Pgiam/iStock via Getty Images

Medtronic (NYSE:MDT) is one of the leaders in the medical devices industry. The firm is broadly diversified. While it is most known for its products in the cardiological field, Medtronic has significant revenues from neurological products, medical surgical devices, and diabetes treatments.

Medical devices are a growing industry which should see rising spending given the aging of the world’s population and the increasing healthcare expenditures as a proportion of GDP that we’ve seen in various countries. Combine the general tailwind with Medtronic’s strong R&D and generally successful acquisitions, and the company has been a tremendous winner; shares have risen more than 10,000% over the past forty years:

However, the compounding has come to a halt, at least recently. Shares are now flat over the past five years and have dropped significantly in recent months. Will this be remembered as merely a pause in Medtronic’s exemplary track record, similar to how 2000-10 was a lost decade for the company? Or has Medtronic peaked in terms of performance?

That’s the big picture framing. Focusing on the shorter-term, however, Medtronic is set to announce its fiscal Q2 ’23 earnings on Tuesday morning. What should investors be looking at in the quarterly numbers, and what will that say about Medtronic’s longer-term prospects?

Why Shares Have Been Weak

Heading into 2022, the view was that medical devices had been temporarily disrupted due to the Covid-19 pandemic. Many hospitals delayed elective surgeries to keep staff and hospital beds available for potential Covid patients. On top of that, many people understandably wanted to stay out of the hospital and avoid any possible exposure to Covid during the height of the pandemic. As such, many surgeries were delayed significantly, lowering demand for Medtronic and other companies’ medical devices.

However, this was supposed to have cleared up by now. Investors bought back into these stocks, in some cases pushing them to new highs in 2021, on the expectation that there would be a swift recovery in surgery activity. This catalyst hasn’t played out quite as the bulls had hoped. Despite a normalization in hospital activity, medical device revenues have been fairly sluggish.

To that point, analysts are projecting that Medtronic’s Q2 earnings will see revenues fall 1.9% year-over-year and earnings dip by 3% over the same period. This is not a disaster by any means, but it is far short of what investors might have anticipated at this point in the economic reopening cycle. And slight declines are more troubling given the surge in inflation. A minus 2% revenue number in nominal terms is closer to minus 10% in real terms once you add in inflation.

So what else is causing a shortfall in results? Currency has been another problem. Medtronic generates just over half of its revenues from the United States with the rest coming from international markets. The value of those international sales has dropped sharply in 2022 thanks to steep declines in the value of the British Pound, Japanese Yen, Euro, and other currencies.

I would expect FX to continue to be a major drag on results this quarter. The Dollar Index peaked in September of this year, with the dollar surging during much of this past quarter. Thus, we should expect to see maximum negative currency translation impacts this quarter. However, the Dollar Index has now dropped by roughly five percent from its recent high, which should put Medtronic on a better footing for next quarter as opposed to the current one.

Another negative factor for Medtronic, in particular, has been the underwhelming results from its OnMed Symplicity Spyral trial results. This is part of Medtronic’s renal denervation program which intends to lower blood pressure in patients who are actively taking hypertension medication.

The trials did show a benefit in lower blood pressure in readings at a medical office. And safety was not a concern. However, the inability to show consistent results in ambulatory blood pressure is likely to raise questions about the value of Medtronic’s offering and reduce willingness of insurers to reimburse this treatment.

Is this a big deal for Medtronic? A reasonable chunk of the company’s anticipated intermediate-term growth was expected to come from this program, and its failure would be a negative. However, I’d note that investors may be overestimating the severity of the impact, or at least in proportion to where Medtronic trades today.

Morningstar analyst Debbie Wang cut her price target for MDT stock from $129 to $122 due to these negative clinical results. $7 is a meaningful reduction in fair value, more than 5% of her prior assessment of Medtronic valuation. On the other hand, the difference between $122 and $129 is not that considerable when shares are currently trading in the low $80s.

Capital Allocation & Spin-Off

Another point of concern with Medtronic has been that the company has been stuck-in-its-ways and unimaginative. Medtronic has kept humming along in its core categories, but it hasn’t done much to shake things up or make major strategic moves. Combined with an underperforming share price, and this has made Medtronic a potential target for activist investors.

It appears management has gotten the message that it needs to explore options for maximizing shareholder value. To that end, the company recently announced plans to spin off its Patient Monitoring and Respiratory Interventions operations into a separate company.

This probably won’t have a major impact on day-to-day results at Medtronic. These divisions currently account for less than 10% of total revenues and have a margin profile not too far removed from the rest of the business. As such, this spinoff shouldn’t be expected to move the overall numbers for Medtronic too much nor create a particularly different spinco.

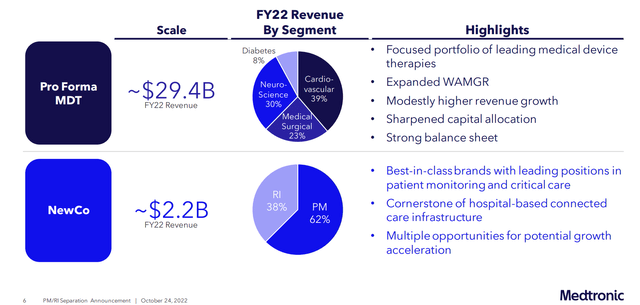

Medtronic Spin-off Details (Corporate Presentation)

Medtronic’s presentation states that this as a way to get a slightly higher overall growth rate and improve its capital allocation. Meanwhile, the spun-off business gets to establish itself as a leader in patient monitoring and perhaps find new growth avenues, such as acquisitions, which would have been too small to move the needle over at the far larger Medtronic.

Zooming out, some analysts have been urging Medtronic to reevaluate its product portfolio and consider taking strategic action to refocus operations. This could be read as the first step in creating a leaner and more focused Medtronic going forward. In any case, it should get back to the broader point; Medtronic is a seriously undervalued collection of medical device assets, and it should only be a matter of time until that value is unlocked.

With the current earnings report, I believe many analysts will be focused on this spin-off and the broader message it sends to the market. On its own, I don’t see this deal as fundamentally transforming Medtronic or creating an especially exciting NewCo either. That said, if management hints at further moves or some continuation of the current sharpening process in capital allocation, that could set off a much bigger move in MDT stock.

Medtronic’s Bottom Line

Specifically as it pertains to Q2 earnings on Tuesday, I don’t see that much reason for optimism. The medical device industry has failed to bounce back from Covid-19 as strongly as expected. And now, a sharply higher U.S. Dollar is going to weigh on results further. This quarter is unlikely to be the one that fixes everything as far as Medtronic’s operational momentum goes.

That said, sentiment is washed out here with the stock near five-year lows. Any sort of favorable commentary on the coming spin-off and potential other capital allocation moves could give investors something positive to latch onto.

And, more broadly, shares are cheap at 15x forward earnings. Medtronic is a Dividend Aristocrat and is currently offering a 3.3% starting yield. Traders may want to wait for a few more quarters until the company’s earnings results start to inflect positively. That said, longer-term investors are getting a solid growth and income company at an attractive entry point.

Be the first to comment