Khanchit Khirisutchalual

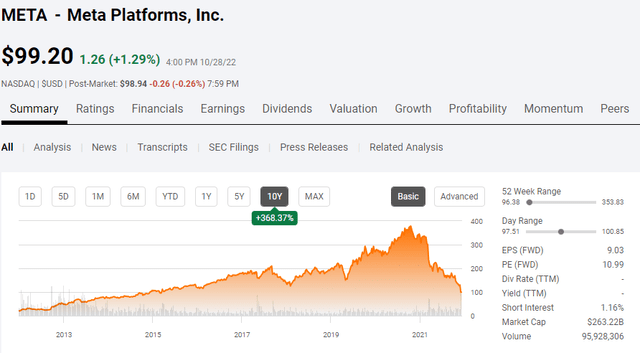

Meta Platforms (NASDAQ:META) reached an inflection point, and regardless of the warning signs2, Mr. Market was flashing, Mr. Zuckerberg went full speed ahead. META has claimed the throne as the largest capital destroyer, as roughly $700 billion of shareholder value has evaporated since September 2021. Shares of META topped out at roughly $382.18 on September 3rd, 2021, and since then, have fallen -74.4%. Shareholders have watched $282.98 of value disappear, leaving shares under $100 since its peak. For many investors, Q3 earnings were the last straw as the Capex spend on Reality Labs was unacceptable. Prior to earnings, Brad Gerstner, the Founder and CEO of Altimeter Capital, which had $18 billion in assets under management as of April 2022, and long-time META shareholder, penned an open letter to Mr. Zuckerberg. The OPEN letter expressed his frustration with META’s current direction and outlined a 3-step plan that would double META’s FCF to $40 billion per year.

Nobody enjoys seeing their investments decline, and for long-term shareholders, the destruction of shareholder value that META has delivered is a hard pill to swallow. META is no longer a top-10 holding in the SPDR S&P 500 Trust ETF (SPY), and its market cap has fallen below $300 billion. There were aspects about the quarter that I liked, but in the end, the numbers matter, and many just can’t justify what is occurring. It’s never too late to exit a position if you believe there is a larger return to be made through another investment vehicle, but exiting META is a difficult proposition. I believe META has tremendous potential, but things could get much worse as the markets enter tax-loss harvesting season. There is certainly a chance that META could finish the year lower. The real questions each investor needs to ask themselves are the following, do I believe in Mark Zuckerberg’s vision, and is the investment in Reality Labs the best use of META’s capital? META isn’t my only investment, and I have made the decision after reading over the earnings call and press release several times to add to my position. META’s shares may continue to decline, and if they do, I will probably add to my position again, but I am looking out 5-10 years as I am fully ready for 2023 to be a disaster.

The Q3 Earnings debacle and why investors have every right to disagree with the direction META is going.

Mark Zuckerberg is running a public company, but the dual share class protects his power. Class A shares which are the common shares, have 1 shareholder vote, and the Class B shares have 10 shareholder votes tied to each share. Back in May of 2021, Bloomberg reported that Mr. Zuckerberg controlled 58% of META’s voting shares due to his ownership of Class B shares. In May 2019, Mr. Zuckerberg disposed of more than half a dozen shareholder proposals to limit his power as he personally voted on the matter. One of the proposals went as far as to remove him as Chairman of the board and cancel the super-voting rights the Class B shares afford him. While the shareholder community can’t vote him out, or make him change META’s future direction, they can vote with their brokerage accounts and continue to sell off their shares. Over the last 13 months, Mr. Zuckerberg has personally lost over $100 billion, and while shareholders can’t compete in the board room, his personal losses are not going unnoticed, and if they continue to plummet, there is a chance he will get the message. The problem for shareholders is that he might not care.

The direction for META has been decided, and there may be nothing that can change this. Only time will tell if this is the correct decision or if taking a similar approach as Apple (AAPL) to return a larger portion of the profits back to shareholders will have created more value over time. The message is clear, META intends to grow operating income from their family of apps, while investing in AI and Reality Labs. The problem is that shareholders do not like what they see when it comes to capital allocation.

