Drew Angerer/Getty Images News

MercadoLibre (NASDAQ:MELI) has soared since releasing second quarter earnings results. As it turns out, the growth engine is still roaring strong in spite of macro headwinds and tough comps. While the health of its credit portfolio is not quite improving, the strong overall growth rates continue to be the most important factor. The company remains profitable with a solid balance sheet. Trading at just over 4x this year’s sales, this remains an attractive buying opportunity for what looks like a long term compounder.

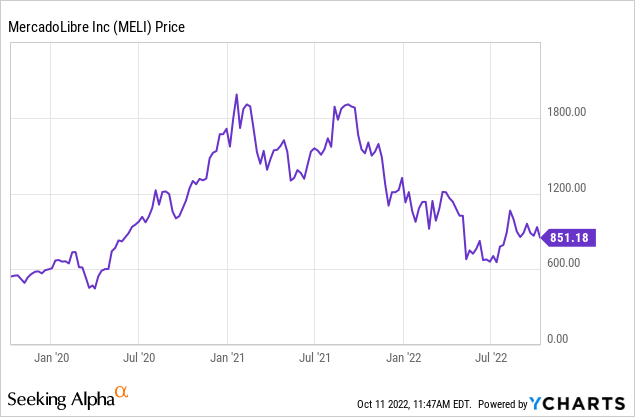

MELI Stock Price

MELI reached the $2,000 per share range in early 2021 but has struggled to keep up since.

I last covered MELI in June where I rated it a buy on account of the valuation being the most attractive as compared to historical levels. That ended up being very close to the 52-week low, as the stock has since risen 30%. Even after the run-up, the stock remains compelling at current levels.

MercadoLibre Key Metrics

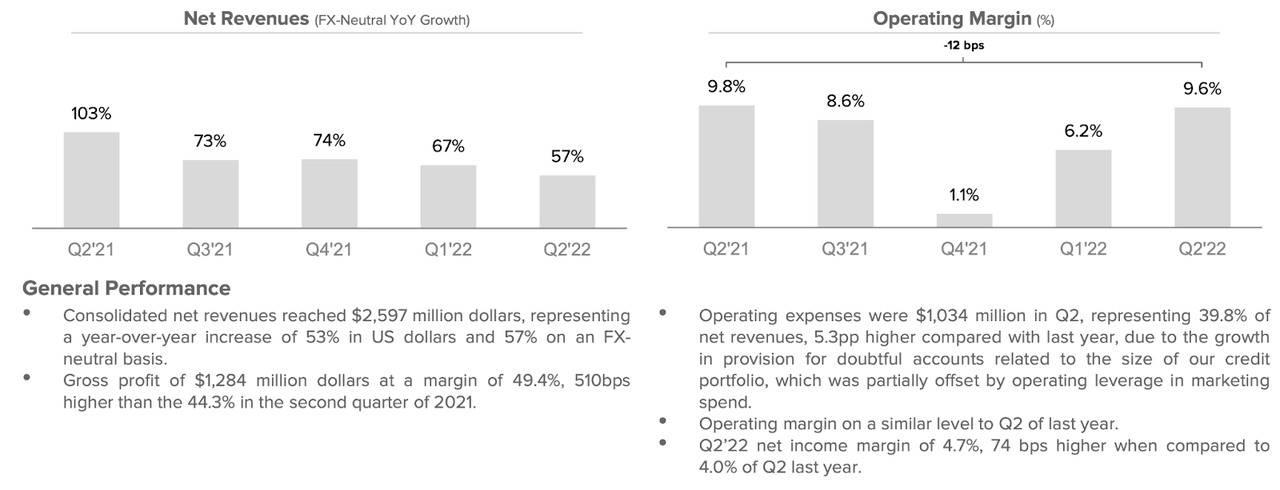

MELI is often referred to as “the Amazon of Latin America.” This is an environment in which e-commerce operators across the board are reporting decelerating growth rates due largely in part to tough comps during the pandemic. While MELI has also seen decelerating growth, investors probably don’t have an issue with the 57% revenue growth rate of this latest quarter.

2022 Q2 Presentation

MELI also generated a 9.6% GAAP operating margin. That is an impressive profitability result, but it nonetheless represented 12 basis points of margin compression over the prior year’s quarter – mainly attributable to an increase in credit loss provisions.

