BrianAJackson/iStock via Getty Images

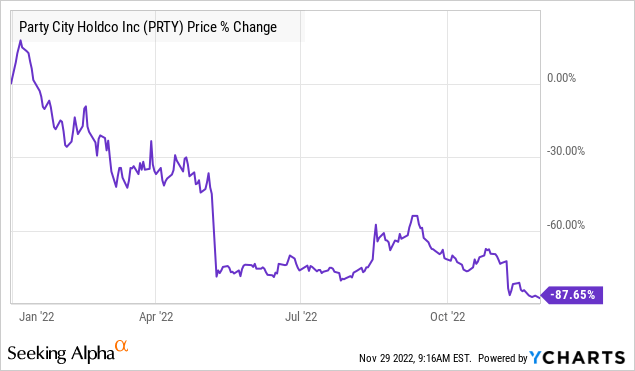

Party City Holdco Inc. (NYSE:PRTY) is facing some serious challenges as shares are down by a disastrous 88% in 2022 and trading near its pandemic crash low. The company’s latest quarterly financials were highlighted by disappointing sales and a somber outlook with management citing ongoing macro headwinds. Fundamentally, the real issue here is the massive debt position that appears unsustainable leading to a deteriorating liquidity profile. Indeed, there’s not much to celebrate and our view is that the need for a capital raise through new share issuances will open the door for further downside in the stock.

PRTY Key Metrics

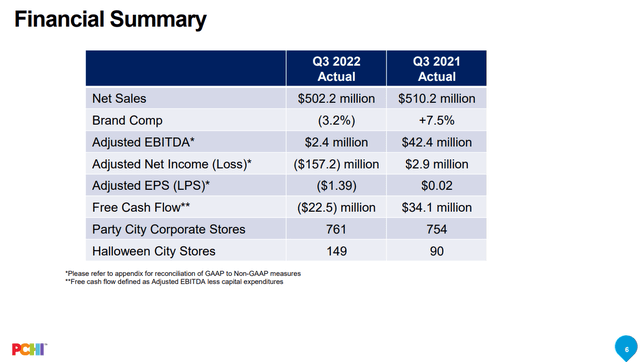

PRTY reported its Q3 earnings on November 8th with a non-GAAP EPS loss of -$1.39 representing a negative adjusted income of -$157 million. Net sales this quarter at $502 million declined by 1.6% year-over-year while comparable sales were also down by 3.2%. Industry shortages of helium, which is critical for the business of decorative balloons, have also impacted the sales momentum.

The gross margin has declined to 31.6% from 36.0% in the period last year, in part, based on inflationary cost pressures. Management included a goodwill impairment charge of $133 million reflecting a lower forecasted value of assets carried on the balance sheet. Reconciling a large impact on its income tax expense recognition, the adjusted EBITDA of $2.4 million was down from $42.4 million in the period last year.

During the earnings conference call, management attempted to focus on some silver linings including the trend of comp sales still above 2019 benchmarks. Party City has found some success in its “Halloween City” pop-up stores operating 149 of these concepts in October compared to 90 last year. The positive contribution of this concept is expected to be captured in the Q4 results.

Moving forward, the strategy is centered around Party City’s “NXTGEN” stores transformation based on the modernization and remodeling of existing locations. The idea here is to support higher margins and stronger sales momentum going forward. From 761 total Party City corporate locations at the end of Q3, the goal is that 175-180 are NXTGEN remodels or new openings by year-end although it was noted that the pace of conversions is moderating considering the current financial environment and macro uncertainty.

In terms of guidance, the company expects full-year 2022 net sales between $2.14 to $2.19 billion, which implies approximately $666 million at the midpoint in Q4, down from $698 million in Q4 2021. Historically, Q4 is the busiest period for the company amid the holiday season. Full-year comparable sales are expected down between -3% and -1%. The target for adjusted EBITDA is between $130 and $150 million compared to $266 million in 2021.

