Fahroni/iStock via Getty Images

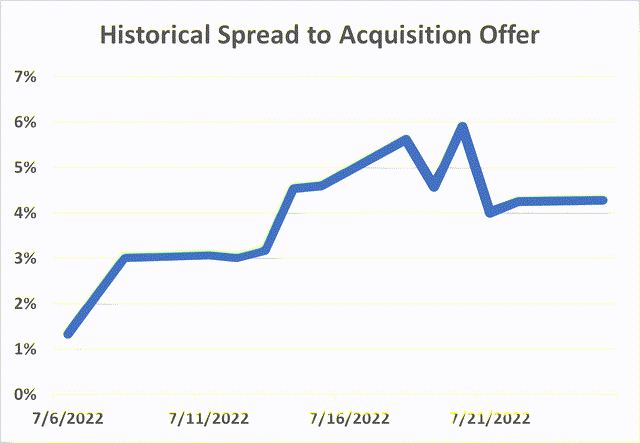

This is a recently announced going private transaction which seems highly likely to close. The spread of 1% seemed to reflect this upon the announcement but has since widened despite no transaction-related news and now stands at 4%. The merger is expected to close in Q4’22 which would imply a ~9% annualized return.

A South Korean buyer consortium is acquiring US diagnostic test kit maker Meridian Bioscience (NASDAQ:VIVO). The offer is $34 per share in cash or a total of ~$1.53bn. After the acquisition, two buyers – South Korean peer SD Biosensor (SDB) and a PE firm SJL Partners – will own 60% and 40% of the company. Overall, the merger makes strategic sense as SDB operates in the same industry and will be able to expand its broad product portfolio to the US.

The announcement comes after a strategic review. VIVO shareholder and regulatory approvals will be needed, however these should not be a hurdle:

-

VIVO’s institutional shareholders (>50% stake) have a low cost-basis. Moreover, the transaction values VIVO at ~18x EV/TTM EBIT – close to its significantly larger peers, such as Qiagen (~19x), PerkinElmer (~20x) and Abbott Laboratories (~22x).

-

Antitrust approvals are unlikely to be an issue – the companies have small market shares in all geographies. Meanwhile, CFIUS approval seems like a formality.

The main risk here is the DOJ’s ongoing investigation into the company’s blood lead test products since 2018 due to their allegedly misleading test results. The merger announcement explicitly mentions “the absence of specified materially adverse outcomes” in the investigation as one of the closing conditions. The DOJ has issued several subpoenas to the company and currently the investigation is ongoing. No timeline has been provided. A positive is that VIVO has complied with all of FDA’s requests and inspections on its blood lead test products so far. In August 2021, VIVO was issued a close-out letter from the agency, meaning that the company has addressed issues identified in the initial warning letter sent by the FDA in 2017.

Business & Strategic Rationale

VIVO is a life science company operating in the in vitro diagnostics (IVD) market. IVD are tests on samples of blood or tissue from the human body. The company produces 1) diagnostic test kits (Diagnostics segment) and 2) reagents used by other diagnostic test manufacturers (Life Science segment). Diagnostics historically contributed a higher revenue share (68% in 2019) but have seen a decline (40% in 2021) as Life Science revenues increased on the back of high demand for COVID-19 related reagents.

Likewise, SDB operates in the IVD industry and has the same operating segments. Both companies have overlapping product portfolios, which include diagnostic test kits/reagents for respiratory, gastrointestinal and cardiovascular diseases, among others. In particular, immunoassay reagent offerings (i.e. antibody and antigen as opposed to molecular) are highly complementary. An important distinction here, however, is that VIVO generates ~45% of its revenues in the US compared to only ~7% of SDB’s sales coming from North America. The buyer has stated that its product portfolio expansion to the US market is one of the underlying reasons behind the merger. In 2020, SDB formed a distribution agreement with Roche (OTCQX:RHHBY) and several of its COVID-19 test kits have been launched in the US. Now, the company is reportedly seeking US authorization for its other offerings, such as Standard M10 rapid COVID-19 test kits. In this context, the transaction seems highly synergistic given VIVO’s distribution network and knowledge of domestic regulations. After the acquisition announcement, SDB hinted at building a new manufacturing plant in the US which points to the company increasing its distribution in the US.