As we can see below, MELI continues to see strong growth in its three top markets of Brazil, Argentina, and Mexico.

2022 Q2 Presentation

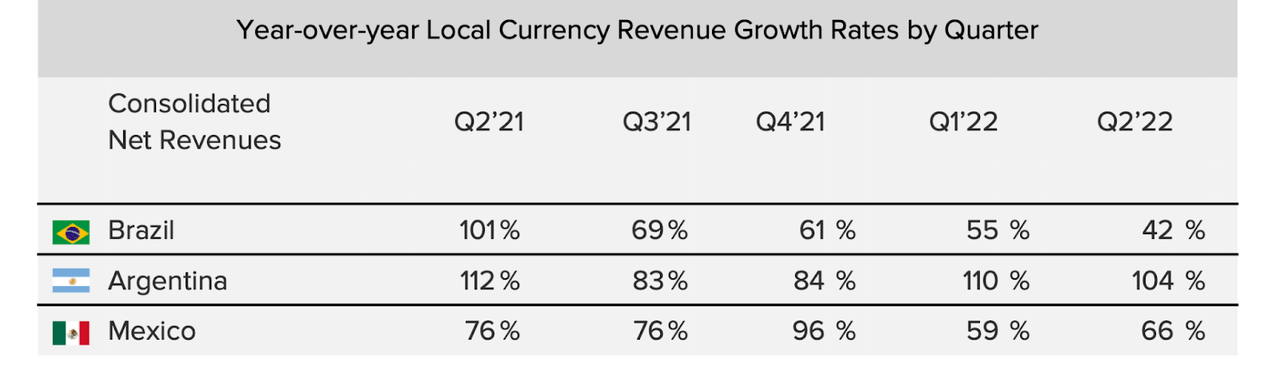

Gross merchandise volume growth did slow to 26% in the quarter.

2022 Q2 Presentation

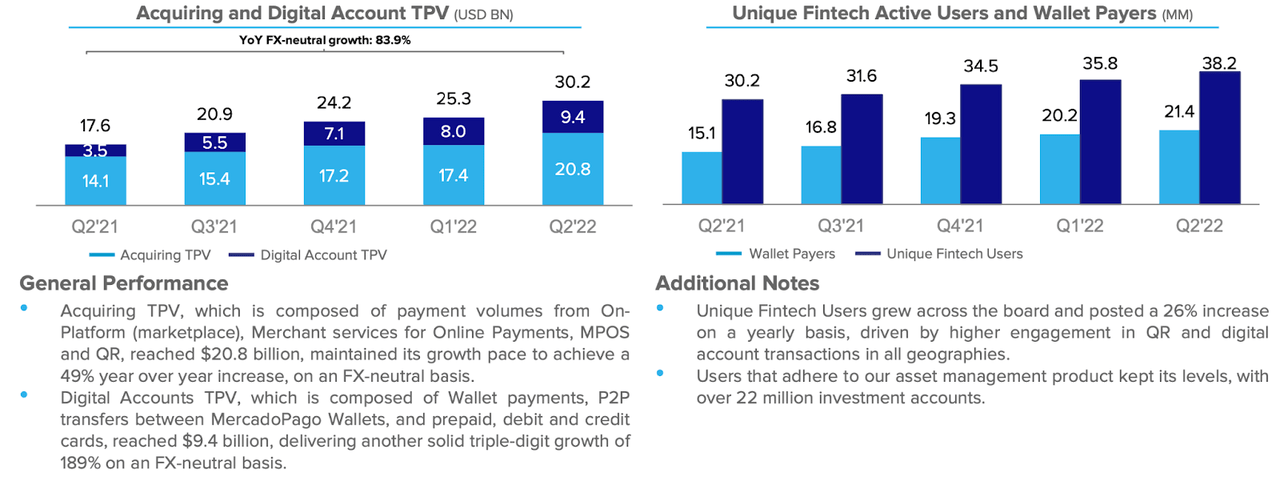

The company made up for that slowing growth with continued exponential growth in its fintech operations. MELI generated 189% FX-neutral growth in digital accounts total payment volume. Unique fintech users grew by 26.5% year over year.

