Krisada tepkulmanont/E+ via Getty Images

Thesis

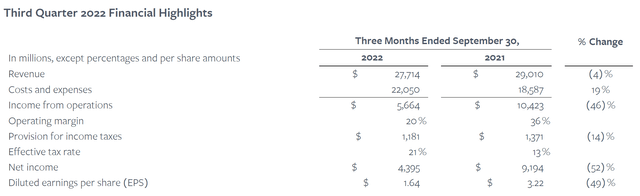

By the time you are reading this, I assume you already know the bloodbath following Meta Platforms, Inc. (NASDAQ:META) Q3 earnings report (“ER”). Furthermore, I assume you’ve already had the time to look into its financials in detail like many other Seeking Alpha authors have. I won’t further add to the interpretation of its Q3 results. In a word, everything is going down except costs, as you can see from the following chart.

So here I will directly get to my point – judging by the market reaction following the Q3 results, my view is that the market has largely misunderstood the potential and also the timeline of its VR (virtual reality) initiatives. And the market will regret such a misunderstanding. In the remainder of this article, I will argue that:

- The addressable markets of its VR initiatives are way beyond video games and social networks.

- The timeline for META to monetize on these potentials is closer than the market recognizes.

AI and VR are approaching singularity point faster than you think

While most people are probably still under the impression that AI and VR are sci-fi fantasies and we won’t be able to benefit from them in any foreseeable future, leading AI and VR experts are worried about the exact opposite. They are worried that the singularity point (the point that they begin to improve themselves) is approaching faster than we can be ready. Two examples are probably sufficient. And whether these examples are scary or impressive depends on your perspective.

- AI gaming. You all know that Google DeepMind released AlphaGo back in 2015. The surprise is NOT that it played better than any human players (most AI experts expected it). The surprise is its timeline. Most experts only expected this to happen decades later. Since AlphaGo, new AI algorithms have been developed to learn and master dozens of computer games LIKE A KID WOULD—these are the operative words here. Meaning, these algorithms do not need instructions anymore – just like kids figuring out their ways with a new toy (they do not start with reading the instructions and manuals).

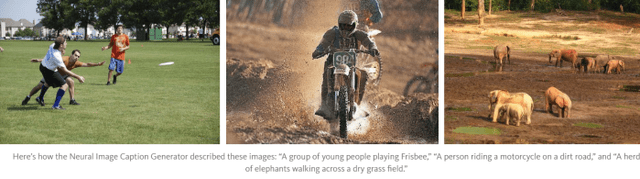

- Image recognition. In 2014, a Google team led by Ilya Sutskever demonstrated an algorithm that can recognize and label images. For example, the algorithm created the following labels for the three photos below, “a group of young people playing a game of Frisbee,“ “a person riding a motorcycle on a dirt road,“ and “a herd of elephants walking across a dry grass field.“ It looks so unimpressive on the surface – something a 4-year-old can do. But the scary or impressive part is that the algorithm had no concept of frisbee, young man, motorcycle, or elephants, whatsoever. The algorithm, purely based on the colors in a bunch of pixels, somehow “learned” these concepts and correctly labeled these images.

What do these have to do with META?

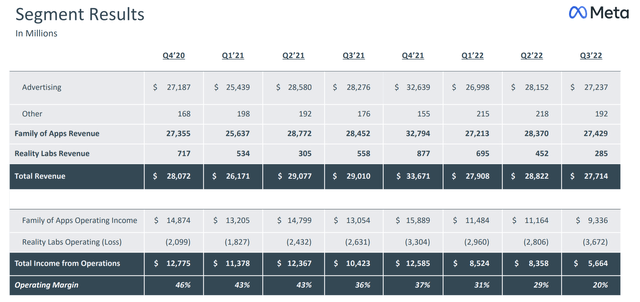

META has been betting heavily on the AI and VR future in recent years. In its Q3 ER, Chief Executive Mark Zuckerberg asked investors again to be patient with the company’s big bets. Zuckerberg tried to rationalize the ballooning spending and negligible revenues (see the chart below) while its profits kept falling short of Wall Street analysts’ expectations. To wit, the operating loss from its Reality labs increased from about ~$2.1B in Q4 2020 to the current level of $3.6B last quarter, while the revenues are only $285M, pocket change for META.

