Sergey Dolgikh/iStock via Getty Images

A Quick Take On GreenBox POS

GreenBox POS (NASDAQ:GBOX) reported its Q2 2022 financial results on August 15, 2022, and produced payment processing volume of $1 billion for the first time.

The company provides a range of payment processing and related software and services to businesses in the U.S. and internationally.

I’m generally not optimistic on GBOX’ business in the face of rising gateway/ISO fees and growing operating expenses, so I’m on hold for GBOX in the near term.

GreenBox POS Overview

San Diego, California-based GreenBox was founded to develop point of sale, delivery payments and financial management software and related services.

Management is headed by Chief Executive Officer, Fredi Nisan, who has been with the firm since 2017 and was previously founder of Firmness and also launched Brava POS.

The company’s primary offerings include:

-

DEL – delivery app APIs

-

PAY – payment app APIs

-

QuickCard Payment System – cash management

-

POS Solutions – Point of sale hardware/software

-

Loopz Software Solution – mobile delivery service operations

-

Crypto payouts

-

Forex

GreenBox POS’ Market & Competition

According to a 2019 market research report, the market for payment processing services is expected to reach $62.3 billion by 2024.

This represents a forecast CAGR of 9.9% from 2019 to 2024.

The main drivers for this expected growth are a continued growth in the number of merchants seeking integrated payment processing solutions and the entrance of new market participants with new technology offerings.

Major competitive or other industry participants include:

