PeopleImages/iStock via Getty Images

A Quick Take On MGO Global

MGO Global (MGOL) has filed to raise $7.5 million in an IPO of its common stock, according to an S-1 registration statement.

The firm operates the licensed Messi Brand of sporty apparel, accessories and home decor products.

While the company has promise due to the licensing of the Lionel Messi brand, management hasn’t shown it can grow sales to any degree based on the company’s results so far.

The MGOL IPO is highly speculative, so I’m on Hold for it.

MGO Overview

Fort Lauderdale, Florida-based MGO Global was founded to acquire and operate a portfolio of lifestyle brands anchored by notable personalities.

Management is headed by co-founder Chairman and CEO Maximiliano Ojeda, who has been with the firm since inception in 2017 and was previously an executive at various real estate development organizations.

The company’s primary offerings include:

-

Apparel

-

Accessories

-

Home Decor

As of September 30, 2022, MGO has booked fair market value investment of $4.1 million from investors.

MGO – Customer Acquisition

The firm sells its licensed products via an online storefront and through its Messi Store mobile apps.

MGO relies on social media and digital marketing tools on major social networks.

Selling expenses as a percentage of total revenue have fluctuated as revenues have decreased, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended September 30, 2022 |

7.1% |

|

2021 |

3.4% |

|

2020 |

4.7% |

(Source – SEC)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling spend, fell to negative 9.3x in the most recent reporting period, as shown in the table below:

|

Selling |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended September 30, 2022 |

-9.3 |

|

2021 |

6.2 |

(Source – SEC)

MGO’s Market and Competition

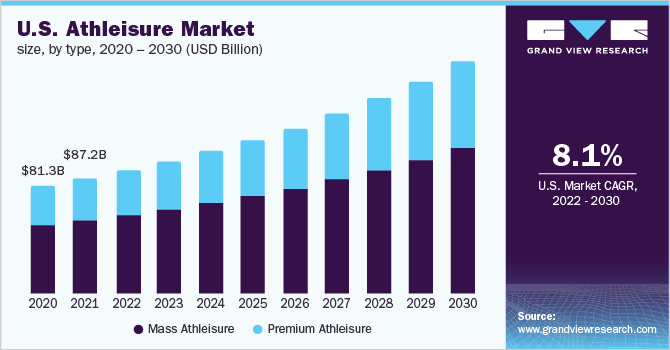

According to a 2021 market research report by Grand View Research, the global market for ‘athleisure’ products was an estimated $307 billion in 2021 and is forecast to reach $661 billion by 2030.

This represents a forecast CAGR of 8.9% from 2022 to 2030.

The main drivers for this expected growth are a growing interest for sports and other outdoor activities by younger demographics for enjoyment as well as health and fitness reasons.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. athleisure market:

U.S. Athleisure Market (Grand View Research)

Major competitive or other industry participants include:

-

CR7

-

MDC

-

Etudes

-

Adidas

-

Vuori

-

PANGAIA

-

Under Armour

-

Outerknown

-

EILEEN FISHER

-

Patagonia

-

Wear Pact

-

Lululemon Athletica

-

Others

MGO Global Financial Performance

The company’s recent financial results can be summarized as follows:

-

Highly variable topline revenue

-

Negative gross profit and gross margin

-

Reduced operating loss

-

Increasing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended September 30, 2022 |

$ 336,103 |

-39.7% |

|

2021 |

$ 880,340 |

26.7% |

|

2020 |

$ 694,585 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended September 30, 2022 |

$ 258,545 |

-1.0% |

|

2021 |

$ 487,933 |

56.5% |

|

2020 |

$ 311,765 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended September 30, 2022 |

76.92% |

|

|

2021 |

55.43% |

|

|

2020 |

44.89% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended September 30, 2022 |

$ (196,946) |

-58.6% |

|

2021 |

$ (919,259) |

-104.4% |

|

2020 |

$ (1,379,174) |

-198.6% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended September 30, 2022 |

$ (2,081,192) |

-619.2% |

|

2021 |

$ (985,895) |

-293.3% |

|

2020 |

$ (1,423,786) |

-423.6% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended September 30, 2022 |

$ (1,178,005) |

|

|

2021 |

$ (769,822) |

|

|

2020 |

$ (401,579) |

|

(Source – SEC)

As of September 30, 2022, MGO had $20,586 in cash and $1.5 million in total liabilities.

Free cash flow during the twelve months ended September 30, 2022, was negative ($1.8 million).

MGO Global IPO Details

MGO intends to raise $7.5 million in gross proceeds from an IPO of its common stock, offering 1.5 million shares from the company at a proposed price of $5.00.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

A separate prospectus indicates that selling shareholders may offer up to 2.5 million additional shares.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $59.4 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 11.37%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

65% of the net proceeds (approximately $3.8 million) for team expansion and marketing; and

35% of the net proceeds (approximately $2.1 million) for general and administrative corporate purposes, including working capital and capital expenditures.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says it isn’t aware of any legal proceedings that would have a material adverse effect on its financial condition or operations.

The listed bookrunners of the IPO are Boustead Securities and Sutter Securities.

Valuation Metrics For MGO

Below is a table of relevant capitalization and valuation figures for the company:

|

Metric |

Amount |

|

Market Capitalization at IPO |

$65,946,150 |

|

Enterprise Value |

$59,424,564 |

|

Price / Sales |

100.10 |

|

EV / Revenue |

90.20 |

|

EV / EBITDA |

-81.00 |

|

Earnings Per Share |

-$0.20 |

|

Operating Margin |

-111.36% |

|

Net Margin |

-408.59% |

|

Float To Outstanding Shares Ratio |

11.37% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

-$1,772,416 |

|

Free Cash Flow Yield Per Share |

-2.69% |

|

Revenue Growth Rate |

-39.73% |

(Source – SEC)

Commentary About MGO’s IPO

MGO is seeking U.S. public capital market investment for its marketing growth plans.

The company’s financials have produced fluctuating and still tiny topline revenue, gross loss and negative gross margin, lowered operating loss but higher cash used in operations.

Free cash flow for the twelve months ended September 30, 2022, was negative ($1.8 million).

Selling expenses as a percentage of total revenue have varied as revenue has fluctuated; its Selling efficiency multiple was negative (9.3x) in the most recent reporting period.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the company’s growth initiatives.

The market opportunity for providing athleisure products is large and expected to grow at a substantial rate of growth in the years ahead, so the company enjoys positive industry growth dynamics in its favor.

Boustead Securities is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (70.4%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risks to the company’s outlook as a public company are its tiny size and lack of operating history that show any significant revenue growth.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 90.2x, an extremely high multiple given the firm’s lack of revenue growth and history.

While the company has promise due to the licensing of the Lionel Messi brand, management hasn’t shown it can grow sales to any degree based on the company’s results so far.

The MGO Global IPO is highly speculative, so I’m on Hold for it.

Expected IPO Pricing Date: To be announced.

Be the first to comment