SDB has also highlighted its mass-production know-how as a synergy – reasonable given the company’s size (~$3.4bn in market cap) and the fact that SDB is the world’s largest COVID-19 test kit seller. Another benefit of the buyout – expansion of the molecular reagent/assay segment. VIVO’s molecular offering segment has been generating a much higher share of total revenues – ~47% versus ~6% for SDB in 2021. Here it is important to note that this segment has higher margins than immunological/other non-molecular reagents/assays. Given SDB’s scale manufacturing expertise, the company might very well pursue an expansion of VIVO’s molecular testing segment. In its 2021 annual report, SDB also stresses that molecular diagnosis has high growth potential (8.4% CAGR from 2018 to 2023).

Shareholders

I see several reasons why shareholders will approve the transaction:

-

Two of the largest shareholders – Blackrock and Vanguard (28% combined stake) – have accumulated most of their shares between 2010 and 2019. By my estimate, they will cash out on at least a 50% return if the transaction closes. Similarly, other equity holders – Earnest Partners, Impactive Capital, Royce & Associates and Renaissance Technologies – are also sitting on returns in the ballpark of 50%. Combined, these institutions have a 56% ownership stake.

-

VIVO stock has rallied over the last year – 66% increase year-on-year before the merger announcement. This contrasts with broader sector performance – the Nasdaq Biotechnology Index (NBI) fell 23% over the same period. In my view, given the macroeconomic and industry environment, institutional shareholders will be willing to de-risk their investment in VIVO. Moreover, COVID has been a huge tailwind for the company – revenues rose 58% from 2019 to 2021 compared to low-mid single digits annual growth before. Now that the demand for COVID-related reagents and test kits is fading, shareholders could see this as a good exit opportunity. DOJ’s ongoing investigation only adds to this incentive.

-

Relative valuation (see below) shows that the transaction values VIVO in line with larger competitors.

Regulatory Outlook

CFIUS approval seems likely – VIVO and SDB’s technologies/products are not unique or pose any national security concern. For reference, last year CFIUS approved Intel’s NAND $9bn business sale to the South Korean memory chip supplier SK Hynix which is one of the largest semiconductor companies in the world. As the semiconductor industry appears to be under higher scrutiny than the IVD market, I expect CFIUS approval to be granted.

Antitrust approvals are also not likely to present any issues – both VIVO and SDB have low market shares in all the geographies they operate in (see below). Admittedly, SDB is the world’s largest COVID-19 test kit seller, however, VIVO has much lower revenues in this segment. Overall, the IVD market is dominated by large players – four giants Roche, Abbott (ABT), Danaher (DHR) and Siemens (OTCPK:SIEGY) controlled ~50% of the industry as of 2017.

Company market shares in primary geographies (based on total IVD market revenues for 2021):

|

Region |

VIVO |

SDB |

Total Market Revenues ($bn) |

|

North America |

0.4% |

0.3% |

36.7 |

|

United States |

0.4% |

– |

33.4 |

|

Europe |

0.4% |

5.2% |

25.0 |

|

Asia |

0.2% |

2.8% |

29.0 |

|

South Korea |

0.2% |

3.3% |

4.5 |

|

Total |

0.3% |

2.2% |

99.9 |

Sources: Company filings, Statista.

