coldsnowstorm

Introduction

There’s not much to like about tech stocks, as most companies are reporting disappointing numbers and providing underwhelming guidance that force analysts to slash estimates in a heartbeat. While the software space certainly benefited from pandemic tailwinds and is cannot escape a reversion to the mean, Microsoft Corporation (NASDAQ:MSFT) is one robust name that deserves our attention as macro pressures continue to drive down tech valuations.

Revisiting the bull case

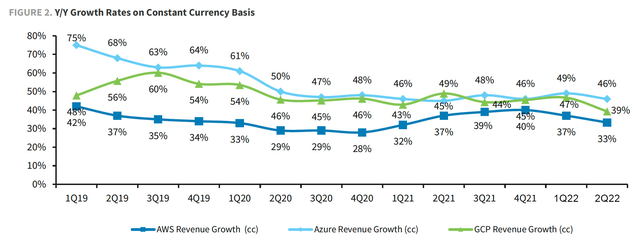

The most straightforward bull case for Microsoft is that cloud migration remains a sustainable growth story despite some moderation. From a top-down perspective, 1H22 was strong for the public cloud market, which delivered >35% growth, although the big three (AWS, Azure, GCP) saw some decelerations on tougher comps. The top 3 cloud vendors now boast a total annualized run rate of $147 billion which grew 36% YoY in Q2 vs. 41% in Q1.

Azure is estimated to have a gross margin of over 60%, while AWS (AMZN) had a 29% operating margin in Q2. Google Cloud Platform (GOOG, GOOGL), the distant third vendor with less than 10% of the market, is yet to turn a profit but still produced 36% YoY growth in Q2 vs. 44% in Q1. Unlike some pockets of the tech sector that were one-time beneficiaries of the pandemic, there’s no question that cloud migration will continue to be a structural vs. cyclical theme.

Azure outlook remains strong

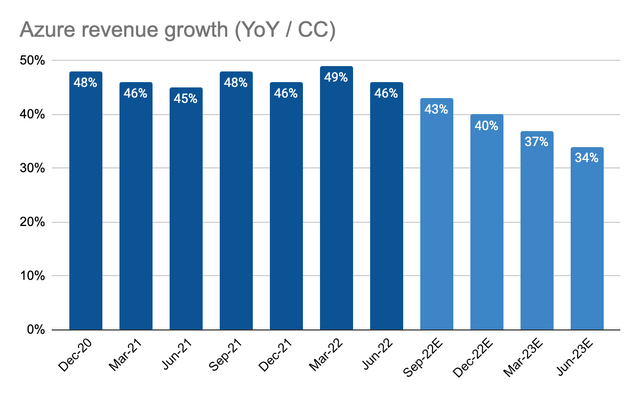

In the June quarter (4QFY22), Microsoft reported total revenue growth of 12.5% YoY and +16% in constant currency, which was roughly inline with consensus. Despite some FX impact due to a strong dollar, total RPO grew 32% vs. 28% in the prior quarter. Commercial bookings increased 37% CC to $189 billion. Management highlighted a record number of Azure deals that were above $100 million and $1 billion. Azure sales increased by 46% (1% below consensus), and is expected to grow 43% in the September quarter (1% below consensus). Despite the slight moderation amidst macro concerns on more consumer-centric sectors and SMBs, Azure’s growth remains strong on longer bookings commitments.

While CEO Nadella was cautious on the macro developments during the earnings call, he saw cloud transformation as a deflationary force in an inflationary environment where corporations are forced to do more with less.

That’s why I think coming out of this macroeconomic crisis, the public cloud will be even a bigger winner because it does act as that deflationary force. – MSFT 4QFY22 call.

Besides Azure, demand for cloud security continues to be in a favorable trend as enterprises look to spend more to protect their data and digital operations. Microsoft reported Security revenue growth of 40% YoY, approaching the $20 billion run-rate mark.

For the September quarter (1QFY23), Azure growth is guided to decelerate from 46% CC to 43% CC where management highlighted some consumption softness. Suppose growth is to decelerate by ~3 points per quarter going forward, Azure could exit FY23 with a still respectable 34% growth rate in FQ4. While the current macro narrative does put pressure on tech overall, Azure is in an enviable position to capitalize on a strong IaaS (Infrastructure as a Service) market estimated to grow another 30% to $156 billion in 2023 (Gartner).

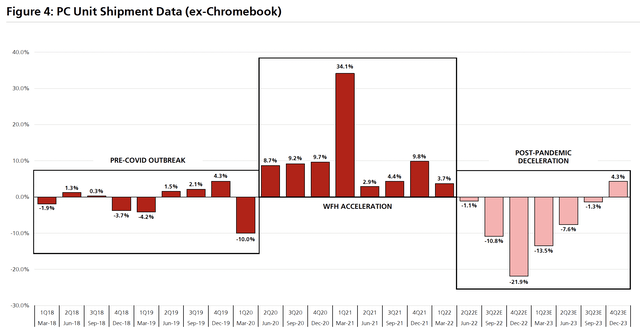

PC softness is an issue, but a well understood one

Microsoft’s Office and Windows revenue are most definitely not immune to a slowdown in the PC market. Since the PC segment was a major beneficiary of the pandemic, PC makers across the board have been witnessing demand normalization this year:

- Asus: Experiencing demand headwinds, said many are looking at 10-15% decline in the PC market in 2022.

- Lenovo: PC market is experiencing weak consumer demand and supply chain issues as a result of Covid-19.

- HP: Weakening consumer demand and higher price competition

- Dell: Demand slowed, B2B customers are delaying purchases and being more conservative on IT budgets.

Though the weakness in the PC market will put pressure on Office and Windows revenue, the Windows operating system remains in a dominant position while Office products are highly sticky. Microsoft has implemented 15-25% price increase in the Office product family which is a clear indication of pricing power, a highly desirable attribute in an inflationary environment. Overall, while the PC business is no doubt experiencing a slowdown post-Covid-19, markets should have already priced in the impact as nothing lasts forever.

Recent dip presents another buying opportunity

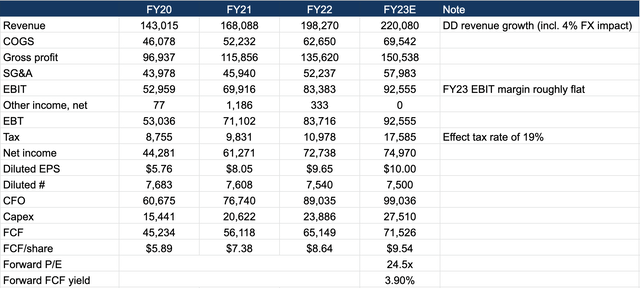

Microsoft’s FY23 guidance calls double-digit top-line growth with a 4% impact from FX. This shows the relatively robust and defensive nature of the company’s offerings which should lead to lower risks of downward revisions, in my view. While operating margins are guided to be flat (favorable depreciation schedule impact offset by FX), estimated FY23 operating margin of ~42% and FCF margin of ~33% still make Microsoft an earnings powerhouse.

Though Microsoft’s valuation isn’t exactly in bargain territory, I suspect negative investor sentiment and cautious positioning should be a good setup for better-than-feared results going forward. As a result, I see the recent dip in share price as a buying opportunity at 24.5x forward earnings / 3.9% forward FCF yield and will start to get more aggressive should valuation overshoot to the downside to ~20x or ~$200 a share.

Be the first to comment