Chip Somodevilla/Getty Images News

Meta Platforms (NASDAQ:META) stock has been one of the biggest casualties of 2022’s bear market. Down 51% for the year, it is doing far worse than the NASDAQ-100. If you had invested $10,000 in Meta at the start of the year, it would be worth about $4,900 today. That’s gotta hurt.

However, there are many reasons for optimism toward META stock. Its most recent quarter was about in line on revenue, missing on earnings mostly because of increased Metaverse spend. After the last earnings call, Mark Zuckerberg vowed to “slow the pace of investment” on Metaverse initiatives, which means that there is potential for Meta to beat on earnings in the next release. As of right now, there is no specific dollar value attached to the “slowing of pace of investments,” so we’re not sure what the impact will be. However, we know that Zuck is making good on his word. Recently, Meta freezed hiring at several business units. There were no job cuts, but the freeze suggests that maybe the metaverse spending will remain a flat $3 billion per quarter instead of progressively growing, as was originally planned.

The Metaverse has been a major point of contention among META holders. Many people think that the projects–AR glasses, VR headsets–are too much of a long shot to go mainstream. Some of Reality Labs’ products have shown promise. Oculus, for example, is getting rave reviews, and its software component was #1 on the app store last Christmas. These are positive indicators for Oculus itself, but Reality Labs–Meta’s Metaverse division–isn’t limiting itself to VR. It’s also experimenting with AR glasses, a product category that flopped for Alphabet (GOOG) and has serious issues with content visibility. Given their track record, it would be prudent to estimate that AR glasses will take a long, long time to go mainstream–if they ever do. Meta itself forecasts that the Metaverse investments will take 3-5 years to pay off, which is a lifetime when compared to many investors’ time horizons.

None of this, however, is even the slightest negative to the long-term investor. If you have a long enough time horizon, then taking 3 to 5 years for an investment to pay off is normal. It’s normal for entrepreneurs to run losses for a couple years before breaking even on new businesses. It takes time for sales to ramp up and for costs to be absorbed. Meta’s Reality Labs is nothing out of the ordinary in this regard. Plus, when you buy it, you get not just reality labs, but also a wildly profitable ad-tech business that, as I will show in the coming paragraphs, stands a great chance of bouncing back from its current woes in Q3.

Why Meta’s Growth Has Slowed

It’s impossible to talk about Meta stock in 2022 without also mentioning Apple (AAPL). Last year, Apple made changes to its data tracking policy that negatively impacted Meta’s ability to target ads. The changes, known as “app tracking transparency,” forced developers to ask users permission before they could track their data. As of the most recent reports, the opt in rate for META was a mere 25%. That’s an improvement from the 4% initially reported, but it’s still pretty bad. With only 25% of users opting in, we have 75% of users who can’t be shown targeted ads based on:

-

Their location.

-

Websites they’ve visited.

-

Their activity on other IOS apps.

