MOZCO Mateusz Szymanski/iStock Editorial via Getty Images

CD Projekt (OTCPK:OTGLF) (OTCPK:OTGLY) may have added to its ‘Witcher’ series gaming IP with the recently released AAA title, ‘Cyberpunk 2077,’ but its financials have been mixed. Q2 was more of the same, featuring YoY revenue and profit declines despite cost-cutting efforts. The biggest disappointment from the quarter was the ‘Cyberpunk 2077’ expansion news, though, with management guiding toward only one paid downloadable content pack (DLC) for the game through 2023. This strikes me as a rather disappointing outcome, given the untapped monetization potential and the considerable time gap relative to the next AAA game release (likely post-2023).

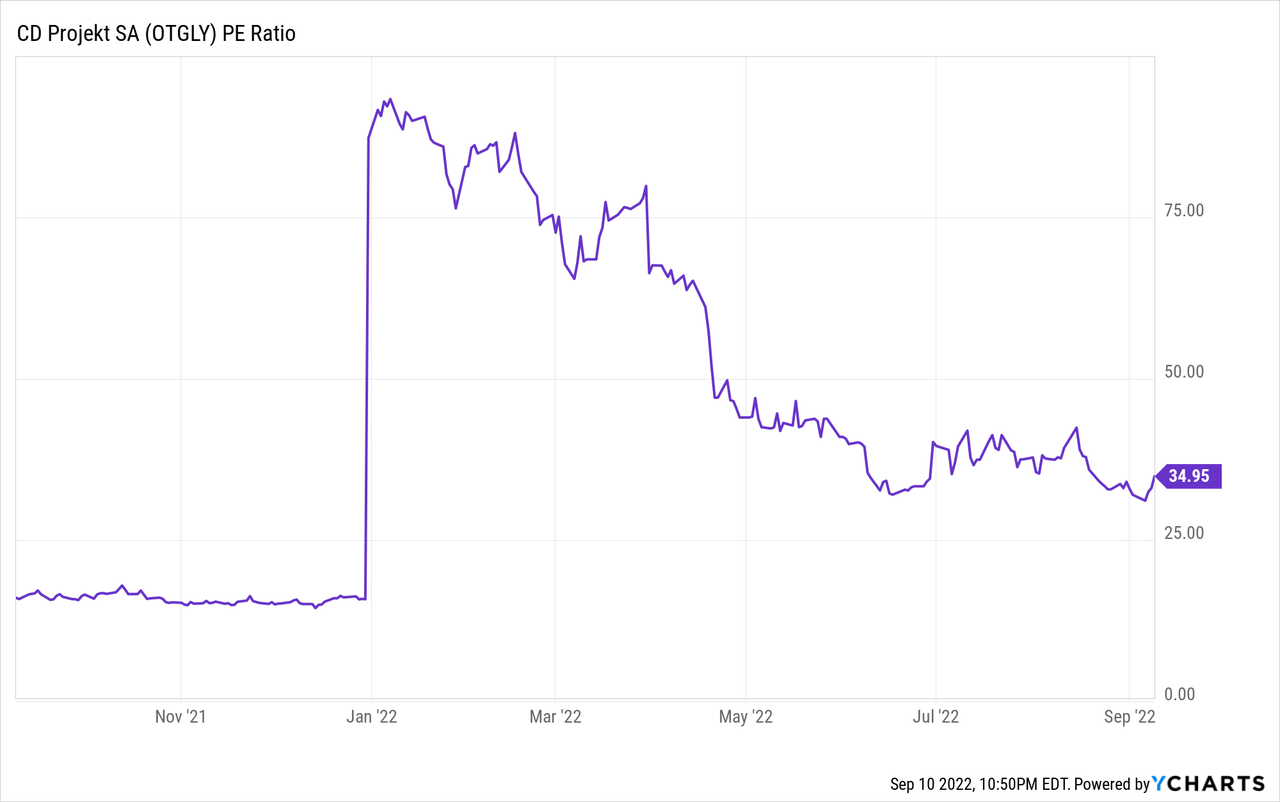

Plus, CD has yet to address its consistent deadline misses for new product releases (e.g., the multi-quarter next-gen ‘Witcher 3′ delay), raising investor skepticism about its ability to recover from creative hurdles down the line. While the stock price has been pummeled YTD (now down to multi-year lows), the valuation multiple remains at a premium ~35x trailing P/E and could come under further pressure. Pending visibility into improved AAA game development using the new engine (Epic Games’ Unreal Engine 5 technology) and the upcoming strategy update in October, I would remain on the sidelines.