-

PayPal

-

Global Payments

-

Block

-

Wirecard

-

Visa

-

Jack Henry & Associates

-

Paysafe Group

- Others, crypto

GreenBox POS’s Recent Financial Performance

-

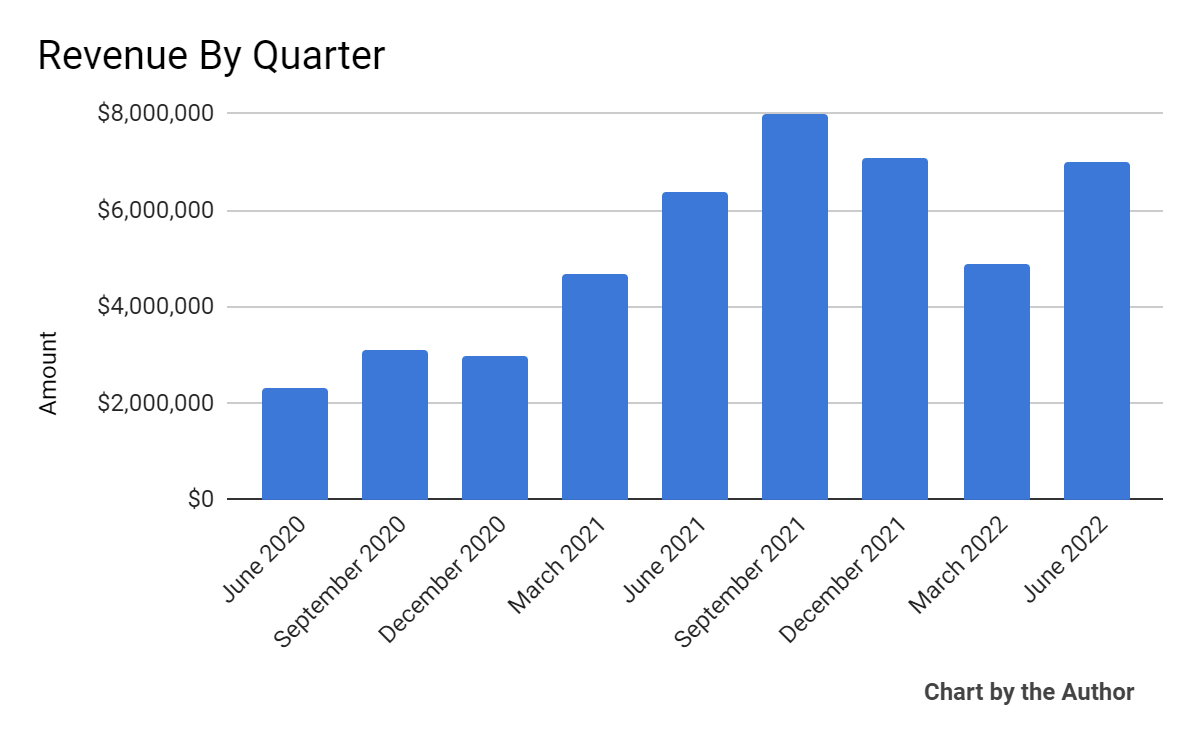

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

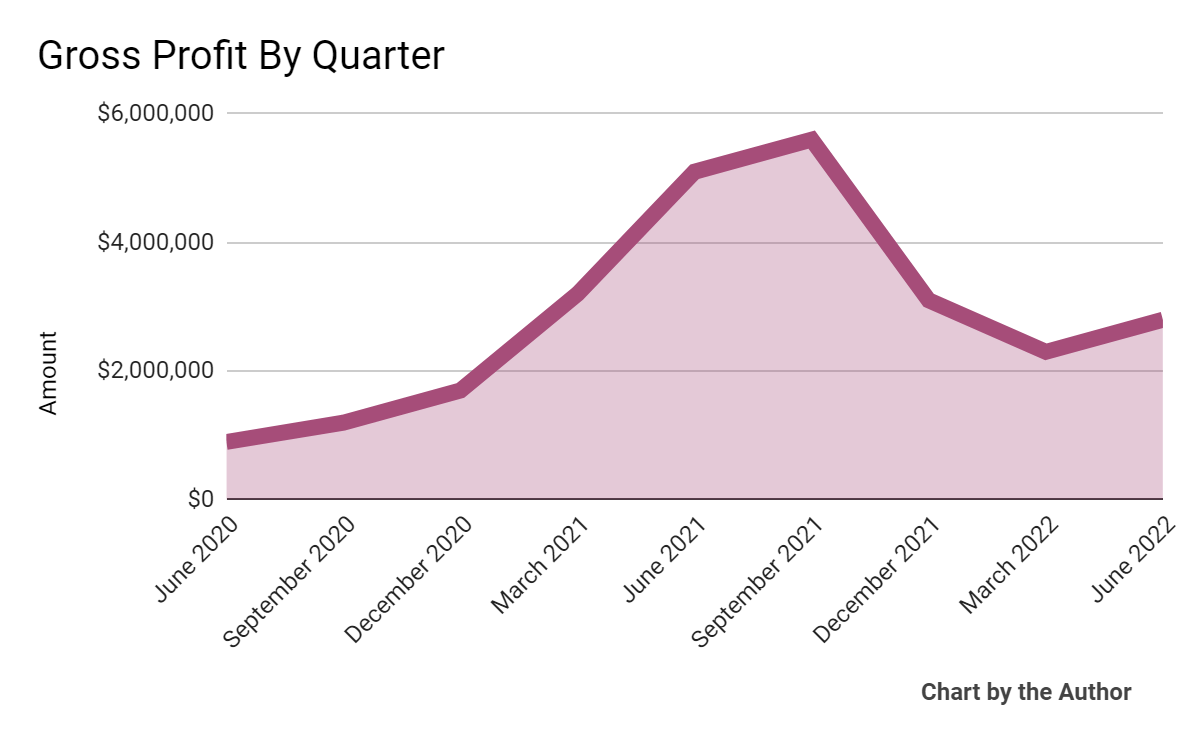

Gross profit by quarter has varied materially as the chart shows here:

