andresr

Medical Properties Trust Inc. (NYSE:MPW) offers a high level of income value for passive income investors, as the valuation understates the trust’s FFO value and the stock appears to have bottomed out.

The market values MPW as if the trust must reduce its dividend payout, but this does not appear likely based on my analysis. The real estate investment trust is still very cheap and trades at a very low funds from operations multiple, which is why I increased my position in MPW this week.

Furthermore, the trust’s low pay-out ratio and recently reduced guidance for 2022 FFO suggest that investors are misinterpreting the trust’s value proposition.

3 Ways The Market Gets Medical Properties Trust Wrong

This year, the market punished Medical Properties Trust with a 45% valuation cut due to concerns about higher inflation and costs in the REIT sector. Some investors are even concerned about the possibility of a dividend cut, which, based on the trust’s dividend coverage, I believe is unfounded.

In fact, I believe there are up to three reasons why passive income investors should buy Medical Properties Trust’s high yielding stock as the market continues to shun the healthcare trust for no apparent reason.

- MPW Has Much Better Dividend Coverage Than Investors Might Know

Medical Properties Trust is a diversified real estate investment trust with operations in multiple countries, which allows the trust to be less exposed to and reliant on the healthcare market in the United States.

Medical Properties Trust’s dividend is well covered by funds from operations, according to my most recent calculation of the trust’s dividend coverage ratio.

The pay-out ratio in the third quarter was 69%, compared to 65% over the previous twelve months. A real estate investment trust that pays out only 65 cents on the dollar in funds from operations is unlikely to be forced to cut its dividend and may even surprise the market by increasing it again.

Medical Properties Trust’s dividend was previously increased by $0.04 per share annually, and a $0.01 per share per quarter dividend increase would result in a dividend yield of 9.8%.

2. The Trust Recently Narrowed Its FFO Guidance

The low end of Medical Properties Trust’s funds from operations forecast was raised from $1.78-1.82 per share to $1.80-1.82 per share.

Medical Properties Trust’s stock is currently valued at 6.8x funds from operations, based on the new FFO forecast. At such a low multiple, investors get a pretty big margin of safety, so even if the dividend is cut (which I believe is highly unlikely), passive income investors get a pretty low entry price for a steady stream of dividends.

3. The Bottom Is Likely In For Medical Properties

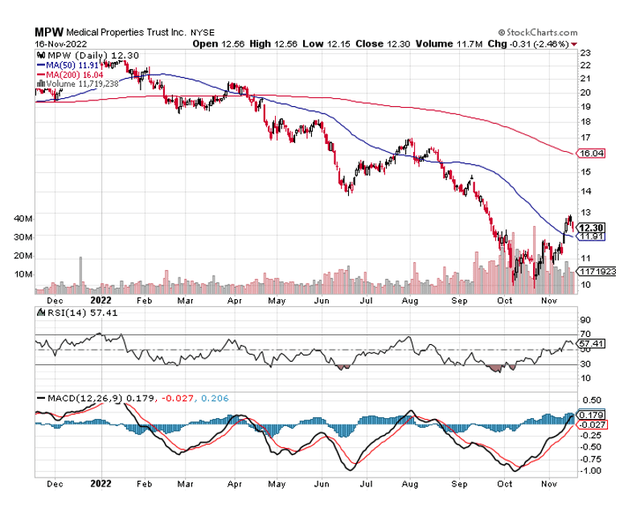

According to the Relative Strength Index, MPW is no longer oversold, and the real estate investment trust has recovered 24% since hitting a 52-week low of $9.90.

Given the (still) low valuation multiple based on FFO and improving technical sentiment, I believe MPW represents a compelling investment opportunity for passive income investors seeking a covered and sustainable 9.4% dividend yield.

Why Medical Properties Trust Could See A Lower/Higher Valuation

Medical Properties Trust could have issues if the real estate investment trust failed to cover its dividend with funds from operations, but given MPW’s low dividend pay-out ratio, I don’t see how this could happen.

So far, the real estate investment trust has covered its dividend with funds from operations, and this is likely to continue only in the event of a larger operator failure (and associated loss of rental income).

My Conclusion

I believe the market misunderstands Medical Properties Trust because too many investors are concerned about rising interest rates, inflation, and higher costs for real estate investment trusts.

The pay-out ratio is low enough that Medical Properties Trust will not have to reduce its dividend, and the narrowed FFO guidance for 2022 confirms this.

Furthermore, the valuation is so low that investors have a very high margin of safety, which should protect them from another valuation cut, in my opinion.

Technical sentiment has also improved in November, making MPW a compelling contrarian investment idea in my opinion.

Be the first to comment