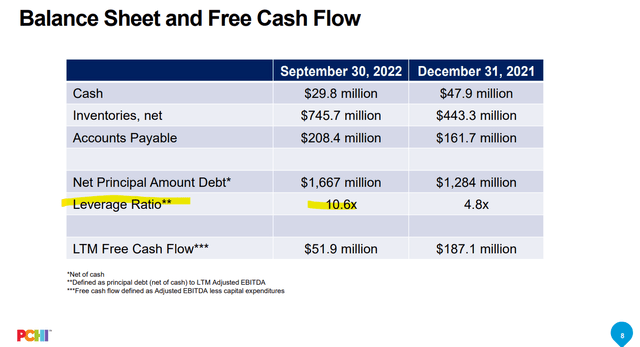

Party City ended the quarter with $30 million in cash against $1.7 billion in total debt. This is particularly concerning as the leverage ratio has reached 10.6x, up from 4.8x at the end of last year. For context, the annual cash interest expense is above $100 million against $52 million in adjusted free cash flow over the last twelve months. In response, the company is looking to capture approximately $30 million in cost reductions realized in 2023 although it’s evident the financial flexibility is limited from here.

PRTY Stock Price Forecast

The attraction of Party City is its leadership position within this segment of “all celebratory things” specialty retail. If you need to organize goodie bags for a kid’s birthday party or decorate events like an office extravaganza, the local stores are a good one-stop option although there are plenty of alternatives from e-commerce players.

On the other hand, the expansion efforts over the past decade coupled with arguably poor management execution and the setback of the pandemic have left the balance sheet simply over-leveraged. Without a significant re-acceleration of growth or materially higher margins, profitability will remain elusive for the foreseeable future.

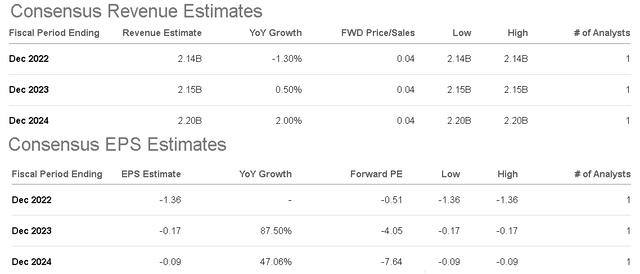

According to a single Wall Street estimate as the consensus, sales are expected to remain flat through 2024 while the net loss only narrows. The big risk with PRTY is that there is a downside to the sales estimates and the margin improvement simply doesn’t materialize. On this point, management has noted that its inventory position is based on goods purchased incorporating supply chain challenges and high logistical costs earlier this year meaning margins will remain under pressure into 2023.

More pressing is the real liquidity concerns heading into an uncertain macro backdrop. Fitch Ratings recently downgraded the company’s debt further into junk status to a (CCC) credit rating citing significant negative free cash flow this year and an “untenable capital structure”. We agree.

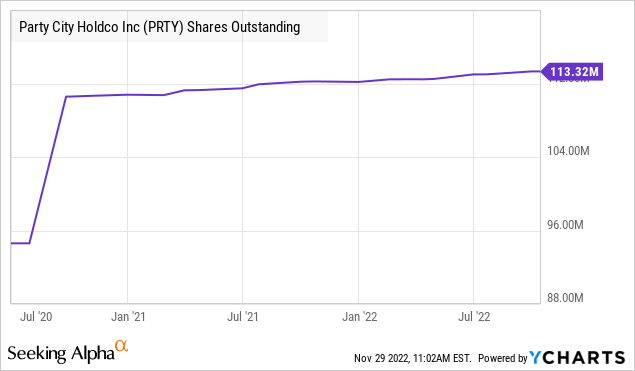

What’s curious about Party City is that the company has not yet resorted to a large secondary equity issuance. The outstanding share count has remained relatively flat going back to 2020 when the company added about 15 million shares as part of debt financing at the time.

The setup here is that a new capital raise is likely necessary into 2023 which would be dilutive to current shareholders. Considering the stock is trading under $1.00 and pushing the compliance requirements of its NYSE listing, the next step could be a reverse-split type of corporate action as part of a broader restructuring.

The takeaway here is that even as shares of PRTY with a current market cap of $85 million have already lost more than 60% of their market value over the past month, our call is for more downside. A bankruptcy scenario is still possible and we recommend avoiding this one.

On the upside, it would likely take several quarters for the company’s result to confirm a real financial turnaround, which is an extremely speculative bullish case at this point. As a “penny stock” the only certainty here is to expect extreme volatility to continue.

Be the first to comment