9 Quarter Gross Profit (Seeking Alpha)

-

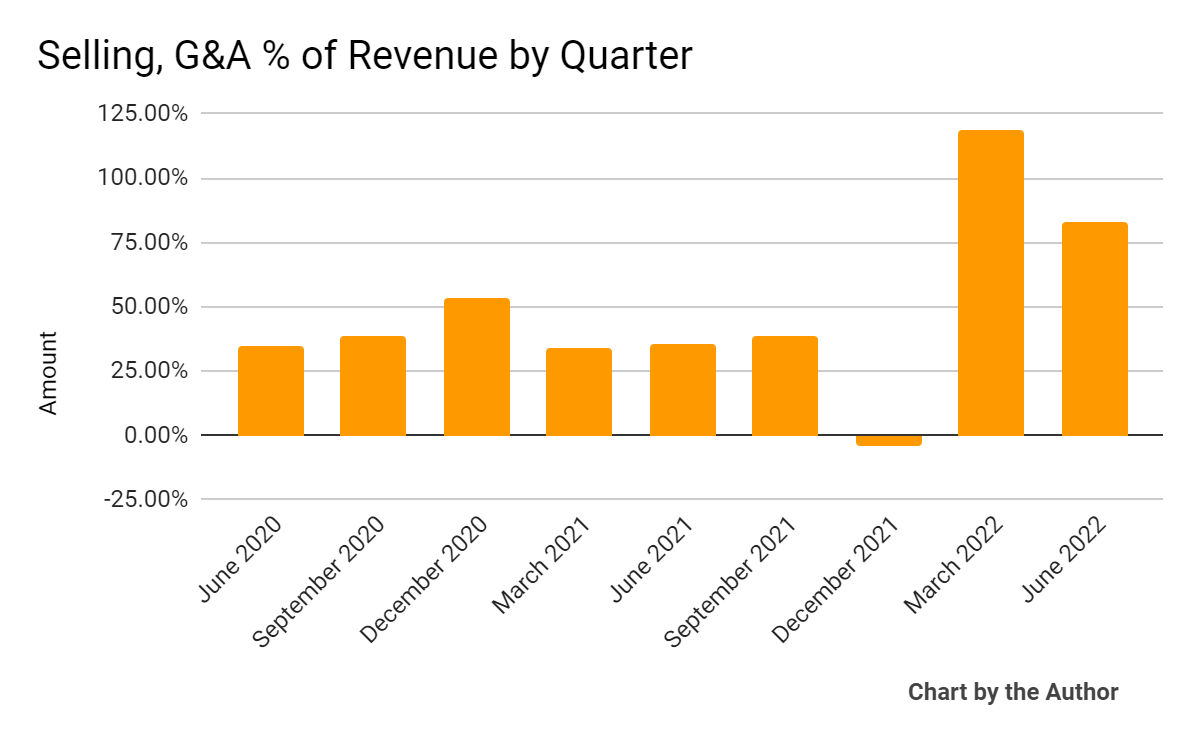

Selling, G&A expenses as a percentage of total revenue by quarter have risen sharply in recent quarters, a worrying result:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

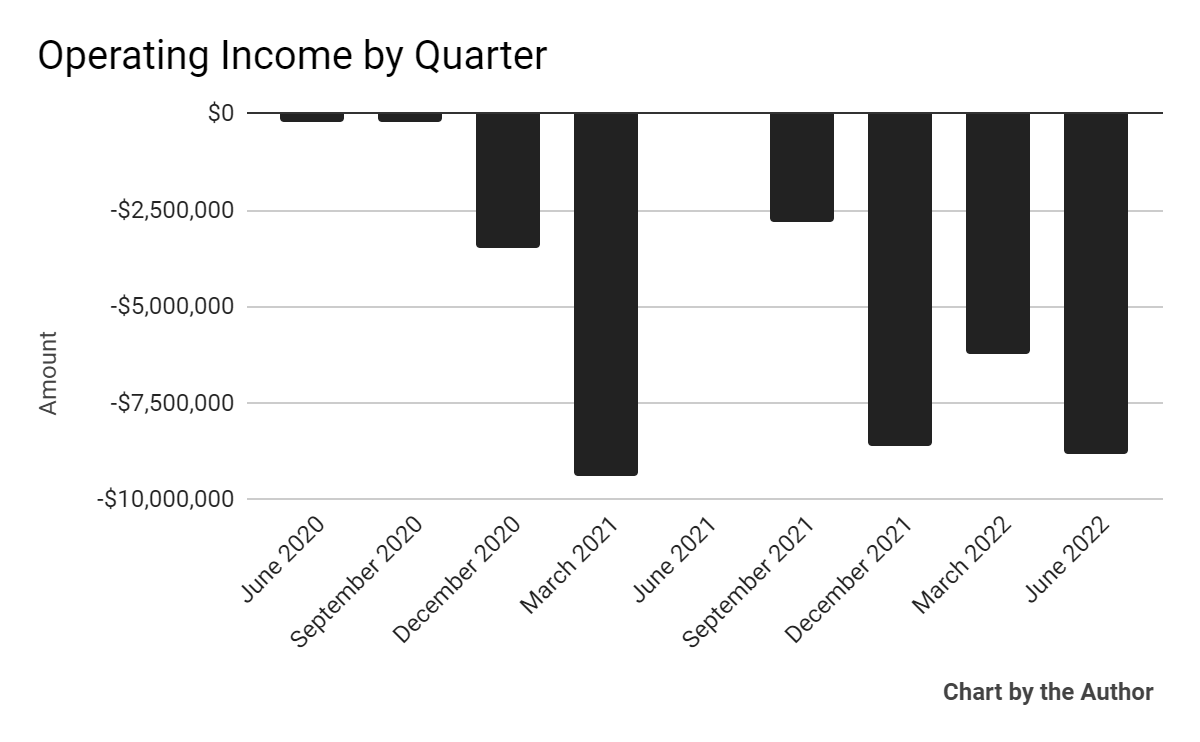

Operating losses by quarter have been significantly negative:

