Marko Geber

In early April of this year, I took my Turtle Beach Corporation (NASDAQ:HEAR) chips off the table in an article with the mind numbingly uncreative title “Taking Turtle Beach Chips Off the Table.” Since then the shares have lost about 66.4% against a loss of 20.4% for the S&P 500. I thought it would be interesting to review the name yet again to see if it’s time to buy back in. As I bragged in the article cited above, I’ve done well trading this stock based solely on valuations. I’ve bought when the shares were cheap, and I’ve sold when they became too dear. So, I’m obviously intrigued now that the shares have moved from $22 to $7.20. I’ll decide whether or not it makes sense to buy back in by reviewing the latest financial history, and by looking at the stock as a thing distinct from the underlying business. Finally, I feel like writing about put options, so I’m going to write about put options. To remind readers, I generally consider these to be wonderful instruments that help us reduce risk while enhancing yield.

If you guessed that this is the portion of the article where I offer up my thesis statement, well great job! In the following paragraph I’ll offer what I hope is a succinct and pithy summary of this article. As my regulars know, I offer this as a public service for those who want to understand my thinking about a given name, but want to minimize their exposure to my bragging, bad jokes, and proper spelling. There’s no need to thank me for this, but if you wanted to commission a bronze statue of me, I wouldn’t complain. Anyway, Turtle Beach shares are relatively inexpensive by some measures. In fact, they’re very near the prices last seen during what I now characterise as the “pandemic stock shock.” That said, they’re not unambiguously cheap, and there’s reason to think the shares are still expensive. Also, anyone who has seen my wardrobe knows that I’m, uh, let’s call it “old fashioned.” One example of my tendency toward “old fashioned-ness” manifests as my need to see a company earning positive earnings, and free cash flow before I get excited about it, no matter how cheaply the shares are trading. For that reason, I’m going to continue to eschew these shares until the underlying company turns profitable. Finally, although I like writing deep out of the money puts on profitable companies, I won’t do so in this case, in spite of the rather rich yield on offer. The market is offering high premia for deep out of the money puts at the moment, and I, for one, will not “bite.”

Financial Snapshot

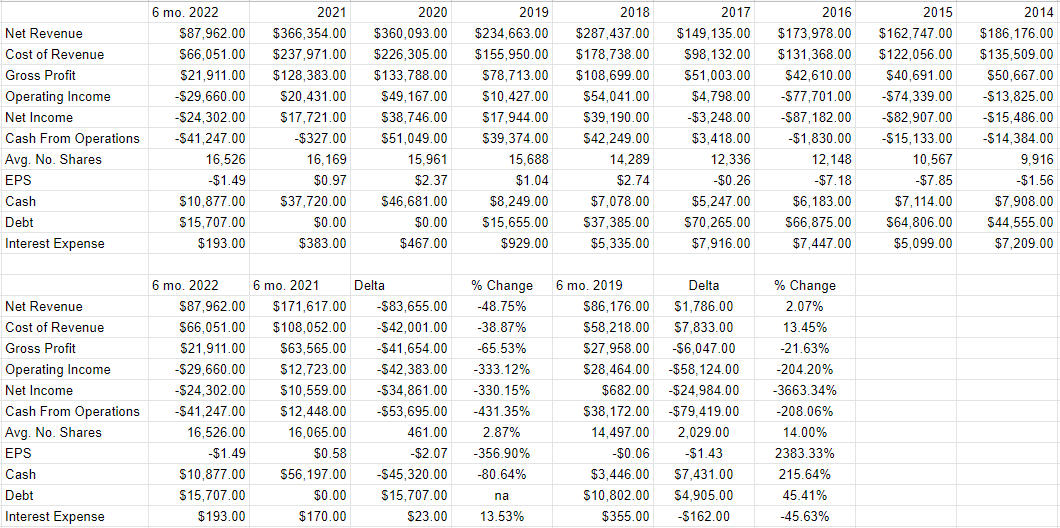

I don’t think it’s an understatement to suggest that Turtle Beach has had a challenging year so far, especially when compared to 2021. Revenue was off nearly 49%. Although the company managed to lower sales and marketing and cost of revenue by 17.7% and 39% respectively, net income cratered and was down over 330%. In spite of the drop off in sales, R&D, G&A, and non-operating expenses were up by 23.5%, 23.4%, and 255% respectively. Things don’t look much better when we compare the most recent half year to the same time in 2019. Revenue in 2022 was higher by only 2%, and net income has swung from a slight profit of $682 thousand to a loss of $24.3 million. At the same time, the share count is about 14% higher than it was in 2019, so shareholders are being diluted. All in, there’s not much to get excited about here in my view.

