Editor’s note: Seeking Alpha is proud to welcome Jonah Lupton as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

imaginima

Thesis: Profitable Growth

MercadoLibre (NASDAQ:MELI) is largely known as the Amazon/eBay of Latin America due to its e-commerce business. While e-commerce in LatAm will continue to grow significantly at an approximate 25% CAGR between 2021-2025 as projected by Americas Market Intelligence (AMI), the Fintech Solutions of MELI is the segment to watch closely as it is currently, and will remain, the main growth engine of the whole company.

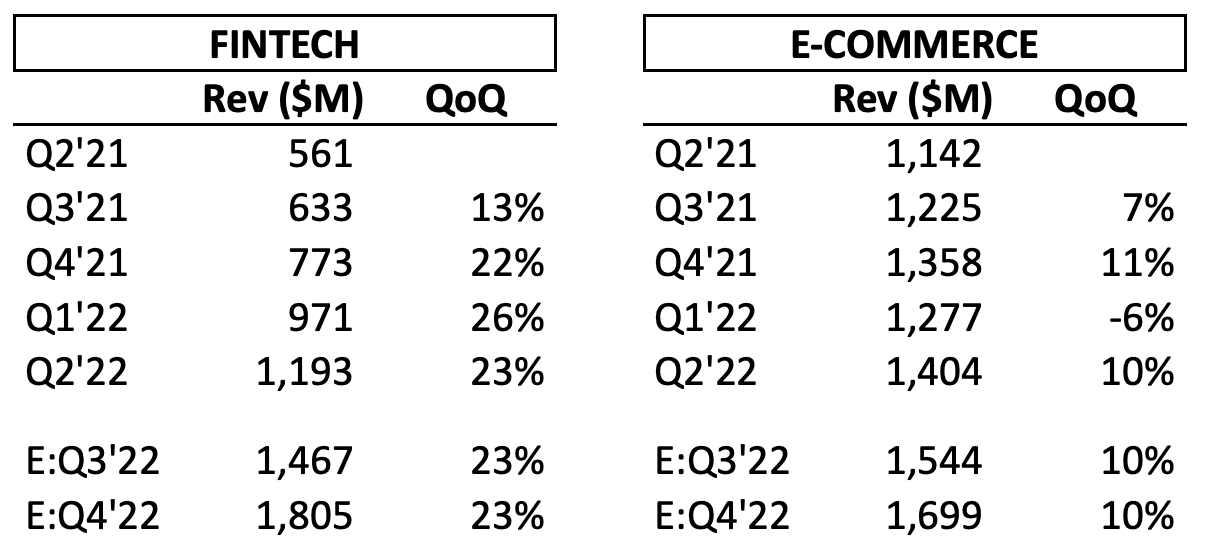

Within the underbanked geography of Latin America lies the fintech juggernaut, MercadoPago, which is set to overtake MELI’s revenue from e-commerce in Q4’22 if we assume consistent QoQ growth rates of 23% and 10% (see below projections). In fact, it could even happen in Q3’22 considering a 10% QoQ growth rate for e-commerce is generous given current macro headwinds. Regardless of when it happens, the narrative surrounding MELI as an e-commerce company is beginning to shift to fintech and I believe it is currently being underappreciated by the market and masked by e-commerce macro news.