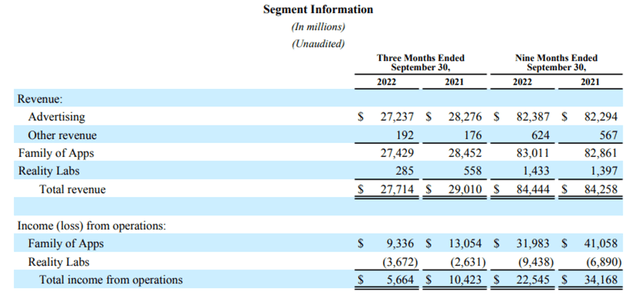

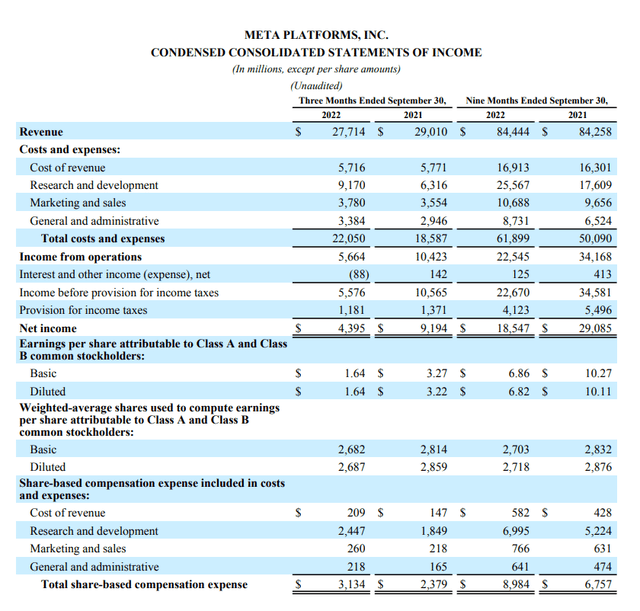

At the end of Q3 2021, shares of META traded at $343.01 and its downward spiral had just begun. In 2021’s first 9 months of operations, Reality Labs contributed $1.4 billion (1.66%) to META’s $84.26 billion of revenue. To this point, META had invested roughly $8.29 billion of capital into Reality labs as its income from operations loss was -$6.89 billion. META’s core businesses generated $82.86 billion of revenue and had an operating income margin of 49.55%, as their operating income was $41.06 billion. When Reality Labs was factored in, it’s $1.4 billion of revenue and operating loss of -$6.89 billion negatively impacted META’s operating income margin, causing it to decline to 40.55%.

While this wasn’t necessarily a problem in the Fall of 2021, what has materialized over the recent year drastically impacted shareholder confidence and, ultimately, shareholder value as shares of META has declined -74.4% from their peak. Upon META’s earnings release, shares plummeted -22.69% (-$29.36) from $129.04 to $100.04. In the first 9 months of 2022, META’s core business revenue was flat as it came in at $84.44 billion, but their operating income significantly declined by -22.1%, falling from $41.06 billion to $31.98 billion. The core business operating margin declined from 49.55% to 37.87%. The sticking point for many investors was that after a large capital investment throughout 2021 into Reality Labs, its revenue increased by $36 million YoY in the first 9 months of 2022, but the operating losses continued to expand. Reality Labs operating income went from -$6.89 billion to -$9.44 billion YoY in the first 9 months of operations. 2022 has been a difficult operating environment, and after roughly -$20 billion in operating losses between 2021 and the first 9 months of 2022, Reality Labs is nowhere close to breaking even, let alone generating positive income from operations.

