Erik S. Lesser

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on October 10th, 2022.

Healthcare is generally a recession-resistant sector. It is often assumed that people will still prioritize their health no matter what the economy or stock market is doing. Sometimes it is, unfortunately, a choice between life and death. Thus, there is a strong incentive to take the procedures, services or treatments to extend one’s life.

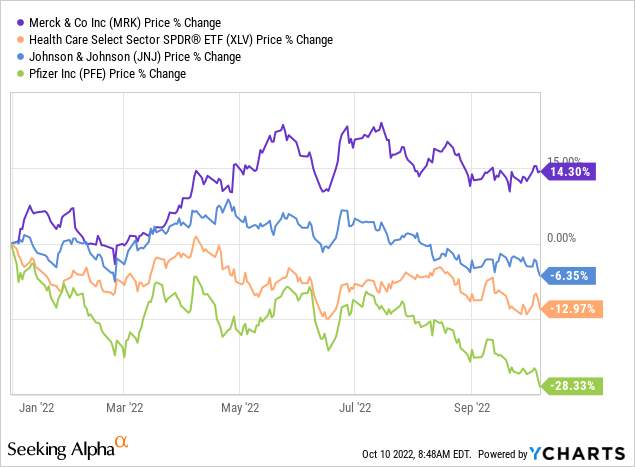

Despite this, the Health Care Select Sector SPDR (XLV) is still down this year by quite a large extent. Healthcare giants Johnson & Johnson (JNJ) and Pfizer (PFE) have also succumbed to these plunges. However, there is one name we can see that has bucked this trend. By price action alone, Merck & Co., Inc. (NYSE:MRK) is up 14.30%.

Ycharts

COVID Recession For Merck Was Much Different

What might be even more interesting is that MRK is a bit different from the others. They are more reliant on elective procedures and physician-administered products. That is essentially what had MRK being one of the poorest performing healthcare names in the COVID pandemic.

If one recalls, this specifically caused the company to lower their revenue guidance during that year, while others were less impacted – even benefitted in certain circumstances. Here’s what Merck had to say all the way back in their Q1 2020 earnings call.

[T]he impact to our business from the ongoing pandemic is largely driven by a reduction in healthcare provider and patient interactions, as hospitals redirect resources toward COVID-19 and patients avoid healthcare facility visits, and postpone preventive care. To better understand the impact to Merck, it is important to highlight that our portfolio is heavily weighted towards products administered by a physician. In fact, roughly two-thirds of our global Human Health revenue is comprised of physician administered products.

This included non-urgent elective procedures that were postponed or canceled. These can include knee joint replacement, removing wrinkles and other cosmetic surgeries. These postponements and cancellations were either to slow the spread of COVID by keeping people out of hospitals or just staff that was diverted to the efforts of helping patients with COVID. These office visits and elective procedures were reported to be down 70%. Even urgent procedures were impacted, as Merck noted in the same quarterly earnings call.

Many sources are reporting current declines in elective procedures of over 70% with urgent procedure volumes also being affected, though to a much lesser degree. These declines impact a product like BRIDION, which is used across many surgery settings. And even oncologists are delaying appointments and procedures as they prioritize patients based on severity and the immediate needs of different tumor types, resulting in extended dosing schedules for existing patients, as well as delays in the start of therapy for newly diagnosed patients.

With a new recession looming, MRK is in a very different situation, as the next recession expected for 2023 is very different from the 2020 crash. Preventative care can continue even during a recession; most health insurance plans encourage these sorts of things and are even required to provide these at no cost. Hospitals and other healthcare facilities won’t likely be diverting facilities and labor forces for pandemic relief. Therefore, these sorts of services can continue unabated.

That being said, it could still be argued that these non-urgent elective procedures could come down once again in a recession if it is severe enough. Despite this, the stock price certainly isn’t reflecting these risks. This could suggest that other investors also appear to be thinking similarly. That the next recession for MRK will be much different, and the negative impacts would likely be limited.

MRK’s key products include Keytruda, Gardasil, and Bridion. However, Keytruda is by far the money printer for Merck. It accounts for 41.17% of all their pharmaceutical segment sales as of the Q2 2022 numbers ending June 30th, 2022. It is nearly 36% of the entire company’s sales when including the animal health unit.