Author’s projections

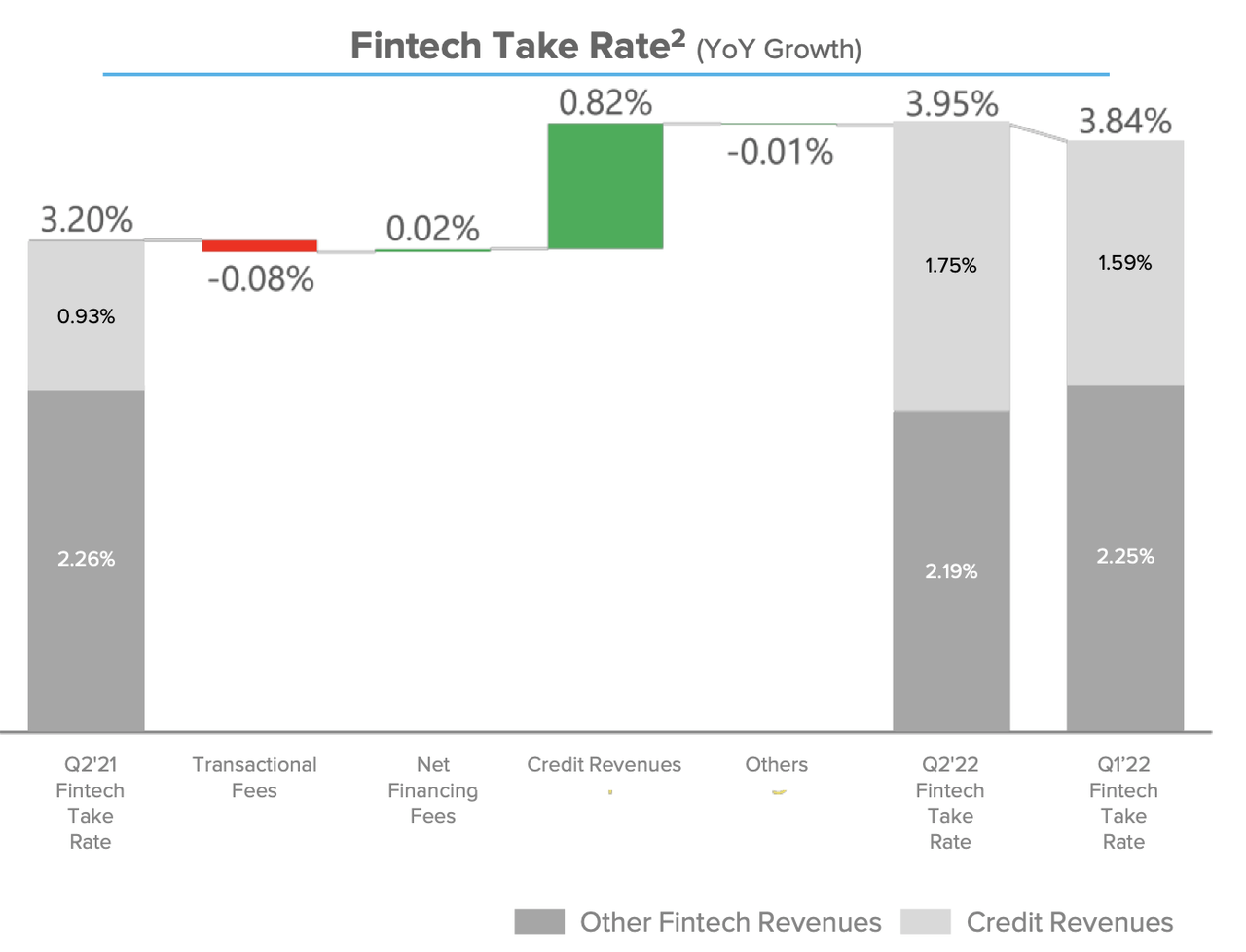

MELI reinvests a large portion of capital into their business growth while remaining profitable, sustaining free cash flow generation, expanding margins, and also increasing take rates. The take rate for the fintech segment is particularly strong and expanded to 3.95% in Q2’22 from 3.84% in Q1’22 and 3.20% in Q2’21. Take rate will be an important metric to monitor every quarter considering the significant growth of TPV and the credit portfolio since it is a function of gross fintech revenues.