9 Quarter Operating Income (Seeking Alpha)

-

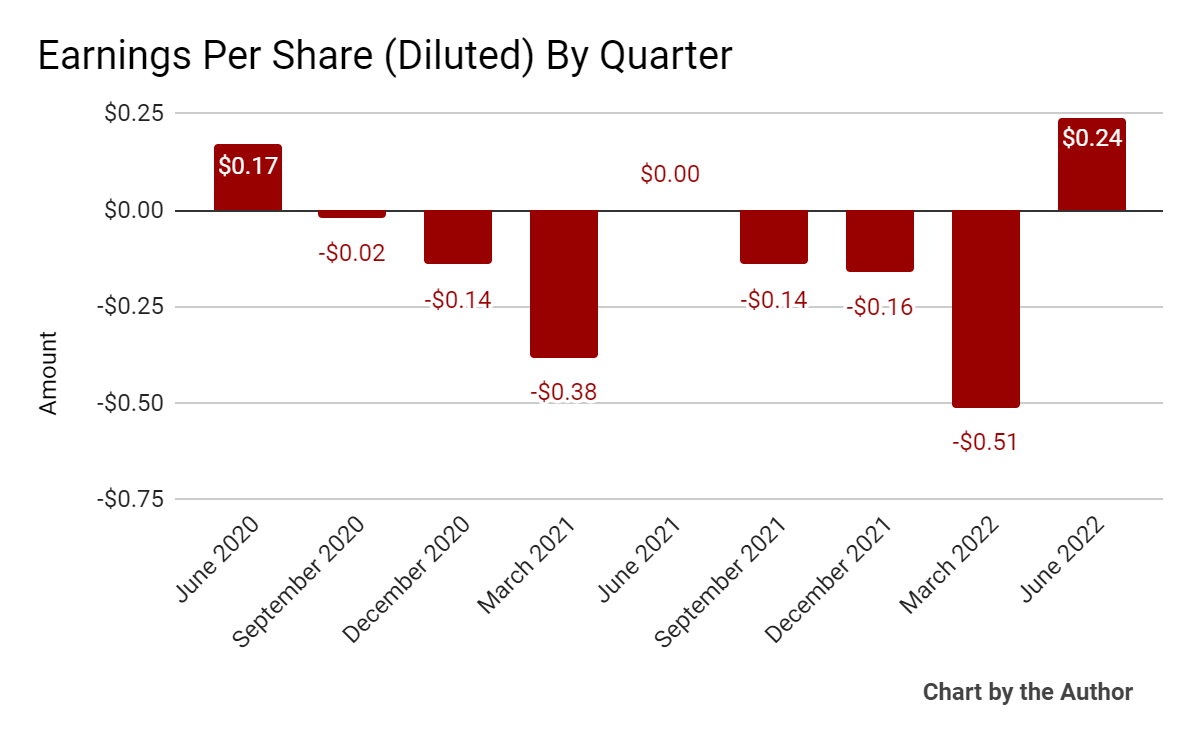

Earnings per share (Diluted) have fluctuated substantially in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

