Marko Georgiev

Published on the Value Lab 2/9/22

Merck & Co., Inc. (NYSE:MRK) is a company that sells major oncological drugs, in fact one of the bestsellers in the U.S. It also has vaccine expertise that has opened new doors and benefited from the recovery in vaccination rates for anything besides COVID-19. Loss of exclusivities (LoEs) are far off on all the major earners, and for the quality the stock looks cheap. We do discuss one issue which is the Medicare drug negotiation bill, which will affect Merck quite definitely because of Keytruda. Still, seems a buy on balance with Keytruda LoEs not far behind the price capping for Medicare covered patients.

Quick Dig into Q2

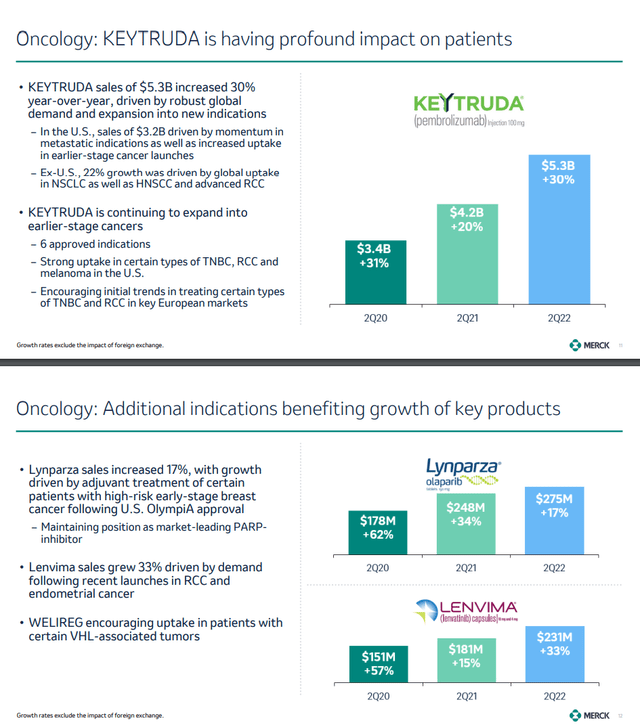

Let’s give the headlines for the Q2. Sales are up 28% YoY, EPS more than 100%. Keytruda, which is about 33% of revenue, is growing at 30% as indications expand now into metastatic conditions. It’s a huge drug, one of the U.S.’ bestsellers after just Humira by AbbVie (ABBV), which is getting knocked down due to LoEs, and part of the reason is that it performs so well that it’s first line. They’ve even beaten out Bristol-Myers (BMY), the most focused company on Oncology among big pharma.

In general, Oncology performs well. Lynparza, which I believe is a drug marketed and developed jointly with AstraZeneca (AZN), is up 17%, and accounts for about 2% of revenue, and well as Lenvima, which similarly accounts for about 2% of revenue, growing at a 33% clip.

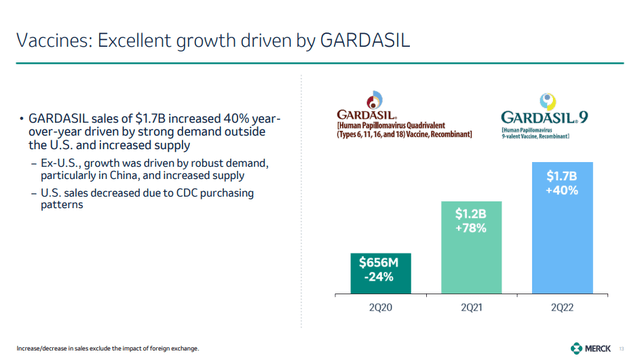

On the vaccine side, they are expanding indications of Vaxneuvance into pediatrics, which puts it up against Pfizer’s (PFE) Prevnar. Gardasil, which is for HPV, is also up as people go back to vaccinating themselves for things other than just COVID-19.

Their hospital portfolio, drugs that are needed for operations and other procedures like Bridion, are performing strongly. These account for about 6% of revenue, and are up around 16% thanks to the recovery in hospital procedures, again a reversion to the mean from COVID-19 depression.