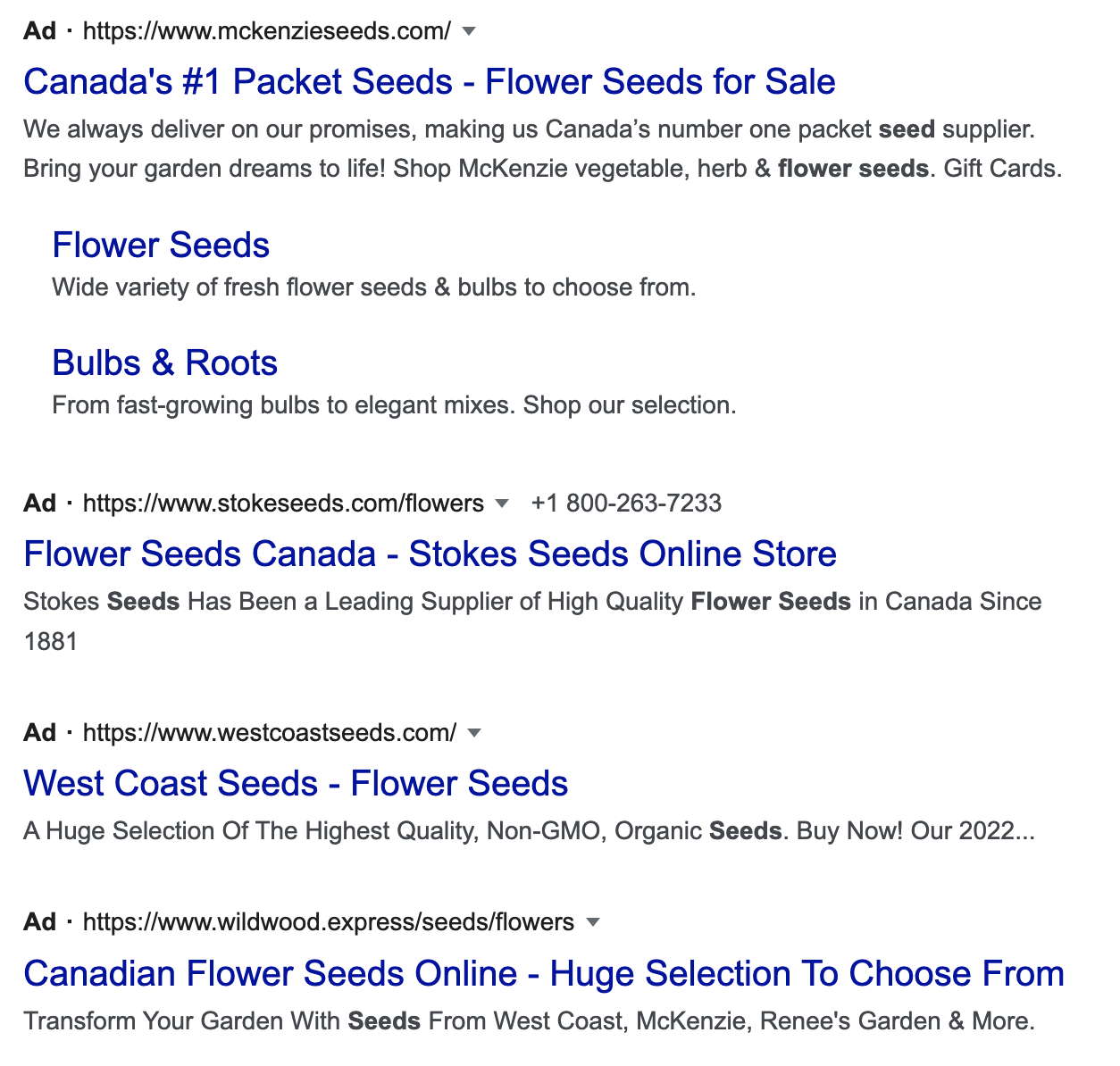

That has the effect of reducing the effectiveness of FB’s ads. It’s also affecting Meta’s competitive position. Meta is currently the #2 advertising platform in the world after Alphabet. Until recently, the former had been gaining share on the latter. Unfortunately for Meta, ATT changed all that. Alphabet’s advertising–particularly Google Search–depends on tracking much less than Meta’s does. When a person searches for a product in Google, they can be shown a targeted ad based on that query immediately. This process does not require tracking the user across apps and websites, because the user “feeds” the relevant data into Google right there on the spot. As an experiment, I ran a Google search for “flower seeds,” something I had never searched for before in my life. Immediately, Google was able to show me the four targeted ads below:

Alphabet

Under ATT, none of Meta’s platforms could ever show me such an ad if I hadn’t signaled interest in it elsewhere on the internet. They could get a cue if I liked a “flower seeds” page on FB itself, but that’s about it. People generally use Facebook search to find people, not things. So, its usefulness in targeting ads is quite limited.

What does all this mean?

That Apple is sending $10 billion a year from Meta to Google–and collecting a large cut of the proceeds itself!

Because ATT discourages tracking, it results in more ad spend on platforms that work with less tracking. That has resulted in advertisers migrating away from Meta and toward Alphabet. On the Q4 earnings call, Meta’s CFO David Wehner said that ATT would cost Meta $10 billion in 2022, and that Google would receive that money at its expense. In the first quarter, Meta grew revenue at just 7%, the slowest growth rate in its history. So, it looks like ATT did in fact take a bite out of Meta’s sales. Apple itself is profiting, as it takes a $15 billion cut of Google’s search ad revenue every year!

