MF3d/iStock via Getty Images

Micron Technology, Inc. (NASDAQ:MU) is set to release earnings this week. The release is coming amid a severe beatdown for the stock, which fell along with other semis in this year’s sector-wide rout. Since the start of the year, MU has fallen 38%, and the upcoming release is part of the reason why. Many think that Micron will fail to hit analyst estimates because DRAM prices are falling. DRAM is the largest and most profitable part of Micron’s business-when it takes a hit, the whole company suffers.

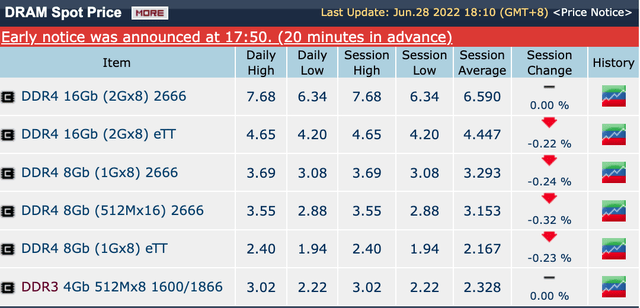

The reports saying that DRAM prices are down this year are accurate. If you visit DRAM Exchange on any given day, you’ll mostly see falling prices.

DRAM spot prices (DRAM Exchange)

These price declines are happening, but it’s hard to say for sure that they will affect Micron. RAM price “quotes” usually involve sampling and estimation, they don’t always correspond to what big buyers like Apple (AAPL) are paying. Micron guided for extreme growth when it released Q2 earnings in March, and the RAM price decline was already underway then. Perhaps the company knows something the markets don’t.

In any case, Micron is actively working toward making its products less commodity like, and clients have touted its expertise in low power performance for selecting it. Given this fact, there is reason to trust Micron’s guidance, and believe that Q3 earnings results will be solid. While I can’t prove MU’s earnings will beat analyst expectations, I think I can establish that revenue growth will be positive and well into the double digits.

In this article I will make my case for Micron’s Q2 earnings being strong, while exploring other aspects of my bullish thesis on the stock.

Where Micron Makes Money – It’s Not Where You Might Think

One big reason why I’d trust Micron’s guidance over RAM price charts is because Micron does not make most of its money selling to consumers. Instead, it makes money selling to:

-

Phone manufacturers;

-

Data centers;

-

Computer manufacturers;

-

Other semi companies.

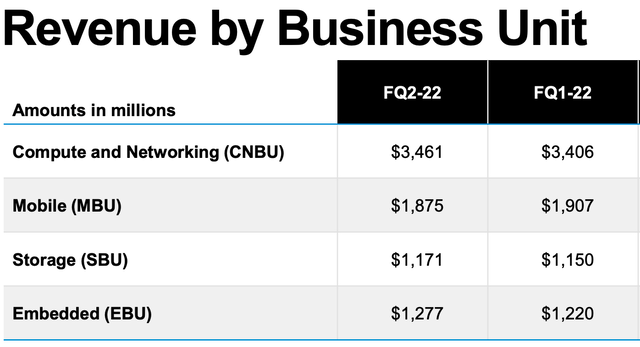

Micron divides its revenue by segment in its quarterly presentations. For the most recent quarter, the breakdown was:

-

$3.46 billion in compute and networking;

-

$1.87 billion in mobile;

-

$1.17 billion in storage;

-

$1.27 billion in embedded.

revenue by segment (micron technology)

Of these segments, we know that mobile and embedded are almost entirely business-to-business (B2B) sales, as there is no big consumer market for smartphone or car RAM. Storage likely has some business to consumer (B2C) sales, as that’s the segment that produces SSDs. The same is true for compute and networking, although Market Realist reports that much of that segment’s sales come from NVIDIA (NVDA) and Intel (INTC).

You might wonder why I’m spending all this time breaking down Micron’s segments by B2B vs B2C sales. The answer has to do with how RAM prices are estimated. DRAM Exchange and TrendForce use spot prices for RAM, SSDs and other semi components. But Micron is increasingly locking in years-long pricing contracts with its B2B clients. Business clients are paying pre-set prices, consumers are paying the spot price. Micron only rolled out these contracts recently, so perhaps some business clients are paying spot. But the point stands: DRAM spot prices won’t predict Micron’s revenue with perfect accuracy. Such a metric isn’t consistent with MU’s revenue mix.

RAM – Will it Always be a Commodity?

Whatever happens to RAM prices in the short term, one thing is beyond dispute:

Micron is working toward making its products less “commodity-like” in the future. In pure economic terms, RAM and Flash storage are commodities, but Micron is working on differentiating its products. It is tailoring its DDR5 memory to be low power and high-speed, and it has the fastest discrete graphics memory around. As memory becomes more specialized, it may cease to be a commodity. Also, the industries that Micron is tailoring its solutions to are among the fastest growing in the world:

-

5g smartphones;

-

Graphics cards;

-

AI powered cars;

-

Advanced photography.

