belterz/iStock via Getty Images

Dr. Michael Burry, notorious for his large short position in the housing/financial crisis, has been sending out many warning signals to investors in recent years. Although, he is still big on a few big players, with a large position in Meta Platforms, Inc. (NASDAQ:NASDAQ:META).

In this article, we will look at why Meta could be a good play, even during a recession, and why the baby may be thrown out with the bathwater, as investors have put extreme pressure on the company’s valuation.

A Bumpy Ride Ahead

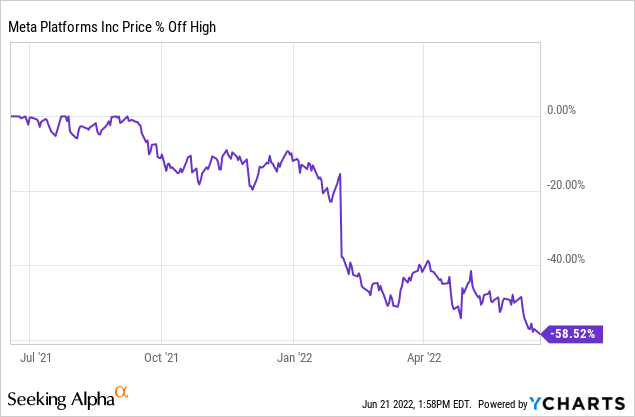

To say that Meta has had a bad start so far this year is perhaps an understatement. They closed 2021 with exceptionally strong revenue growth and an optimistic outlook, and were knocked back to reality with a sledgehammer blow in the first quarter.

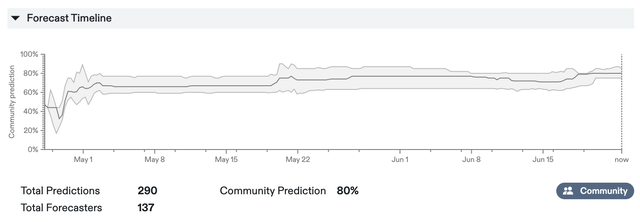

Beyond the internal stress at Meta, investors are also seriously weighing the risks of a recession as the Fed begins to remove assets from its balance sheet and interest rates begin to rise, making it harder to borrow capital and sucking liquidity out of the global economy. In fact, according to one of the most popular polling sites, Metaculus, the likelihood of the U.S. entering a recession by 2024 is now 80%.

A few days ago, Mark Zuckerberg also announced that Meta would wait to collect a revenue share from its creators until 2024 instead of 2023, causing some analysts to downgrade their revenue forecasts for the next few years.

Weighing the Risks

This was accompanied by a few other serious headwinds, as Facebook struggles to switch to short-form video, and mitigate the risk that ByteDance’s private company TikTok currently poses. Meta already had a bad start this year, when it announced that it could lose up to US$10BN due to Apple’s (AAPL) “App Tracking Transparency” feature, which allows users to choose whether to share crucial data with Meta.

Another risk could be the start of a slowdown in e-commerce spending as the economy rebounds and consumers have spent more money in physical stores compared to e-commerce over the past 2 years. A report from Mastercard’s (MA) SpendingPulse showed that e-commerce transactions were down 1.8% from last year, while in-store sales were up 10%.

According to Champion Analysis, ad rates for Meta are down 8% YTD compared to last year, making it difficult to project the exponential growth Meta has enjoyed in the past for the rest of this year. This may also be exacerbated by Russia’s ban on Meta, which was upheld a few days ago after Meta lost their appeal in Russian court over “extremist activities.”

However, Facebook responded to all these headwinds in April and will be investing less aggressively, slowing down the pace of investment according to Mark Zuckerberg. Leaked internal employee notes also show that they are limiting new hires due to disappointing revenue expectations, pausing or slowing hiring for most mid- to senior-level positions. On the other hand, this can be seen as a good thing, as they try to be prudent and preserve capital in case the U.S. falls into a recession/depression.

