Capuski

Internet and communication stocks have been on a free fall over the past year with most trading as a bloc in both the US and China. Zoom Video Communications lost 72%, Chinese online entertainment group, Bilibili Inc. (BILI) dropped 71.84%, Hello Group (MOMO) declined 55% while Tuya Inc. (NYSE:TUYA) is down 90.18%. On its part, Baidu Inc. (BIDU) reduced its losses in the period shedding only 13.75% after an optimistic outlook in Q2 2022. The US economy has dwindled due to rising inflation with the Fed said to be preparing a cushioning monetary policy. China on the other hand outlined stimulus measures to boost the economy after opening the country post-Covid19 lockdowns. Additionally, the US and China are working to settle the auditing compliance of US-listed Chinese firms which could see more than 270 Chinese firms delisted from the NY bourses if unresolved.

Thesis

Tuya’s growth over the past year has been hampered by revenue declines, negative operating margins and adverse macroeconomic conditions. The ⁓26.1% YoY decline in the total revenue as of Q2 2022, may prevent Tuya Inc from launching products that target vertical user growth. However, the company has been expanding its promotion of universal open standards that enable the use of products with high Internet of Things (IoT) capabilities to enable secure connection and interaction. For instance, with its support for Matter, smart home solutions, Tuya will be able to augment connections between more devices. Tuya also plans to increase strategic partnerships that will perpetuate innovation and change the future of connectivity. While this article recommends a sell rating of the stock, it will also explore additional factors to the upside that may support positive fundamentals in the future.

Dual Listing

Fifteen months after raising $915 million in its NYSE IPO in March 2021, Tuya Smart announced (in June 2022) that it had listed its shares in Hong Kong. The global IoT service provider’s initial offering stood at HK$19.30 at the beginning of July 2022. Tuya’s primary listing of Class A ordinary shares on the exchange would see it gross approximately HK$141 million ($17.95 million) before the exercise of the over-allotment option. Tuya planned to use its proceeds to enhance its IoT technologies and increase strategic partnerships over the next 5 years. This dual listing will not only act as a hedge in case of NYSE delisting but also help it secure capital funding.

Earnings Review

Tuya’s total revenue in Q2 2022 declined 26.1% (YoY) to hit $62.5 million. Its biggest business the IoT Platform as a Service (PaaS) was the worst hit on annual analysis after falling 38.1% (YoY) to $47.6 million but was up 13.6% on quarterly review. The company attributed the annual business decline to inventory pressure due to supply mismatches faced by downstream players in the IoT device industrial chain. Still, the company witnessed a 10.81% increase in the total number of IoT Paas Customers in the quarter which led to a 42.5% growth in its gross margin.

Overall, the business outlook was weak in the quarter not only due to the Covid19 lockdowns that limited spending but also due to fluctuating forex exchange rates. While Tuya was working to expand its customer base, it was forced to lower its gross profits. Despite decreasing its operating expenses by 14.2% to $66.2 million (more than its quarterly revenue), the company’s gross profit declined 25.0% to $26.8 million. The gross margin for smart device distribution gained 11.4% as compared to 13.1% in Q2 2021 indicating lesser sales per product in the quarter.

Currently, Tuya is collaborating with Amazon’s (AMZN) cloud-based voice service- Alexa to implement its streamlined set-up based on its new connectivity protocol, Matter. But before we delve into this partnership, it is important to mention some pertinent reasons that probably led to declined gross margins as far as Amazon and other e-commerce websites are concerned.

An article published in Q2 2021, stated that some top Chinese sellers including Tuya had their accounts suspended on Amazon due to the documentation of fake review scams. Notably, Tuya recorded lower annual sales after revenues declined from the $83 million to $86 million range guidance provided in Q3 2021. Tuya’s CEO Jessie Liu stated:

Our customers face a series of challenges, including Amazon’s strict execution of seller policy,” in which Amazon had banned cross-border e-commerce stores.”

Arguably, more than 200,000 Amazon accounts were suspended after Amazon discovered over 13.1 million records of fake reviews. Over a billion dollars in gross merchandise value (GMV) were affected by this suspension. Amazon’s annual revenue still recorded a 3.4% increase since December 2021 indicating a minimal impact of the suspension.

However, it appears, that Tuya is working to regain its lost space into Q2 2022 when it announced that it had launched the Matter Smart solution in conjunction with Amazon.

Role of Matter in Tuya’s economy matrix

Matter was introduced by Amazon, and Apple (AAPL), Google (GOOG), Comcast, and the Connectivity Standards Alliance (CSA) to provide a unified smart home standard. It is a communication and application layer protocol that allows devices and smart home systems to operate seamlessly and provide users with a more convenient smart home experience. Tuya was involved in the initial Frustration-Free-Setup (FFS) for Matter and has worked with Amazon Alexa.

Tuya

Q1 2022 saw Alexa announce that Tuya was included as a participant for the FFS beta program as well as the technical documents for the FFS (Wi-Fi) and Thread-based Matter devices. So, for H1 2022, Tuya aimed to look at the Interoperability Testing of Matter’s products with Amazon. By the end of 2022, Investors expect Tuya to unveil the FFS on devices certified by Matter and offer customers a quicker set-up experience. Further, Alexa’s new Local Adapter Platform (LAP) will be integrated by Tuya to help partners whose devices support the local protocol.

