Chip Somodevilla

Investment Thesis

Meta Platforms’ (NASDAQ:META) mission is ‘to give people the power to build community and bring the world closer together’, and whilst the latter is somewhat debatable, the company has certainly changed the way we interact and connect forever.

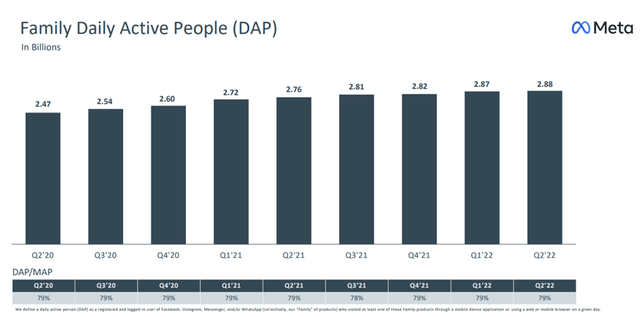

Meta’s core business revolves around its family of four apps: Facebook, Instagram, Messenger, and WhatsApp, which have a combined 2.88 billion daily active people – that is, ~36% of the world’s population use at least one of these apps on a daily basis. The company makes most of its money through advertising right now, with advertisers being able to showcase products across Meta’s Family of Apps to these 2.88 billion pairs of eyeballs.

Meta Q2’22 Earnings Presentation

There is a lot to like about Meta’s core business, but as the company has struggled to cope with recent iOS privacy changes, constant negative PR, and competition from the likes of TikTok, is the core business at risk of slowing down both substantially and permanently?

Aside from its Family of Apps, the next evolution of this business is expected to be within the metaverse; a buzzword that was placed at the forefront of investors’ minds last year when Facebook changed its name to Meta. Whilst this undoubtedly is an exciting opportunity, it involves a whole host of risks, with CEO Mark Zuckerberg describing it as ‘obviously a very expensive undertaking’, and there’s certainly no guarantee that it will pay off any time soon (if at all!).

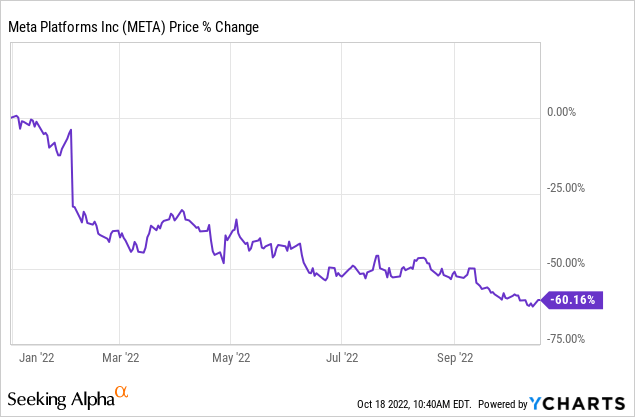

2022 has been a painful year for Meta shareholders. The core Family of Apps business has seen a substantial slowdown, and the company’s metaverse ambitions remain just that – ambitions. This goes some way to explaining why shares have tumbled 60% so far this year, with shareholders wondering exactly when this pain will end.

To that end, let’s look ahead to Meta’s Q3 results and focus on what Wall Street expects, and what investors should be watching out for.

Latest Expectations

Meta is set to report its Q3’22 earnings on Wednesday, October 26, after the market closes, and there are several key items that investors should keep their eyes on.

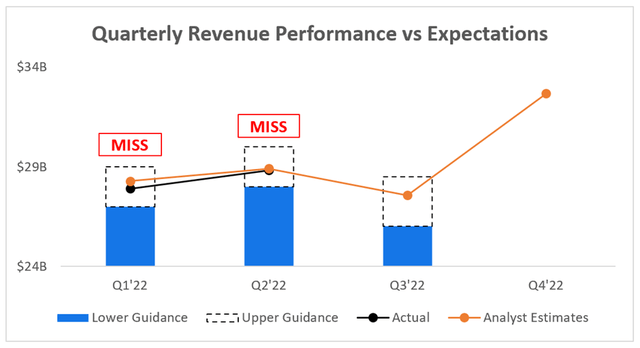

Starting with the headline numbers, where analysts are expecting Q3’22 revenue of $27.57B, representing a YoY decline of 5.0%. This was revised downwards following Meta’s Q3 guidance of $26.0-$28.5B, which was given when its Q2 results were announced. Prior to the guidance announcement, analysts had been expecting Q3 revenues of ~$30.5B.

This helps to explain partially why shares have fallen so harshly in 2022; the expectations baked into Meta’s share price at the start of the year have certainly not come to pass, with the company disappointing investors each quarter of the year so far.

