Tatiana Antonenko/iStock via Getty Images

Thesis

Meta (NASDAQ:META), one of the tech titans and a member of the FAANG group, has fallen hard in the past year. The stock is down more than -64% since its highs in September 2021 and has managed to “outperform” the Nasdaq index on the downside. Sheryl Sandberg’s exit as META’s COO in June after a 14-year run, should have signaled to savvy investors the carnage to come. The stock is down almost -25% since her announcement.

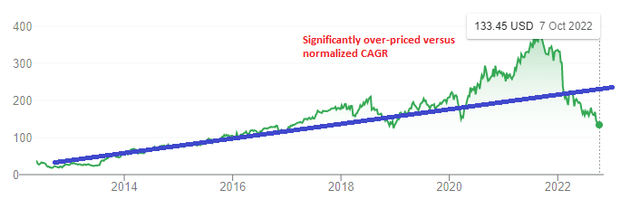

The stock is now trading with a 12x P/E ratio, after touching almost 30x last year. The fall has been swift and hard. In our view, the company is reverting to a more normalized annual CAGR, after being significantly overvalued during the zero rates environment and work from home trends that characterized 2020 and 2021. After having overshot on the upside, we now feel the stock is overshooting to the downside, with the current pricing back to its 2016 levels. Market timing is almost impossible to achieve, hence a savvy investor can choose to start layering in the name via a conservative options strategy.

The article puts forward a one-year cash covered put strategy that can result in yields exceeding 18% if the META stock trades above $135 per share in September 2023. While the next few months will be turbulent for the wider stock market and META, we are of the firm opinion that a year from now we will be discussing the magnitude of the rate cuts to come rather than increases, and tech stocks will be bid once again. This conservative approach also provides an investor with a -17% discount to current spot prices if META does continue to exhibit weakness even a year from now. In our view, taking advantage of the stock’s implied volatility is a very smart way to take a position without the need to market time the stock, a historically impossible feat to achieve.

What is the trade?

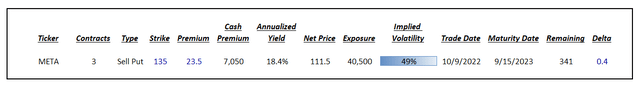

The trade we are putting forward is selling an at the money 1-year put option on META:

We are looking at selling 3 contracts with a September 2023 maturity date. The trade pays a 23.5 premium per contract, which translates into an investor pocketing a $7,050 cash premium if the trade expires without being triggered. The high put option premium is driven by the high implied volatility, which clocks in at 49% for this strike and tenor. As a reminder, implied volatility is the main component of options pricing and is the driver for the current trade.

The high premium translates into an annualized yield of 18.4% if the put option expires without getting triggered. We are calculating the yield as a percentage of the maximum notional out the door at the strike price if the investor needs to purchase the stock.

Ultimately, there are two scenarios that can occur upon maturity date:

Scenario 1:

- META settles at a price above $135 per share on September 15, 2023

- the put option expires worthless

- the investor pockets the $7,050 premium and realizes a yield of over 18% on the cash covered put

Scenario 2:

- META settles at a price below $135 per share on September 15, 2023

- the put option gets triggered

- the investor buys 300 shares (3 contracts) of META at a net price of $111.5 per share ($135 strike minus the 23.5 premium per contract)

- the realized purchase price is -17% lower than the strike, thus providing a substantial buffer for the potential stock decline

Selling puts is a very conservative way to take a long position in a stock because it allows for a downside buffer in the stock price (in this case -17%), and more importantly it does not subject an investor to market timing issues. Market timing is virtually impossible to achieve. However, an investor can identify when pricing is becoming “cheap” and take positions from a relative value standpoint. The high implied volatility exposed by META now, coupled with a price level which was pervasive in 2016 has pushed the stock to the “cheap” range. Has the stock bottomed? We are not sure, but we are fairly certain that one year from now when the put maturity comes to the fore, we are going to be talking about rate cuts, not rate increases, and tech will be bid again. This should translate into higher prices for META.

Earnings Estimates & P/E Ratio

The tech bubble is deflating and META has not been spared:

META is down more than -64% since its highs achieved in September 2021 versus -29% for the Nasdaq. The stock is now trading at 2016 levels:

The fall and de-rating have been swift. But just like in other cases, the stock will revert to a normalized growth rate:

Bubbles are characterized by euphoric crowding of trades that make very little sense from a valuation standpoint. That was the case with META in 2020 / 2021 when the “stay at home / work from home” trend was fully entrenched. It is fairly easy to spot how over-priced the stock became during that period versus its historic CAGR levels. The stock has overshot on the upside, and it will do the same on the downside. Based on its historic trend, the stock should be somewhere closer to $200 per share by the end of 2023.

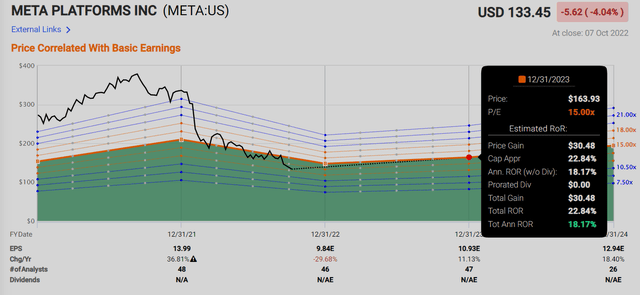

We can see that applying a 15x multiple to earnings gets us fairly close, specifically to a $163 price level:

META Price Estimate (Fast Graphs)

The P/E de-rating for META has been especially violent. Last year, in 2021, the stock was trading with a P/E close to 30x. It is now at 12x, but we believe that as the rates stabilize and Tech stops being pummeled we are going to move to a very historically cheap large cap P/E ratio of 15x on META.

Conclusion

META, a tech titan and original member of the vaunted FAANG cohort, has fallen by more than -64% in the past year. This type of return would have been hard to phantom at the beginning of the year, yet investors are not quite certain if this is the bottom. Market timing is a quasi-impossible feat to achieve, yet we are fairly certain that one year from now we will be discussing the magnitude of the rate cuts to come, not increases, and tech stocks will be bid once again. We believe the most appropriate and conservative trade to take advantage of that view is a 1-year cash covered put strategy on META. With a very high implied volatility, an at the money sold put option offers yields in excess of 18% if the stock ends up above $135 per share in September 2023. Conversely, the same strategy results in a discount of -17% to current spot prices if the shares are ultimately purchased.

Be the first to comment