MercadoLibre presentation

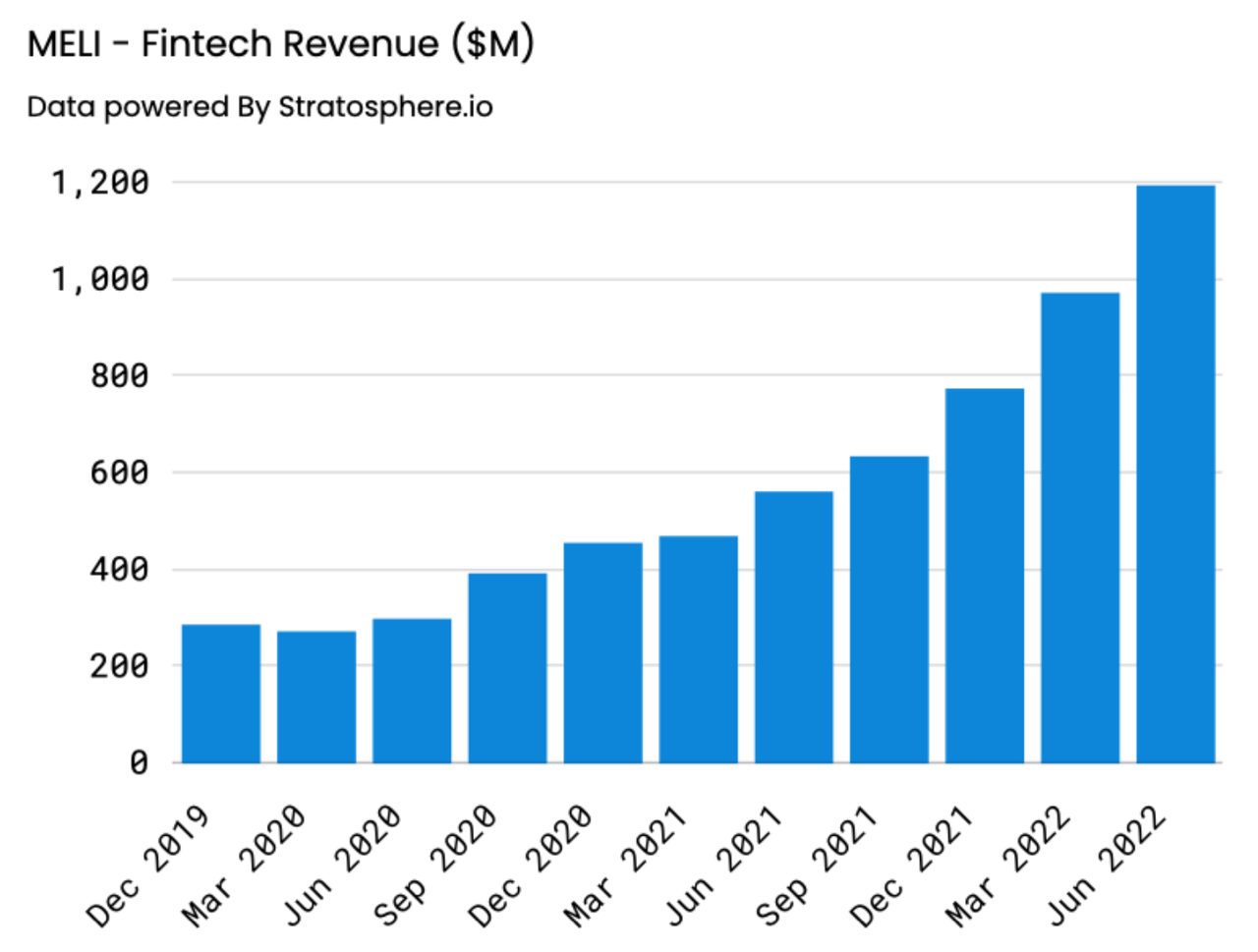

Exceptional Fintech Growth

Fintech revenues overall for Q2 2022 grew 107% YoY to $1.19B. In comparison, the e-commerce/marketplace revenues for Q2 2022 grew 23% YoY to $1.40B. Mercado Pago is an integrated online and offline payment solution, card issuer, and digital wallet that just surpassed TPV (Total Payment Volume) of $30B in Q2 2022 for the first time ever.

