Kira-Yan

Introduction

This article will not look to facilitate a discussion on valuation, or the financials of Meta (NASDAQ:META), this article seeks to discuss the qualitative factor that is often forgotten in value investing and I believe is increasingly missing from the investors’ thesis’ on Meta.

The Metaverse

Much has been written about the Metaverse, none better than JPMorgan (JPM), on the opportunities that may be present within the Metaverse. Much like social media was instrumental to the growth and implementation of Web 2.0, I believe that the Metaverse will also play a vital role in the facilitation of Web 3.0. I do not see a discussion on the validity of Web 3.0 as necessary, as it is evident that the next formative stage of the internet will come to fruition, but I do hold reservations with the method, timing, and intent behind Meta’s move.

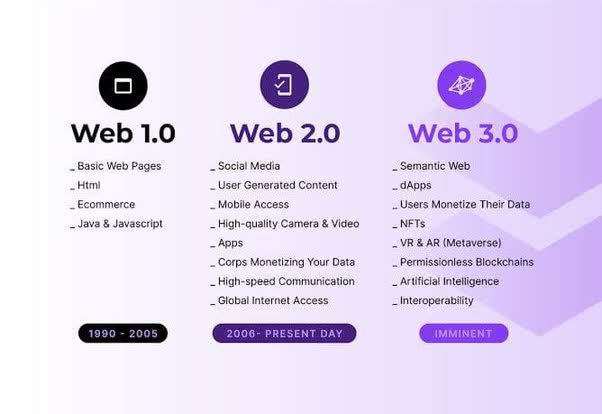

I would like to direct readers to the below chart which highlights the differences between Web 1.0, 2.0, and now 3.0.

Medium.com

Social media was instrumental to the Web 2.0 revolution and has impacted consumers’ habits in unimaginable ways since. Though it should be noted, Facebook was not a first mover into this space, but evidentially became the largest beneficiary. It was famously MySpace that was experiencing supernormal growth as a social media platform. As is usually the case, first mover advancers, specifically in tech, rarely hold onto their first mover advantage. Facebook was able to achieve exceptional returns for shareholders and owners alike, due to its ability to facilitate consumer demand

MySpace being a first mover in the formative infrastructure that built Web 2.0 was not sufficient to facilitate survival. Much like MySpace’s fate, Meta is fixated on its ability to execute as a first mover in the formative infrastructure that is building Web 3.0 could prove to be detrimental. This relationship between first movers and the final beneficiary is well documented, as per the below.

|

First Mover |

Current Leader |

|

Yahoo, altavista, excite |

|

|

MySpace, Friendster |

|

|

Internet explorer, Firefox |

Google Chrome |

|

Juno, Yahoo, Hotmail |

Gmail, Outlook |

Source: Author’s Work

History doesn’t repeat itself, but it often rhymes

Time as a currency

Throughout much of our everyday activities, we encounter two broad categories of applications, systems, and/or companies. The ‘time takers’ and the ‘time givers. A ‘time giver’ is characterized as a function available to consumers that allows them to perform tasks that provide them with more free time when compared to alternative methods of performing those tasks. For example, Microsoft’s (MSFT) Excel or Google’s search engine has effectively saved consumers an unfathomable amount of time. A ‘time taker’ attempts to compete for your time in what many view as a value-destroying manner, much like how consumers feel about social media. Whether that is spending time on Facebook or scrolling through Instagram, time spent on the app directly correlates to Meta’s revenue. While most companies, even the ones mentioned above, display this relationship between time and revenue, their core products in their essence have effectively proven to be efficient and helpful applications in completing their respective tasks and therefore providing the user with excess time available for other tasks (think when Excel did a calculation that would have taken you hours, or when you Googled that quote from a song etc).

Human time is fleeting, and consumers are generally aware of how time is sent. Meta’s ‘bet’ is that consumers are willing to submerge themselves more into their digital surroundings, using the Metaverse.

But if you want to be able to make eye contact or have your physical facial expressions just automatically get translated to your avatar in real-time, then our hardware will provide the best metaverse experience, whether you’re playing a game or meeting with co-workers in Horizon Workrooms.

Mark Zuckerberg Q2 2022, Meta Platforms, Inc.’s (FB) CEO Mark Zuckerberg on Q1 2022 Results – Earnings Call Transcript

Companies such as Google, are looking to use Web 3.0 to provide solutions that once again provide consumers with the efficiency of streamlining their routine tasks.

We are also seeing a new frontier with augmented reality. We have been testing exciting prototypes in our labs like the device we shared at I/O that puts real-time translation and transcription in your line of sight. It’s one example of how AR can solve real needs in the real world.

Sundar Pichai Q2 2022 Google Alphabet Inc. (GOOG) CEO Sundar Pichai on Q2 2022 Results – Earnings Call Transcript

Investors appear to believe that they are paying a P/E of 14.8 for a social media giant but fail to see behind the numbers, that Meta, (I think the name change says it enough) will no longer focus all of its efforts on their social media companies, but rather the metaverse – made evident by the creation of Horizon, the Metaverse social media platform.

Is this Zuckerberg’s world and you’re living in it?

Given how much Zuckerberg has spoken at length regarding how this has been his vision, one would assume that given the opportunity he would signal to the market his confidence in this transition. One would further assume, given the initial market reaction and the mammoth discount present, Zuckerberg would in fact seize the opportunity to buy stock in the open market. But he, and all insiders, are yet to buy a single share in 2022.

It is rudimentary level Corporate Finance that may be at play here. One may conclude that this appears to be Zuckerberg’s pet project, in which he has spent 26% of the free cash flow available to the firm in FY2021 ($10 Billion in 2021 alone). With growth slowing in their social media apps and spending on the Metaverse gaining pace over the next decade, this level of spending will weigh heavily on Meta’s margins for years to come.

What do they see that we don’t?

Facebook has a plethora of data on consumers and their habits. I do believe, that given the level of granularity in their data, they have access to data that fair as leading indicators which are able to model future active user accounts. This sudden and large shift towards a new direction, for a company of this size, could be an indication of the strength of the deterioration they are seeing from consumers within this data. This, coupled with Apple’s (AAPL) attack on Meta’s moat, the personal biographies of 1 billion consumers’ data, could be viewed as a signal of the deterioration in the top line within the near future.

Much like Netflix’s (NFLX) recent fast pace move to add an ad-supported tier, which allows them to tap into a different revenue stream, the speed in which they completed this change indicates that their internal data attests to the rapid deterioration in the way consumers view content – whether that is movies or short-form videos, I believe these are transformative years for both companies.

It can be argued that both companies are in desperation mode, in the hope of reliving their growth days, and postponing their eventual maturity.

Conclusion

Will Meta provide good returns over the next few years? Possibly, it has its reputation to support it for a while.

If it succeeds in the Metaverse, can it continue to deliver outsized returns to shareholders? Yes, probably.

Are there better opportunities out there with much more defined paths? 100%.

Be the first to comment