reklamlar/E+ via Getty Images

The WSJ recently reported (on 9/21) that Meta Platforms, Inc. (NASDAQ:META) is looking to cut expenses by at least 10% in the next few months through headcount reduction. This further confirms that the social media giant is seeing tough times ahead in the backdrop of competition from Tik Tok and YouTube, unfavorable iOS privacy policy, and an economic recession.

“Realistically, there are probably a bunch of people at the company who shouldn’t be here.” – Mark Zuckerberg on a 6/30 call with employees (The Verge)

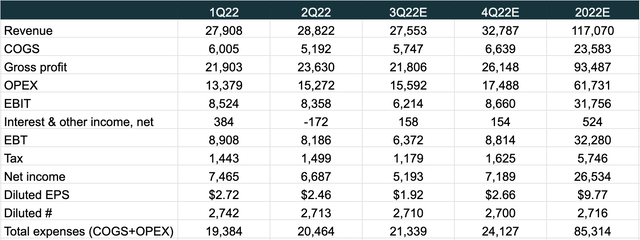

On the 2Q22 earnings call, Meta guided full year 2022 total expenses of $85-$88B, a step down from the previous guide of $87-92B. In 1H22, Meta reported total expenses of $39.8B (COGS+OPEX). Street estimates currently have total expenses at $85.3B for 2022, implying 2H22 expenses of $45B. Assuming a gross margin of ~80% (inline with previous quarters), 2H22 OPEX will likely come in around $33B (total expense-COGS), including $15.6B in 3Q22 and $17.5B in 4Q22.

Consensus estimates, Albert Lin

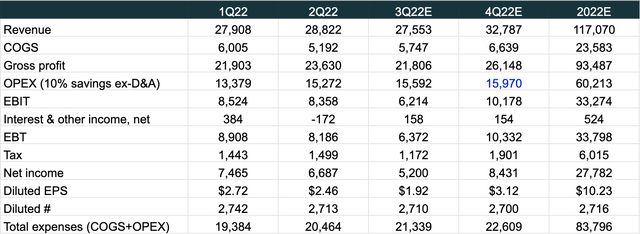

The key question now is whether Meta can cut costs quickly to generate meaningful savings on the income statement. Suppose management can cut OPEX (excl. depreciation and amortization) by 10%, or roughly $1.5B in 4Q22, full year EPS could come in at $10.23, a 5% bump from the previous estimate of $9.77.

Consensus estimates, Albert Lin

So, why didn’t markets send Meta shares up 5% on the news? Broad-based selloff aside, the expense cut is an indication that Meta is seeing a challenging environment which puts future top-line estimates at risk of downward revisions. The Street currently forecasts revenue to decline by 4.9% in Q3 and 2.9% in Q4, but expects growth to return in 1Q23 and reach double-digit territory in 3Q23. Given the current macro narrative, these figures look ambitious, in my view.

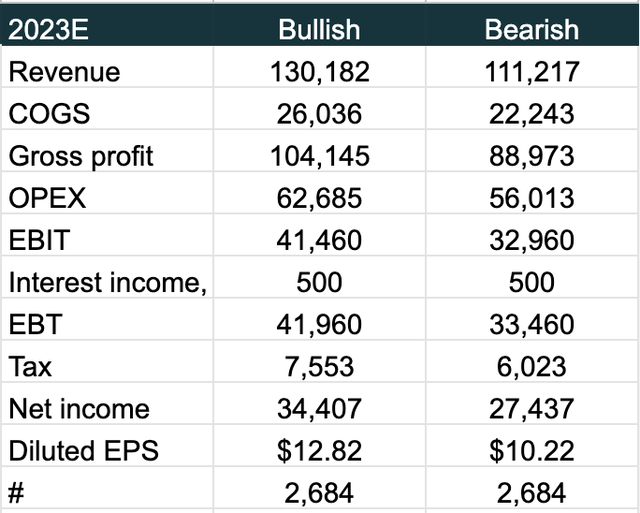

Since a recession remains the wildcard for 2023, the question now for Meta is what revenue growth will look like. In a bullish scenario, Meta meets top-line expectations of 11% growth, realizes $6B in OPEX savings ($1.5B per quarter) to keep total expenses contained at $89B (+6% vs. $84B in 2022), expands EBIT margin to 32%, and delivers EPS of ~$12.8 (+25% vs. $10.23 est. 2022 EPS). In a bearish scenario, your guess is as good as mine, but suppose revenue growth turns to negative 5% in 2023, Meta will have to cut OPEX by at least 7% or $4.2B vs. 2022 to keep EPS from falling below last year’s level. Either way, expenses will need to be cut to protect margins in order to provide support for the stock’s valuation.

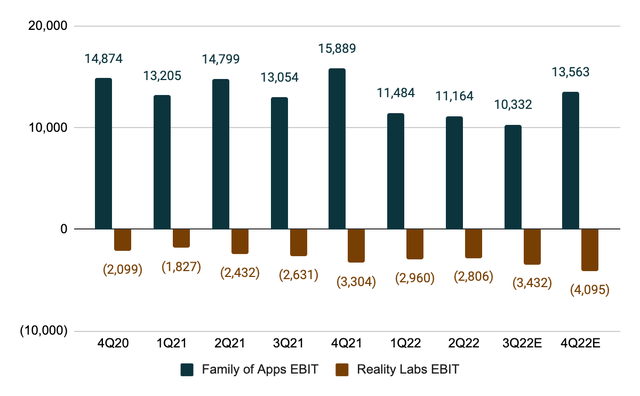

All told, 2022 has been a difficult year, and the setup for 2023 doesn’t look good for Meta as well as the digital advertising space in general. Facing a slowdown in its core advertising and rising competition from TikTok and YouTube, Meta is doing everything it can to increase monetization for Instagram Reels (currently below that of Feed and Stories), manage ongoing iOS privacy impact ($10B lost revenue in 2022), and invest heavily in Reality Labs with the hope that the metaverse will be the next big thing. While I admire the vision of RL, losing $2-$3 billions every quarter is probably not what investors would want to see in this environment.

Consensus estimates, Albert Lin

Conclusion

Meta is proactively cutting expenses to protect margins which will be a key support for the stock’s valuation going forward. However, the macro uncertainty puts 2023 revenue estimates at risk and in the event that growth turns negative, management will certainly have to do more to protect the bottom line. While lowering expenses may alleviate investors’ concern that Meta is destroying value by betting the farm on a moonshot (the metaverse), a 2023 recession remains a major wildcard as advertisers will first look to the top end of the marketing funnel (impression-based vs. conversion) to save ad dollars. In my view, Google (GOOG, GOOGL) remains the best value play in the digital advertising sector (analysis here).

Be the first to comment