Fritz Jorgensen

Meta Platforms (NASDAQ:META) dropped after-hours; however, for the day the company remained roughly balanced. The company had weak earnings as it continues to spend massively on Reality Labs and this quarter it also had weak earnings from Europe as the country is mired in rising energy prices and instability.

As we’ll see throughout this article, Meta Platforms still has the ability to drive substantial shareholder returns.

Quarterly Financial Performance

Meta had moderate financial performance representing the company’s first QoQ revenue drop in a while.

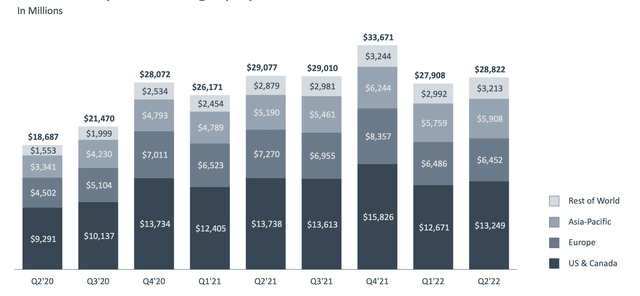

Meta Financial Performance – Meta Investor Presentation

The company had almost $29 billion in earnings, down roughly 1% YoY. The majority of this was from the weakness in the company’s European revenue which dropped 10% YoY along with a low-single-digit decline in the company’s US & Canada revenue. Inflation in Europe combined with instability is hurting the company’s interest in advertising dollars.

However, the company’s annualized revenue is still more than $100 billion.

Meta Platforms Expenses

From an expense point of view, total expenses for the year are still ~$86-87 billion at a midpoint, down several billion from the last forecast. The company’s expenses for the revenue were 70% of revenue in the second quarter which is still a substantial increase over the company’s prior year numbers.

The largest cost for the company has been the increase in R&D spending which has gone from 20% to 30% of revenue. The company’s international business means currency headwinds which will be several billion and the company has several billion in Reality Labs for the quarter. These expenses have pushed down its income more than its revenue decline.

Meta Platforms Continued Investments

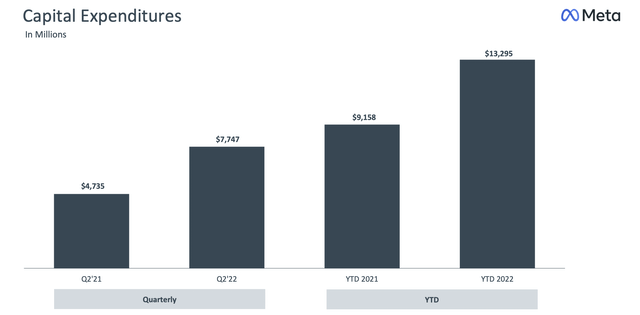

The below chart shows Meta Platform’s rising capital investments.

Meta Capital Investments – Meta Investor Presentation

The company’s expenses have gone up by 40% YTD over the past year. The company lost $2.8 billion in Reality Labs for the quarter, something it can comfortably afford, but it still represents roughly 25% of the company’s profits. That means its profits are dropping significantly as a result of its Realty Labs investments.

The company will consistently be able to afford all of its investments there’s no doubt about that but it’s a substantial amount of profit that’s being given up with indeterminate returns. The company is effectively blocked from making substantial acquisitions and it’s looking to home-grow a massive market.

Meta Platforms Shareholder Return Potential

Meta Platforms continues to have impressive cash flow generation and the ability to generate substantial shareholder returns.

The company repurchased $5 billion of stock in the first quarter, representing a more than 4% annualized buyback rate. The company still has $25 billion remaining in its buyback authorization. The company still has more than $40 billion in cash and marketable securities, enough to repurchase almost 10% of its shares.

The company earned almost $7 billion in net income for the quarter, a P/E of around 16. It needs to stabilize its net income drop and fortunately the company’s MAU and DAU both remain strong. We’d like to see the company continue buying back shares during share price weakness with as much spare capital as it has.

We’d also like to see the company aggressively manage its expenses.

Thesis Risk

The largest risk to our thesis for the company is the company’s increasing expenses and inability to manage income. The company needs to focus on profits and invest in new technologies without drowning out its profits. We’d like to see quarterly profits back over the $10 billion level with the majority of profits being used to share buybacks.

Conclusion

Meta has the ability to continue generating substantial shareholder returns. The company has been repurchasing shares and repurchased more than 1% of shares in the most recent quarters. In the first quarter it repurchased more than 2% of share. The company is managing expenses but still has incredibly high R&D expenses.

We’d like to see Meta continue to recover its profits numbers to more than $10 billion per quarter while spending the majority of this on share repurchases. Despite the big hit that Meta took, the company has the ability to generate substantial shareholder returns, making the company a valuable investment.

Be the first to comment