David Ramos/Getty Images News

Thesis

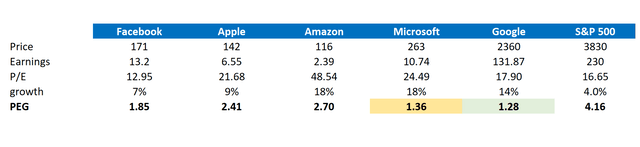

Microsoft Corporation (NASDAQ:MSFT) stock is down approximately to 20% YTD, in line with the broad market (Reference: S&P 500). With regards to price-earnings multiple, however, the stock is trading at a P/E GAAP (FWD) of x27.5 vs approximately x16 for the S&P. Thus, Microsoft stock appears expensive – at first.

But this is not how I see it. In my opinion, investors should consider the company’s valuation in a richer context, as MSFT undisputedly outperforms the market with regards to: growth expectations/potential (1); profit margin (2); competitive moat (3); R&D investment (4); brand equity (5); and talent attraction (6). That said, if we put things in perspective, the stock appears cheap. Based on a residual earnings framework anchored on analyst EPS estimates, I calculate a fair implied share price of $368.64/share.

Is Microsoft cheap?

I have been holding MSFT stock for years now. And, every year I debate myself if I should sell the stock given the company’s perceived P/E multiple premium. But merely looking at P/E ratios is not the correct way of thinking about equities, as the ratio captures only the present earnings of a company, while the price incorporates the future. That said, investors are advised to look at a company’s growth (1), the business’ profit margins (2), and the competitive moat to defend growth and margins against competition (3). With regards to these dimensions, Microsoft truly stands out.

First, let us look at the company’s growth. Analyst consensus expects a 3-year CAGR for Microsoft of approximately 20%, from 2022 until 2025 (Source: Bloomberg Terminal). If we consider nominal GDP growth at slightly below 3%, Microsoft is outpacing the broad market by a factor of x7!

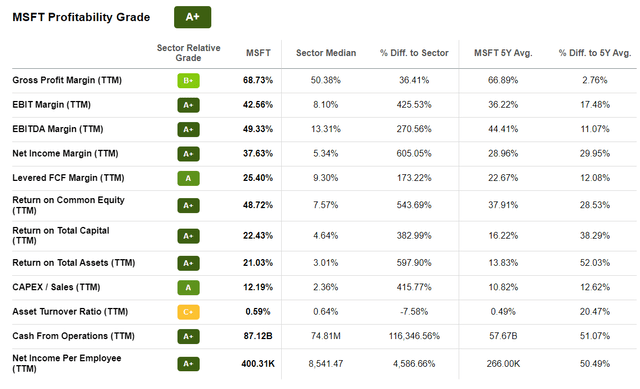

Microsoft’s profitability is unmatched. Microsoft’s operating margin (EBIT) margin scores at 42.56%, versus 8.10% being the sector median. Respectively, net-income margin (TTM) is 37.63% versus 5.34%. Most notably, not even Apple (AAPL) matches Microsoft’s profitability. Despite Apple’s brand equity and pricing power, the company “only” achieves 30.93% EBIT margin and 26.41 net-income margin, implying that Microsoft’s margins are about 10 percentage points higher! Moreover, Microsoft’s expected growth is unlikely to dilute margins, since cloud IaaS (53% of sales) and high-margin PaaS (43% of sales) are expected to achieve 50% and >70% operating margin.

From a competitive standpoint, Microsoft looks like an impenetrable fortress. There are multiple aspects that support the company’s moat, including $210 billion of brand equity, $23.35 billion of R&D investments, intellectual property (including more than 8.500 US patents), and top-league talent attraction.

As a side note, if we consider the Metaverse, a 13 trillion market according to Citi research, Microsoft is the only player with leading exposure to infrastructure (hardware, VR, cloud), software (AI) and content (games).

So, is Microsoft cheap? If we consider the FAAMG universe (I cancel Netflix), then we see that Microsoft’s 2023 forward P/E is the second highest at x24.49. Facebook/Meta Platforms (META) looks very cheap at x12.95. However, if we include 3-year CAGR expectations, the picture changes considerably. The PEG is broadly considered as an adequate valuation metric to capture the relative trade-off between the company’s current stock price, current earnings and the expected growth. The ratio is calculated as a P/E divided by 3-year CAGR expectation. Microsoft suddenly looks very cheap. Or in other words, considerably cheaper than Facebook, Apple, and Google (GOOG, GOOGL).

