naphtalina/iStock via Getty Images

Meta Platforms (NASDAQ:META) dove again after hours on abysmal earnings as the company, in our view, refuses to act as a business versus a tech hobby fund. The company completely rebranded just over a year ago, triggering a massive market decline as the company continues to invest $10s of billions in a business model with no proven profits.

Overall, the company has a unique and impressive portfolio of assets; however, it needs to reorient its plans.

The Non-Virtual Problem

The problem Meta has is the company has completely reorganized and re-branded itself around VR.

There’s no doubt that the company is the leader here, however, what the company hasn’t done is proven a market, especially one that justifies the massive amount of continued investment. The most recent quarter saw operating costs in the business jump to almost $4 billion and the company has stated it expects that number to grow significantly in 2023 before tapering.

This is not an insignificant number. In the most recent quarter, Reality Labs cost the company roughly 40% of its overall operating income. Even in the prior stronger quarter that number was almost 30%. That’s a substantial increase from 2020 when that number for the company was <15%. However, across the board it’s been an expensive bet.

There’d be an argument to be made if the company was trying to be the leader, with this capital spending, in a clearly proven market (i.e. self-driving cars) where the customer use case is clear. Arguably, it’d even be valid if the company was trying to dominate an incredibly competitive market, i.e. the smartphone. Or be Microsoft and buy gaming companies.

Where we don’t believe is valid is when the company is losing >$10 billion a year (and accelerating) in a market where even if the company succeeds in constructing its vision, there’s potentially no end-user who’s interested. The idea is interesting and as an avid Quest user there is potential. However, we don’t see it at the scale that the company is spending.

Don’t Be A One-Stop Shop

Fundamentally, we think the problem here is that Meta platforms needs to move away from attempting to be a one-stop shop to being a holding company. The classic era of the mega-conglomerate is over, as seen with businesses such as General Electric unraveling themselves to drive more shareholder value.

A cluster of independent operating companies with minimum overhead, however, is still valid. WhatsApp, Instagram, and Facebook are all still incredibly strong players in their respective markets. As surprising as it is, “Facebook Reels” has picked up a surprising number of interested users. These are strong and incredibly profitable businesses that Facebook should utilize.

Core Potential

The core potential in Meta is visible through its core portfolio of assets.

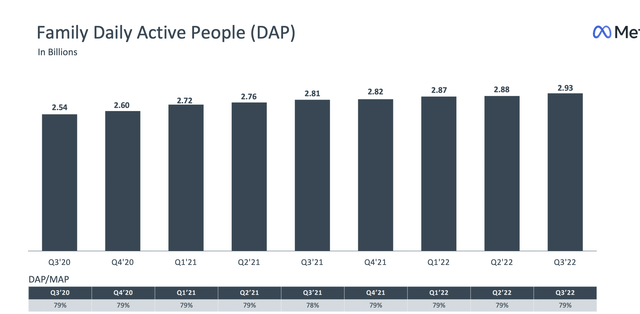

Meta Platforms Investor Presentation

The company had some of its strongest user growth while maintaining the fixed 79% DAP / MAP ratio highlighting how users remain relatively active. YoY the company’s revenue decreased slightly, not too surprising given Apple’s advertising changes and other competition, along with economic woes hurting advertising budgets.

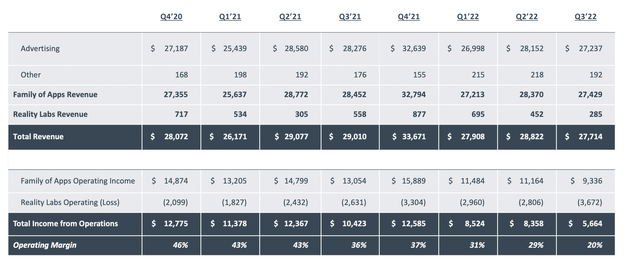

Meta Platforms Investor Presentation

In fact, given the impact of both a market slowdown and Apple’s push for privacy, we think it’s quite respectable that the company saw revenue drop <10% YoY. The company’s pain has been less about an impact to revenue and more about the rapidly growing costs of the company’s Reality Labs operations and its impacts.

The core potential is here and the company continues to have avenues to grow these segments. We’d like to see it continue to focus on this.

Our View

In our view, the future success of Meta platforms depends on whether Mark Zuckerberg, with his majority ownership share, can admit that he was wrong.

Our view is that the Oculus is an interesting product, and there is potential here, but the company needs to work rapidly to get its operating loss to <$1 billion on a quarterly basis. The company also needs to diversify, with this operating loss including multiple different “other bets” rather than all-in on the idea of VR.

From there, the company needs to focus on generating profits and buying back shares as long as its share price remains low. Operating profit in 2021 was ~$60 billion – a strong level for a company with a market cap of ~$250 billion. The company announced prior buybacks at a higher price and now is the time to accelerate those.

Combining those two factors, we expect the company to be able to drive substantial shareholder rewards from current levels, taking advantage of the required structural shift. We recommend cautiously investing with the idea that the company will work to optimize operations.

Thesis Risk

The risk to our thesis is the company’s execution. Financially, the company has shown a unique ability to negatively impact profits and spend outside of its means, an ability that in our view makes the company a much riskier investment to have. Until the company can fix that, we expect it to continue to underperform.

Conclusion

Meta Platforms has an interesting and unique portfolio of assets. The company’s core assets (Facebook, Messenger, Instagram, and WhatsApp) remain incredibly popular communication and messenger tools for billions of people. Surprisingly, despite the well-known nature of the company’s assets, it continues to connect more people each day.

However, the company is spending $10s of billions on a bet that, even if it succeeds, has no proven market. That’s a strong risk to the company’s ability to drive future shareholder returns and one that we recommend investors cautiously pay attention to. Until the company revamps on that strategy, its ability to drive additional returns will be tough.

Be the first to comment