gorodenkoff

Introduction

MercadoLibre (NASDAQ:MELI) was a popular stock since the corona crisis. The corona measures forced physical stores to close, giving an extra boost to online shopping. Favorable for MercadoLibre, as it is the largest e-commerce platform in Latin America.

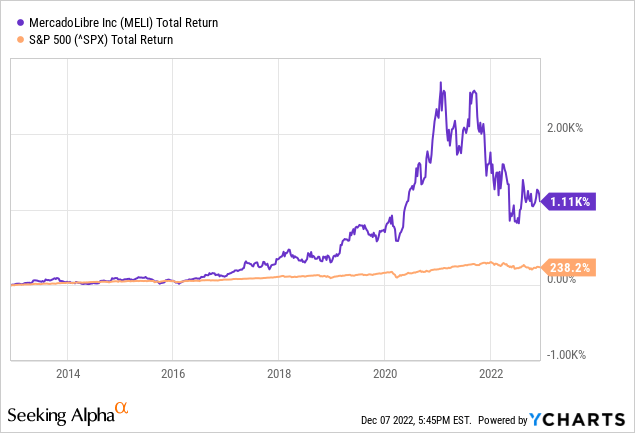

The stock price was on a strong rise over the past 10 years, but has been experiencing a correction since 2021. Still, the stock return is very high with as much as 28% on average per year. The recent decline makes it interesting to take a closer look at the stock.

Behind the strong growth figures lies considerable risk. Investors should be aware of the risk they are taking when they invest in MercadoLibre. The risk-reward ratio is now favorably skewed toward the reward part of the equation. The stock is assigned a buy rating with a high-risk warning.

Company Overview

MercadoLibre is Latin America’s largest e-commerce platform, with more than 140 million active users and 1 million active sellers as of the end of 2021 in 18 countries. In addition to its e-commerce platform, the company has complementary businesses such as Mercado Envios (shipping solutions), Mercado Pago (payment provider), Mercado Libre Ads (ads) and Mercado Shops (turnkey e-commerce stores), and others. It generates revenue from fees, ad royalties, payment processing, insertion fees, subscription fees and interest income from loans to consumers and small businesses.

Revenue up 61% YoY

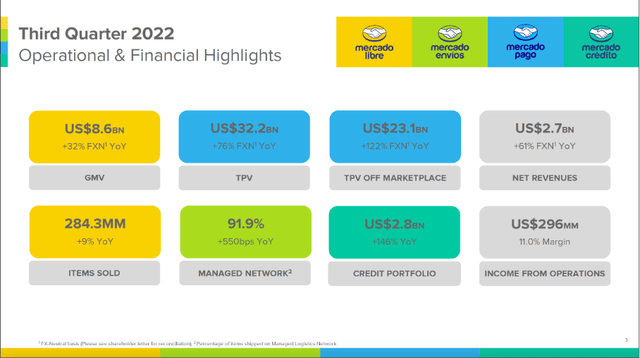

Operational & Financial Highlights (3Q22 MELI Investor Presentation)

Third quarter results were strong, with revenue up 61% year-on-year on a forex-neutral basis. The operating margin for the quarter was unprecedented at 11%. All segments performed strongly, but the FinTech business (Mercado Pago) saw revenue decline due to a greater mix of larger merchants in total payment volume.

Mercado Libre grew strongly as gross sales volume increased 32% year-on-year and 9% more items were sold on the platform. The company gained significant market share in Brazil and more unique buyers from Mexico purchased items on the platform.

Mercado Envios saw the percentage of items shipped increase to 91.9% through its Managed Logistics Network.

Mercado Pago is its FinTech business, which increased its total payment volume by 76% to $32.2 billion. Mercado Pago exceeded 40 million unique active users for the first time, with all geographic segments contributing to this growth.

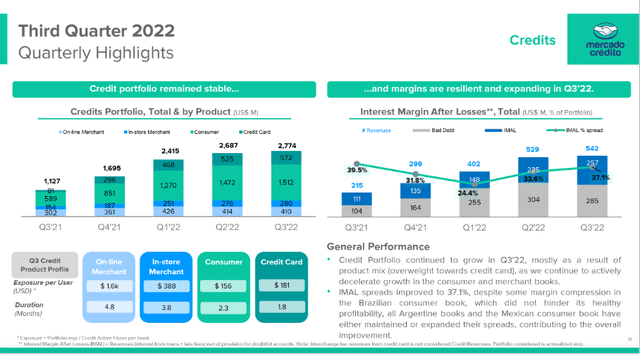

Mercado Credito is the credit business, whose portfolio increased to $2.8 billion. Although there is a significant amount of “bad debt” on the books, credit activity remains solid, as the interest margin after losses (IMAL) was 37% in the third quarter of 2002.

