Kevin Dietsch

Meta Platforms, Inc. (NASDAQ:META) just released its third quarter earnings and delivered a significant miss. The company beat on revenue but delivered a wide miss on the bottom line. Sales came in at $27.7 billion, down 4% year-over-year, while earnings per share (“EPS”) came in at $1.65, down 49% year-over-year.

Meta faced a lot of challenges heading into this release. The company took a hit from Apple’s (AAPL) privacy changes last year, which CFO David Wehner said would cost it $10 billion this year. Wehner’s prediction came true, as Meta delivered the weakest revenue growth in its entire history in the first three quarters of 2022. In the second quarter, revenue grew at -0.88%. In the third, it fell 4%. We’ve definitely seen a real slowdown in Meta’s business here, and it’s not obvious where the recovery is going to come from.

To add insult to injury, Apple Inc. announced just a day before Meta’s release came out that it would start taking a 30% cut of “boosted post” revenue, so we now have the foundation for yet another Apple-related revenue headwind in the near future. The fact that Apple is able to smack Meta around this much on the revenue front is very concerning. It’s clear that in today’s tech landscape, platform control counts, and Meta does not control the platforms that its apps run on.

With that said, Meta’s stock is now cheaper than it has ever been. At today’s prices, it trades at just 11.3 times trailing earnings, 14 times forward earnings, and 6.3 times operating cash flow. With multiples like these, a company can be a solid value even after a considerable decline in earnings.

In light of the valuation, Meta’s third quarter release was not quite as bad as it appeared. Earnings and cash flows both declined for the period, but on the flipside, the stock is cheap enough already that it is worth higher than today’s share price with just 0% growth. The challenge for management is to get costs under control while bringing the new metaverse investments closer and closer to profitability. If the cost-cutting works out, then it will help propel Meta stock higher, and if the Metaverse actually pays off, it will be a game-changer. These are all very large “ifs,” though, so I can’t rate Meta any higher than ‘hold’ in light of the Q3 earnings miss.

Earnings Recap

Meta Platforms delivered a mixed release in the third quarter. The results were overall in-line with what analysts expected (top line beat and bottom line miss), which is to say they were pretty underwhelming. Some highlight metrics included:

-

Revenue: $27.7 billion, down 4%.

-

Net income: $4.39 billion, down 52%.

-

Operating income: $5.66 billion, down 46%.

-

Free cash flow: $178 million, down 98%.

-

Stock-based compensation: $3.1 billion.

-

Buybacks: $6.55 billion.

On the whole, it was a pretty bad showing. The growth was negative, and free cash flow (“FCF”) almost flipped to a net outflow! On the flipside, the profitability ratios were still pretty high. Based on the numbers above, we get the following margins:

-

Net margin: 15.5%.

-

Operating margin: 20%.

-

FCF margin: 0.6%.

Not bad overall. As an investor, it’s easy to get caught up with growth, since growing earnings tend to signal rising stock prices, but profitability is important too. Stocks are theoretically valued based on their potential dividends. If a company has no growth but an 80% profit margin and you buy it at one times sales, you can theoretically get a very high dividend yield. If a stock’s dividend or earnings yield is high enough, then it can be worth a decent amount of money even with 0% growth. I will explore this concept in more detail in the next section, but for now, the point is that Meta is still very profitable.

Valuation

Having looked at Meta’s earnings, we can proceed to a valuation of its common stock. To begin with, let’s look at the multiples. At today’s prices, Meta trades at:

-

11 times trailing earnings.

-

14 times forward earnings.

-

3.2 times sales.

-

2.95 times book value.

-

6.3 times operating cash flow.

These are fairly low multiples, but Meta’s earnings are trending downward. For example, in the third quarter, net income declined 52%. If Meta’s earnings keep going down, and its stock price doesn’t change, then the multiple will trend upward. To illustrate: if you have a $100 stock with $10 in annual earnings, it has a 10 P/E ratio. But if earnings decline to $5, then suddenly it’s at a 20 P/E ratio if the stock price doesn’t change. If investors think that the new, lower earnings level indicates a long-term trend, then they should demand a 50% lower share price in response.

