We Are/DigitalVision via Getty Images

Meta (NASDAQ:FB) is at just over half of its 52-week high. The company has been punished heavily after revealing declining user count and increased spending on its “Metaverse”, a substantial expense without proven income. As we’ll see throughout this article, Meta needs a “Tim Cook” to turn itself around, however we expect continued performance.

Apple

After Steve Job’s unfortunate demise, many were certain that innovation at Apple (AAPL) was over. Some would still argue that. However, what’s undeniable is that Apple’s financial performance since Tim Cook took over has been unparalleled. Deploying the cash on Apple’s balance sheet and steadily improving margins has led to unparalleled performance.

Meta, in our view, is at the same turning point.

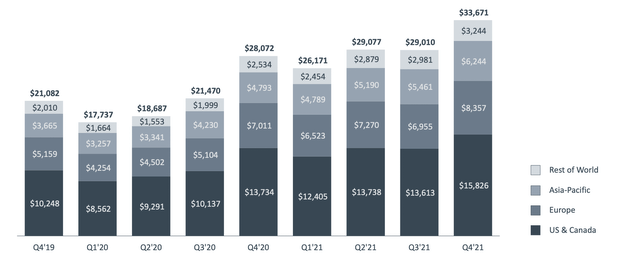

Meta Revenue

Meta has been steadily increasing its revenue showing its financial strength.

Meta Revenue – Meta Investor Presentation

Meta has managed to consistently improve its revenue. YoY the company managed double-digit revenue growth, and from 4Q 2019 to 4Q 2020 the revenue growth was even stronger. That revenue growth was in the face of iPhone advertising policy changes, showing the company’s ability to adjust, which should continue.

More importantly, the company has managed to grow across the world, it’s not seeing growth driven by a single region. That consistent growth means that the company has less geopolitical risk and can continue its overall revenue growth even if one region stagnates.

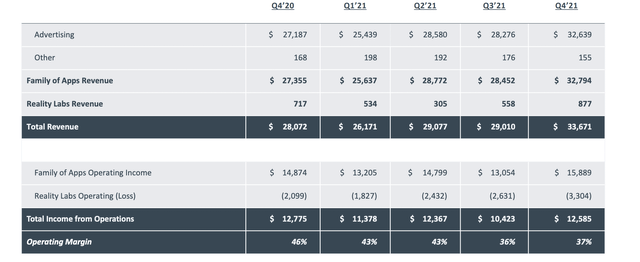

Meta Segment Performance

Now one of the major takeaways of Meta’s earnings was just how much money the company was spending on Reality Labs.

Meta Reality Labs – Meta Investor Presentation

The company’s operating margin has struggled, partially as Realty Labs operating loss has increased more than 50% YoY. That has resulted in the company’s operating margins decreasing as that operating loss has hit almost $15 billion annualized with no sign of slowing down. That operating loss is the different between a P/E of 10 and 8.

The takeaway from the company’s segment performance here is that the company has impressive financials, however, its Realty Labs division needs performance to improve significantly to increase shareholder rewards.

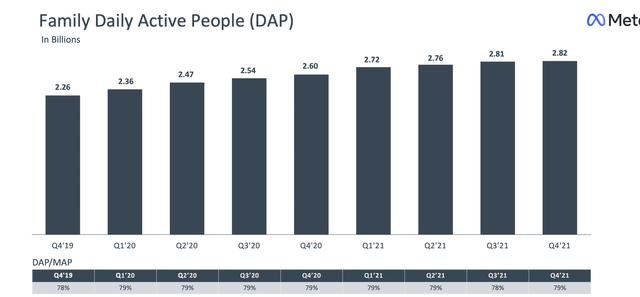

Meta User Growth

One other concern that drove down the company’s share price was concerns over the slowdown in growth.

Meta User Growth – Meta Investor Presentation

Meta saw its daily active user growth stagnate although it’s worth noting that 2Q 2021 to 3Q 2021 was a stronger QoQ performance. The company’s DAP / MAP ratio at 79% remains roughly constant with where it was for the last two years. We don’t see any indication for that ratio to change significantly over the upcoming quarters.

With increased internet growth and increased industrialization, we expected that number to steadily tick up. However, we see the years as long-term growth being over.

Meta Shareholder Return Potential

Overall, Meta has a unique ability to generate substantial shareholder rewards. That’s despite the company spending $20 billion on very expensive share buybacks.

The company generated more than $12 billion of FCF in the most recent quarter. The company is trading at a ~8% FCF yield and P/E of ~10 despite the massive Reality Labs spending that’d we’d like to see decrease. We expect steady growth for the company both in user count (slowly) and in revenue per user.

The company will generate strong earnings. Any improvement in Reality Lab’s losses will dramatically increase those earnings. We would like to see the company undergo substantial share buybacks, helping to support long-term shareholder rewards as it continues to grow. The company can comfortably afford share buybacks with its massive cash flow.

The company has argued that 2022 Reality Labs losses will increase significantly, however, there’s not yet any cap yet for the losses. That’s worth paying close attention to as it could hurt the company’s continued shareholder returns. The company needs to direct its cash from growth at all costs to shareholder returns.

Thesis Risk

In our view, there’s two primary risks to our thesis.

The first is Reality Labs. So far it’s been a money pit with no sign of paying off. Until that changes, it’ll continue to cost the company $10s of billions, hurting its ability to drive continued overall shareholder rewards. That’s an expense that management has done a poor job of guiding when it’ll pay off for interested shareholders.

The second is competition. The internet business is incredibly competitive. Facebook has managed to acquire several major competitors, however, with increased antitrust pressure, we expect that’ll no longer be the case. That increases the chance of a competitor that manages to take significant market share from the company.

Conclusion

Facebook has a unique portfolio of assets, and at its lower share price, a unique ability to generate substantial shareholder rewards. The company is continuing to face massive losses from its Realty Labs division, losses that the company has yet to guide a timeline forward for. Those losses hurt the company’s overall shareholder returns.

Facebook needs a Tim Cook, one that cares less about growth at all costs, and instead is focused on maximizing long-term shareholder rewards. Current prices represent a unique opportunity to buyback shares, helping to highlight how the company is a unique investment.

Be the first to comment