more than 5%, which was the last quarter where it rose by 6.69%, then we should be pretty comfortable looking at options 5% out of the money just before the close on Tuesday. If that were right now, with the stock price at $246.60/share, then 5% out of the money would be $258.93/share. It is important to note that Microsoft options trade in increments of $2.50/share, so if one was faced with this scenario near the close on Tuesday, the choice would be to sell a call at a strike price of $257.50/share or at $260/share. The $257.50 call would generate an option premium of roughly $2.42/share (0.98% in yield if not called), or $242 per contract, and the $260/share call would generate a premium of roughly $1.82/share (0.74% in yield if not called), or $182 per contract.

Is It Worth The Effort?

Writing the call option against shares in the current week and 5% out of the money generates less than 1% in options premiums using those two strike prices. One could generate significantly higher premiums by going out to next week’s maturity date, however, the probability of shares being called does change.

We think that investors could utilize this strategy here to generate additional yield (which is in the ballpark of Microsoft’s current annual dividend of 1.10%) while also potentially locking in a price during a bear market rally that is 5%+ above the current stock price. If the risk of getting called is too great at the 5% level, with the implied volatility right now, one can still get decent premiums further out of the money. One could generate about $1/share at the current strike of $265/share and just over $0.50/share at the $270/share level (just under 10% out of the money).

Our Thoughts

This is a strategy that we have been utilizing over the course of 2022 in order to minimize portfolio losses and try and create some outperformance in our portfolios. It has worked to varying degrees for various positions (including with Microsoft before), but we think that the data here points to a strong case for making a trade, because even if called, you walk away with a 6.17%+ gain (from the appreciation in the stock price and the option premium) from current prices and if earnings disappoint and shares decline, then you generated about three-quarters worth of dividend yield with one trade. While this may not be especially attractive for those who have a higher cost basis in Microsoft shares, it is the type of trade that makes a lot of sense for anyone who recently purchased at lower prices by providing some current yield with a designated offramp should a rally after earnings occur.

We will be watching this tomorrow to see if it makes sense to place a trade of about 5% out of the money to collect the option premium.

Be the first to comment