Michael Burry and Institutions

Michael Burry, who has taken a bearish stance on stocks and the U.S. economy in recent years, came out with a tweet last month reaffirming his stance on U.S. equities:

As I said about 2008, it is like watching a plane crash. It hurts, it is not fun, and I’m not smiling. -Michael J. Burry

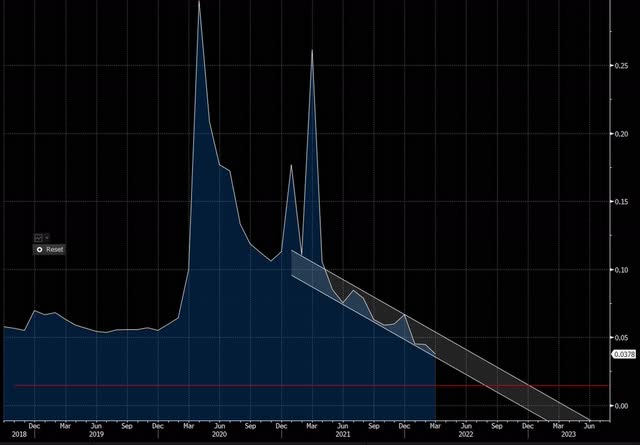

Several other things he also mentioned, for example, is the amount of U.S. personal savings/GDP that is outstanding. Despite record stimulus spending, which has put trillions of dollars in the hands of consumers, the savings rate is on track to hit an all-time low between September and December of this year, if depletion continues as it has over the past 12 months.

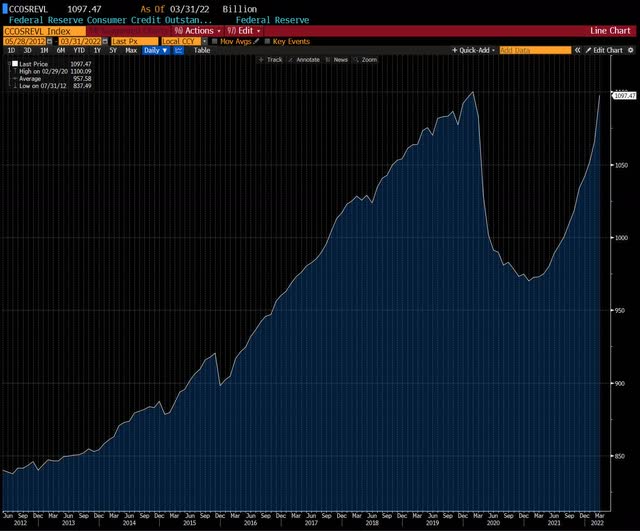

He is concerned about a consumer recession lurking around the corner. He also pointed out that the amount of revolving credit card debt outstanding has risen at a record pace, back to 2019 levels from before this pandemic. All of these factors could have a serious impact on profits as consumers appear to be in less healthy shape than the Federal Reserve believes.

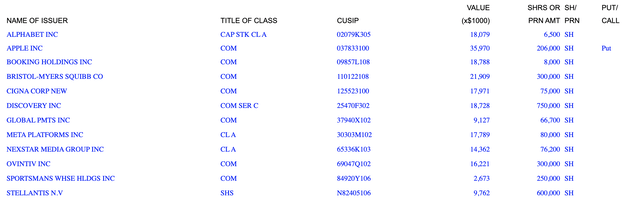

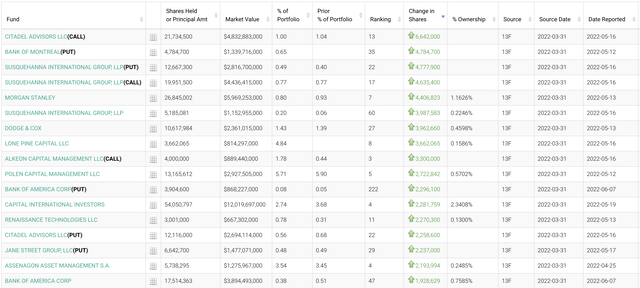

As you can see in the post below, Michael Burry’s fund, Scion Capital, reported in its latest 13-F with the SEC that his fund has put contracts on Apple, for a total of US$35M. This compares to Meta, of which he reportedly holds a position of US$17.79M, along with Alphabet (GOOG) (GOOGL), which we also recently highlighted as a strong buy in one of our recent articles.

Some other “heavy hitters” have also jumped on this opportunity and taken advantage of Meta’s share price, which has plunged in recent months. Despite a record outflow of institutional investors in the stock market, they still seem to be positive about Meta.

Institutions like Citadel bought more than 6.6 million shares, worth more than US$1BN. Other institutions such as Morgan Stanley, Susquehanna and BofA also bought hundreds of millions of dollars worth of shares. Legendary quant firm Renaissance Technologies, owned by Jim Simons, also seems to have picked up the trade, with over 2.27M shares, bringing their total to just over 3M shares.

We will explain shortly why, like the majority of hedge funds and institutions, we believe Meta is fundamentally undervalued at its current share price.

The Metaverse

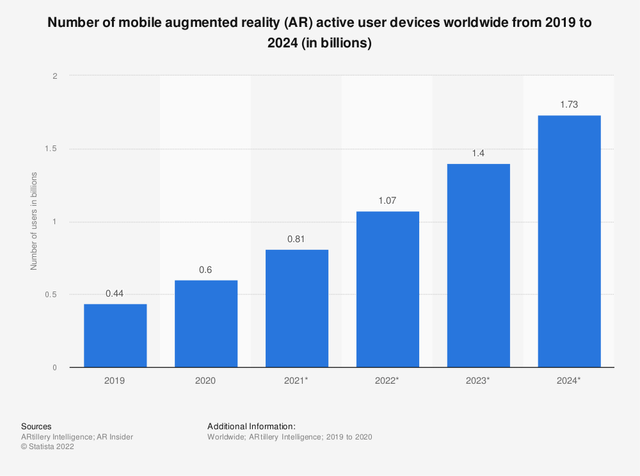

Like it or not, Mark Zuckerberg seems to have a good sense of what products or features to introduce, and where to allocate capital, if you look at revenue growth over the past 10 years. Even now, for example, some forecasts predict that the number of active users of mobile AR will grow to 1.73 billion users by 2024, which is 1.5 billion more than the 200 million in 2015. And Mark Zuckerberg is keen to cash in on this opportunity at all costs.

Earlier this week, Mark Zuckerberg himself showed off numerous new designs for new VR headsets, which could be released before its predecessor, the Oculus Quest 2. Meta is still expected to spend about $10 billion on the Metaverse this year, although there is a chance that this could be watered down in the event of a serious downturn in revenue from its front business, advertising.

Also, if the U.S. falls into a recession, there is always the possibility of spending less capital on future projects, including the Metaverse, and prioritizing operating margins, to ensure Facebook’s profitability and satisfy investors.

Valuation

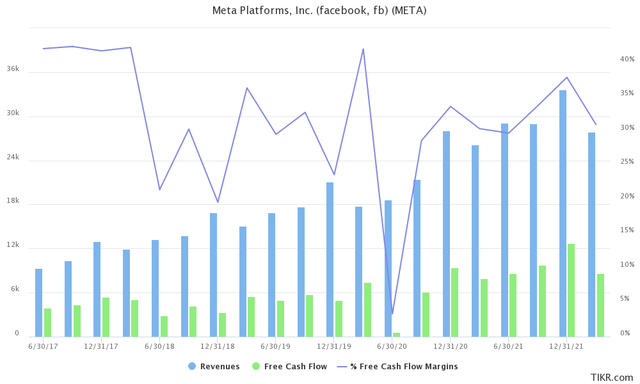

Looking at Meta’s valuation, we think it meets all the perfect criteria. In a period of high inflation, slowing growth and rising interest rates, Meta might be a perfect fit, as we believe there is still a lot of growth ahead, combined with very reasonable fundamentals and an extremely solid balance sheet.

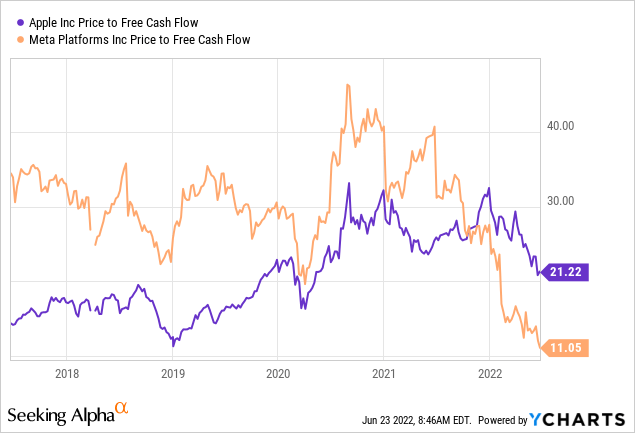

Oddly enough, since March 2020, when the pandemic broke out, there have been some differences between Meta’s valuation and Apple’s. While we love both companies and have them both in our portfolio, it can be noted that Meta is drastically cheaper. In terms of P/FCF alone, Meta is considered almost twice as cheap. This was almost reversed in the early 2020s, when Apple was trading at a much lower P/FCF multiple.