On the Q3 conference call Dave Wehner, META’s CFO, made it crystal clear that Reality Labs operating losses in 2023 will increase significantly YoY. META’s operating loss for Reality Labs in Q3 was -$3.67 billion, and if this is matched in Q4, it will bring the operating loss for Reality Labs to -$13.11 billion in 2022. I have no clue what Mr. Wehner considers a significant YoY increase, but Realty Labs could theoretically lose an additional -$1.31 billion to -$6.56 billion, placing it’s 2023 operating income loss anywhere from -$14.42 billion to -$19.67 billion.

|

2022 Operating Income Loss |

2023 % Increase |

2023 Operating Loss Increase |

2023 Operating Income Loss |

|

|

Reality Labs |

-$13,110,000,000.00 |

10.00% |

-$1,311,000,000.00 |

-$14,421,000,000.00 |

|

Reality Labs |

-$13,110,000,000.00 |

20.00% |

-$2,622,000,000.00 |

-$15,732,000,000.00 |

|

Reality Labs |

-$13,110,000,000.00 |

30.00% |

-$3,933,000,000.00 |

-$17,043,000,000.00 |

|

Reality Labs |

-$13,110,000,000.00 |

40.00% |

-$5,244,000,000.00 |

-$18,354,000,000.00 |

|

Reality Labs |

-$13,110,000,000.00 |

50.00% |

-$6,555,000,000.00 |

-$19,665,000,000.00 |

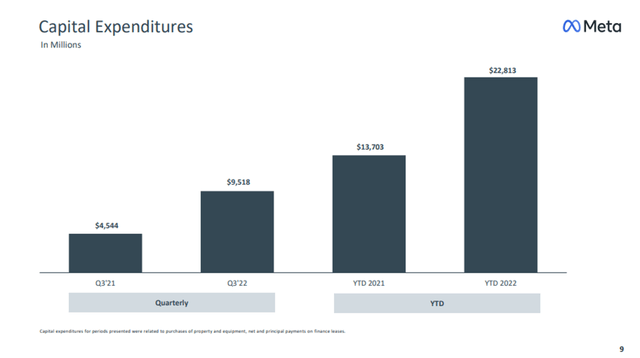

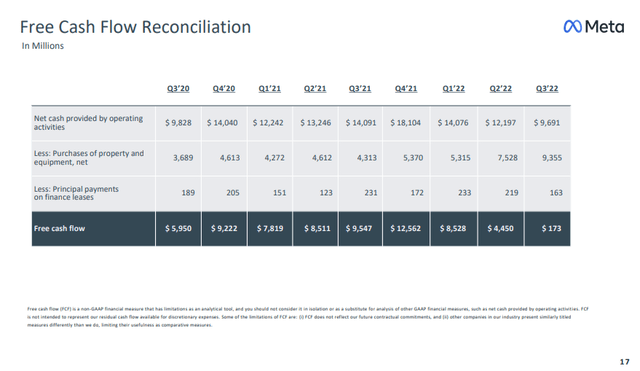

YTD, META’s Capex spending has increased by $9.11 billion or 66.48%, and we can expect another year of YoY increases in Capex. This has caused META’s Free Cash Flow (FCF) to become almost non-existent in Q3 as they generated $173 million of FCF. This is a QoQ decline of -96.11% in FCF, and investors have every reason to be critical. Due to Mark Zuckerberg’s voting percentage, he doesn’t have to justify anything to shareholders, but that doesn’t make it the correct way to run a publicly traded company. When it’s all set and done, META will easily exceed $100 billion of investments into Reality Labs, and there has not been a clear plan of how Reality Labs will generate even a fraction of these investment costs from the operating income it is projected to generate.

The most insight Mr. Zuckerberg has provided to shareholders is that beyond 2023 META expects to grow its total operating income by pacing Reality Lab investments. That basically means that 2022 and 2023 will have been a scaling blitz. Mr. Zuckerberg has also been clear that META’s capital allocation philosophy over the long term is to allocate a portion of the profits generated from its core businesses towards new initiatives with the intent on creating a greater return of capital to shareholders.

