Derick Hudson

Meta Platforms (NASDAQ:META) has had a tough time recently as Apple (AAPL) changed its out-of-app tracking policy, which created an environment where advertisers were seeking other platforms, particularly streaming ones, to spend their advertising dollars. This was due to the company’s ad targeting efficacy drop.

But the company’s future is far from bleak, and they’ve still been reporting solid growth in their core social media business segment which is Facebook and Instagram, along with messaging app WhatsApp and Messenger. However, it’s actually their cost cutting and operational efficiency efforts that have me optimistic that the company can blow past current sales and earnings per share expectations over the next 2 to 3 years, presenting a potential spike in market capitalization and value per share.

Bad News Isn’t Going Anywhere

The bad news for the company isn’t going anywhere, with Apple changing it policy options to allow users to state whether Facebook, or any application for that matter, can use your personal information and track your activity across other platforms in order to utilize it in their own application. As Facebook’s parent company Meta has said, this move along should cost them about $10 billion a year in sales.

Facebook uses this in order to track your activity across its own and other platforms so it can more carefully curate what advertising material would be best suited for you. Or in other words, what you’d most likely click on or engage with, which is how they make more money from affiliated advertising.

The company’s ability to more effectively target their ads means that more companies will spend more on their platform. Taking this feature away from them means that advertisers are more likely to hesitate before increasing their ad spending, the effectiveness and targeting of which may decline over time.

One of the immediate effects we’ve seen is in political advertising ahead of the ongoing 2022 midterm elections in the United States. Facebook has been very good at using and tracking your activity across other platforms to determine if you are a potential voter and / or someone who is somewhat interested in what’s going on in the political world. They were then able to use this on your advertiser profile and target you if you lived in a certain area. Now they must rely only on the activity on their own platform, which can often be misleading.

Now, with this new policy in place, the company has seen a dramatic shift away from their platform and over to streaming platforms like Alphabet’s YouTube (GOOG) (GOOGL) and others. In the 2020 election cycle, around 75% of the advertising budget for the Democratic Governors Association went to Facebook ads, but now that targeting is down to under 50% in the most recent election cycle. This should happen in other industries as well as advertisers move to other platforms where they can target individuals more effectively.

What This Means For Revenues…

These changes in the company’s revenue streams, or even future potential revenue streams, are clearly present in the current expectations for the company’s revenue growth over the coming years. After growing at double digit rates for quite some time, analysts now expect the company to report sales growth at high single digits at its peak, with one year of sales growing by around 11.6%.

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| Sales | $116B | $123B | $138B | $151B | $163B | $177B | $180B |

| Growth | -1.3% | +6.1% | +12% | +9.4% | +8.1% | +8.2% | +2.2% |

(Source: Analyst Sales Projections – Seeking Alpha Aggregator)

While this growth isn’t too shabby at all, it’s still well below historical averages, and these figures have seen downward revisions in the past few quarters. Even so, it’s clear that the company is still set to find new advertising dollars and make ’em come their way as they refocus some of their efforts to help make up for the targeting headwinds they face with the new Apple policies.

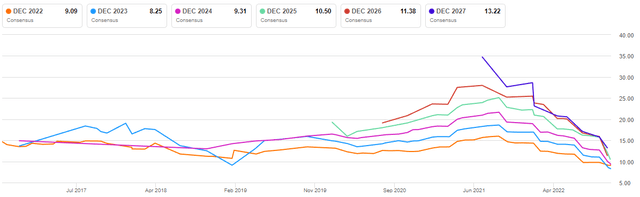

META EPS Revisions (Earnings Revision Summary)

But this is as far as I go when it comes to analysts projecting figures for the company’s future. Currently, as you can see in the above-linked Seeking Alpha aggregator of analyst earnings and sales projections, the company is projected to report earnings per share figures not all that higher than sales, which means that they expect the company to report lower gross margins and higher operating expenses, which the company is clearly working on changing.

Gross Margin & Operating Expenses Trends

Right now, the company is spending more and more money as it gears up to launch new features and parts of the Metaverse, which has caused their operating expenses to surge to record levels. At the same time, their advertising dollars have been made with more spending, with cost of revenues increasing slightly on a comparative basis, up from 14% to around 20%.

But there are two different parts to my theory of why this won’t be the case forever. The first is that the company’s SG&A (selling, general and administrative) expenses are going to decrease by about 20% over the next year or two as they lay off employees and encourage others to transition out of the company. This was announced earlier this year and again this past week when the company announced it would lay off as many as 11,000 employees, which should save them a serious bundle of cash moving forward.

The second is that, similar to their current social media platform, the cost of revenues in the Metaverse should continue to be significantly lower than actual products. While the costs of their Oculus headsets and various other hardware will be at substantially lower margins, the main product is likely to be companies paying for the service and software which is ‘The Metaverse’ should be quite higher.

This means that as the company grows and shifts their business into Metaverse-related segment, I expect them to continue and produce high margins and return to a point in time where they were reporting gross profit margins of over 85%.

What this means is, I believe, that the company will report a roughly 80% gross profit margins over the next few years, which presents the following gross profits:

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Sales | $116B | $123B | $138B | $151B | $163B | $177B |

| G. Profit | $94B | $100B | $112B | $122B | $132B | $143B |

Now, with a 10% to 20% reduction in their SG&A expenses, as well as a slight increase in their R&D (research & development) expenses, the company should report roughly $60 billion in total operating expenses for the upcoming year, followed by a slight increase of around 5% each year thereafter. That presents the following operating income for Meta:

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Sales | $116B | $123B | $138B | $151B | $163B | $177B |

| G. Profit | $94B | $100B | $112B | $122B | $132B | $143B |

| O. Profit | $34B | $37B | $46B | $53B | $59B | $67B |

With an 18.5% effective tax rate average, the company will make the following projected net income for the next 5 to 6 years, based on my estimates:

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| O. Profit | $34B | $37B | $46B | $53B | $59B | $67B |

| I. Tax | $6.3B | $6.8B | $8.5B | $9.8B | $11B | $12B |

| N. Profit | $28B | $30B | $38B | $43B | $48B | $55B |

Given that the company currently has 2.7B shares outstanding and they continue to repurchase shares, I’m going to use an average of about 2.5B shares for the calculations down the line, resulting in the following earnings per share for the aforementioned time period:

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| EPS | $11.20 | $12.00 | $15.20 | $17.20 | $19.20 | $22.00 |

As we can see by the figures I just presented, the company will, I believe, report a near doubling of net income in the form of earnings per share over the next 5 years while their revenues only increase by about 55%, a testament to their cost cutting efforts.

Valuation & Conclusion

If we take a conservative valuation for Meta at 10x forward earnings, we get a fair value of around $172.00 per share through 2025 and over $200.00 per share through the end 2027, which presents a potential increase in value of over 53% over the next 2 to 3 years. This will almost certainly outperform the broader market as a whole as well as peers.

While other companies like Amazon (AMZN) and Alphabet are also cutting some costs and looking to divest from underperforming businesses, their stock prices are, generally speaking, at normal levels, which means that while the savings may be similar – the potential gain is lower.

Due to these factors, I am upgrading my stance on Meta’s longer-term prospects from bullish to highly bullish and will be continuing to add to my position over the next few weeks, at a price point of under $120.00 per share.

Be the first to comment