Valuation

VIVO identifies much larger companies – Becton, Dickinson (BDX), Cepheid (owned by DHR), Abbott and Thermo Fisher (TMO) – as its major competitors. This makes direct comparison somewhat complicated. That said, on an EV/EBIT basis the company seems to be valued fairly compared to most peers considering the size discrepancy.

|

VIVO |

QGEN |

PKI |

BDX |

ABT |

DHR |

TMO |

|

|

Market Cap ($bn) |

1.5 |

10.9 |

18.5 |

69.0 |

191.2 |

199.2 |

219.8 |

|

Enterprise Value ($bn) |

1.4 |

11.8 |

22.7 |

84.3 |

200.1 |

215.3 |

250.3 |

|

TTM Gross Margin |

59% |

64% |

55% |

46% |

57% |

61% |

48% |

|

TTM Operating Margin |

24% |

28% |

22% |

13% |

21% |

25% |

24% |

|

EV/TTM EBIT |

17.7 |

18.7 |

20.3 |

32.6 |

21.7 |

27.5 |

25.5 |

|

EV/TTM Revenue |

4.2 |

5.2 |

4.5 |

4.2 |

4.5 |

7.0 |

6.1 |

Source: Company filings. Note: VIVO figures are at the offer share price.

Lead Testing Matters

DOJ’s ongoing investigation into the company’s lead testing products is the main uncertainty here. Timeline:

-

March 2016 – VIVO acquires Magellan Diagnostics, a developer and manufacturer of FDA-approved products for blood testing to diagnose lead poisoning. The transaction values Magellan at $66m.

-

May 2017 – Magellan gets a warning letter from the FDA noting that the company’s venous blood lead tests may understate actual levels of lead in the blood. FDA inspections start in June 2017.

-

April 2018 – VIVO receives a subpoena from the DOJ accusing the company of withholding information on its products.

-

December 2018-October 2019 – VIVO submits applications to the FDA, seeking to reinstate its venous blood testing systems. FDA inspections are ongoing at the time. The FDA later initiates a third-party study to assess Magellan’s blood lead tests.

-

March-October 2021 – DOJ issues four additional subpoenas to former/current employees of Magellan and other individuals.

-

May 2021 – Magellan initiates a voluntary recall of blood lead products due to an increased risk of false low results. The company attributes this to plastic tubes which reportedly contaminated the test kits.

-

August 2021 – FDA completes an evaluation of Magellan’s corrective actions and sends a close-out letter on previous inspections. Future inspections, however, are still expected to “further assess the adequacy and sustainability of Magellan’s corrections“.

-

February 2022 – Distribution of lead test products resumes.

Currently, the DOJ investigation is ongoing. The company has not indicated any expected timeline and remains cautious about successfully resolving the investigation. From the most recent 10-K filing:

Discussions continue with the DOJ to explore resolution of the matter. The Company cannot predict when the investigation will be resolved, the outcome of the investigation, or its potential impact on the Company.

However, the recent voluntary recall and subsequent production resume show that VIVO continues to closely supervise its blood lead testing line to prevent any further product-related issues. Another positive here is that the ongoing investigation relates only to venous blood lead tests (there are venous and capillary tests). DOJ investigation-related legal fees stood at $2.8m in FY2021 and $2.1m in FY2020 (FY ends in September) – not material at current revenue levels. Overall, blood chemistry assays (which also include tests other than for lead) have made only 12%-15% of diagnostic test kit segment revenues in recent years.

SJL Partners

SJL Partners is a South Korean PE firm established in 2017 by the former JP Morgan South Korea Chief. The portfolio contains 5 companies, one of which is a biopharma Celltrion, though SJL’s stake is only 3%.

One interesting aspect here – the firm partnered with KCC Corporation and Wonik QnC Corporation to acquire advanced materials company MPM Holdings in 2019. This seems like a comparable transaction to VIVO – both KCC and Wonik were strategic buyers operating in tangential quartz/chemical manufacturing industries. MPM was based in the US and transaction size was similar ($3bn versus $1.5bn). The acquisition received CFIUS clearance and closed 5 months after the definitive agreement.

Conclusion

In my view, the merger has a strong strategic rationale while shareholder and regulatory approvals seem highly likely. At the current spread, the annualized return stands at 9%. With this return, I am willing to play risk arbitrage here and will open a position in VIVO.

Be the first to comment