Mr. Market and the investment community like safe and conservative, not uncertainty when it comes to the business model and generating revenue. META is being negatively impacted by the lack of clarity regarding Reality Labs. Investors know that the rate of capital allocated in 2023 toward Reality Labs will substantially increase from the 2022 level. Then in future years, it is safe to project the level of capital allocated toward Reality Labs will replicate 2023’s investment. Investors haven’t been provided a roadmap of the vision, or how META plans on driving revenue from Reality Labs to not just recover the invested capital, but ultimately profit off the venture.

Brad Gerstner’s open letter to Mark Zuckerberg, if he was correct, and my thoughts on the direction of META.

Everyone has an opinion, and Brad Gerstner is correct from the standpoint of his open letter representing what he feels is the best course of action for META. I believe his 3-step plan of reducing headcount expense by 20% or more, lowering Capex costs from $30 to $25 billion, and limiting the capital investment into Reality Labs to $5 billion annually would have been celebrated by the market, and shares of META would be sitting at $150+ right now rather than sub $100.

Mr. Gerstner has many good points and from the outside looking in, his suggestions are pragmatic, and I believe they would have been received well by Mr. Market and the investment community. META is one of the best businesses in the world, and its core businesses generated over $45 billion of operating income in 2021. META’s employee count has increased by more than 3x over the last 4-years, growing from 25,000 to 85,000. Looking at 2021, META generated $38.44 billion in FCF. I would agree with Mr. Gerstner that if META were to incorporate his 3-step plan, their FCF could come in around $40 billion per year, which would include allocating billions in capital toward Reality Labs annually. The point about how he picked 20% for the staff reduction is interesting as he points out that it would take the headcount back to the mid-2021 level, which would leave META sufficiently staffed.

Brad Gerstner’s letter was an interesting read, and I do believe Mr. Market would be extremely receptive to this plan. Mr. Zuckerberg has been clear that what Mr. Gerstner has presented is not the direction META will be taking, and its full steam ahead. It’s going to take years to see who is correct, and it’s Mr. Zuckerberg’s game to lose. While Mr. Zuckerberg doesn’t need shareholder approval, I believe he has an obligation as the Chairman of the board, and CEO to provide shareholders with a more in-depth answer as to what the grand plan is and how it’s monetization will generate not just operating income for META the company, but capital appreciation for shareholders.

