skynesher/E+ via Getty Images

Introduction

Ah, smoking, how taboo, what was once a cultural fad, is now quite the taboo. In fact, it has become taboo that an entire investment category is dedicated to these types of investments, so-called “Sin-Stocks.”

And if you’re talking about smoking, no discussion can be complete without mentioning the infamous Marlboro and Philip Morris International Inc. (NYSE:PM), now known as Altria Group, Inc. (NYSE:MO) in the US.

I’ll leave the moral dilemma of investing in one of these companies up to you, but from a finance and cash flow perspective, these companies are pretty unique. Despite the global push against smoking and nicotine more broadly, these companies continue to throw off piles of cash flow to their investors.

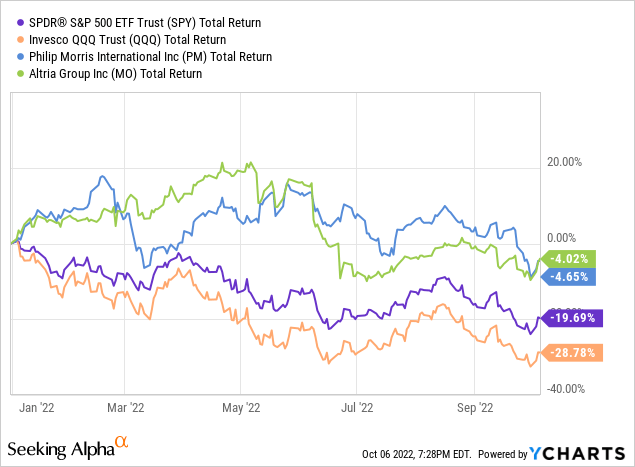

Both companies have held up reasonably well this year, even as we go through one of the most challenging markets of recent memory. But can their relative out-performance continue, and where will their stock prices go from here?

Context and Company Updates

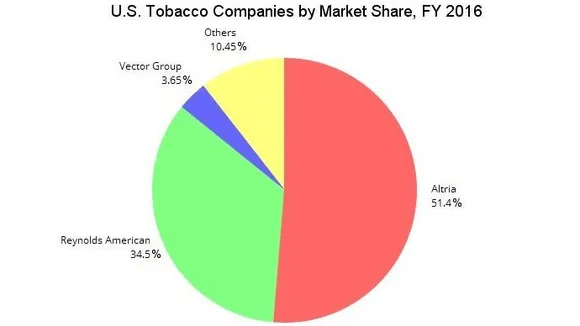

Let’s start first with Altria, which owns the rights to Marlboro in the USA, the most popular cigarette brand in the country.

USA Today

In addition to Cigarettes, Altria had also been historically very active in the M&A space, once owning The Kraft Heinz Company (KHC) and a number of other brands. To this day they are still relatively active in the space, owning a multi-billion dollar stake in Anheuser-Busch InBev SA/NV (BUD) and a significant minority interest in Juul Labs.

Speaking of Juul Labs, well, let’s just say things haven’t been great for our friends over at Juul. It was reported this week that Juul is considering bankruptcy in light of deteriorating conditions at the company. This is especially bad news for Altria, which invested billions of dollars in the company just a few years back in hopes that this e-cig could revolutionize the smoking industry. It’s been reported that they’ve lost 95% of their original investment.

Talk about value destruction

It’s easy to call the move dumb looking back, but hindsight is always 20/20, I’d argue that the investment in Juul could have been the smart choice. It was stealing market share at a voracious pace. But the problem with growing at the pace Juul was is that they painted a giant target on their back. What was supposed to be a tool for cigarette smokers to transition away from cigarettes to vaping instead introduced nicotine to swaths of underage children who were likely attracted by exciting flavors… who remembers the mango Juul pod? I used to smell that flavor being smoked in every bar!

So, the government reacted and began to ban flavors. With no tasty flavors left, the users shifted to other options. Often, less reliable vapes were procured en masse by underage smokers, now hooked on nicotine. Unsurprisingly, parents and politicians were furious.

And then things got worse for the industry. And the pressure continues as states add anti-vaping measures to local ballots that restrict where they can be smoked and what sort of flavors are acceptable.

I won’t opine on whether I support those measures but the effect this clampdown is having is severe and measurable for investors.