It’s a similar story if we do a discounted cash flow model on Meta.

META had $13.02 in free cash flow per share in the most recent twelve month (“TTM”) period. If you simply discount that at 8%, you get a terminal value estimate of $162, which is higher than the current share price. 8% is nearly twice the current treasury yield, so the chosen discount rate encompasses both the opportunity cost and a sizable risk premium. So Meta is undervalued assuming 0% growth and a high opportunity cost.

There’s just one problem: Meta’s free cash flow is declining. In the most recent quarter, it declined 98%. It probably won’t decline as much after this year, because revenue is pretty stable and the big ramp up in Metaverse spending will be reflected in the base period. But if Meta’s FCF declines by just 5% per year, we get the following FCF trajectory.

|

BASE YEAR |

YEAR 1 |

YEAR 2 |

YEAR 3 |

YEAR 4 |

YEAR 5 |

|

$13.02 |

$12.36 |

$11.75 |

$11.16 |

$10.60 |

$10.07 |

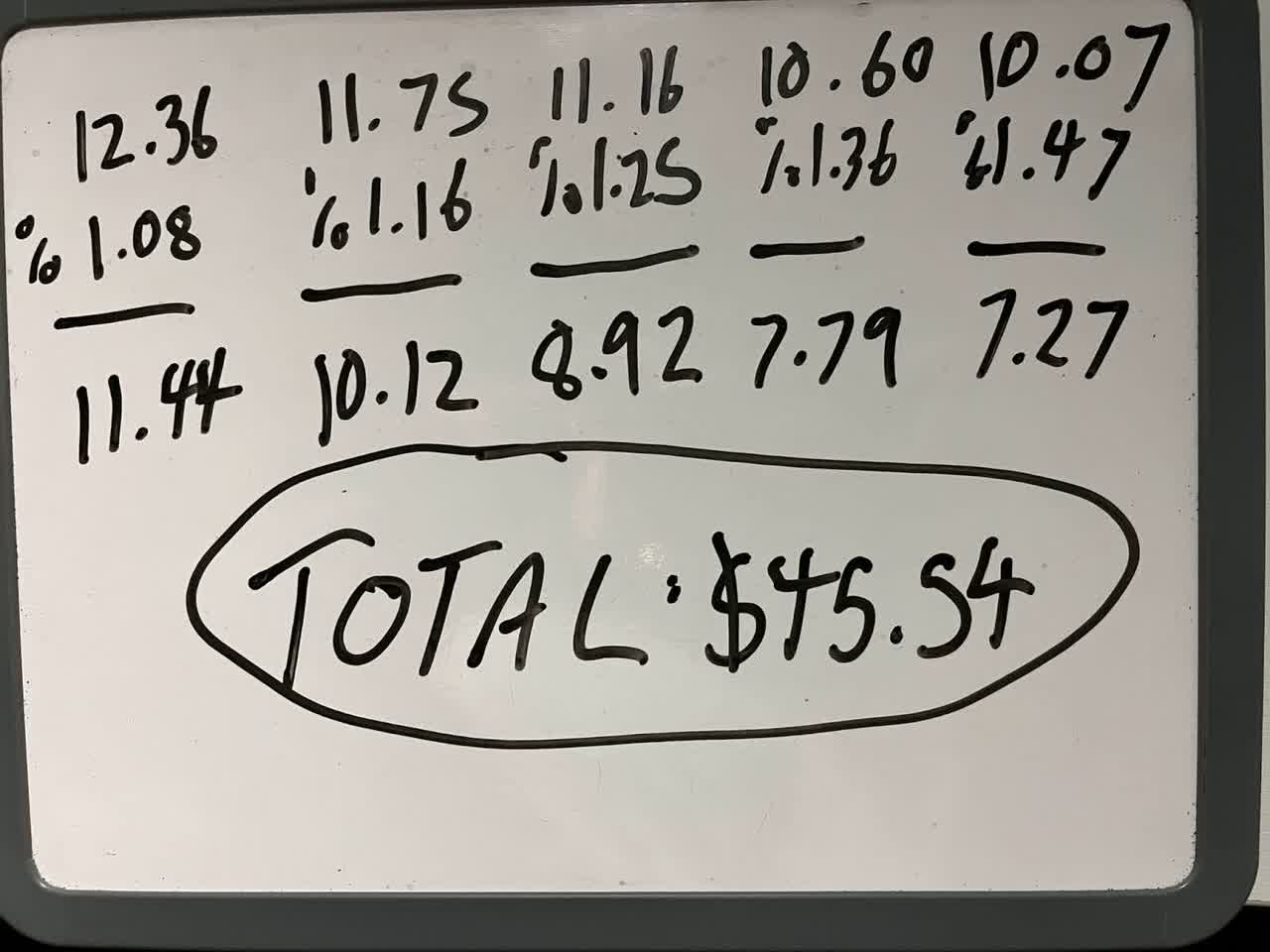

Now, even at $10.07, Meta’s FCF per share is OK given the current stock price: it implies a price/FCF multiple of 12.99. However, this declining trajectory makes the present value much lower in a DCF model. As the table below shows, if you discount each of the cash flows in the table above at one plus 8% to the power of year “N,” you get five years’ cash flows with a present value of $45.54.

Meta Platforms Cash Flows (the author)

Now, if we assume that there’s no growth after these five years are up, then the terminal value in year five is $125.87 (10.07 divided by 0.08). We divide $125.87 by 1.47 to get $85.62 in present value of the terminal value. Add that to the PV of the five years’ cash flows and our estimated value is only $131.16. In this scenario, we get basically no upside.

The Metaverse Spending

Having established that Meta Platforms has significant upside if it grows at 0%, but no upside if cash flows decline 5% per year, it’s time to ask:

Will Meta’s cash flows continue declining?

That’s the trillion dollar question. Meta could have had flat earnings and cash flows in Q3 had it wanted to. The increase in costs was almost entirely due to the heavy investments the company is making in Reality Labs–the segment that develops the Metaverse.

