NorGal/iStock via Getty Images

Just two months ago, I covered Micron Technology, Inc. (NASDAQ:MU) in a thought piece focused around the company’s recently initiated dividend. Although, a dividend yield of around 1% will hardly be a reason for retail investors to consider the stock, it was an odd decision by a company that is operating in a highly cyclical industry, which is also likely reaching its cyclical peak.

In the previous article I warned of all the dangers associated with the industry and more specifically, Micron’s positioning. The company operates in a highly commoditized segment of the market – storage and memory solutions, while at the same time is having very capital intensive business model. This results in significant volatility in both earnings and share price, during market peaks and bottoms alike.

That is why, it is hardly a surprise that in the span of just two months, Micron has fallen by 22% at a time when the S&P 500 lost a bit less than 8%.

Seeking Alpha

As Micron is scheduled to report its fiscal year 2022 earnings this week, investors should keep a number of things in mind before proclaiming MU a bargain just because it has fallen so sharply.

Uncertain Outlook

As with any highly cyclical industry, during the peak investors are usually ecstatic as businesses flurry to proclaim how the industry has changed and emphasize the long-term potential.

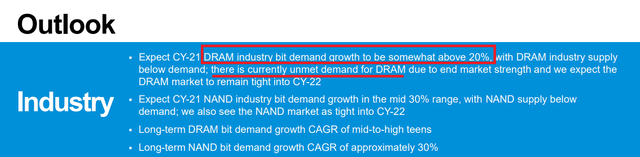

In a similar fashion, about a year ago when MU reported its Q3 2021 results, there optimism about the future was running high.

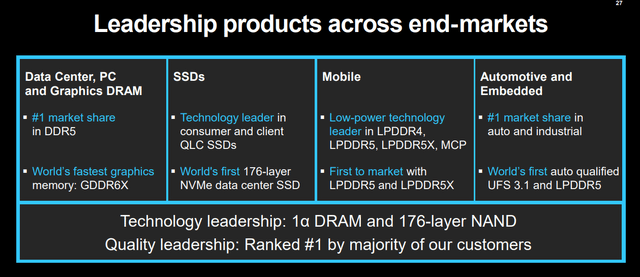

Micron Technology Q3 2021 Earnings Presentation

The narrative was driven by supply shortages, double digit growth rates and of course, eye-watering long-term growth projections.

A few months later, when the company reported Q1 2023 results, the DRAM demand expectations have already cooled off from ‘somewhat above 20%‘ to ‘to be in the low 20% range’.

Micron Technology Q1 2022 Earnings Presentation

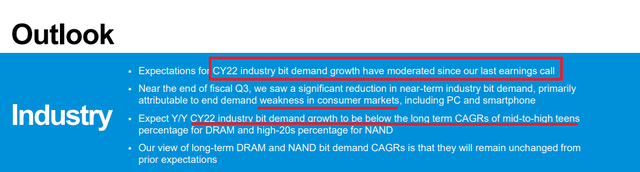

Just three months later and the supposedly robust industry demand was already expected to be in the mid to high teens for DRAM, which is the most important product segment for Micron.

Micron Technology Q2 2022 Earnings Presentation

During the last quarter, the expected bit demand for the calendar year 2022 has once again moderated and was expected to be below the long-term projects due to weakness in the consumer markets, namely mobile and PC.

Micron Technology Q3 2021 Earnings Presentation

This makes industry-wide forecasts are both in the short and long-term look useless. In the meantime, Micron’s positioning within the semiconductors industry makes it far more vulnerable to its broader peer group during market downturns.

Justified Low Multiples

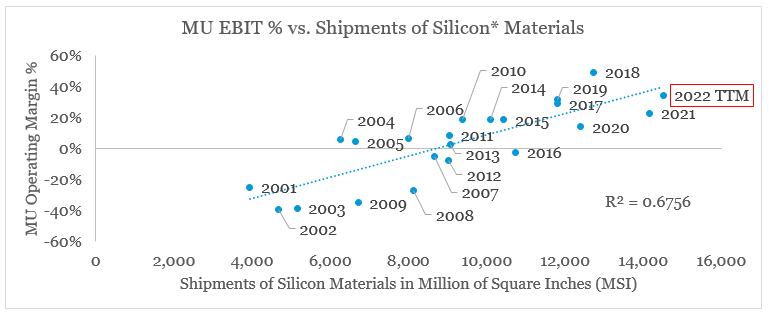

The reason why the industry demand is so important for Micron is that as a highly capital intensive business, its margins are also heavily dependent on the overall state of the industry.

prepared by the author, using data from SEC Filings and semi.org

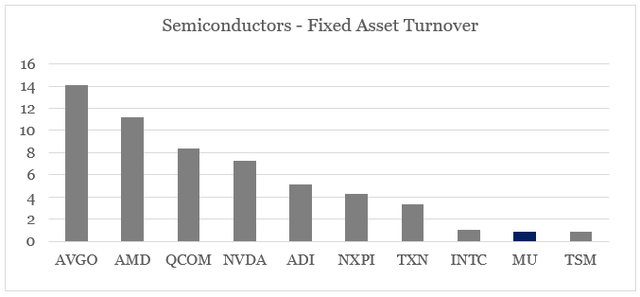

While this is largely true for most semiconductor companies, not all business models are made equal. For example, Micron’s high capital intensity results in the company having one of the lowest fixed asset turnover ratios in the industry.