Philip Morris International

Back in 2007, Philip Morris gained its independence vis-à-vis a spin-off to shareholders. The idea was Altria would be the US entity, only exposed to domestic risks, and PMI would take all the international risks but maintain exposure to foreign growth markets where smoking was gaining steam in many instances.

Just like Altria, so too does Philip Morris engage in M&A. PMI is engaged in its own takeover over Swedish-tobacco juggernaut, Swedish Match AB (OTCPK:SWMAY) the largest producer of nicotine products in the Nordics. Owner of popular smokeless tobacco brands “Snus” and “ZYN,” Swedish match has made a name for itself in non-smoking tobacco products. The all-cash deal will further strengthen Philip Morris’ dominant position, especially in Europe where they already hold a significant market share.

From an M&A perspective, I’m much more of a fan of Philip Morris’s approach as compared to Altria. While e-cigs could yield high growth, they are very much a political target. The same cannot be said about the oral brands that Swedish Match sells. Should the deal go through, I would expect a significant acceleration in growth from Philip Morris, as they are able to increase sales of Swedish Match products through what I believe is a superior supplier network.

While these companies do differ slightly from an operational perspective, the core of their business is the same, selling Marlboro cigarettes. Juul and Swedish Match are differentiators but given the scale of their traditional businesses, I still see these companies as easily comparable, almost identical companies. So to really drill down on which one makes the better investment we should shift our attention to the financials and then finally, valuation.

Financials

Revenue

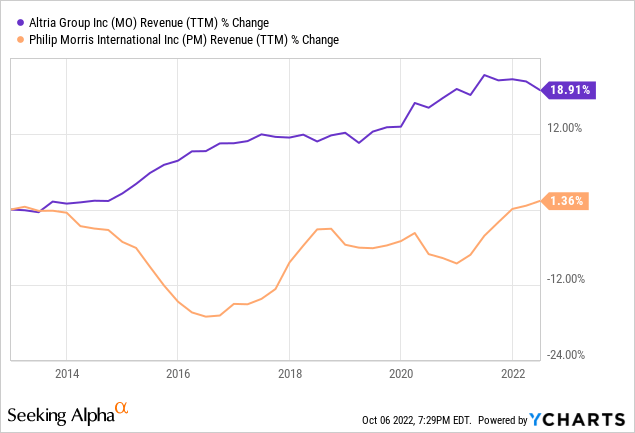

To start, let’s see the benchmark with their revenue growth over the past few years. As we all know (or we should know) Revenue = Price * Quantity. As smoking rates decline in many countries the Q can be expected to decrease over time in tandem. But what does not move in tandem is the price, as volumes decline companies like Altria and Philip Morris, which sell addictive products, are able to increase prices beyond their loss volume, ultimately resulting in higher revenues.

In Altria’s case revenues are up roughly 20% over the past 10 years, now that might not seem like much, but when you look at the margins, that’s more than enough to move the needle. Philip Morris hasn’t fared nearly as well, revenues are roughly flat over the period, most likely due to the strength of the U.S. dollar over the past few years.

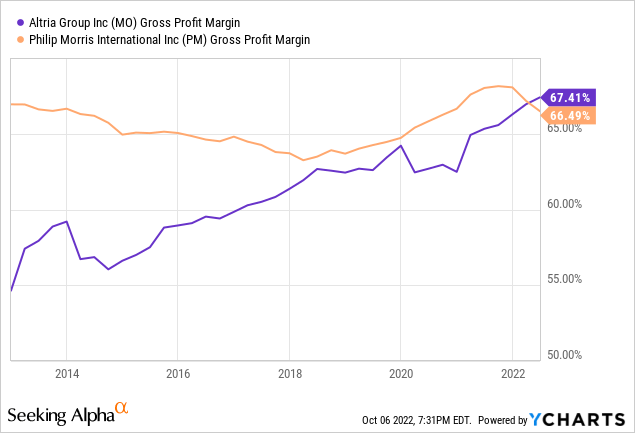

Margins

As I suggested above, these companies have best-in-class margin profiles. Their gross profit margins in the mid-’60s continue to increase, especially in the case of Altria which has grown its margins by over 10% within that 10-year period.

Suddenly that 20% revenue growth doesn’t look so bad anymore, does it?

