DNY59/iStock via Getty Images

Investment Thesis

Despite the temporary macro headwinds and tough YoY comparison to 2021’s hyper-growth, MercadoLibre, Inc. (NASDAQ:MELI) continues to report stellar normalized growth in its revenues and performance metrics in FQ2’22. Long-term MELI investors would also be encouraged by the stellar 5Y Total Price Return of 233.9% and 10Y Total Price Return of 998.2%, despite the brutal market correction since Q4’21.

We are of the opinion that these market conditions provide speculative investors with an excellent opportunity to add at extreme bottoms. Especially, since the MELI stock is likely to exceed the consensus estimates’ price target of $1,290.00 over the next few years, once the macroeconomics improves and Mercado Pago hits the inflection point. Savvy investors would benefit from holding on to this monster stock for long-term investing and growth through the coming decade.

Mercado Pago’s Performance Metrics Reveal Its Massive Growth Potential

MELI’s Growth Post Reopening Cadence

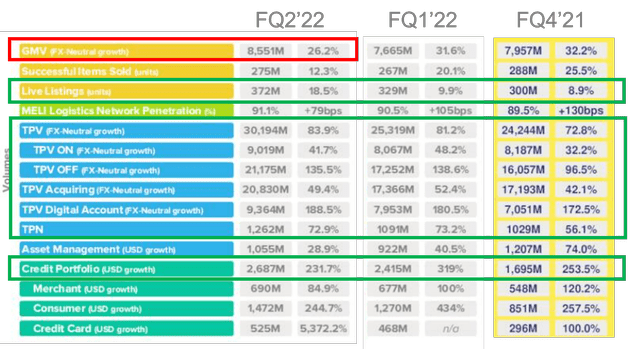

It is apparent that MELI’s growth is slowing down, partly attributed to the hypergrowth experienced in 2021. However, these have directly contributed to the rapid rise in its e-commerce Gross Merchandise Value ( in red ), with a remarkable increase of 22.9% YoY to $34.87B in FY2022. Thereby, accounting for an impressive 20.9% of South America’s market share then. Furthermore, MELI continues to boast 40.8M unique marketplace buyers with $1.4B of e-commerce revenues in FQ2’22, indicating an increase of 7.7% and 23% YoY, respectively, despite the tougher comparison.

In addition, investors cannot ignore the stellar growth in Mercado Pago (in green), with a Total Payment Volume of $30.19B, unique wallet payers of 21.4M, and fintech users of 38.2M in FQ2’22. These numbers represented a stellar YoY growth of 83.9%, 41.7%, and 26.4% for the latest quarter, compared to 72.8%, 45.3%, and 31.1% in FQ1’22, respectively. Thereby, indicating its massive runway for growth ahead, as the company reports accelerated growth in its TPV despite the notable deceleration in user acquisition.

MELI’s Growth In EPS & FCF For The Past Three Years

Combined with MELI’s ( red ) sustained growth in EPS for the past three years, compared to other e-commerce and fintech giants, such as Amazon (AMZN), PayPal (PYPL), and Block (SQ), it is evident that MELI is growing to be a force to be reckoned with. Its aggressive expansion into the fintech market may also prove to be the saving grace during a time of economic uncertainties, since its fintech segment already accounted for 45.9% of its revenue by FQ2’22 and will likely surpass the e-commerce segment in the next few quarters.

The adoption of fintech services has obviously been accelerated by the COVID-19 pandemic and is further expanded post-reopening cadence as inflation continues to rise. These digital solutions often aid and empower the most vulnerable unbanked consumers in managing their finances and cash flow. Especially, in the South American region, where rising inflation has risen uncontrollably in the past two years to potentially reach a record high of 12.1% in 2022 and 8.7% in 2023, compared to the current 8.5% in the US.

With the digital payment industry in South America expected to grow at an aggressive CAGR of 55% through 2024, we may expect to see Mercado Pago report breakneck growth moving forward. Thereby, significantly boosting its profitability while triggering a stock price rally over the next three years.