Will Micron’s advances be enough for buyers to see its memory as non-interchangeable with that of the competition? Potentially, yes. Mobileye selected Micron as its primary provider of RAM for its AI driving platform. In a Press Release, Mobileye’s VP of Engineering cited Micron’s “memory expertise” and low power performance as reasons for selecting it. This suggests that Micron’s claims of superior low power performance aren’t fluff, as buyers are confirming them.

This bodes well for Micron’s competitive position. DRAM is an oligopoly, a concentrated industry with three main players: Micron, Samsung (OTC:SSNLF, SSNNF) and SK Hynix. Oligopoly industries typically have good margins, because they don’t have a lot of competition. However, when you’ve got an oligopoly in a commodity industry like RAM, there is still potential for revenue weakness due to falling prices. Like any other commodity, RAM waxes and wanes in price. Sometimes that can negatively impact sellers’ revenue. But with Micron working to differentiate its products, it may enjoy pricing power in the future. That combined with the new long term contracts could give the company more revenue stability than it ever had in the past.

Financials and Valuation

To understand why Micron’s upcoming earnings release could be a bullish catalyst, we need to look at its financials and valuation. Micron stock is already outrageously cheap, and if earnings beat expectations, it will get even cheaper (assuming no change in the stock price).

So, let’s dig into Micron’s earnings and balance sheet, to gauge how the company is going.

Financials

In the most recent 12-month period, Micron delivered:

-

$31 billion in revenue, up 32%;

-

$10.4 billion in EBIT, up 187%;

-

$9 billion in net income, up 182%;

-

$15 billion in operating cash flow (“OCF”), up 62%;

-

$4.34 in free cash flow (“FCF”) per share, up 330%.

Incredible results. The growth was, of course, extremely strong. On top of that, margins were high. For example, with $9 billion in net income on $31 billion in sales, you get a 29% net margin. So, Micron is very profitable.

Now let’s look at the balance sheet. As of its most recent reports, Micron had:

-

$63.6 billion in assets;

-

$15. 8 billion in liabilities;

-

$47.8 billion in equity;

-

$21.5 billion in current assets;

-

$6.9 billion in current liabilities;

-

$6 billion in long term debt.

From these balance sheet metrics we get a 0.125 debt to equity ratio and a 3.11 current ratio, suggesting high solvency and liquidity. So, Micron is not at risk of going bankrupt or experiencing liquidity problems.

Valuation

Given its extraordinary growth and pristine balance sheet, you’d think that Micron would command a high price tag in the markets. But think again! At today’s prices, Micron trades at rock bottom multiples, including:

-

Adjusted P/E: 6.8;

-

GAAP P/E: 7.4;

-

Price/sales: 2.1;

-

Price/book 1.37;

-

Price/operating cash flow: 4.37.

These are all extremely low multiples. And they’re combined with superior growth. As I’ve shown, Micron grew in the high double digits in the past year. If it hits guidance with its upcoming earnings release, and the stock price doesn’t change, all of the multiples above will go even lower. At this point, Micron is approaching liquidation value. So, this is one stock that every value investor should take a serious look at.

Risks and Challenges

As we’ve seen, Micron Technology stock has extreme growth, a cheap valuation, and a solid balance sheet. It certainly seems like an open and shut case. However, there are some risks and challenges to be aware of, most of them short term risks. Some of the most salient include:

-

The earnings reaction. Just a few days ago, Nike (NKE) put out an earnings release that beat expectations, but the stock sold off afterward. This is pretty typical of post earnings stock movements this year, which has seen many stocks sell off despite strong results. It’s not clear exactly why this is happening, but tech stocks like Micron have been affected. MU’s most recent release beat expectations, but it sold off afterward. So, if Micron’s upcoming release is in line or even a modest beat, it may experience short term volatility.

-

Sector wide selling. There are many headwinds facing the semi industry this year, leading to weakness in the whole sector. The crypto crash, for example, is leading to less mining activity, and some think that will lead to weak demand for GPUs. If Micron customers like NVIDIA start selling off, that could affect Micron itself. First, lower NVIDIA sales would likely hit Micron’s own revenue; second, sector wide selling in semis could hit Micron regardless of its financial performance.

-

Poor sales figures from Apple. Apple is one of Micron’s biggest customers, and it was thought to have been adversely affected by China’s lockdowns earlier this year. Apple does all of its manufacturing in China, and many Chinese manufacturing plants were shut down in the first and second quarter due to lockdowns. Many analysts think that Apple will fail to hit revenue targets for the current quarter because of the issues in China. If that’s the case, then Micron’s sales could falter too, because a large percentage of its business comes from Apple.

The Bottom Line

The bottom line on Micron is that it’s a combination of growth and value that you rarely see side by side in the same stock. This is a company that is growing earnings at 180%, yet has a P/E ratio barely above 5. It certainly looks like a good value. And if its efforts at product differentiation and long term contract pricing succeed, it will prove to be one.

Be the first to comment