Eoneren

Investment thesis

Medical Properties Trust (NYSE:MPW) has been massively sold off and is seemingly attempting to form a base. The stock hasn’t been so negatively extended since the financial crisis in 2008, when it reversed spectacularly. Despite some fundamental headwinds and major macroeconomic risks, in this article, I want to focus on the technical aspects that could hint at an actionable trading setup. The stock is hovering at price levels not seen since 2016 and has completed its Elliott impulse sequence, while it could now attempt to form its corrective sequence. MPW has shown in the past the ability to build up significant relative strength and be resilient after major pullbacks. By considering appropriate stop-loss levels and actively managing their exposure, more risk-tolerant investors could size their entry positions and take advantage of the actual technical setup, while long-term-oriented investors could also consider the interesting dividend yield at 10%.

A quick look at the big picture

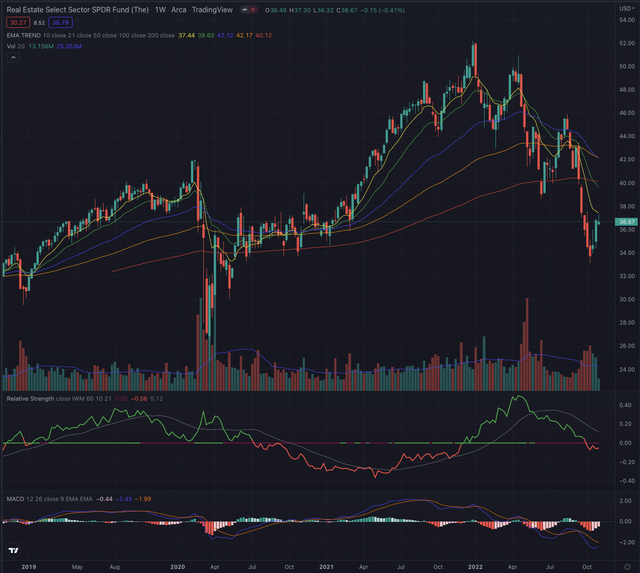

The real estate sector in the US has been a laggard, losing about 25% in the past twelve months, and is still struggling to recover, as shown in the past 3 months. Despite the whole sector seems to suffer in a severe downturn, some groups including REITs in the retail, hotel, and motel industries, are seemingly showing some signs of reversal in the past few months, while REITs in the healthcare facilities industry are still among the sector’s laggards.

Considering more specific groups of the industry, the Real Estate Select Sector SPDR ETF (XLRE) which marked its All-Time-High (ATH) on December 31, 2021, has been struggling coming out of the pandemic low, reporting significant relative weakness when compared to the broader iShares Russell 2000 ETF (IWM), as the general market was setting up a massive rally through 2021. While during 2022 the sector could initially perform better than the broader market, it then rapidly declined in a long-term downtrend, reporting significant relative weakness, especially in the past two months.

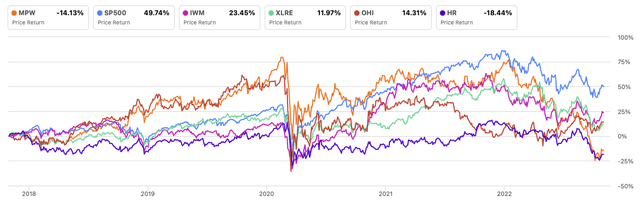

By analyzing the historical stock performance, we notice that MPW had a quite strong performance when compared to most of its main references over the past 5 years, reporting significant relative strength, especially in the years before the pandemic crash. Despite the resulting poor performance of -14.13% over the analyzed period, mostly as a consequence of the recent sell-off, the stock could most of the time significantly perform better compared to peers such as Omega Healthcare Investors (NYSE:OHI) and Healthcare Realty Trust Incorporated (NYSE:HR). All mentioned peers underperformed the S&P 500 (SP500), the broader iShares Russell 2000 ETF (IWM), while the more specific industry reference Real Estate Select Sector SPDR ETF (XLRE) despite some sporadic relative strength, reported a relatively modest performance.

Author, using SeekingAlpha.com

Where are we now?

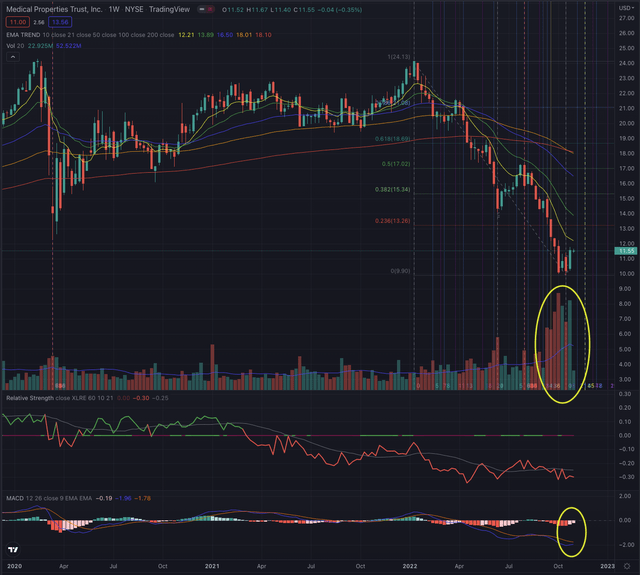

MPW reached its ATH on February 18, 2020, re-testing that level on January 14, 2022, and has since performed rather poorly by entering its long-term downtrend on February 14 on a daily scale, and mid-April in a weekly perspective. The stock could seemingly have started its bottoming process on October 21, 2022, as hinted by the extreme increase in its weekly volume, started by massive distribution days, and followed by weeks with significant buy-side volume, as well as by the build-up of a momentum reversal, although, it’s still early for calling out the bottom as the stock is still extremely extended in its stage 4.