2022 Q2 Presentation

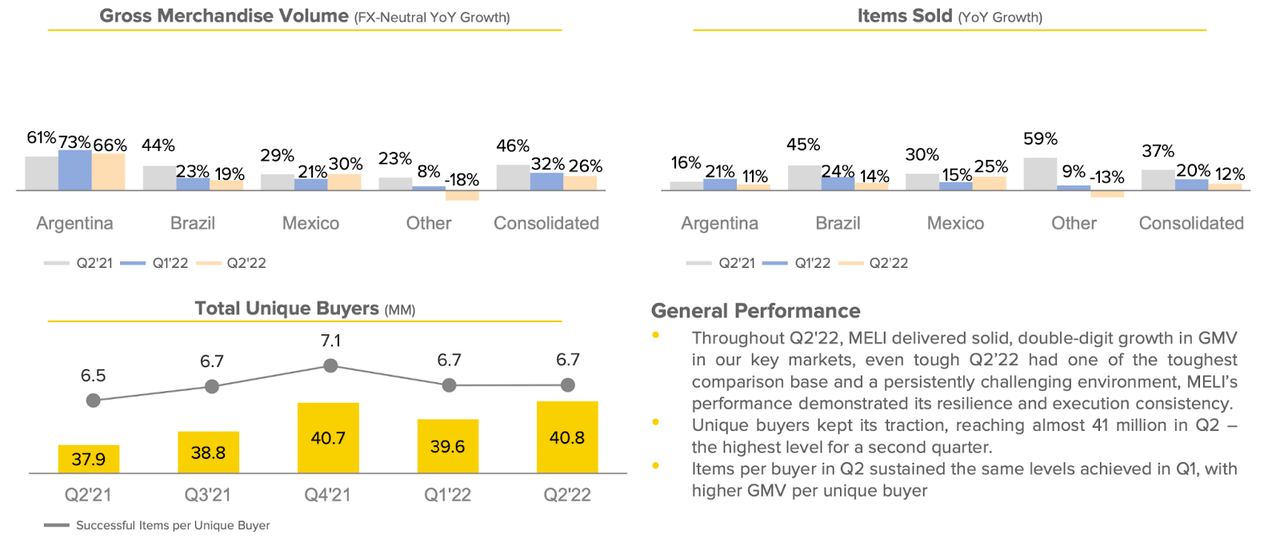

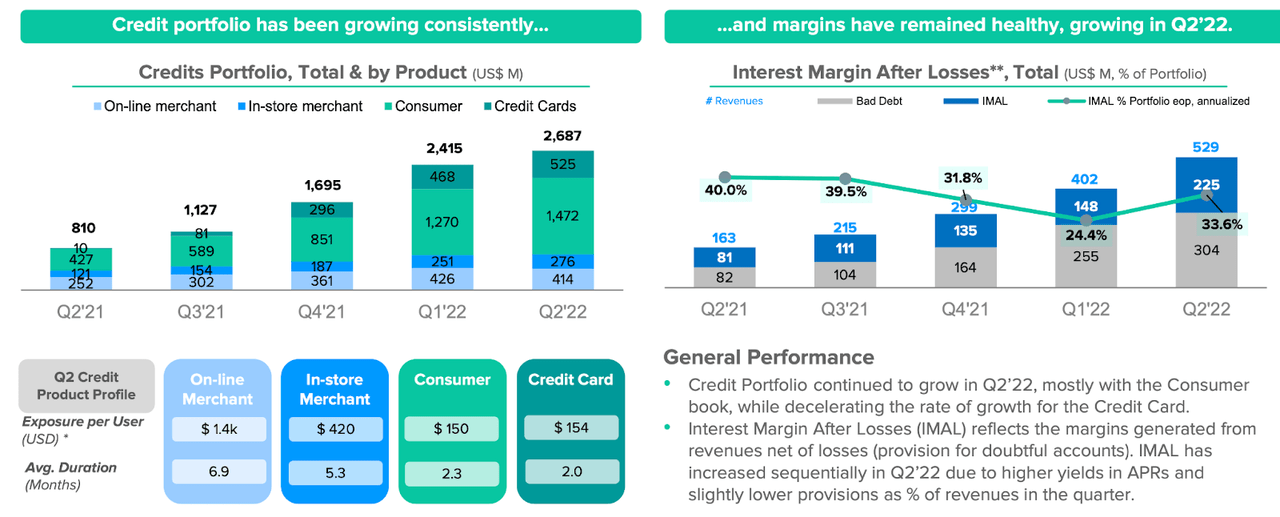

The company continues to rapidly grow its credit portfolio – its total portfolio stood at $2.69 billion as of the end of the quarter. MELI has released a new financial metric in “interest margin after losses” to indicate the profitability of its credit operations