Kelly Sullivan

The following segment was excerpted from this fund letter.

A recent purchase: Meta Platforms (NASDAQ:META)

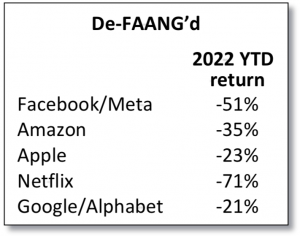

The extraordinary performance of the stock market following the initial 2020 Covid lockdowns was led by a quintet of businesses that benefitted from people pretending to work from home. From the market’s 2020 low in March, these so-called FAANG stocks (Facebook, Amazon, Apple Netflix and Google) increased an average of 125 percent during the remainder of the year. The skyrocketing performance of these stocks has come to an abrupt reversal this year, providing us with an opportunity to add Meta Platforms to the portfolio. (Meta is the new moniker for the company formerly known as Facebook.)

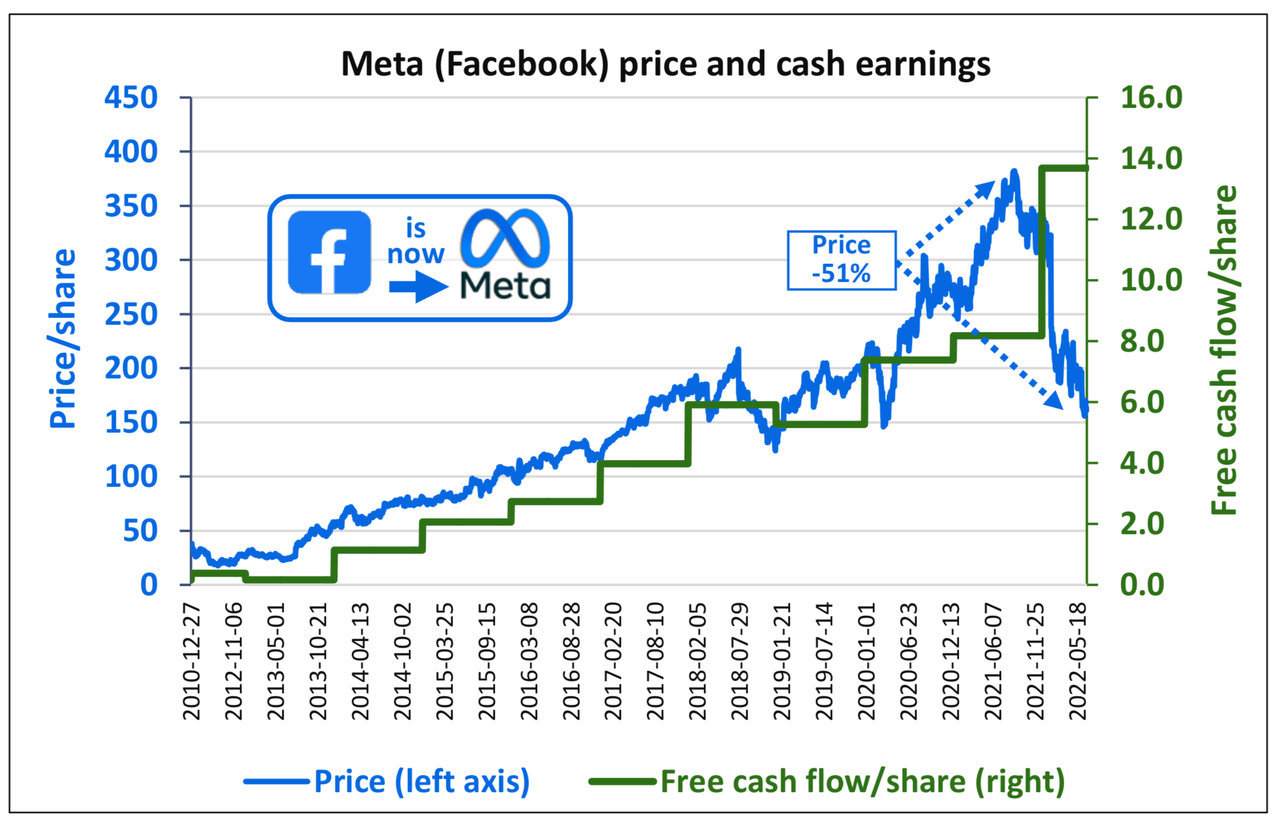

For most of the past decade, Meta’s share price has marched almost lockstep with its meteoric rise in earnings and free cash flow. That was until almost a year ago. Since August 2021, Meta shares have dropped more than 50 percent, while its free cash flow has increased 60 percent.

While Meta is facing certain headwinds related to changes in Apple’s latest operating system release (iOS 14’s optional identifier for advertisers (IDFA) blocking) that impact Meta’s ability to track and thus effectively target its user base, we believe the company will be able to effectively mitigate these changes. Meta estimates that these changes will result in a $10 billion headwind in 2022. To the extent that the company solves the IDFA problem over time, improvements in returns on advertising spending could result in a partial recovery of revenue dollars that creates a future tailwind.

Meta is also spending aggressively on augmented and virtual reality through the company’s Reality Labs division. Meta’s vision is that, over the next decade, the expansion of virtual reality may create the next major computing platform after mobile. The company is investing heavily in this area, dedicating more than $10 billion per year in the form of operating expenses running through the income statement. While the company is currently being penalized for these investments, we think it is more appropriate to view these costs as free options, given that the plug can be pulled at any time if the investments don’t develop into meaningful revenue contributors.

Meta’s core advertising business is clearly entering a more mature phase of its life cycle – or, at least, it is no longer the tiny newcomer in the advertising industry. Meta is now a $120 billion-a-year business, more than ten times its size in 2010. Starting from a base of less than $2 billion in 2010, Meta’s revenues have grown more than 40 percent annually. While it is easier to produce 40 percent annual revenue gains with a $2 billion business than with a $120 billion one, we expect that Meta will continue to siphon ad spending from traditional broad-based, “shotgun approach” legacy ad platforms, such as newspaper, magazine, radio and television. The digital ad space continues to operate as a duopoly shared by Facebook and Google (GOOG, GOOGL) (with Amazon [AMZN] gaining slight ground) and digital ad spending will continue to grow over time.

(For any readers younger than 30-years-old, please ask a parent or grandparent to explain what newspapers and magazines are. Or used to be.)

While the company’s user base is no longer steadily increasing due to the law of large numbers (monthly active users are 3.6 billion compared with roughly 4 billion internet users outside of China), it has multiple avenues to drive additional revenues. There is an enormous gap between the annual revenue per user in North America and the rest of the world. There also remains a monetization story at its subsidiary WhatsApp, which has yet to generate profits but has more than doubled users since Facebook’s $22 billion acquisition in 2014. (For those over 50, ask a teenager to explain WhatsApp, the world’s most popular messaging app.) However, at today’s prices, we don’t think we are paying for any future growth and don’t believe it is needed for an attractive outcome.

Following its massive price drop this year, Meta trades at a market capitalization of roughly $435 billion, with a debt-free balance sheet that carries more than $50 billion in cash and investments. Our purchase price of less than 7 times pre-tax earnings is not only lower than that of many no-growth consumer names, but it is also as low as many industries in secular decline. Meta is a high-margin monopoly that trades as if it is a coal company.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment