MoMo Productions/DigitalVision via Getty Images

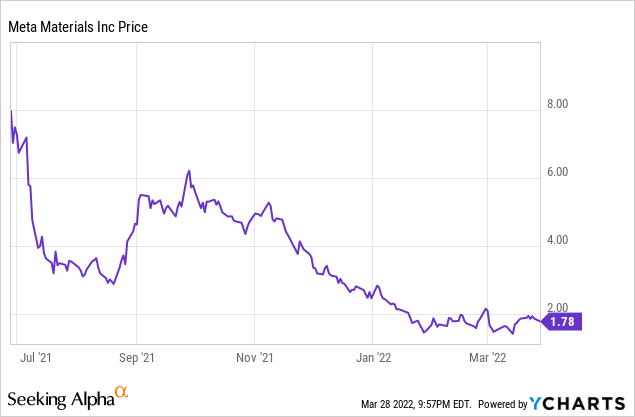

Q4:21 results were mixed with revenues up 748% YOY while net loss widened to $29.5 million. We decrease our target price to $3.50 per share (earlier $6.50) and maintain our rating at BUY.

Q4:21 Highlights

- Q4:21 revenues were $2.29 million, up 748% versus Q4:20 primarily due to the acquisition of Nanotech Security. The acquisition contributed nearly $1.8 million to Q4:21 revenue.

- Gross profit was $1.76 million, and the gross profit margin was 76.9% in Q4:21.

- The company reported an operating loss of $17.1 million in Q4:21, versus a loss of $3.5 million in Q4:20 due to costs associated with the Nanotech acquisition.

- Net loss increased to $29.5 million in Q4:21 versus a loss of $5.8 million in Q4:20. Diluted loss per share was $0.13 versus $0.04 in Q4:20.

- The company’s cash and cash equivalents totaled $50.3 million in Q4:21

PRIMARY RISKS

- The company has a limited operating history. To date, Meta Materials’ (NASDAQ:MMAT) revenues have been limited to development fees, without any material contribution from product revenue.

- The company’s plans are dependent on its ability to scale up production via its new facility. Any delay in setting up the facility may impact operations.

Quarterly Summary – Q4:21

The company posted Q4:21 revenue of $2.29 million, up 748.1% YoY, driven by a contribution of $1.8 million from the acquisition of Nanotech Security. Q4:21 net loss increased to $29.5 million, compared to a loss of $5.8 million in 2020. As of the end of Q4:21, the company’s cash and cash equivalents totaled $50.3 million, while the debt was $3.2 million in interest-free loans from the Atlantic Canada Opportunities Agency.

During the quarter, MMAT completed the acquisition of Nanotech Security. The acquisition gives META the manufacturing capacity to make nano-optic structures on thin films at high volume. About 47 patents came with the company.

Management noted that it expects development programs, including the contract with a confidential G10 central bank, to account for most of the revenue over the next 12 months. META is currently pursuing multi-year, multi-million dollar contracts with several OEMs.

META is scaling metamaterials application development and production capabilities across all locations, building out roll-to-roll capabilities like the way newspapers are printed. In Dartmouth, Nova Scotia, the company is on track to complete the renovations to its new 68,000 sq. ft. headquarters, which is expected to be operational in H1:22. In Thurso, Quebec, META is doubling production capacity and in Pleasanton, California, it has already expanded operations by nearly four times.

Earnings Estimate

For fiscal 2022, management expects most of the revenue to be generated from development programs. We forecast revenue of $13.1 million with the majority contribution from non-recurring development revenues. However, we expect development revenues to decline over time in favor of commercial product revenues. With regards to Product revenue, we assume increasing sales of products targeting needs in 5G and 6G communications. We have also assumed additional product revenues derived from the sale of protective eyewear, as well as automotive applications including de-icing and de-fogging applications. Driven by higher contributions from product revenues, we expect sales to reach $33.6 million in 2023 and $62.0 million in 2024. We expect operating income to follow suit increasing from $(13.1) million in 2022 to $(4.7) million in 2023 and $15.1 million in 2024. We model a net loss of $(9.2) million in 2022.

Valuation And Recommendation

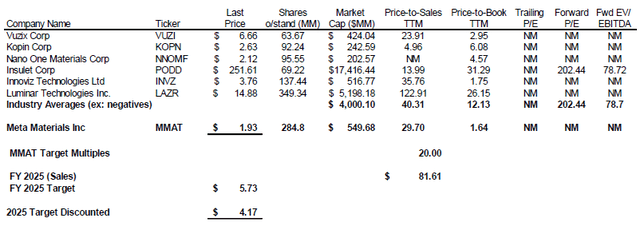

We value MMAT using a combination of multiples based on industry peer companies (a P/S multiple) blended with our Discounted Cash Flow (DCF) valuation to derive a fair value target price for the company.

MMAT’s peer valuation is challenging given the lack of any similar publicly traded pure-play company. Because of the lack of directly comparable metamaterial-focused companies, we compare MMAT against other innovative electronic component manufacturers targeting applications such as augmented reality and autonomous cars. The potential market for these applications is large and that is reflected in the high price to sales multiple (average peer group multiple of 40.3x). We also note that many of the companies in the peer group are early-stage with no significant revenue, similar to that of MMAT. Against this background, we value MMAT at 20x FY:25 sales of $81.6 million and discount that result back at our computed cost of capital (9.5%). We arrive at a peer group multiple based target price of $5.73, which we discount back to $4.17.

We weight the other 50% of our target using our Discounted Cash Flow target. Our DCF model uses our forecasted free cash flow to the firm over the first four years and then grows EBIT at a 50% rate over years 5-6, 30% over years 7-9, and 15% for year 10. We apply a weighted average cost of capital of 9.5%. Our DCF produces a value of $2.80.

We combine our peer-based target of $4.17 at 50% and our DCF model target of $2.80 at 50% to obtain a target price of $3.50.

Be the first to comment