metamorworks/iStock via Getty Images

Investment Thesis

MercadoLibre (NASDAQ:MELI) is a sprawling modern conglomerate. It has several business units. Within the Commerce business, there’s Mercado Libre and its logistics business, Mercado Envios. And on the other side of the business is its Fintech business, Mercado Pago, and the credit business, Mercado Credito.

The good news is that MercadoLibre’s growth rates continue to astound. The bad news is that right now, investors crave strong bottom-line performance, more than they crave impressive revenue growth.

What’s Happening Right Now?

Interest in investing in a foreign company, no matter how attractive, has in the past few months seen a reduction in investors’ interest. Put simply, investors’ risk appetite has now dramatically shrunk.

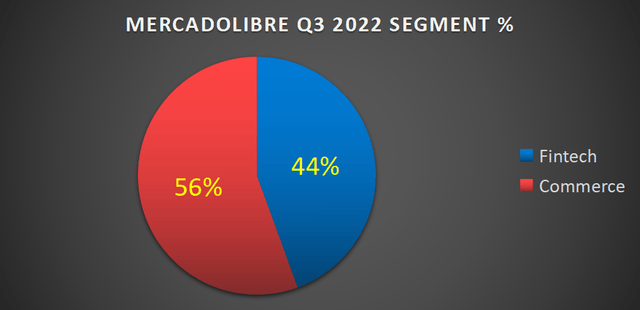

Digging into MercadoLibre’s recent results, Q3 2022 saw MercadoLibre’s commerce business grow very strongly, and this allowed it to regain its position as MercadoLibre’s biggest segment.

I contended in my previous analysis that over the next two years, MercadoLibre would change its narrative from a Commerce player with a Fintech business to a Fintech business with a Commerce business attached.

Even if MercadoLibre’s Commerce business is growing at a breakneck pace, MercadoLibre’s Commerce business is no pushover. However, it’s just a matter of time before the Fintech business becomes MercadoLibre’s biggest segment.

On the other side of the equation, it’s worthwhile noting that presently investors’ interest in Fintech businesses is not what it was last year. Accordingly, investors are now no longer willing to assert a high multiple to just about any shiny Fintech business. Readers can look towards PayPal (PYPL), Block (SQ), SoFi (SOFI), and others as examples.

Revenue Growth Rates Remain Alluring

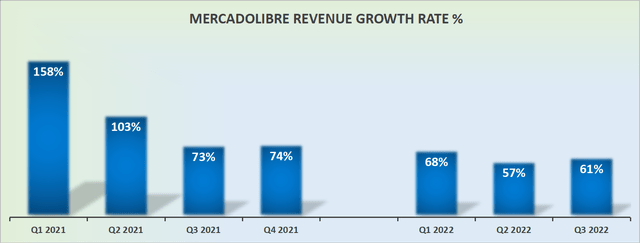

MercadoLibre revenue growth rates, FX neutral

All that being said, MercadoLibre’s growth rates continue to be astonishing. Not only have most Commerce and Fintech businesses struggled for compelling growth in 2022, but of those that are still growing at a fast clip, to the best of my knowledge, have not seen their businesses accelerating their revenue growth rates from Q2 into Q3 of this year.

And that’s exactly what we see here for Q3 2022. Accordingly, this is my argument, irrespective of the lack of interest from investors, as reflected in MercadoLibre’s share price, this business is a giant and is showing no signs of slowing down any time soon.

But what about its profitability?

MercadoLibre’s Profitability Profile, What to Think About

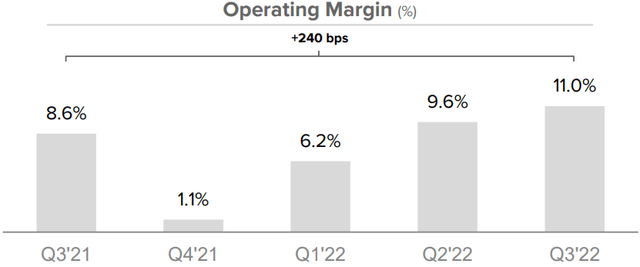

Here’s the thing, MercadoLibre’s operating margins continue to move in the right direction. So, you not only have strong top-line growth but together with its large scale, you are seeing positive operating leverage.

However, its EPS line was “only” up 33% y/y, less than its revenue growth rates. So, even though the business should be sizzling even more at its EPS line than its revenues, the opposite is happening.

And the reason for this slight drag on the bottom line comes from FX impacts, loss on debt extinguishment, and higher taxes. With FX and taxes both being outside of MercadoLibre’s control.

Next, let’s discuss its valuation.

MELI Stock Valuation – 62x Next Year’s EPS

Analysts’ consensus EPS figures are for $14.05 non-GAAP EPS. The likelihood that MercadoLibre’s EPS ends up at that figure is relatively small. If indeed, MercadoLibre is able to continue growing at close to 45% to 50% in 2023, it’s very likely that MercadoLibre’s full-year 2023 EPS could come in above this estimate.

Furthermore, if indeed, MercadoLibre is able to continue growing at somewhere close to +45% CAGR for a period of time still, then paying approximately 62x next year’s EPS is quite justified in my opinion.

The Bottom Line

I remain positively inclined toward MercadoLibre. While recognizing that the stock, for now, is in no man’s land, the stock isn’t so cheap to become a screaming buy. It’s more of a middle-ground stock between growth and value.

Investors should remain patient. But alas, this is the most expensive commodity in this market.

Be the first to comment