Tuya is Amazon Alexa’s solution provider partner. Among other things, it provides hardware and software development solution support for Alexa Voice Service (AVS) and Amazon Skills. From this partnership, Tuya’s customers will be able to differentiate their smart products and benefit from increased demand for voice-control smart devices. The Amazon Dash Replenishment (ADR) is another integrated smart-home service that will benefit Tuya customers. This system helps customers automatically reorder household consumable products. It will not only enhance new-user satisfaction but also create new business opportunities by strengthening consumable sales.

While it is a remarkable achievement, Tuya is yet to clarify the portion of the Amazon Alexa market currently in its grasp.

Outlook of the Smart Speaker Market

Amazon Alexa is part of the smart speaker market whose market size is estimated to grow from $9.46 billion in 2021 to $35.93 billion by 2028. It is expected to grow at a CAGR of 21% over the forecast period. In 2021, Amazon and Google both sold more than 73 million smart speakers with Alexa and Eco accounting for more than 40% of the market share followed by Baidu. The partnership between Tuya and Amazon Alexa will see the former manage part of the hardware and software of more than 40 million Amazon smart speaker units sold (as of 2021).

Tuya’s full-service support will come in handy when customers develop Matter devices based on its experience in marketing and application. Using Tuya’s solutions such as the IoT PaaS, device manufacturers of Matter can manage information and upgrade over-the-air (OTA) without rebuilding the Data Control Language (DCL) server. Customers using Tuya can also avoid wrong code marks by using automatic manufacturing technology that attaches each product with a unique distribution network code.

Additional Risks to the Downside

Tuya is still facing increasing losses as well as negative operating margins. In Q2 2022, Tuya’s loss from operations narrowed by 5% from $41.5 million to $39.5 million (QoQ). The accumulated deficit since June 2021 has also increased 69.2% to $458.7 million from $271.1 million.

Tuya went public on March 18, 2021, and its IPO price stood at a high of $21. The stock has never risen above its IPO price with its 52-week high trending 36.86% below at $13.26.

Seeking Alpha

Further, after going public in Q1 2021, Tuya diluted its total outstanding shares by more than 100% (from 268.2 million to 545 million). It will take more catalysts for the share price to rise above $2.00 seeing it is trending below that level since the end of June 2022.

Tuya’s operating margin in Q2 2022 was -63.1% from -49.0% in Q1 2021 (a decline of 14%). This increasing negative operating margin means that Tuya has been unable to control its costs since it went public. The company has also been susceptible to industry-wide challenges that have aggravated the costs of revenues for the past year.

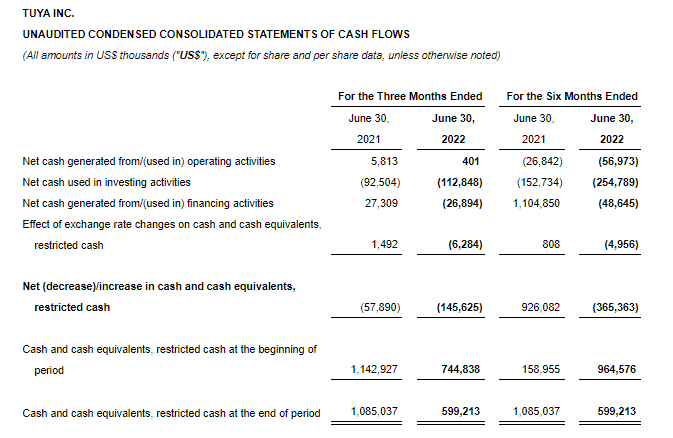

Finally, Tuya reported that its cash position as of June 30, 2022, was $951.5 million. The company was optimistic that this liquidity status was sufficient to meet its expenditures and other working capital needs for the foreseeable future.

Tuya

From this analysis, the expenditures against the available cash and its equivalents as of Q2 2022 only leave the company with just $200 million. Expenditures total $779.415 million against a cash position of $951.5 million. Arguably, Tuya will be unable to fund its activities for the next year since it has decreased its cash position by almost $800 million in the past 6 months.

Additional factors to the upside

In its Q2 2022 earnings call, the company stated that it was determined to upgrade its Cube smart private cloud offer. It is described as a secure and reliable private IoT platform that can be deployed on Microsoft Azure, AWS, Google Cloud, Oracle Cloud, and any other individual data center.

Tuya

The company also intends to expand its business portfolio in China. Tuya’s revenue in the second quarter suffered partly due to the economic downturn in the real estate sector caused by the Covid19 lockdowns. This affected Tuya’s deployment of smart office and smart community SaaS solutions. The company is also progressing with its IoT project with China Gas which will also see the company roll out smart solutions in the energy sector.

Tuya formed the Tuya plus Triangle team structure to not only focus on its initiatives but also its KA customers in the hotel industry. Tuya hopes to increase its market share in the hotel industry by building smart hotel solutions to centralize management and improve service delivery.

Bottom Line

Investors should not ignore IoT and the global need to increase interoperability and connectedness. Tuya’s dual listing in the NYSE and Hong Kong Exchange can be interpreted as a sign of near delisting from the New York bourse in case the US and China fail to reach an agreement on the need to submit audited statements. Still, investors can also view it as a way to avoid further stock dilution since the company needs cash to proceed with its capital expenditures. However, Tuya’s cash position is wanting and the company needs additional funding to remain stable. The company’s investment in Matter and other IoT systems may take years to break even. For these reasons, we recommend a sell rating for the stock.

Be the first to comment