google search

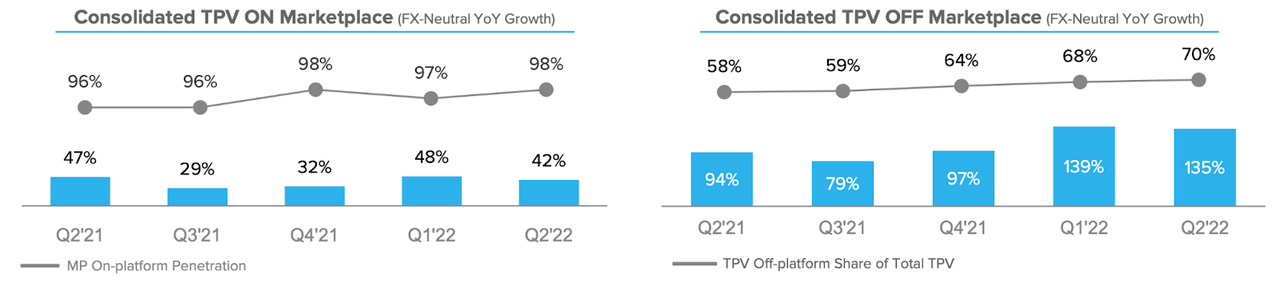

MercadoPago grew total TPV 84% YoY (FX-neutral basis), which is impressive, but let’s dig deeper to see what is responsible for driving this growth.

-

ON Marketplace TPV: “Measure of the total U.S. dollar sum of all marketplace transactions paid for using MercadoPago, excluding shipping and financing fees.”

-

OFF Marketplace TPV: “Measure of the total U.S. dollar sum of all transactions paid for using MercadoPago through merchant services for online payment, MPoS, QR and Wallet Payments, and Card payments.”

The Off Marketplace TPV, which is the crown jewel, grew 135% YoY and now makes up 70% of the total TPV for MELI. I would love to see this continue at high growth rates because it enhances their market penetration and serves an underbanked population to help digitize LatAm. A significant reason I am very bullish on the future growth and profitability of MELI is that Pago has been growing Off Marketplace TPV by over 100% YoY which will serve as a key growth driver because it broadens their reach to bring brand new customers into the MercadoLibre ecosystem of products and services. This obviously opens up further opportunities for cross-selling.

MercadoLibre presentation

The Digital Accounts TPV within the Off Marketplace TPV is the area that is capitalizing on the underbanked region of LatAm and consists of wallet payments, P2P transfers between MercadoPago Wallets, and prepaid, debit and credit cards. The Digital Accounts TPV grew at 189% YoY on an FX-neutral basis showing they have been successful at bringing on new customers and introducing digital payments to a population which has lacked banking innovation for many years. The significant growth was driven not only by the incremental addition of unique fintech users but also from existing users increasing their transactions on wallet payments/transfers, QR, and card usage. This demonstrates that once a new user creates an account, they continue to increase their usage over time.

