iQoncept

Fund Overview

The Invesco BuyBack Achievers ETF (NASDAQ:PKW) gives investors exposure to companies that have bought back a significant portion of their shares in the past 12 months. The PKW exchange-traded fund (“ETF”) has $1 billion in assets.

Strategy

In general, there are two ways companies can return excess capital to shareholders. They can either pay a dividend, or buy back their shares.

Dividends are usually distributed out of a company’s after-tax profits and signal management’s confidence in the company’s future, since once begun, a cut to regular dividends is heavily punished by investors.

Buybacks are another way companies can return surplus capital to shareholders. Buybacks are a more tax-efficient way to return capital because investors don’t incur any tax through the buyback process; only those investors who sell their shares incur capital gain taxes (if applicable), whereas dividends are taxed in the range of 15-20%.

Pausing or decreasing buybacks also receive less stigma than a dividend cut, since buybacks are often thought of as a ‘discretionary’ management decision.

The PKW ETF tracks the NASDAQ US BuyBack Achievers Index. To qualify for the index, a company needs to have effected a net reduction in shares outstanding of 5% or more in the trailing 12 months. The index is reconstituted annually and rebalanced quarterly.

Buybacks Below Intrinsic Value Creates Shareholder Value

Companies buy back their shares for a variety of reasons, but the most common one is the belief that the shares are ‘undervalued’ relative to their ‘intrinsic’ value.

In fact, famous investor Warren Buffett is a big fan of stock buybacks. Some of his favorite stocks like The Coca-Cola Company (KO) and Apple Inc. (AAPL) regularly buy back lots of shares. When discussing Apple in 2018, he said:

I’m delighted to see them repurchasing shares… You can say we own 5 percent of it. But I figure with, you know, with the passage of a little time we may own 6 or 7 percent simply because they repurchase shares… I find that if you’ve got an extraordinary product, and ecosystem, and there’s lots to be done, I love the idea of having our 5 percent, or whatever it may be, grow to 6 or 7 percent without us laying out a dime. I mean, it’s worked for us in many other situations.

Portfolio Holdings

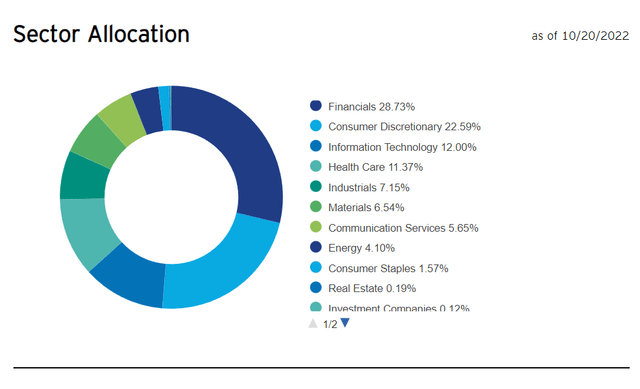

The PKW ETF’s sector allocation is shown in Figure 1. The fund is overweight financials and consumer discretionary stocks, and underweight technology companies, relative to the market.

Figure 1 – PKW Sector Allocation (invesco.com)

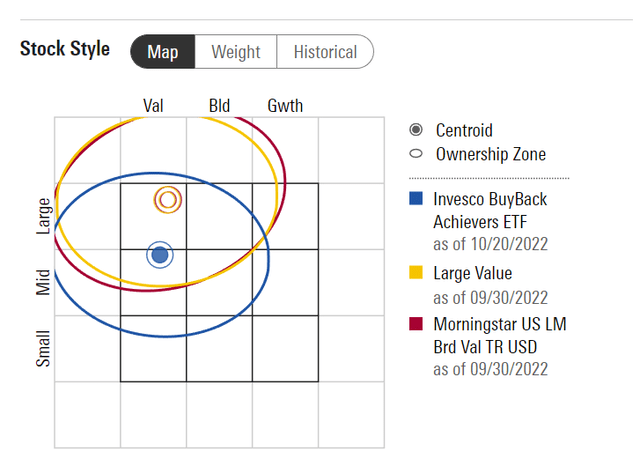

Due to the strong cash flows required to effect buybacks, the PKW ETF skews towards value stocks in terms of holding style (Figure 2).