Turtle Beach Financials (Turtle Beach investor relations)

The Stock

If you subject yourself to my stuff regularly, you know that I think the stock is distinct from the business in many ways. A business buys a number of inputs, like headphone cushions, for example, adds value to those inputs and then sells the results, sometimes for a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company, and the stock is buffeted by a number of forces some of which may have little to do with the underlying business. For instance, a fashionable analyst may cut their forecasts for console gaming. The crowd may form a view about the relative attractiveness of stocks in general, and that drives shares up or down. I recommended taking the Turtle Beach “chips off the table”, and the shares are down about 66.4% against a loss of 20.4% for the S&P 500. I mention this as a way to get in one more brag, obviously, but also to suggest that some portion of that 66.4% loss may be attributed to a change in our collective appetite for stocks in general. Thus, some portion of Turtle Beach’s drop in price may have nothing at all to do with the company. Strangest of all in my mind, stock investors can be mesmerized by the pronouncements of Fed officials, who drive prices up or down massively because of a 50 basis point difference in the overnight rate. Anyway, every stock is impacted by a host of factors that have more or less to do with the underlying business. You’d be forgiven for thinking that the market often overreacts to variables that are only peripherally related to the company.

Although it’s tedious to see your favorite investment get buffeted around for reasons having little to do with the health of the business, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. This is why I only ever want to buy a stock that is relatively cheap. Not to beat the proverbial dead horse, but this “buying cheap, selling dear” is the methodology that I’ve used to trade Turtle Beach well over the years. In other words, there’s nothing that I’ve done here that all of you can’t do also. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

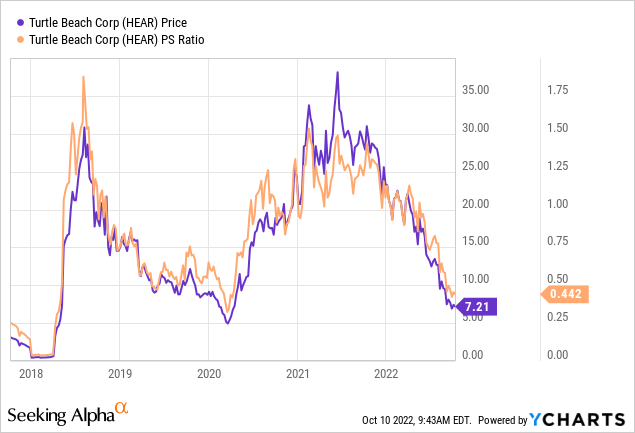

As my regulars know, I use a host of measures to judge the relative cheapness (or not) of a given stock, some of which are quite simple, some of which are quite sophisticated. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think “cheaper wins”, I want to see a company trading at a discount to both the overall market, and the company’s own history. In case you’ve forgotten, I eschewed Turtle Beach stock when it was trading at a price to earnings ratio of 22.25 times, and a price to free cash of 223 (!) times. Fast forward a few months, and obviously both free cash flow, and earnings are distant memories, so I can’t compare the present to the past, but I would note that the market is paying very near the “pandemic stock shock” lows last seen at the end of Q1 2020.

If you know I like cheap stocks, you also know that I want to try to understand what the market is currently “thinking” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Turtle Beach at the moment suggests the market is assuming that this company will grow earnings at a rate of ~12% in perpetuity, which I consider to be wildly optimistic. Given the mood of the market at the moment, and the fact that there are much more compelling stocks trading at cheaper valuations, I’m going to continue to avoid Turtle Beach. I’ll change my tune if the company starts earning money again. I know I’m old fashioned, but I like to see positive earnings and cash flow before I can become excited about a company, no matter how cheap the stock.

Options As Alternative

Those who know me know that I really enjoy selling deep out of the money put options. I consider these to be “win-win” trades for the simple reason that the outcome is positive no matter what happens. If I’m exercised, I pick up a great business at a great price. If I’m not exercised, I collect premia, which is never a hardship. So to those people who know me, and who might be curious to know if I’m planning to sell puts, allow me to put that curiosity to rest. I will not be. Although the yield is fairly rich at the moment (December Turtle Beach puts with a strike of $5 are bid at $0.24), I don’t like the prospects of being exercised on this profit-light business. In my view, some stocks are cheap because the world is down on stocks as an asset class at the moment, and this presents opportunity. Some other stocks are cheap for very sound reasons. Until it turns a profit I think Turtle Beach fits into the latter category.

Be the first to comment