Meta’s recent pullback can be partially attributed to concerns about their growth, and whether it was sustainable. When the fourth quarter results for Meta came out and gave a poor outlook for the first quarter, they were quickly given a reality check, as investors began to discount Meta’s future user and revenue growth, and to weigh the risks of a recession and economic slowdown.

Although, if we zoom out, we can see that Meta has experienced several of these setbacks in the past, with Q1 revenues being lower than usual. This time around, Q2 might not turn out as well, with Russia being shut off from Meta’s platform/services and a few other headwinds such as Apple’s privacy futures and others we’ve mentioned before.

We do not believe that temporary headwinds will burden Meta in the long run, as some analysts expect, fully discounting any meaningful future growth for Meta. If Meta succeeds in introducing short video formats and gaining market share in future potential markets such as VR, we believe there could be much more growth ahead.

VP of AR/VR Andrew ‘Boz’ Bosworth at OC6 (Meta IR)

There have always been concerns about other platforms like Snapchat, Twitter (TWTR), YouTube and others gaining market share from Meta in the past. A good example is how Meta stole Snapchat’s story function a long time ago, gaining more revenue.

In the most recent earnings call, Mark Zuckerberg also used the example of Facebook switching from Desktop to Mobile in 2012, and that monetization was initially weaker. A few years later, and mobile became Facebook’s main driver for monetization.

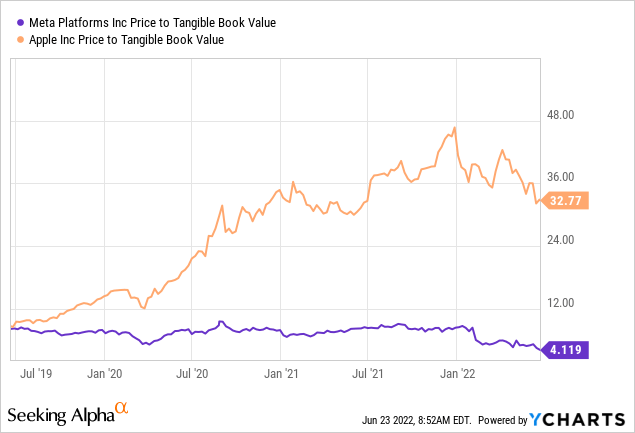

We also found that since the pandemic, there is a clear divergence in the correlation between the price of both stocks and tangible book value, as you can see in the chart below.

Currently, Meta is trading at only 4.1x price-to-tangible book value, compared to 32.8x for Apple, which arguably makes Meta a more solid/safe play during a severe recession. Also, noteworthy is that Meta has US$43.89BN in cash and cash equivalents, compared to Apple, which has US$51.51BN in cash and cash equivalents, making them pretty close in terms of liquid positions.

That’s pretty remarkable, knowing that Meta is currently trading at a market cap of about US$420BN, compared to Apple’s US$2.21T market cap.

If we also look at Apple and Meta from a long-term perspective, in terms of pure revenue growth, Meta saw a CAGR of 41.80% in terms of revenue between 2012 and 2021, compared to only 9.89% for Apple. Although over the past 3 years, Meta had a CAGR in terms of revenue of 28.30%, compared to 11.26% for Apple.

This means that Apple is still growing at a steady pace, and Meta’s frenzied growth is slowing down a bit. It is also important to note that past results are not indicative of future performance. But it is clear to see why Michael Burry is going short Apple, and long Meta, probably as a pair trade, betting on the markets showing more interest in pure current valuations.

The Bottom Line

We believe Meta is currently in a deep value area, providing investors with a great opportunity to provide significant alpha above broad benchmarks. Currently, Meta appears to be valued as if it has no further growth prospects, referring to its historically low P/E ratio and P/FCF metrics.

Meta certainly has a strong balance sheet, with US$43.89BN worth of cash and cash equivalents, oddly similar to Apple’s liquid position, which is priced at over 5x Meta’s EV. Meta generates a strong FCF and has a strengthened balance sheet, making it seem like a great play even during a recession.

Combining the strong growth it has experienced for a decade with its balance sheet and historically low valuation, Meta also seems to us to be a good protection against inflation or a company

Be the first to comment