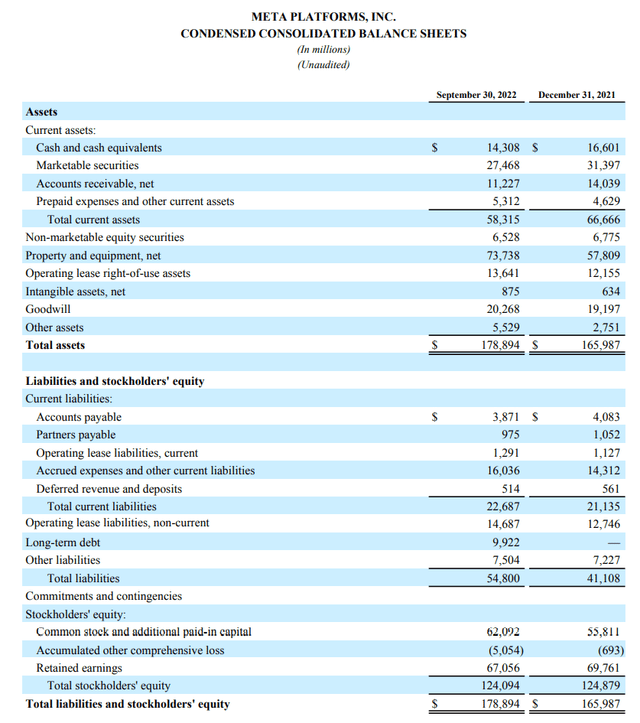

In the past, I have given Mr. Zuckerberg a tremendous amount of credit, and I have supported the capital investments into Reality Labs. After reading through Q3 I am not as supportive as I was. META’s growth had previously come organically as it was self-funded through its FCF. Q3 2022 marks the first time since 2012 that long-term debt wasn’t $0. Prior to Q3, I was less concerned because my investment thesis was based on a different subset of information. Now, in a rising rate environment, META has added $9.92 billion of long-term debt to its balance sheet and has told shareholders that investments into Reality Labs will substantially increase in 2023. I am now questioning what the long-term debt number becomes at the end of 2023, and if it crosses over the $20 billion mark? On the one hand, $9.92 billion in long-term debt isn’t the end of the world for META, it’s more the principle. META has $41.78 billion in cash on its balance sheet under short-term assets. When you include accounts receivable and non-marketable equity securities under long-term assets, META could unleveraged its balance sheet and eliminate every dollar of its total liabilities. Its balance sheet is still a fortress, but the problem I have is that META is now taking on debt to fund a project that may or may not materialize.

While I agree with Mr. Gerstner’s assessment, I am not running META, and I am not privy to Mr. Zuckerberg’s plans. As a long-term shareholder, I have decided to place my support behind Mr. Zuckerberg, and I am buying more shares of META. There is a lot I still like about META, and while Mr. Gerstner made some great points that I feel would be handsomely rewarded in the short-term, I am willing to back Mr. Zuckerberg’s play. If the Metaverse materializes and Mr. Zuckerberg is correct, META will be so far ahead of everyone that this could be a replication of social media in the 2010s, where META’s platforms were the only games in town.

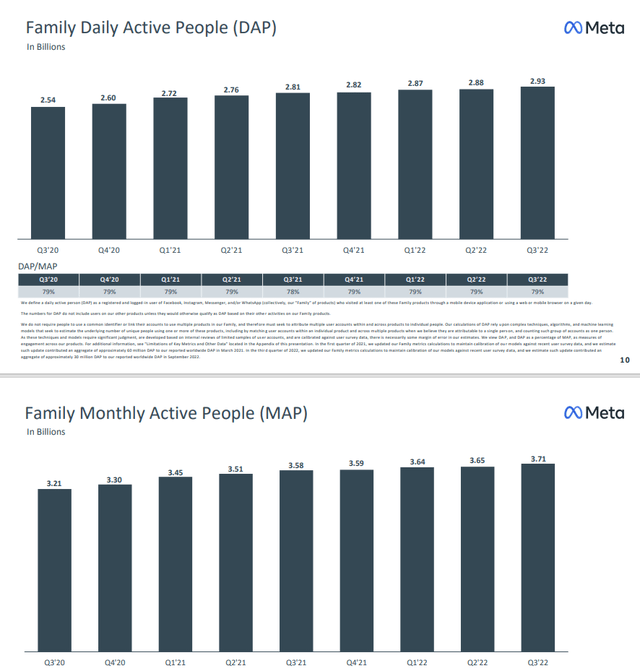

META’s platforms are the largest social media platforms in the world, and it doesn’t seem as if anything will change this. In Q3 META’s user growth grew across the board QoQ. Family Daily Active People grew by 1.74% (50 million) QoQ, Family Monthly Active People grew by 1.64% (60 million) QoQ, Facebook Daily Active Users increased 0.81% (16 million), and Facebook monthly Active Users increased by 0.82% (24 million) QoQ. Facebook is still growing and that’s a testament to its continued relevancy throughout society.

On the Q3 conference call, Mr. Zuckerberg stated that META will focus its investments on a small number of high-growth opportunities, including its AI-discovery engine powering Reels and other recommendation experiences, its ads and business messaging platforms, and the Metaverse. There are now more than 140 billion Reels plays across Facebook and Instagram each day which is a 50% increase from 6 months prior. META’s capital allocation toward the AI-driven discovery engine is directly targeted to take eyeballs away from TikTok and other competitors. In Q2, Reels crossed the $1 billion annual revenue run rate level, and the META just announced that the combined run rate across Facebook and Instagram has grown to $3 billion just 3 months later. Billions of people and millions of businesses utilize WhatsApp and Messenger daily. META has just started to really monetize WhatsApp and Messenger as Click-to-Messaging ads is one of META’s quickest-growing products with a $9 billion annual run-rate. The bulk of revenue comes from Click-to-Messenger, but Click-to-WhatsApp just passed a $1.5 billion run rate, a growth rate that exceeds 8-% YoY.