Another Quarter of YoY Declines

As of Q2, CD posted ~ZL1 62m of revenues, a 41% YoY decline relative to a solid 2021 base, and a worrying ~25% drop QoQ. Given the benefit of the weaker PLN, which depreciated >15% YoY relative to the USD in Q2 2022, the underwhelming revenue result likely implies a drop off in ‘Cyberpunk 2077’ copies as well. Echoing Q1 2022, additional detractors include continued GWENT (i.e., ‘The Witcher Card Game’) revenue declines following the termination of the consortium agreement, lower digital store revenues from new releases amid launch delays, and the suspension of CD’s operations in Russia and Belarus.

Despite the revenue headwinds, CD did expand its EBITDA margins in Q2 by ~6%pts YoY on lower ‘Cyberpunk 2077’ service costs (~ZL18m of amortization booked during the quarter under the cost of revenue line). While SG&A cost cuts also helped margins, CD’s reported net profit of ZL 44.8m was still a -51% drop on a YoY basis (-35% QoQ). In turn, its operating cash flow also disappointed at ZL 0.5m, impacted by high cash taxes as well as a QoQ acceleration in new project expenditures at ZL 62m (up from ZL 28m in Q1 2022). All in all, the net cash position was slightly down sequentially at ZL 1.18bn, though the dividend-paying capacity remains intact (recall, the company paid >PLN 100m in dividends in July).

Near-Term Guidance Offers Little Cheer

Worryingly, CD management sees continued wage pressure in the coming quarters, as changes in work preferences post-COVID create new talent retention challenges. In particular, developers are increasingly able to work from Poland for higher global salaries, creating upward pressure on CD’s wage structure. That said, the company sees opportunities to hire abroad as well – quality is a big concern here, but if successful, CD could see some labor inflation offset while also beefing up its capability to develop more AAA titles going forward. Management guidance has already pegged 2022 wages in line with last year’s levels at ~23%, though, so the bar isn’t low.

On the revenue side, CD cited a limited impact on sales thus far from a weaker consumer spending/macro backdrop, though the continued sequential revenue and profit declines remain a concern. Plus, the impact of suspending its Russia and Belarus operations will remain a headwind to YoY comps throughout the year. There will be a strategy update in October, but given the uncertainties, my base case is for no major changes from the prior one, although additional color on key issues (e.g., the new incentive scheme) would be welcome.

Cyberpunk Expansion Throttled Amid ‘Unreal Engine’ Transition

In conjunction with the earnings report, CD also announced Phantom Liberty, the first ‘Cyberpunk 2077’ expansion, scheduled for launch in FY23 across next-gen consoles and PC. Management sees this as an important step in supporting the long-tail sales of the ‘Cyberpunk’ title, dedicating most of its development capacity to the expansion. Even with management calling this a major expansion, the price point remains undisclosed, so it is difficult to pinpoint the specific revenue opportunity here. On a positive note, the ‘Cyberpunk 2077’ expansion pack launch will see a boost from the media side, with a new Cyberpunk anime series to be released on Netflix in conjunction (created by CD and Japanese studio Trigger). That said, the company’s plan for only one large expansion pack in 2023 leaves a sizeable gap between product cycles and thus, comes as a letdown on the monetization front.

For context, a key reason for the limited release schedule is the company’s shift from its internal game engine to the Unreal Engine 5 platform. Future games, including the next addition to the Witcher saga (currently in pre-production), will use Epic Games’ Unreal Engine 5. Over the long run, the transition should pay off – the advanced capabilities of the new engine will not only enable more efficient development but also makes it easier to attract and retain new talent. Through the strategic partnership with Epic, CD will also be able to tap into Android for its future games, effectively de-risking the development process (a key pain point thus far). In the meantime, CD’s development woes continue – having suffered numerous delays from the initial Q2 2022 launch, the next-gen version of ‘The Witcher 3’ (free for gamers who already own it) is now slated for a Q4 2022 launch.

Still a ‘Show Me’ Story

CD’s subpar Q2 financial performance aside, the outlook for its next-gen console content remains far from rosy – even with the upcoming ‘Cyberpunk’ updates and the next-gen ‘Witcher’ edition. While the new expansion pack is a step in the right direction, the limited content release slate is a concern in the near term, particularly given the scale of the planned investment. Plus, monetization of ‘Cyberpunk 2077’ has been disappointing, falling short of getting CD back to its prior expectations on units sold. Development upside from the pending Unreal Engine 5 platform transition should also be treated with some skepticism, in my view, due to CD’s past execution issues and its struggle with attracting talent post-COVID.

The stock price has been de-rated accordingly to multi-year lows, yet, its P/E valuation remains at a premium. This leaves it vulnerable, in my view, to further downside on future execution delays or disappointments at the strategy update next month.

Be the first to comment