MELI Demonstrates Excellent Financial Health Despite Temporary Headwinds

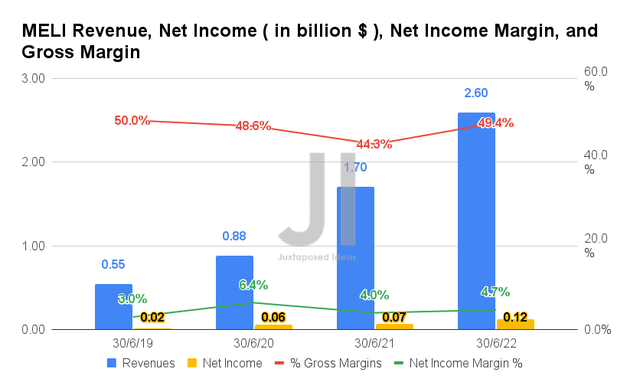

In FQ2’22, MELI reported revenues of $2.6B and gross margins of 49.4%, representing stellar YoY growth of 52.9% and 5.1 percentage points, respectively, despite the rising inflation. In the meantime, the company reported net incomes of $0.12B and net income margins of 4.7% in the latest quarter, representing an increase of 71.4% and 0.7 percentage points YoY, respectively. Otherwise, a tremendous increase of 284% YoY, after adjusting for bad debts of $303M in FQ2’22 and $82M in FQ2’21.

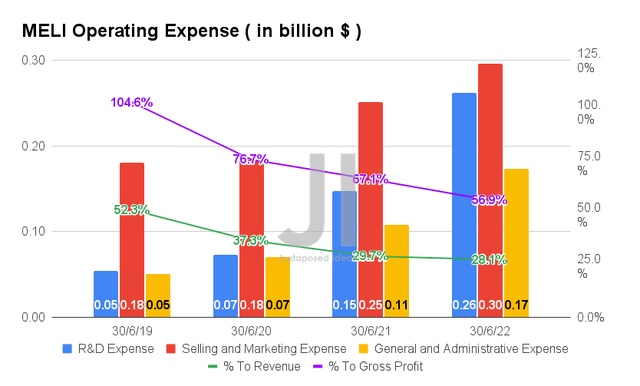

MELI has also been keeping costs down during a time of rising inflation, since it reported operating expenses of $0.73B in FQ2’22, which indicated an increase of 43.1% YoY. However, the ratio of these costs to its growing sales has also moderated, to 28.1% of its revenues and 56.9% of its gross profits in the latest quarter, compared to 29.7%/ 67.1% in FQ2’21 and 37.3%/76.7% in FQ2’20, respectively. Thereby, contributing to MELI’s sustained growth in operating income by 50.6% YoY. Otherwise, an impressive 222.9% YoY, after adjusting for bad debts.

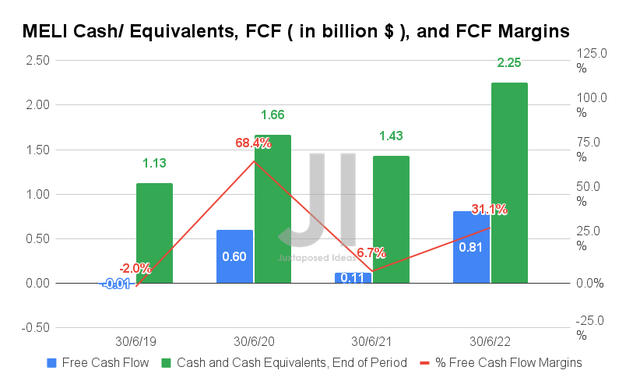

As a result, we are not surprised by MELI’s improved Free Cash Flow (FCF) generation of $0.81B and an FCF margin of 31.1% in FQ2’22, representing massive improvements of 736.3% and 24.4 percentage points YoY, respectively. It has directly contributed to its growing war chest of $2.25B in cash and equivalents on its balance sheet, bolstering its armor in case of a speculative economic downturn ahead.