META is still a cash cow, and over the first 9 months of 2022 has generated $84.44 billion in revenue, despite macro headwinds. One factor that I am keeping front and center is that META has increased its total expenses, and its revenue is relatively flat, which has caused margins to decline, but META still produced $22.55 billion in income from operations and $18.55 billion of net income throughout the first 9 months of 2022. This is not a distressed company, and regardless if you agree with Mr. Zuckerberg’s vision or the direction he is taking, the company, META, still generated $4.4 billion of net income in Q3, despite the rise in costs and capital allocation toward investments.

As a long-term shareholder, I am looking at the reality of FCF and margins declining in 2023. Investments in Reality Labs will increase, and there is no clarity yet regarding how macro headwinds will impact revenue generated and costs incurred. META also took on over $9 billion of debt, so there will certainly be additional capital going out the door to service its debt load. My shorter-term outlook is tied to 2025, and my longer-term outlook is tied to 2030. 2023 could be a difficult year, and META’s numbers may not improve enough to get the investment community excited until 2024. I think we will see improvements over the course of 2023 in regard to the monetization of different apps and features such as WhatsApp and Reels. My investments are a play on META’s revenue growing significantly outside of the existing platform state as it is. META has continued to prove people wrong, and when I look at the business, excluding Reality Labs, I don’t see revenue declining over time; I see it growing.

When I think about Reality Labs and the Metaverse, I look back at how technology has evolved. I am 41, and I have grown up with the evolution of video games, laptops, cell phones, smartphones, tablets, etc. I would think there were many who never thought the video game industry would grow into what it has become today, and I am fairly certain that when the first smartphones were introduced, very few people could have envisioned the impact they would have on society and how much time people spend on them daily. When I walk through NYC, I see a tremendous amount of people looking down at a screen while they walk, and people’s faces are buried in their phones while they are eating with others at restaurants. Why is it so hard to envision that the Metaverse is the next evolution in technology and that it will have an overwhelmingly successful adoption rate? Kids and teenagers will never know life without smartphones, social media, or tablets. While I don’t have a clear vision of how META will monetize the Metaverse, it’s not unrealistic to me that a large amount of revenue can be generated through microtransactions within the Metaverse, selling virtual tickets to sporting events and concerts or that virtual access to conferences won’t be held in the Metaverse. There will also be countless applications for training simulations and learning experiences. If the Metaverse becomes a success, it is possible that META’s capital investments could prove to be a fantastic investment. If they do and operating losses of $10 billion-plus turn into billions in operating income, what’s that worth to the market cap of META?

Conclusion

Mr. Zuckerberg has executed on a vision that others have disagreed with time and time again. I believe there are good reasons for the decline in 2022, but not to the extent that META has sold off. Even with the large investments into Reality Labs, META is still on track to generate over $20 billion in net income throughout 2022. I believe the market would be rewarding META if Brad Gerstner’s plan was followed, and the conversation about META would be much different. There are several unknowns, and I believe investors are walking away from META because the level of capital being allocated toward Reality Labs without a public plan of how consumer adoption and monetization will occur is too large for their comfort. I am not happy that META is taking on debt for the first time in a decade, but at the same time, I am willing to cut Mr. Zuckerberg a lot of slack. I am prepared for 2023 to be ugly for META, but I see a path for their strategy to pay off in 2024, and beyond. I believe the Metaverse will be huge, and even if Baby Boomers, and Gen X doesn’t become a driving force behind it, the adoption rate for Gen Y and Gen Z will be massive. META is in a position where they can take these risks, and I am going along for the ride with my eyes wide open, knowing that 2023 could get uglier.

Be the first to comment