Figure 2 – PKW Investment Style (morningstar.com)

Returns

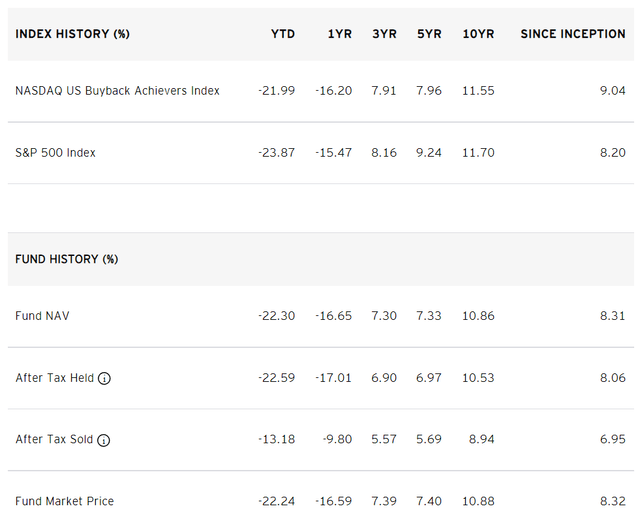

Returns for the PKW ETF have been fairly strong. It has 3/5/10 Yr average annual returns of 7.3%/7.3%/10.9% respectively to September 30, 2022. However, it has lagged the S&P 500 Index, which has returned 8.2%/9.2%/11.7% over the same time frames. YTD, the PKW ETF has returned -22.3%.

Figure 3 – PKW Returns (invesco.com)

Distributions & Yield

The PKW ETF has a 1.2% trailing 12-month distribution yield, as the companies the fund invests in tend to return capital to shareholders in terms of buybacks instead of dividends.

Fees

The PKW ETF charges a 0.5% management fee and a 0.61% expense ratio. This is relatively high compared to the broad equity funds like the SPDR S&P 500 ETF Trust (SPY) which charges a 0.09% expense ratio and has performed better over the long term.

Risk

The issue with companies buying back a lot of their shares is that sometimes, they are buying back shares for the ‘wrong’ reasons. If shares are bought above their intrinsic value, then the act of buying back shares actually destroys value.

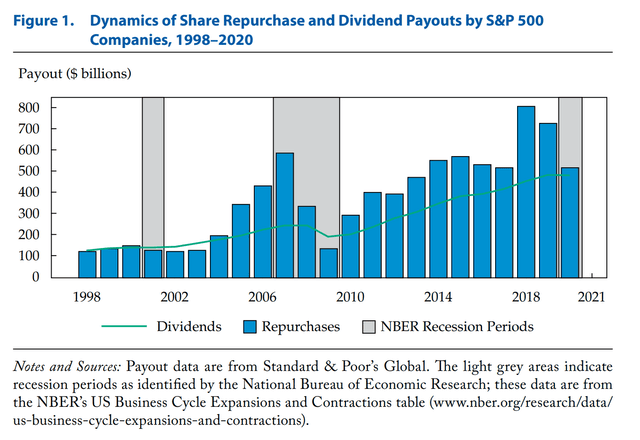

For example, a recent study from the CFA Institute shows that stock buybacks are very pro-cyclical. Companies tend to buy back a lot of their shares at market peaks, just before a recession/crash. On the other hand, stock buybacks are dramatically reduced during recessions and equity bear markets, when stock valuations are arguably at their cheapest.

Figure 4 – Buybacks are pro-cyclical (cfainstitute.org)

Another issue is the principal-agent problem with company management. In today’s environment, top management of companies are often rewarded with stock options and restricted shares that are worth tens of millions of dollars or more, and only vest when certain per share goals are reached. Therefore, they have an incentive to reduce the share count in order to boost their personal rewards and bonuses.

Conclusion

In theory, buying companies that return lots of capital to shareholders through buybacks is a good idea, provided the shares can be bought below “intrinsic value.” However, in practice, the investment returns of PKW have lagged those of simple market ETFs like SPY. The main drawback to the PKW strategy is that in aggregate, companies tend to buy back their shares when markets are buoyant and shares are expensive, and they stop buying during bear markets when shares are arguably cheap.

Be the first to comment