Mr. Market Is Unfortunately Pessimistic As A Potential Global Recession Looms

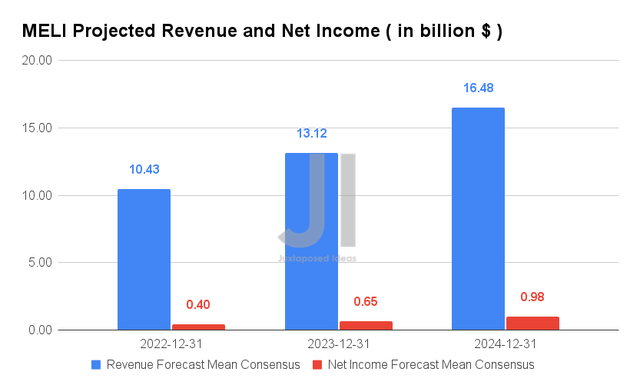

Over the next three years, MELI is expected to report revenue and net income growth at an excellent CAGR of 32.60% and 127.44%, respectively. It is essential to note that Mr. Market continues to be confident of its forward execution, given the relatively inline top-line and minimal -14.7% moderation in bottom-line growth from consensus estimates in March 2022.

This is an entirely different story for Amazon, with the upheaval experienced in the past two quarters and the immense decline of -5.2% in projected revenue and -27.8% in projected net income growth through FY2026. The latter had infamously lost $430B of enterprise value in the six weeks post FQ1’22 earnings, before successfully recovering more than half at the time of writing.

In the meantime, MELI is expected to report revenues of $10.43B and net incomes of $0.4B in FY2022, representing an impressive increase of 47.5% and 480.1% YoY, respectively. It is even more impressive since the revenues represent a significant upgrade in estimates by 10.8% and in-line profitability since March 2022. Therefore, we are not surprised by the massive 21.5% rally experienced post exemplary FQ2’22 earnings call, from $890.87 on 03 August to $1,082.66 on 15 August 2022.

Unfortunately, it is also evident that MELI is vulnerable to the rising inflation and the Fed’s hawkish commentary on aggressive interest hikes through 2023, since the rally has also been thoroughly digested by now. It is painfully evident in the -6.8% plunge post-Powell’s speech between 26 August and 02 September 2022 at the time of writing, despite MELI’s minimal exposure in the US market. It is evident that Mr. Market is increasingly worried about a potential global recession, triggering further headwinds in the e-commerce and fintech space moving forward. We shall see.

In the meantime, we encourage you to read our previous article on MELI, which would help you better understand its position and market opportunities.

- MercadoLibre: The Crystal Ball Looks Rich Ahead – Wait For The Rally To Be Digested

- MercadoLibre: It’s The Perfect Time To Buy

So, Is MELI Stock A Buy, Sell, or Hold?

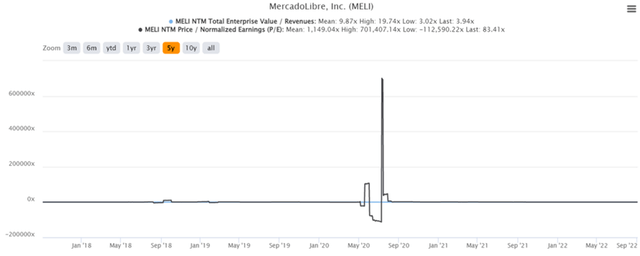

MELI 5Y EV/Revenue and P/E Valuations

MELI is currently trading at an EV/NTM Revenue of 3.94x and NTM P/E of 83.41x, lower than its 5Y mean of 9.87x and 1,149.04x, respectively. The stock is also trading at $855.91, down 56.55% from its 52 weeks high of $1,970.13, though at a premium of 42.48% from its 52 weeks low of $600.69.

MELI 5Y Stock Price

Consensus estimates continue to rate MELI as an attractive buy with a price target of $1,290.00 and a 50.72% upside from current prices. However, we may see further downside from here, since CFO Signals reported that 73% of CFOs from North American companies are highly concerned about the persistent inflation in Q3’22, with 46% expecting a full-blown recession by the start of 2023. Those from the South American region are even more pessimistic, with only 7% of CFOs rating the current economy as good, with a minimal 10% expecting improvement twelve months from now.

Consequently, we may see another bottom of $600s for MELI (or even lower) over the next few months, if macroeconomics and market sentiments worsen after the Fed’s upcoming hike on 20 September 2022. That would provide a better entry point for those seeking to add this stellar stock for long-term growth and investment.

As a result, we rate MELI stock as a Hold for now, given the potential volatility ahead.

Be the first to comment