Although the company showed strong earnings and growth numbers, there were a few metrics that I found risky. In the portfolio, the number of more than 90 days past due increased from 18.2% last quarter to 23.9% this quarter. Investors should keep an eye on these numbers to assess the financial strength of consumers on the platform and Mercado Credito’s profitability. The increase of more than 90 days in arrears is due to bad debts remaining on the books. The provision for doubtful accounts falls to 10.3% from 11.3% last quarter due to the slowdown in applications and unchanged provisioning rules. Mercado speaks of a challenging macro environment, but provisions for current loans remained stable.

Mercado Credito Quarterly Highlights (3Q22 MELI Investor Presentation)

Although the company is growing strongly, investors should be aware that Mercado is a stock with significant risks. However, Mercado provides clear metrics in its earnings report to assess those risks. The increase in payment delays of more than 90 days, the lower allowance for doubtful accounts and the mention of increased macroeconomic risks are significant risks. Since the company operates mainly in Latin America, some countries in Latin America are in financial distress, such as Argentina (inflation rate = 88%). Investors should monitor macroeconomic developments in these countries and accept the risk associated with an investment in Mercado.

The high risk-reward profile is now favorably skewed toward the reward part of the equation, as the stock’s valuation is historically low.

Stock Valuation Is Historically Low

MercadoLibre is a growth stock; earnings are not yet significant to properly chart the stock’s valuation. With an operating margin of 11.0% in the third quarter of 2022, it is more profitable than Amazon (AMZN); Amazon’s operating margin is 2.7%. However, this is comparing apples to oranges.

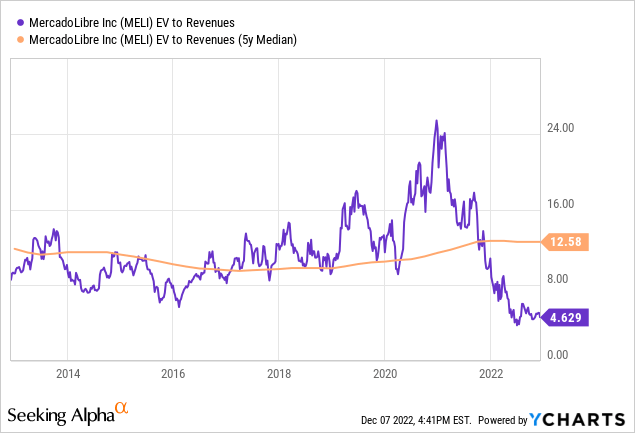

To chart stock valuation, I take the ratio of EV to revenue. EBIT and FCF fluctuate widely, so these do not give a clear picture of its valuation. Sales are growing steadily, so the EV to sales ratio is a better choice.

As the chart shows, the EV to revenue ratio is very low, both below the five-year average and the ratio is historically low over the past five years. While the average EV to revenue ratio quotes 12.6, the current ratio of 4.6 is very favorable.

However, this does not mean that the valuation of the stock is actually favorable. For this, I research earnings per share for the next few years and rely on analysts who have done extensive research on this.

14 analysts revised earnings estimates upward, while 1 analyst revised earnings estimates downward. On average, 10 analysts expect earnings per share at the end of fiscal year 2024 to be around $22.35 per share, representing average annual growth of 59%. Only two analysts expect earnings per share of $32.86 for fiscal year 2025 (growth of 47%). The projected PE ratio for fiscal year 2025 is 26. With expected annual earnings growth of about 50%, and in addition to the favorable EV to revenue ratio, I suggest that the stock is favorably valued.

The strong growth prospects, competitive advantage in Latin America, and cheap valuation make this stock worth buying.

Key Takeaway

- MercadoLibre is Latin America’s largest e-commerce platform, with more than 140 million active users and 1 million active sellers as of the end of 2021 in 18 countries.

- Third quarter results were strong, with net income up 61% year-on-year on a forex-neutral basis. The operating margin for the quarter was unprecedented at 11%.

- In the portfolio, the number of more than 90 days past due increased from 18.2% last quarter to 23.9% this quarter.

- The increase of more than 90 days in arrears is due to bad debts remaining on the books. The provision for doubtful accounts falls to 10.3% from 11.3% last quarter due to the slowdown in applications and unchanged provisioning rules.

- Mercado speaks of a challenging macro environment, but provisions for current loans remained stable.

- The high risk-reward profile is now favorably skewed toward the reward part of the equation, as the stock’s valuation is historically low.

- While the average EV to revenue ratio quotes 12.6, the current ratio of 4.6 is very favorable.

- On average, 10 analysts expect earnings per share at the end of fiscal year 2024 to be around $22.35 per share, representing average annual growth of 59%.

- The projected PE ratio for fiscal year 2025 is 26. With expected annual earnings growth of about 50%, and in addition to the favorable EV to revenue ratio, I suggest that the stock is favorably valued.

Be the first to comment