even after accounting for credit loss provisions (‘IMAL’). IMAL stood at 33.6% in the quarter (I note that the margin is based on revenue, not portfolio size).

2022 Q2 Presentation

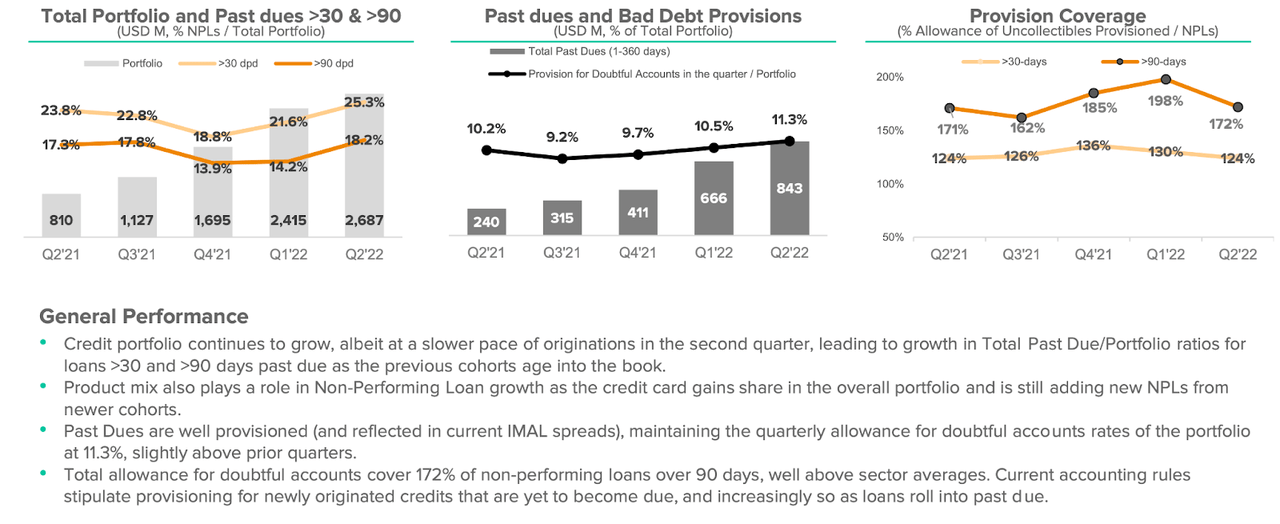

The one negative was that non performing loans continued to climb, with 30-day delinquencies up to 25.3% and 90-day delinquencies up to 18.2%.