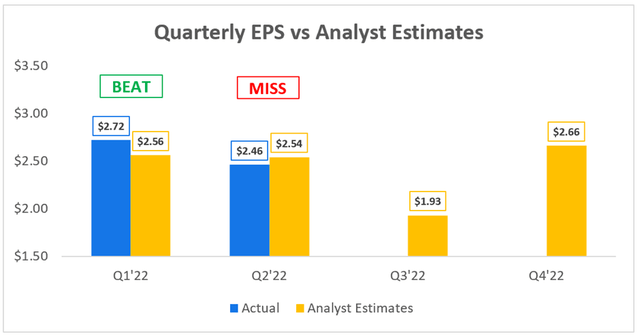

The story improves slightly when we move to the bottom line, as Meta did actually beat analysts’ expectations in Q1 this year, but once again fell short on EPS in Q2. Whilst Meta does not give exact guidance on EPS, analysts used the information they did receive to substantially lower their EPS expectations for Q3 – from $2.59 expected prior to Q2 earnings, to the $1.93 that is now expected.

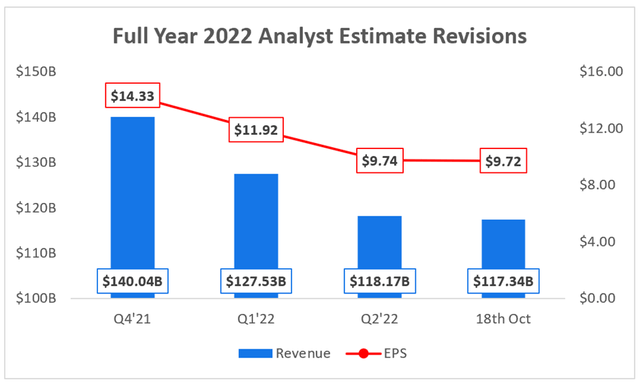

Meta has had a dismal 2022, with the business performance being substantially below par. This can be seen quite clearly in the below graph, which shows how analysts have revised their full year expectations for Meta following each quarterly earnings release.

Expectations for FY22 revenue have tumbled by a fairly staggering 16.2%, with analysts that were previously forecasting revenues of $140.04B in February now expecting Meta to deliver just $117.34B.

It’s a similar, if not more depressing story on EPS, with estimates falling 32.2% from $14.33 in February 2022 to $9.72 in October. Investors in Meta may shrug their shoulders and say that analysts should do a better job with their forecasts, but sadly these were the expectations that had been priced into Meta’s share price at the start of the year – as shown by its rapid decline.

But investing is a forward-looking game, and quite frankly what’s done is done; investors now need to focus on Q3 earnings and hope that Meta can start to turn its fortunes (and those of its shareholders) around.

Key Items To Watch

There are a number of different items to watch for Meta, which include listening for any updates on metaverse traction, understanding how much of the negative impact on advertising is due to the difficult macroeconomic conditions, and seeing exactly how much of an impact the strong US Dollar will have on its results. Aside from the above, there are two items I’ll look at in a bit more detail.

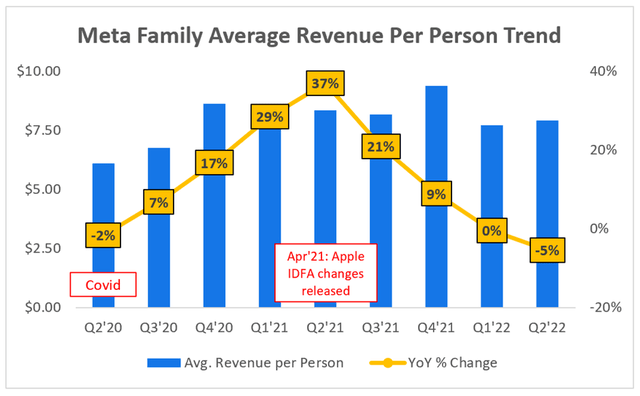

One key metric for Meta is the Family of Apps’ average revenue per person, which helps investors to understand exactly how much value Meta is able to extract from its users. This is a particularly key metric since Meta is unlikely to see substantial user growth over the coming decade, as it already has ~36% of the world’s population within its Family of Apps.

Unfortunately for Meta shareholders, the current trend is not a pretty sight – and we can see two clear stories. The first half of the below graph shows how Meta was able to benefit from an increase in digital advertising as the pandemic struck, and the world was forced to spend a lot more time online. Even when lockdowns lifted, they did so into an economy that was booming.

Then, Apple decided to make some privacy changes; this has made it a lot more difficult for Meta to accurately track its users, and therefore the level and accuracy of data it possesses has fallen, resulting in lower revenue and margins.

We can see that the growth rate in ARPP peaked just as Apple released its changes, and has been in freefall ever since. Combine this with an economy that’s rapidly shifted from boom to recession, and it’s no surprise to see the rapid slowdown in ARPP growth. I would look long and hard at the ARPP figure when Meta releases Q3 results, as this will give a good indication as to how the business is coping with Apple’s privacy changes – if this downward spiral shows signs of easing up, it could spell the start of a more hopeful period for investors.