The company is also different than what it was previously as its made several transformative moves. They spun off Organon (OGN) in mid-2021. This was done to create two more focused companies, where Merck believes they can grow revenue and EPS faster.

At the end of 2021, Merck also completed its acquisition of Acceleron Pharma. This helped provide diversification and build on their “cardiovascular portfolio and pipeline.” Interestingly, it was announced today that sotatercept had some positive results today in the phase 3 trial. That was one of the rights that Merck gained in the acquisition of Acceleron.

After those changes, Merck hasn’t been done either. They are or at least were looking to buy out Seagen (SGEN). This would be a huge acquisition if completed. Though, for Merck, it clearly isn’t an essential acquisition if things don’t work out. Since those initial rumors, SGEN has given up those gains.

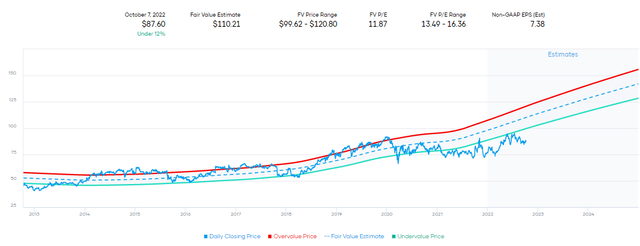

Valuation Of Merck

With a rocking share price this year, it would be hard to imagine that MRK shares are cheap at this time. However, at this time, based on the historical P/E valuation, the stock is still below fair value. The estimate of fair value comes in at $110.21. Shares have been on the lower end of their fair value range since 2020. As EPS kept rising and the share price was relatively muted, the stock became cheaper and cheaper.

MRK Valuation (Portfolio Insight)

Wall Street analysts rate shares a Buy, with an average price target of $100. The low range at $85, and the high estimate is $125.

Earnings Past And Outlook

I wasn’t the only one looking at MRK today, either. Just like the news about sotatercept was announced while I was doing research this morning, another news article hit. It was Guggenheim raising their rating from Neutral to Buy for Merck based on earnings beat ahead, with a $104 price target.

The company has a tendency to beat its earnings expectation, as they have in 13 of the last 16 quarters. In fact, they beat the estimates all the way through the first three quarters of 2020 – when they were supposed to be weaker. Revenue beats came in, beating 12 of the last 16 quarters. So not as consistent, but it is still quite impressive. Once again, they topped the estimates through the first three quarters of 2020.

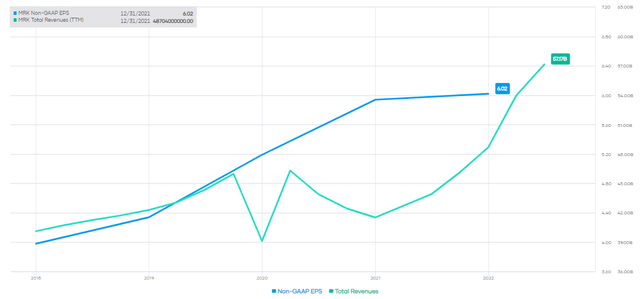

What might be more interesting is that despite the significant headwinds they faced during COVID, the earnings for the full year didn’t take a noticeable hit. At least in terms of its growth. Revenue was more disrupted, but it quickly rebounded and rose dramatically.

MRK Revenue and Profit History (Portfolio Insight)