Not Fazed By Geographic Headwinds

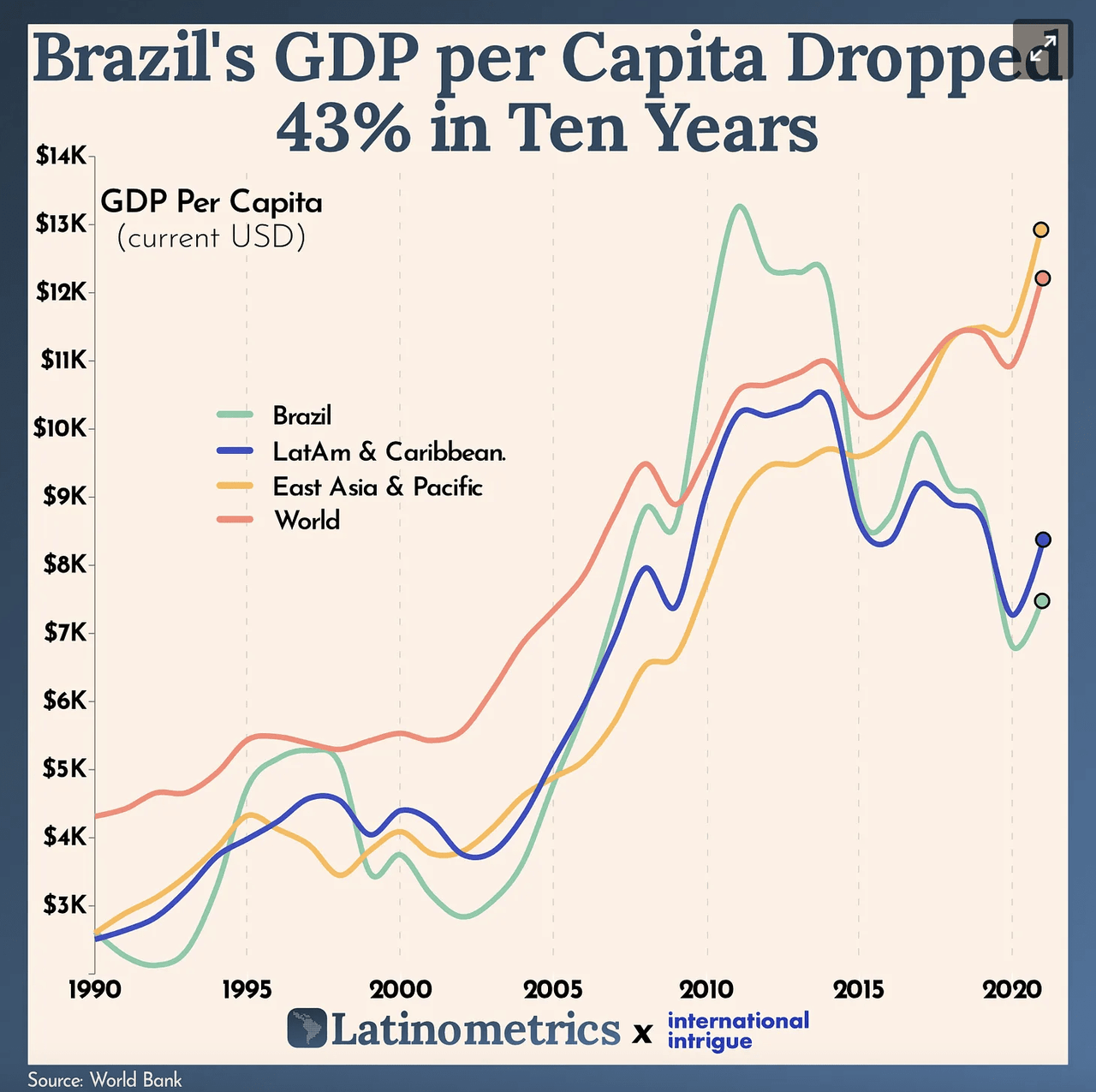

What’s even more impressive is that MELI continues to execute over the past 10 years with consistently high growth rates amid significant decreases in GDP per capita in their main operating regions. In comparison, the rest of the world has seen increases in GDP per capita. It appears the secular tailwinds of e-commerce and fintech innovation have created a stronger push than the numerous macro headwinds pushing back.

Latinometrics

The Bottom Line

After beating consensus estimates on revenue, gross margin, gross profit, TPV, and adjusted EPS for Q2’22, MELI is proving its resilience given the global macro headwinds in addition to the specific geographic headwinds in LatAm. Management is proving its ability to execute quarter after quarter and continue to grow all business segments and capture market share. The long-term outlook for MELI looks promising given the low e-comm and digital banking penetration rates in LatAm which should fuel the growth for years to come.

The long-term potential of MELI and its proven ability to be profitable while growing significantly should give confidence to shareholders despite the many risks it faces. I couldn’t agree more with management as they noted in their Q2’22 note to shareholders: “The best is yet to come.”

We own shares and plan on adding to that position in the near future on any pullbacks.

Are you looking for quality growth companies to maximize long-term returns?

I run a premium service called Disciplined Growth Investor on Seeking Alpha Marketplace, where my team publishes in-depth research on quality growth companies to compound returns over the long term. The service also includes quarterly earnings analysis, buy/sell trading alerts, my personal portfolio updates, live chat, and much more.

Join a free 14-day trial now and get access to 10+ deep dives on the most promising quality growth companies for 2022 and beyond.

Be the first to comment