Analyst Consensus EPS; Author’s Calculations

Finally, I would like to note that the above metrics are anchored on MSFT’s levered valuation (equity). But investors should consider that Microsoft is actually a net creditor, and thus the enterprise value is lower than the company’s equity value. As of Q1 2022, Microsoft recorded 104.66 billion of cash and short-term investments and $77.98 billion of total debt. Thus, Microsoft has a net cash position of $26.68 billion

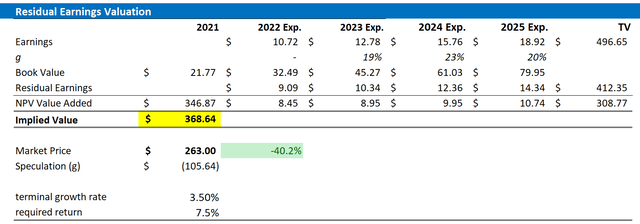

How to value MSFT

I have shown that Microsoft is actually not expensive on a relative basis vs. FAAMG stocks. And Microsoft appears very cheap when compared to the S&P 500. But on an absolute basis, what could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast revenues and EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal.

- The estimate of the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of June 24, 2022. My calculation indicates a fair WACC of 7.5%.

- To derive MSFT’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5%. Although I think that growth equal to the estimated nominal long-term GDP growth is strongly understating MSFT’s potential, especially as the company is spending 20% of revenues in R&D, I want to be conservative in my valuation.

- I do not model any share buyback – further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for MSFT of $368.64/share, implying material upside of about 40%.

Analyst Consensus EPS; Author’s Calculations

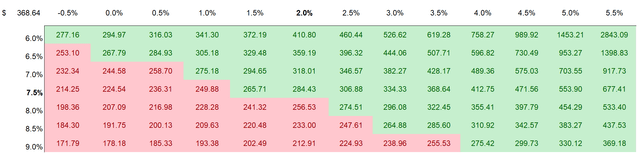

I understand that investors might have different assumptions with regards to MSFT’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red cells imply an overvaluation as compared to the current market price, and green cells imply an undervaluation. The risk/reward looks highly favorable to me.

Analyst Consensus EPS; Author’s Calculations

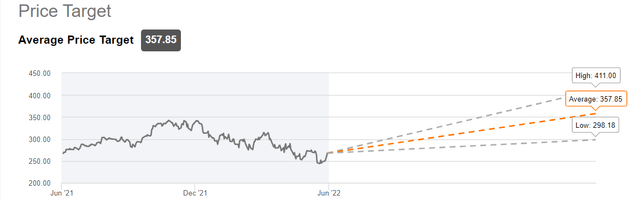

My base-case target price for MSFT stock is broadly in line with analyst consensus. Analysts see the stock’s fair price at around $357.85/share.

Risks

I would like to highlight the following downside risks that could cause MSFT stock to materially differ from my price target of 368.64/share:

First, a worsening macro-environment including inflation and supply-chain challenges could negatively impact MSFT’s customer base, both enterprise and consumer. If challenges turn out to be more severe and/or last longer than expected, the company’s financial outlook should be adjusted accordingly.

Second, investors should monitor competitive forces in the cloud industry. Although I highlighted the difference between TikTok and MSFT from a value-proposition perspective, I also highlighted that the company is competing for advertising spending. Thus, if competition increases more than what is modelled by analysts, profitability margins and EPS estimates for MSFT web must be adjusted accordingly.

Third, much of MSFT’s current share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though MSFT’s business outlook remains unchanged. In addition, inflation and rising-real yields could add significant headwinds to MSFT’s stock price, as the higher discount rates affect the net present value of long-dated cash flows.

Fourth, Microsoft’s size and scale are too difficult to ignore for anti-trust officials. While the company has managed to defend past lawsuits in the EU and the U.S., the anti-competition allegations against Microsoft could accelerate and either force the company to spin-off units and/or slow market expansion.

Finally, Microsoft is a consensus buy on Wall Street. Thus, the company’s share price is vulnerable to downside disappointment.

Conclusion

Judged merely by the MSFT’s P/E multiple of approximately x25, Microsoft stock appears expensive in relation to the company’s FAAMG peers and very expensive in relation to the S&P 500. However, if we add to the P/E multiple growth expectations, the picture reverses: MSFT stock is very cheap in relation to the S&P 500 and cheap in relation to FAAMG – only second to Google.

From a business model perspective, Microsoft’s potential is arguably unmatched. The company operates the world’s leading cloud business with high-margin PaaS offerings being 47% of cloud sales, vs 53% for IaaS. Moreover, if we consider the Metaverse, Microsoft is the only player with leading exposure to infrastructure, software and content. Based on a residual earnings framework anchored on analyst EPS estimates, I calculate a fair implied share price of $368.64/share. Thus, in my opinion, MSFT is a confident buy at <$280/share. Very bullish.

Be the first to comment