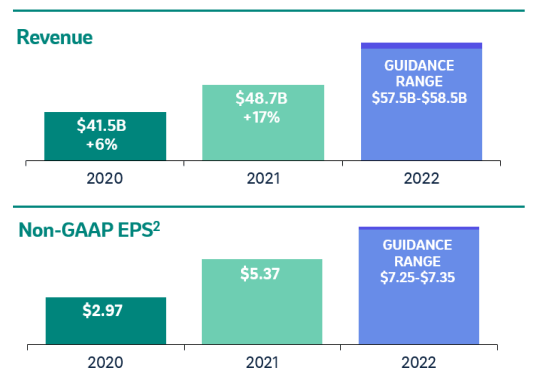

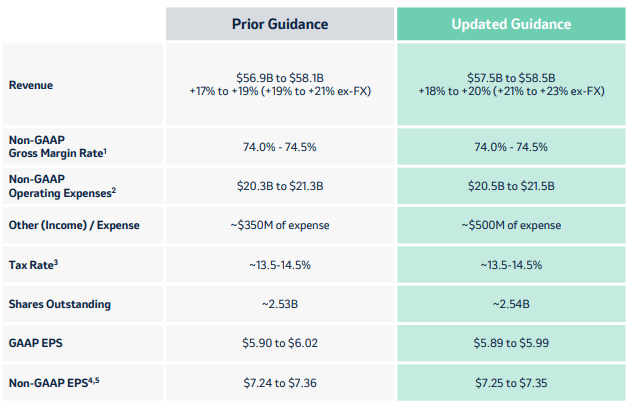

Looking at guidance for fiscal 2022, Merck is optimistic that this growth trajectory is set to continue.

MRK Revenue and Profit (Investor Presentation)

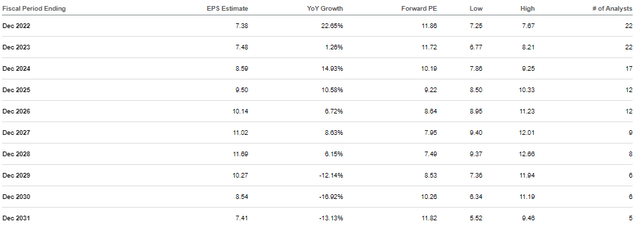

Analysts are additionally expected growth out of the company. For 2022, they are even a bit more aggressive, with an expectation of $7.38 in earnings. Though 2023 they see that growth is expected to slow quite meaningfully before ramping up once again. Of course, all of this can change based on any large acquisitions that might be carried out.

MRK EPS Estimates (Seeking Alpha)

That EPS is above the guidance range of what they announced in the prior quarter – which was notably narrowed EPS guidance and hiked revenue guidance.

MRK Guidance (Investor Presentation)

Dividends And Buybacks

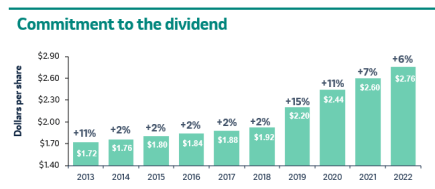

Helping to fuel returns for shareholders, even when the share price of MRK might be flat, is the dividend. They’ve been raising their dividend for 11 years now. The next raise should be announced sometime in November if they stick with the historical timing we’ve seen over the last few years.

MRK Dividend (Investor Presentation)

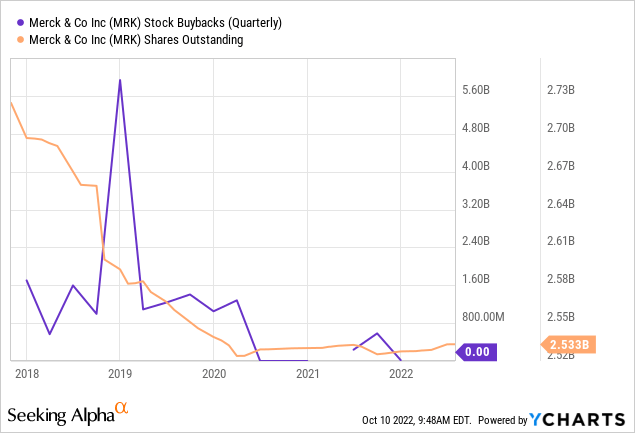

They also have buybacks, but those have been less aggressive in more recent years. They were suspended in 2020, and they have been slow to resume since. For the first six months of 2022, they repurchased zero shares and had $5 billion in repurchases still authorized.

Ycharts

Conclusion

Merck is a healthcare company that has been bucking the trend of poor stock performance in 2022. The company can provide a shield for investors when entering a recession. Not only is it a healthcare name that is naturally more defensive, but the outlook remains positive for the company. Both guidance from Merck and analysts covering the company suggests some more upside possible.

Be the first to comment