The market clearly did not buy into his justification. However, my view is that the market should. Consider at least the following two aspects:

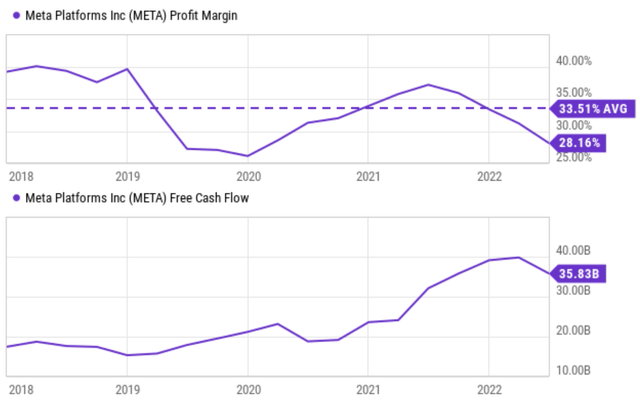

- META is still making a lot of money, with operating margins at a healthy 20%, a net profit of $4.4 billion last quarter, net cash generated by the business of $9.6 billion, and a free cash flow of $35.8B TTM. In the longer term, its net profit margin has been 33.5% as seen, far exceeding the overall economy’s ~10% long-term average. Such organic cash generation would be able to support high-risk and high-payoff bets for the next 10-year as Zuckerberg commented.

- The market should not dismiss Zuckerberg’s vision to bet on the next big ideas without knowing how much the payoff could be. As Zuckerberg acknowledged, it’s just not clear how much the payoff would be even for some of the more near-term oriented bets (such as short video and business texting) – but that is the whole point of making big bets as detailed next.

As aforementioned, these bets are only producing negligible revenues at this point. For example, its revenues from reality labs have been only in the hundreds of millions per quarter so far. But the potential is limitless and the timeline might be nearer than the market thinks. A few notable considerations:

- Gaming. The VR future is far beyond gaming, but let’s start with gaming since it’s an obvious starting point, one that META is already engaging. So far, META’s reality lab revenues mostly come from its gaming headset and its Quest 2 games. As mentioned above, AI gaming algorithms are so developed by this stage that it is conceivable that AI would begin to help META to start designing and testing games soon. This would enable META to develop far more addictive games at a lower cost. And combined with its social network reach and depth, the potential is truly exponential.

- Education. The capability to design engaging VR games cheaply and market them widely via social networks has far-reaching impacts beyond gaming itself. For example, highly customized and engaging games can be applied to education and training, a huge addressable market in dire need of disruptive technologies like those META is researching.

- Healthcare. The VR headset has applications well beyond gaming too, especially when combined with imaging recognizing technologies mentioned above. Needless to say, the imaging recognition algorithm obviously would make its social network more potent (for example, by recommending multimedia content more accurately and targeting ads more effectively). But the true potential lies well beyond. For example, since 2014, AI imaging recognition algorithms have advanced so much that AI could read magnetic resonance imaging (“MRI”) images as good as that of human radiologists for the diagnosis of prostate cancer, and could diagnose lung cancer using microscope images even better than human pathologists. The combination of 3D VR headsets and AI-aid imaging processing capabilities is a key enabling technology to change the landscape of healthcare in my mind and META is at the forefront of it.

Risks and final thoughts

The market certainly has good reasons to panic in the short term, where META is subject to a variety of risks. As reported in its Q3 ER, these risks include high inflation, geopolitical tensions, competition, currency headwinds, cost control, and so on. Other SA authors have already explored these issues in great detail since the ER, so I won’t go over them again here.

Here I will just focus on the risks more specific to META’s bet on VR. Zuckerberg seems very determined to follow this path (which is a good thing in my mind). But the fact that he has super-voting power can be a double-edged sword. On the one hand, he can make independent decisions (without the need to worry about being dethroned by the board or a hostile takeover for example). But on the other hand, the concentration of power can create its own risks.

To conclude, judging by the market reaction following the Q3 results, the market has largely misunderstood the potential and also the timeline of its VR bets in my mind. I feel the market has completely dismissed what Zuckerberg said without really understanding what he said. The market seemed to only have heard the negatives (the payoff is unclear and will take a long time) and completely missed the “But part.” And to iterate, the following Buts are equally important:

- META is still superbly profitable and its organic cash generation would be able to support such high-risk and high-payoff bets in the long term.

- The addressable markets of its VR initiatives are way beyond video games and social networks. Of course, gaming is an immediate lower-hanging fruit. But other areas such as education and healthcare are even larger potential markets and are even riper for disruption.

- And finally, the timeline for META to monetize on these potentials is closer than the market recognizes given recent advancements in AI and VR technologies.

Be the first to comment