Why This Isn’t as Big a Problem as it Looks

As we’ve seen, Apple’s privacy changes have been a hit to Meta’s business. When this was shown to have been occurring, some adjustment in the stock price should have occurred. However, the actual crash we saw–something like 50% in the months after earnings came out–was excessive.

A revenue headwind like ATT will certainly reduce the present value of an affected company’s future cash flows. There is no indication that Meta will ever be able to get back to the financial prospects it had before ATT materialized. There are, however, indications that it will be able to get back to positive growth in the third quarter.

First of all, most IOS users migrated to iOS 14.5 by the third quarter of 2021. That means that, in Q3 2022, META’s revenue and earnings will be compared to a weak base quarter. This makes the likelihood of strong growth higher in Q3 than in earlier quarters of 2022. When you compare yourself to a weak period in the past, strong growth is easier.

Second, there is the possibility that Meta can combat the effects of ATT better over time. Although ATT is a big headwind, there are things Meta can do to combat its worst effects, including:

-

Soliciting more on-platform intent signals. By encouraging more ‘likes’ in-app on FB and Instagram, Meta could collect more buying intent on the platforms it owns itself. Tracking data on these platforms is still allowed.

-

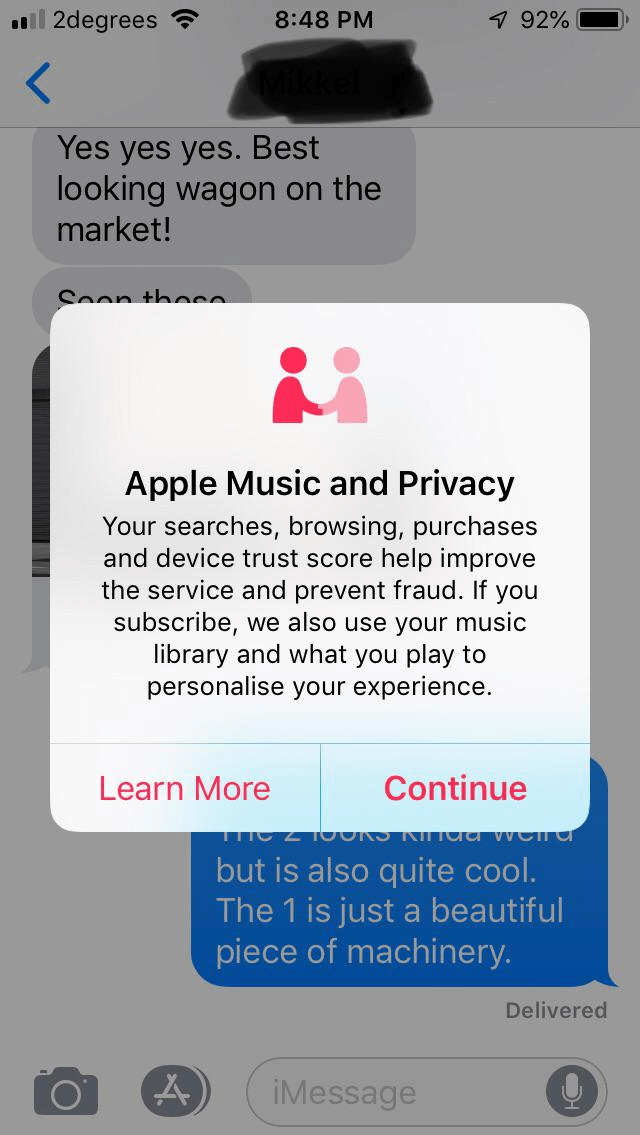

Improving copy on the tracking popup. Apple allows apps to show a pop up where they ask users to opt in to tracking. The headline at the top is written by Apple, but there is a little blurb below it that developers can customize. Potentially, by improving its copy, Meta can boost opt-in rates.