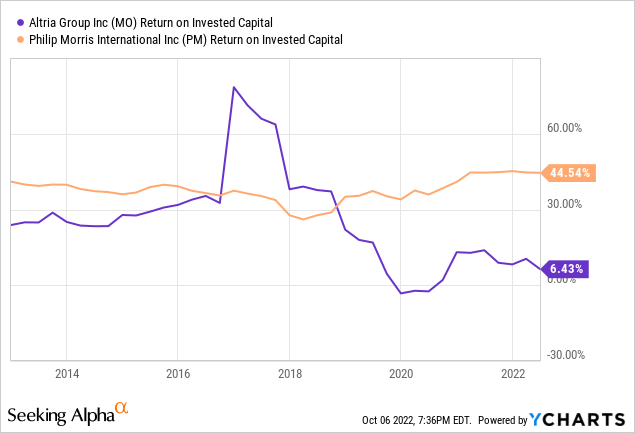

Return on Invested Capital

A good company should operate like a good investor, contributing its cash to where it will earn the highest returns for shareholders. For that reason, I almost always compare the ROIC stats between companies I am considering making an investment in.

Unsurprisingly, like I suggested earlier, it seems that PMI has been a much better capital allocator than Altria has. This is clearly reflected in their ROIC stats. While I normally prefer companies that can deploy my capital into internal growth or M&A in the case of these companies I believe another use for the capital is superior.

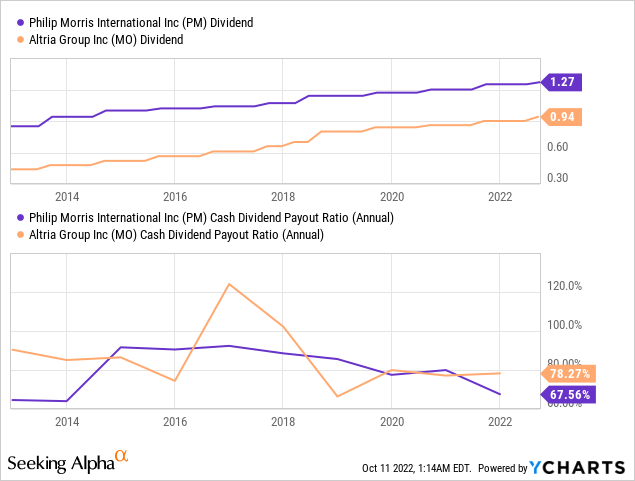

Dividends

I have a love-and-hate relationship with dividends. On one hand, it’s so nice to see that check in the mail with a big fat dollar sign, all for something you didn’t have to work for. Laziness at its finest. But the other part of me hates dividends, as they are tax-inefficient and come usually as a result of a company running out of suitable investment opportunities.

But in the case of Altria and Philip Morris, I love them.

Why? These companies are running out of growth opportunities. There are only so many “Juuls” or “Swedish Matchs” out there, and when you’re already so dominant in any given industry, M&A targets become increasingly limited (and expensive).

Outside of traditional capital allocation logic, I believe that dividends play a special purpose for tobacco companies. Dividends help take the target off their back. They help to change the narrative. For example, Altria isn’t sitting on billions of dollars that need to go to sick patients with lung cancer, it’s the poor retiree’s quarterly stipend, and it’s off Altria’s balance sheet.

Dividends offer companies a useful way to get cash off their balance sheets and avoid creating a political jackpot that interested parties may try to sue to get a piece of (rightly or not).

Risks

As we all know, investments come with risks. But for tobacco companies like Altria and Philip Morris, I see those risks as relatively muted. Valuations are reasonable. The companies sell a tried-and-true product in relatively safe markets. Concerns regarding e-cigs can be expected to continue, but I think the core tobacco business is relatively safe.

The biggest concern I have for these companies would be wasteful M&A. Altria has been especially prone to making M&A mistakes in the past, notably Juul. It’s for that reason I am happy we continue to see high dividend payouts, as I feel that I can better allocate that capital than management may be able to.