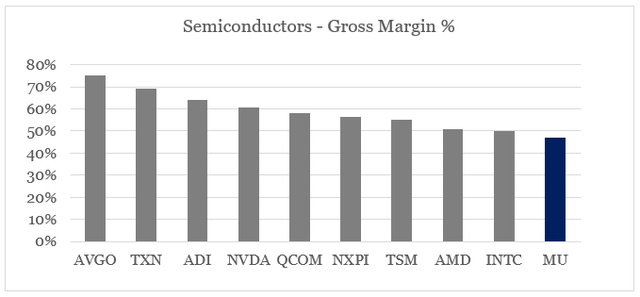

prepared by the author, using data from Seeking Alpha

Obviously, owning the fabs could be a significant long-term competitive advantage, as it is the case for Texas Instruments (TXN) and could soon prove to be beneficial for Intel (INTC). In the case of Micron, however, the risks brought by the high capital intensity are not mitigated by higher profitability.

prepared by the author, using data from Seeking Alpha

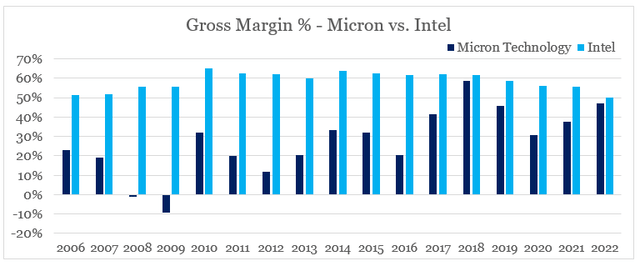

Even though Intel is not very far off from MU in the graphs above, there is a very important distinction to be made. To begin with, Intel is facing some operational difficulties at the moment and companies like AMD (AMD), who rely on third-party manufacturers currently benefit from the superior technology and scale of TSMC (TSM). In the case of Micron, however, the company is currently among the leaders in its space and is not challenged by peers to the same extend that Intel is.

Furthermore, by focusing entirely on DRAM and storage, Micron’s margins are far more cyclical over the long-run and are still well-below even those of the currently struggling Intel.

prepared by the author, using data from SEC Filings

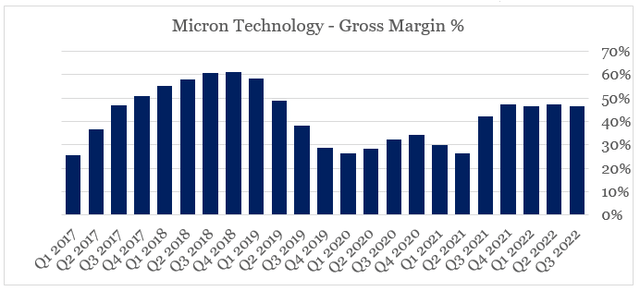

With that in mind, Micron’s gross margin remained firmly below 50% since 2019 when demand for semiconductors benefited from a massive tailwind on the back of a strong digitalization push.

prepared by the author, using data from SEC Filings

Moreover, gross margin is already expected to decline significantly to 42.5% during this quarter.

With all these factors in mind, our non-GAAP guidance for the fiscal Q4 is as follows. We expect revenue to be $7.2 billion, plus or minus $400 million; gross margin to be in the range of 42.5%, plus or minus 150 basis points;

Mark Murphy – CFO

What is also very important to note from the quote above are the wide ranges of both revenue and gross margin – plus/minus $400m and plus/minus 150 basis points for each of them respectively.

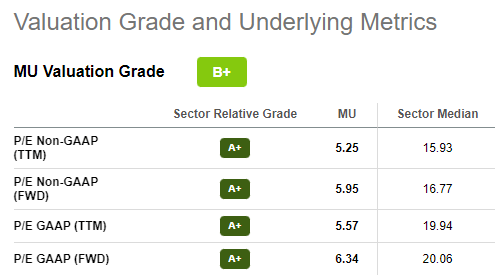

This clearly illustrates the high uncertainty even around short-term forecasts in the segment and the overall risk and unpredictability of future earnings. That is why, relying Micron’s currently low valuation multiples as an argument for its future potential is a very dangerous approach even for long-term investors.

Seeking Alpha

Investor Takeaway

No matter what the upcoming quarterly results for Micron bring, the industry-wide headwinds will likely remain and the company’s narrow focus within the sector would not help. Volatility of both earnings and share price would not go away which makes Micron a poor long-term investment in my view.

Although management continues to execute well, the strategic decision to remain focused on DRAM and storage solutions create significant risks for shareholders. Consequently, the low valuation multiples are not a sign of the share price being a bargain, but rather a reflection of all the risks associated with the company’s future profitability.

Be the first to comment