2022 Q2 Presentation

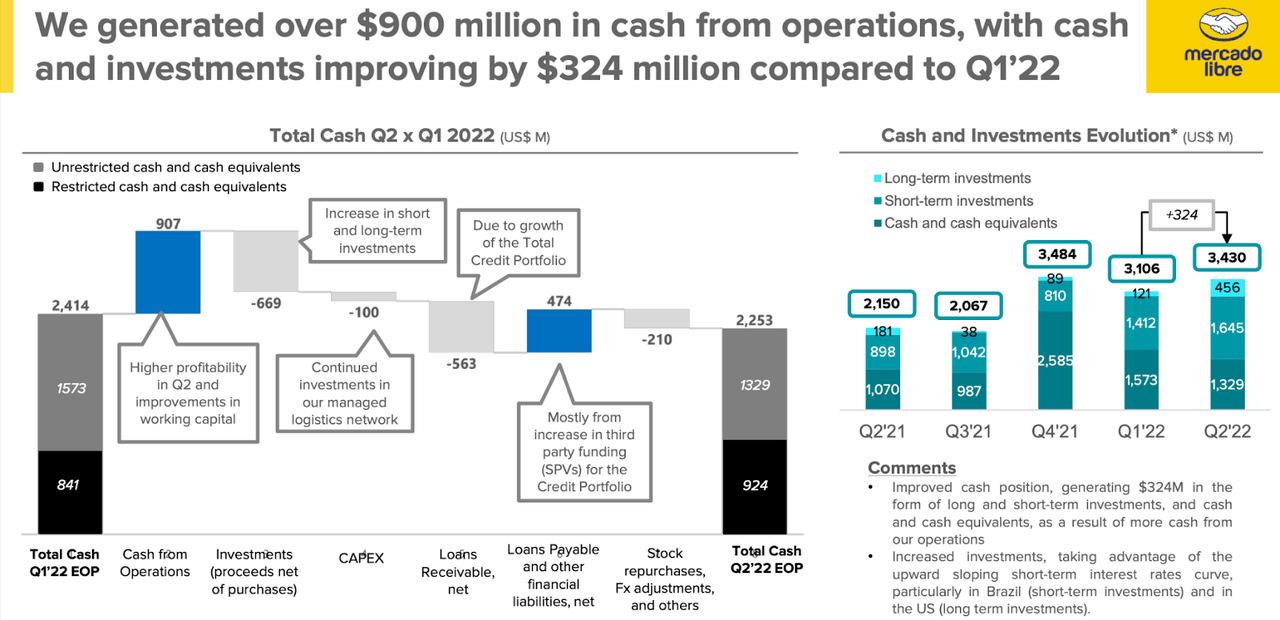

Management continues to believe that they can improve on the credit metrics over the long term. In the near term, it is important to note that MELI’s balance sheet can cushion any credit losses if needed. MELI had $3.4 billion of cash and investments versus $4.4 billion of debt.

2022 Q2 Presentation

Some readers might wonder if MELI’s growth rates are being artificially juiced by customers merely buying items on debt. On the conference call, management estimated that a mid-single-digit to low double-digit percentage of marketplace sales comes from credit, which varies country to country.

Is MELI Stock A Buy, Sell, or Hold?

MELI is a stock which I have long admired, but had few chances to buy in due to valuation. This tech crash has offered investors a protracted opportunity to buy a stake in what has proven to be a top tier e-commerce company in Latin America. At recent prices, MELI traded at only 4.2x sales. I can see MELI eventually generating at least 20% net margins over the long term. Assuming 25% growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I estimate the fair value of MELI to be around 7.5x sales, or $1629 per share. Given that the company is already generating a 9.6% operating margin and gross margins stand at 48.6%, I wouldn’t be surprised if my net margin projection proves conservative. I expect the greatest returns to come from long term periods as the company continues to compound earnings.

What are the risks here? Decelerating growth is always possible if not likely, but I’d argue that such a risk is already priced in with the stock trading at such valuations. Instead, the main risk is that of a credit blow-up. MELI has almost enough cash on its balance sheet to cover all its debt even if its credit portfolio goes to zero (which in itself seems like an overly pessimistic scenario), but the company might feel inclined to raise equity in such a scenario in an overabundance of caution. Such an event would be similar to the Great Financial Crisis in the United States and would likely send MELI stock crashing lower at least in the near term.

That credit event might be caused by inflation and interest rates. If you thought interest rates in the United States were high and rising, then think again. Argentina and other Latin American countries have been dealing with persistent inflation and have already been raising interest rates aggressively. Argentina, MELI’s home country, recently raised its interest rate to 69.5%. That is not a typo. I am no economic expert but it seems plausible to worry about a financial crisis to take place in the country, as interest rates and inflation that high cannot be sustainable. It is likely that MELI would see growth rates negatively impacted in such an event and its stock price crushed. It is also possible that the stock continues to trade at discounted valuations until the country moves past those issues.

While there are clear reasons why MELI might not be such a strong performer in the near term, the stock presents compelling value on account of the company’s dominant market position and strong growth rates. I have discussed with subscribers of Best of Breed Growth Stocks, my approach to investing in a diversified basket of beaten-down tech winners. MELI represents exactly the kind of stock I look for in a long term winner: aggressive secular growth trading at compelling valuations.

Be the first to comment