Finally, animal health is also performing decently well, this is about 10% of their revenue. This is a flat segment, expect little dynamism in those results. Only 2020 was weak because of lockdowns.

Remarks

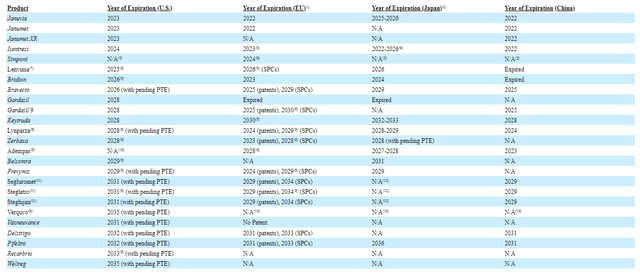

In other words, things are fantastic. LoEs are really far away, especially for the potentially big winners like in the vaccine portfolio but obviously also Keytruda, which expires in the U.S. in 2028. The ones that expire soon are Januvia, Janumet, Isentress, Simponi and Lenvima.

How much revenue is at risk then? Januvia/Janumet are not a growing product, and are at about 10% of revenue. Isentress is about 2% of revenue. Simponi is also 2% and Lenvima is about 2% on its own too.

The profile is generally pretty good, that’s only 16% of revenue at risk starting from 2023. The growth in Keytruda alone is going to cover the majority of that revenue, and all of that which will be lost in the first switch-over wave following the LoEs.

Indeed, Keytruda is a lot of the Merck story. It’s unimpeachable from a clinical standpoint and the growth is there because it easily finds new indications and is the first-line treatment for many cancers. The problem is politics. The Democrats are taxing rich companies like pharma by making it so that Medicare can now negotiate the prices of some key, bestselling blockbusters. Keytruda will be one of the first in that number. Termed negotiations, the CEO has the following to say about these bills, that have by the way passed, and their substantive meaning (emphasis added).

So as we look at that, I think it’s important to understand, first and foremost, we do have significant concern on one very important element of the provision, which is the fact that there is what we see as price setting, it’s termed in negotiation. But in effect, what it is, it is price setting on drugs after a period of time. And we do believe that will be highly chilling on future innovation because, especially if you think about an area like oncology, oncology is an area that the development of the drug continues long after the first approval. If you take KEYTRUDA, the launch in 2014 between 2014 and 2022, we had something like 30-plus indications approved. We expect to have well more than double that between 2022 and 2028. And our concern is that if you start to have the threat of discounts, mandatory discounts that could cause companies to question that innovation because you’ll have to question whether or not you’re going to see the return.

Robert Davis, CEO of Merck

Essentially, starting in 2026, drugs like Keytruda will be price-capped. Only inflation-based price increases will be permitted. Price-hiking is about half of the growth lever available to pharma. This is a pretty big blow and remember Keytruda is 33% of the company’s revenue. While this is quite severe, and should be a theme for your pharma portfolios, the saving grace here is that these price caps apply only in certain cases. Remember, Medicare only covers elderly people. So that’s only a portion of the demographics that Keytruda meets (at most 20% based on assumed population level demographic distribution). Moreover, the LoE is anyway in 2028, so a 2026 set-in of this won’t be such a problem for Keytruda, possibly gimping growth by about 4% between 2026-2028, assuming 50% of growth comes from pricing, and Keytruda is 40% of revenue by then. Not earth-shattering by any means. Finally, price increases can be compensated for in other age groups.

For future drugs that have blockbuster status… well, that’s another story. But for Merck and Keytruda, it happens to be more limited.

Another thing to keep in mind about this new bill is that, over time, more drugs, indeed increasingly smaller drugs (as we understand it) could come to be included on the list and have their returns gelded. This is because only exclusive drugs qualify for the Medicare price cap, so that list will automatically cull itself, and as capacity on the list grows it will include smaller drugs too. Not great for pharma. Definitely, read the bill for yourselves.

While an important theme, Merck trades at a 14x P/E and a sub-10x EV/EBITDA, so it’s cheap despite its growth profile and excellent portfolio. Quality like this deserves more of a premium. The LoEs coming will be overcome in one year. Merck is probably a decent buy.

Be the first to comment