-

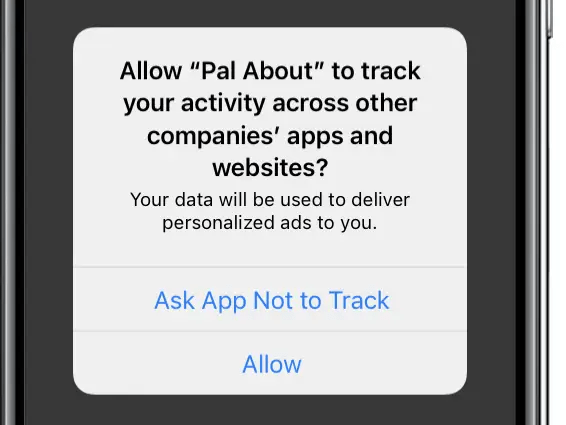

Challenging Apple in court. There are lawsuits ongoing accusing Apple of being anti-competitive with its ATT policy. The issue is double standards. Apple’s own ATT pop up is highly flattering, allowing users to see the benefits of tracking. The popup that third parties use highlight the negatives of tracking. If Apple gets dinged on these anti-trust complaints it will have to play by the same rules third party developers do. If that happens, it may prefer to let third parties use the “flattering” pop up rather than itself have to use the ugly one.

Flattering popup Apple itself uses (Apple)

Scary-sounding popup for third parties (Apple)

Valuation

Having established that Meta has real options for returning to growth post-ATT, we can now move on to valuation. Meta stock is currently cheap by conventional metrics, but its earnings growth in the last few quarters was negative. For the trailing 12-month period, using today’s stock price, the valuation multiples were:

-

P/E: 12.4.

-

Price/sales: 3.3.

-

EV/EBITDA: 7.9.

-

Price/book: 3.6.

-

Price/operating cash flow: 7.45.

For a tech stock, these multiples are dirt cheap. The price/CFO ratio in particular is extremely low. However, Meta’s growth in the most recent quarter wasn’t exactly the kind of explosive surge you want from a tech stock. Sales grew at 7%, easily achieved by a bank or utility stock, and earnings declined. Therefore, the multiples above are only “low” if Meta can accelerate its growth. A price/book of 3.6 for a company growing at 7% is actually fairly high.

But, as I established in the previous section, growth is likely to resume in the third quarter. Meta will benefit from easy base effects in the period, and may come up with ways to combat ATT. Furthermore, Meta is freezing hiring, so we can expect costs to be flat or near flat.

Below is a simple model of a hypothetical company with $100 in revenue and $69 in total costs. This hypothetical company resembles Meta, as both have 31% net margins. If revenue grows at 10% and costs at 0%, we get:

|

Base year |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

|

Revenue |

$100 |

$110 |

$121 |

$133.1 |

$146.41 |

$161 |

|

Total costs |

$69 |

$69 |

$69 |

$69 |

$69 |

$69 |

|

Net income |

$31 |

$41 |

$52 |

$64.1 |

$77.41 |

$92 |

This gives us a 24% CAGR growth rate in earnings, with revenue growing at a mere 10%! Of course, you could say that my forecast of zero growth in expenses is too rosy. A hiring freeze doesn’t mean that current employees won’t demand raises, that more infrastructure won’t be needed, etc. A fair point. It does look like the growth going forward will be slower than in the past, however, and 10% revenue growth could easily be exceeded. So, Meta could easily return to 20%+ earnings growth over the next five years.

One Big Risk to Watch

As we’ve seen, Meta Platforms is likely to resume positive growth in the third quarter, and today’s share price will look cheap once a positive earnings trend is re-established. This is undeniably true should economic conditions be basically unchanged. There is, however, one big risk to keep an eye on:

A deteriorating macro environment.

Meta is fundamentally an ad business, and advertising is one of the first things companies cut out when the economy contracts. Many people think that the U.S. economy is headed into a recession, and if that occurs, it may take longer than Q3 for Meta to resume positive growth. The company already said supply chain issues held back ad spend in Q1, so arguably we’re already seeing this play out. The good news is that factors that have already occurred are already priced in. So, we may be near the year’s low for Meta Platforms stock. At any rate, I know I’m a buyer.

Be the first to comment