The Metaverse is hard to explain, but it’s basically a network of social communities with a VR gaming component. It’s centered around VR headsets and AR devices. Meta has a gaming headset called the Quest 2, which is the most popular gaming headset in the world. The Quest store has done $1.5 billion in revenue since it launched. Right now, the Quest is mainly used for gaming. Mark Zuckerberg’s aim is to get it to the point where it’s widely used in teaching, medicine and industrial applications.

If the Metaverse takes off, then Meta will have its own hardware platform that it controls just like Apple and Google (GOOG, GOOGL) do. In VR, it won’t have to worry about competitors like Apple taking its data away, because it will control policies on the platform.

The problem is that VR isn’t quite there yet. Reality Labs does a few hundred million in sales per quarter–that’s a lot, but it doesn’t move the needle for a company of Meta’s size. The Quest needs to get a lot more popular for this to work. Currently, it faces a hurdle in the form of time spent using the platform. People who buy the Quest rarely spend more than an hour a day using it, because its battery life isn’t great, and it’s prone to causing motion sickness. These issues will need to be solved before the Quest goes mainstream. If they are solved, it will be a game-changer for Meta, which will control an all-in-one hardware platform that’s not vulnerable to things like Apple’s privacy policies.

The Bottom Line

The bottom line about Meta Platforms is that it’s really two stocks in one:

A stable but slow-growing ad-tech business, and a more speculative VR business. The former is under immense pressure due to Apple’s policies, and the latter is an unprofitable long shot bet. As it stands today, with Reality Labs still 3-5 years away from profitability, Meta Platforms is extremely vulnerable to Apple’s data privacy rules and app store fees. For this reason, I will be trimming my exposure by about 75% when the markets open tomorrow.

Be the first to comment