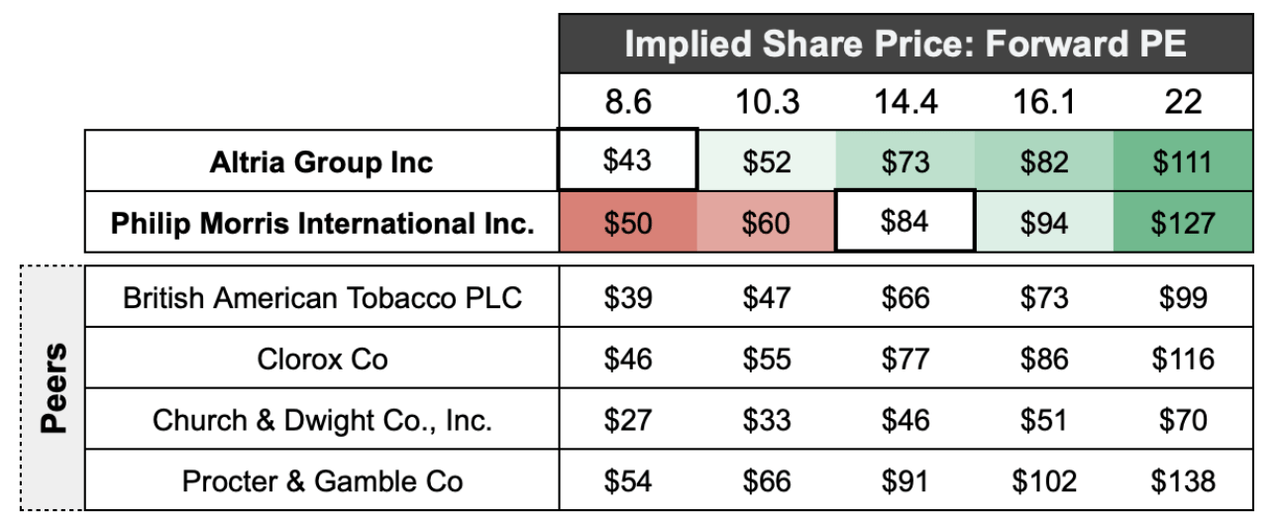

Valuation

To provide a rough estimate of fair value for the shares of these companies I selected a variety of peers. Some tobacco companies, and some traditional CPG firms. Why traditional CPG firms? Because I believe they sell fundamentally similar products that are consumed on a nearly daily basis. Sure, you can make the argument that the CPG firms will be around longer and deserve a premium, I agree with that to an extent, but I believe that, overall, tobacco company valuations are far too negative generally speaking.

|

Company |

Stock Price |

Next Year Earnings Est |

Next Year P/E |

|

MO |

43 |

5.1 |

8.6 |

|

PM |

84 |

5.8 |

14.4 |

|

(BTI) |

37 |

4.6 |

8.1 |

|

(CLX) |

126 |

5.3 |

23.6 |

|

(CHD) |

71 |

3.2 |

22.3 |

|

(PG) |

124 |

6.4 |

19.5 |

|

Average P/E |

16.1 |

||

|

Average Tobacco P/E |

10.3 |

||

|

Average CPG P/E |

22 |

Source: Yahoo Finance, Analyst Expectations & Author’s Calculations

Looking at the forward P/E valuations for other firms in the CPG segment we can see that tobacco firms trade at a rather steep discount. Philip Morris trades for a much larger premium than Altria, but at 14x, it’s hard to say that’s richly valued. The average overall P/E in this group is 16x but it varies significantly between the average tobacco P/E (10x) and the average CPG PE of 22x.

Source: Yahoo Finance, Analyst Expectations & Author’s Calculations

The table above colorfully illustrates the valuation disconnect I outline above. Comparing Altria to other peers is almost head-scratching, how does this company trade at such a low valuation compared to its peers? Sure, they’ve made a few mistakes, but this company is trading at just 8.6x forward earnings estimates!

Conclusion

So, which sin-stock is the best buy? I’m going to take Altria on this one. On a fundamental level I like Philip Morris more, the exposure to so many foreign markets provides them with significant regulation diversification and they’ve made far fewer M&A mistakes as compared to Altria. But holy moly, Altria’s valuation is just crazy (excuse the hyperbole).

If Altria has learned the lesson from its M&A mistakes the company could be gearing up to generate some juicy shareholder returns.

I rate Altria a “Buy” with 1yr price target of $52.

I rate Philip Morris a “Hold” with a 1yr price target of $84.

Thank You

Thank you, seriously thank you! Thank you for taking some time out of your day to read my investment articles here on Seeking Alpha, I really do it for you, the reader! If you have questions or wish to discuss the company further please feel free to chime off in the comments below. Until next time.

Be the first to comment