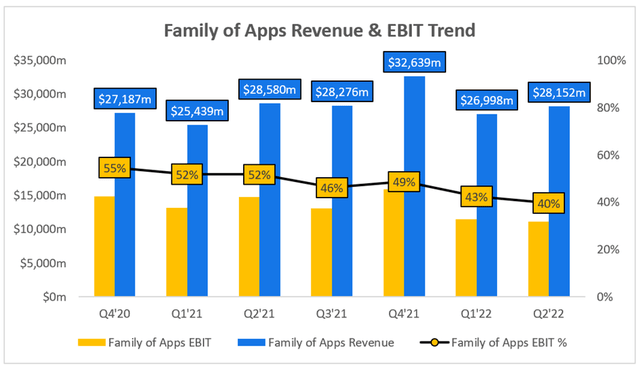

The other key metric worth looking at is the margins in Meta’s Family of Apps. Perhaps quite shockingly, Meta’s Family of Apps EBIT margins have plummeted from 55% in Q4’20 to just 40% in Q2’22; I’m sure there’s a level of seasonality at play here, but it’s a real sharp decline for a business of Meta’s size.

Once again, it’s clear that a decline started following Apple’s IDFA changes in Q2’21 – Meta just hasn’t been able to cope with this shift, and there’s little evidence in the financials that it’s coping any better a year and a half later.

The issue with margins became clearer in Q2, as Meta saw its Family of Apps revenue fall by 1.5% YoY whilst related expenses increased by 23%, driven by employee-related expenses, legal costs, and infrastructure costs. Meta has curtailed its spending plans this year, but investors should be watching margins carefully to ensure that they aren’t spiralling out of control; ultimately, Meta needs to get that top line growing once again in order to stop the rot in its margins.

An Extremely Enticing Valuation

Meta’s shares have come crashing down in 2022, but the company does remain very financially resilient. I know it’s been touted as a value play, so how appealing does it look from a valuation point of view?

Short answer: very appealing.

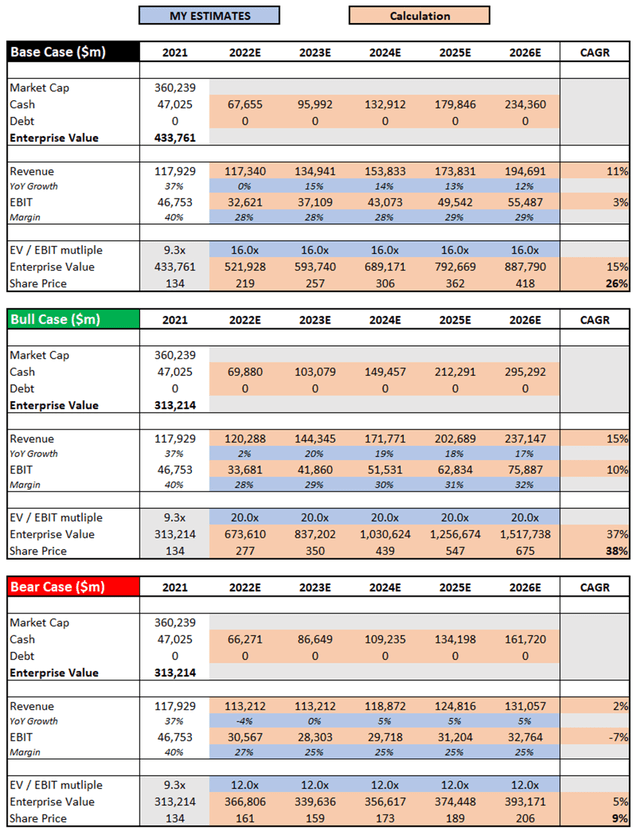

I’ve changed my valuation model slightly from my previous article, as I believe this new methodology does a better job of showing the potential upside and downside in the bull and bear case scenarios. My base case scenario uses similar assumptions to the base case in my previous article, with a few minor tweaks.

The bull case scenario assumes that Meta is able to return to high levels of growth following a tough 2022, driven by either a recovery of the Family of Apps revenue or Reality Labs being able to gain some traction. Either way, there is certainly potential for Meta to improve its current revenue growth trajectory, with margins improving alongside it. My bear case scenario assumes the exact opposite; that Meta is truly a business in decline, and that its glory days of growth are well in the past.

Put all that together, and I can see Meta shares achieving a CAGR through to 2026 of 9%, 26%, and 38% in my bear, base, and bull case scenarios. Whatever your views on the business, it’s clear to see why Meta has been attracting value investors left, right, and center.

Bottom Line

The summary for Meta is pretty succinct. If the company succeeds, shareholders should do very well investing at the current price; if the company fails, then it doesn’t really matter what price investors pay – it won’t end well.

I believe that, if Meta can show signs in its Q3 results that it has stemmed the downward spiral in trends throughout the business, then it could become an extremely attractive investment. Yet for me personally, I am not a big enough fan of the business and its outlook to consider investing, despite the enticing valuation. I look forward to seeing exactly what’s in store when Meta reports its Q3 earnings, but until then, I will keep my ‘Hold’ rating on the company.

If you do have an optimistic view of the business, and I can certainly understand why you would, then I think the current share price provides a fantastic opportunity for long-term investors.

Be the first to comment