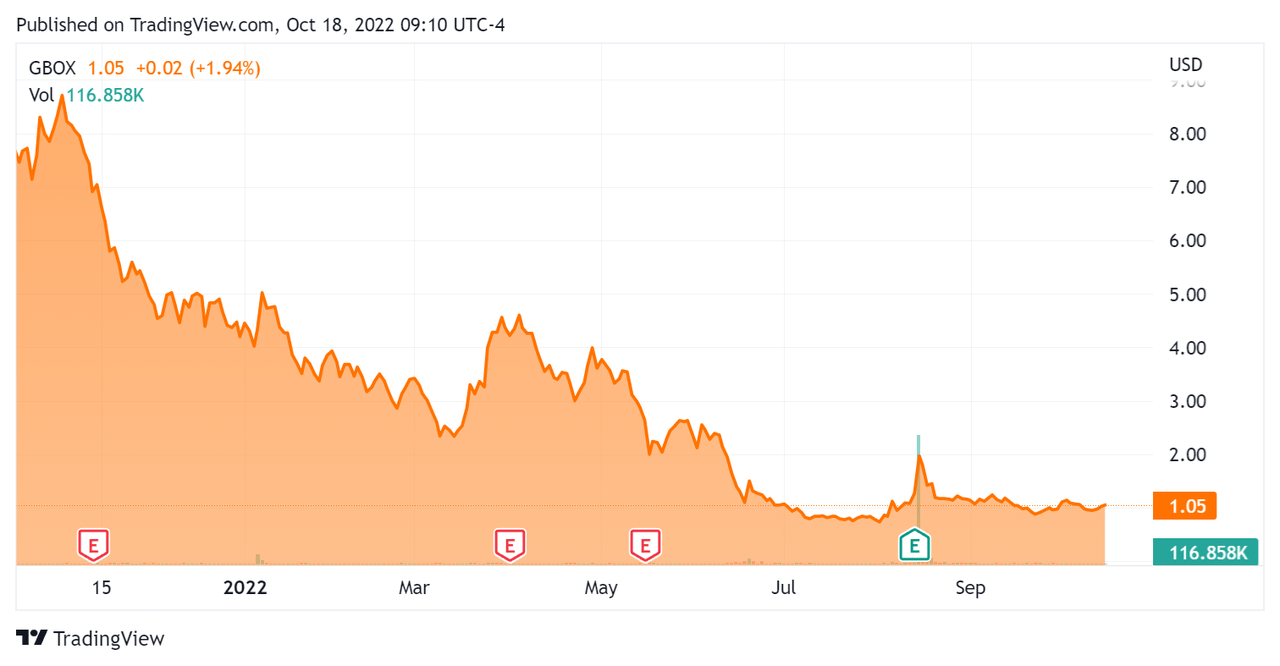

In the past 12 months, GBOX’s stock price has fallen 86.4% vs. the U.S. S&P 500 index’ drop of around 18%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For GreenBox POS

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.91 |

|

Revenue Growth Rate |

57.4% |

|

Net Income Margin |

-88.7% |

|

GAAP EBITDA % |

-84.6% |

|

Market Capitalization |

$46,300,000 |

|

Enterprise Value |

$78,570,000 |

|

Operating Cash Flow |

-$10,400,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.57 |

(Source – Seeking Alpha)

Commentary On GreenBox POS

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the record processing volume result in excess of $1 billion, double its same quarter resulted in 2021.

The firm also continued development of its dollar-backed stablecoin platform, Coyni and made further integration progress from recent M&A activity.

GBOX also made progress deploying its digital payment solutions to American Samoa through its relationship with the Territorial Bank of American Samoa, and now has 13% market share.

Management believes its recent Transact Europe acquisition will enable delivery of its solutions to Europe and the UK as well as being a ‘gateway into the Asian market.’

As to its financial results, net revenue rose in the first half of 2022 by 6.6% over the prior year’s same period, due to an increase in processing volume.

This affected its gross profit, which was down sharply year-over-year from higher fees paid to gateways and ISOs.

Operating expenses rose significantly due to growing headcount and investment in R&D.

The firm booked net income as a result of changes in fair market value of derivative liabilities.

For the balance sheet, GBOX ended the quarter with cash and equivalents of $29.1 million and restricted cash of $26.5 million and $59.4 million in long-term debt.

Over the trailing twelve months, free cash used was $10.6 million.

Looking ahead, management sees increasing ACH volume and some contribution from its Coyni stablecoin business and adjusted EBITDA reaching breakeven in Q3 and positive $3 million in Q4.

Regarding valuation, the market is valuing GBOX at an EV/Revenue multiple of around 2.9x, which is low for its level of revenue growth but unsurprising given its reduced gross profit and higher operating losses.

Also, after the earnings call, management announced the convertible note term extension of one year and interest payments to be paid in company stock instead of cash.

The primary risk to the company’s outlook is an unfavorable cost structure, both in terms of its gateway/ISO fees and its headcount ramp.

While there is room for optimism on the revenue growth side from its ACH business and maybe its stablecoin segment, I’m generally not optimistic on GBOX’ business model in the face of rising fees and growing operating expenses.

I’m on Hold for GBOX in the near term.

Be the first to comment