Anja W./iStock via Getty Images

MFA Financial (MFA) has two preferred shares: MFA-B (NYSE:MFA.PB) and MFA-C (MFA.PC). I cover all these shares in my frequent articles on mortgage REITs, but I rarely focus the entire article on one share. That can make it hard for some investors to find the articles if they aren’t following me.

Fixed Rate

MFA-B has a fixed-rate dividend, which is clearly out of favor today as rates ripped higher. Beyond higher Treasury rates we’re also seeing wider credit spreads. That combination pushes share prices lower and creates a nice bargain.

MFA-B has a yield of 10.24%. If we adjust for dividend accrual (as we should for preferred shares), the stripped yield is 10.3%.

Even with high rates on Treasuries, that is a substantial margin. The coupon rate on MFA-B is only 7.5%. With a stripped yield of 10.3%, that’s 2.8% above the initial rate.

Is that just because the 10-year Treasury yields 3.7%?

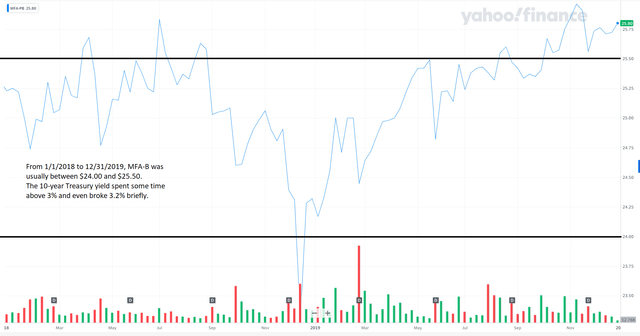

No. In 2018 the 10-year Treasury yield broke above 3%.

Throughout most of 2018, MFA-B usually traded between $24.00 and $25.50. At that point, investors were happy with a stripped yield only slightly above 7.5%.

That makes it clear that we’re also seeing a dramatic widening of credit spreads.

Credit Spreads

When MFA issued another preferred share (several years ago), they issued MFA-C with a 6.5% coupon rate. MFA-C eventually switches over to a floating rate and that feature is very attractive today. The floating rate for MFA-C won’t kick in until 3/31/2025, but it still represents a significant increase in the dividend rate if short-term rates remain anywhere near the current level. For reference, 3-month LIBOR is around 3.6% today. That would drive the yield on MFA-C much higher.

Because MFA-C was issued with a 6.5% coupon rate and MFA-B traded in the $24.00 to $25.50 range while the 10-year Treasury was above 3% in 2018, we can be confident that the weakness in MFA-B is significantly impacted by credit spreads.

Really, the price was in the $24.00 to $25.00 range:

Let’s not say that a 10.3% stripped yield is terrible just because the 10-year Treasury hit 3.7% today.

The Risk

MFA is a mortgage REIT. They are not focused on agency MBS, but market prices on preferred shares from agency mortgage REITs are low also. This is a general trend throughout mortgage REIT preferred shares. We see dramatic discounts to call value (meaning potential upside before a soft cap from call risk) and huge yields.

If the loans MFA owns go bad, that would be a problem. However, their typical loans include a significant discount to the purchase price. The homeowners have to put in far more equity than they would for the typical agency MBS. Consequently, home values need to plunge before the home would be worth less than the mortgage.

During the pandemic, some investors expected MFA to go bankrupt. They didn’t go bankrupt. They weren’t even close to reporting the largest losses in the sector, much less going under. They did sustain some damage, but the damage to the portfolio was vastly smaller than the drop in the share price and far smaller than bears predicted.

There is material risk to home values as the Federal Reserve pushes mortgage rates higher and removes many potential buyers from the market. However, the common shares provide a substantial amount of cushion. MFA uses relatively low leverage since they take on credit risk. Between the lower leverage and having a significant amount of common equity relative to the preferred equity, MFA-B has a respectable shield to absorb losses.

The ideal scenario for MFA-B is one where inflation is falling, and the Federal Reserve realizes it pushed rates too high. Ideally that happens without a severe recession caused by the Federal Reserve’s desire to appear competent. Since the Federal Reserve primarily looks at trailing indicators rather than evaluating what is happening today, they may be slow to recognize when yields need to decline. While investors wait for that environment, they collect a very attractive yield.

Even if rates remain elevated, if the economy recovers it could drive credit spreads much tighter. That could see MFA-B rallying by more than 20% the gap between MFA-B’s yield and treasury yields remains very large.

The Upside

Investors get the 10.3% stripped yield and shares would need to rally 36.5% just to reach the $25 call value. Adjusting for dividend accrual, it’s about 37%. When shares trade near call value, the potential for capital gains is much smaller because investors would be unwise to spend much more than $25.00 for a share that can be called for $25.00 (plus dividend accrual).

I find the combination of yield and upside attractive.

My Positions

I have a small position in MFA, MFA-B, and MFA-C. I see compelling values across each of them. All 3 land within our strong buy range today.

Ratings: Strong Buy on MFA, MFA-B, MFA-C

Be the first to comment