As a general rule, I begin to consider stocks in a late stage 1 and preferably when breaking out into stage 2. While MPW isn’t for the moment qualified as such, I sometimes observe stocks in their stage 4, especially when, like in this case, certain elements attract my attention.

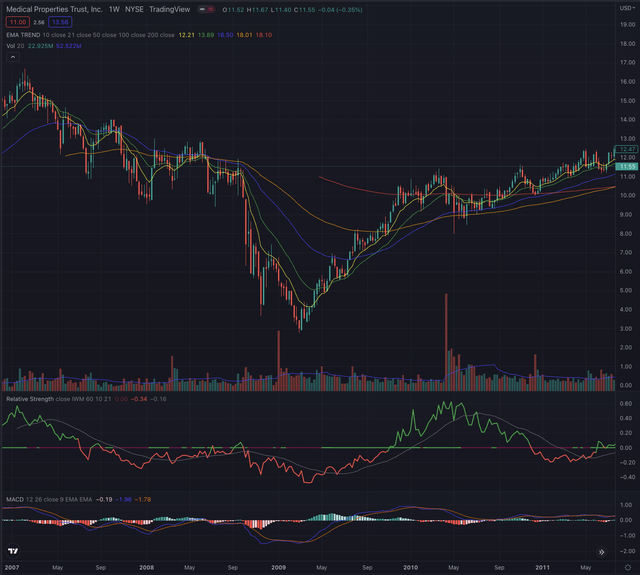

MPW hasn’t reported such an acute sell-off since the financial crisis in 2008, where the stock lost about 75% between September 2008 and March 2009. Only on these two occasions, the stock has reported such an extreme negative extension, forming an immediate reversal supported by meaningful relative strength, after bottoming in March 2008. While the fundamental framework and the reasons for the two sell-offs may differ, it’s worth considering, as the stock is priced at levels not seen since 2016.

What is coming next?

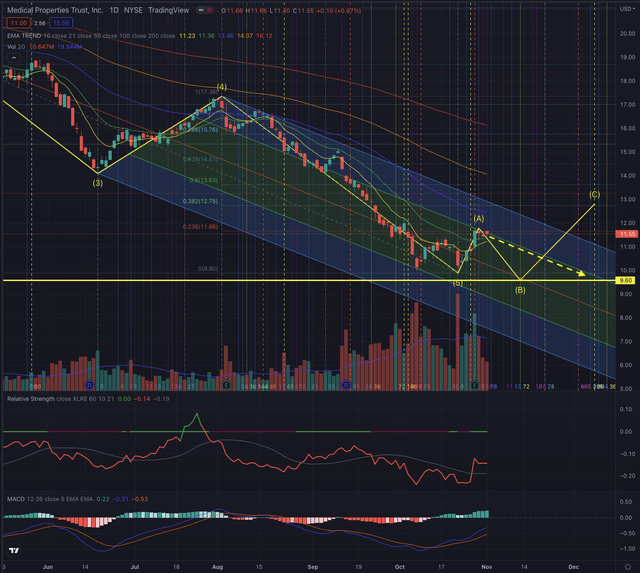

On a daily time frame, it’s interesting to observe how the stock has completed its Elliott Impulse sequence and could be in process of building a sound base, while it seemingly forms its corrective wave sequence. The stock recently broke out of its short-term downtrend, by reporting an increasingly positive momentum, while also giving some positive signs in terms of its long-lasting relative weakness, when compared to the broader Real Estate Select Sector SPDR ETF (XLRE). The stock seems to struggle at the moment to overcome the center trendline, and the coming trading sessions will be particularly interesting, as the volume has been recently dropping from its peak, and this could hint at an upcoming breakout or rejection from the mentioned resistance. MPW’s short interest has doubled in the past 5 months, recently standing at 12.53%, with a short interest ratio above 4 days, which could add fuel to the stock’s momentum in case of a significant reversal.

Despite a further short-term retracement of the recent selloff is possible, as the stock is still massively extended when considering its moving averages, I expect the stock to consolidate in the short term and form its corrective wave sequence, as I consider it likely that the bottoming phase could be undergoing. In this case, probably the recent lows would be tested again, by ideally forming a double bottom, from which the stock could attempt to form a more significant reversal.

As an alternative scenario, I see it as likely forming a more gradual consolidation characterized by a decline in trading volume, while the stock could sporadically attempt to overcome its overhead resistance if the stock manages to stay above its short-term moving averages.

By considering the still significant odds of seeing lower lows, I would size my position accordingly, by entering a first small position and limiting my downside to the EMA21 or at the very lowest under the most recent low, below $9.60. Should the stock continue in its retracement, further positions could be added and investors could consider the stock’s EMA21 and further its EMA50 as a trailing stop, or increase their stop according to their risk tolerance while considering that the stock would likely test again its supports and would require a higher tolerance in volatility.

Long-term-oriented investors who see the recent price levels as an opportunity could consider sizing their long positions according to the stock’s strength in case of a consistent reversal in its price action. I would not consider any major position until the stock has not formed a sound base and completed its first stage while confirming a significant breakout at least of its mid-term downtrend over its EMA50.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

MPW is still in its stage 4 and although the stock may look attractive from a historical perspective, it is still bearing a major risk not only intrinsically, but also from exogenous macroeconomic factors. MPW has an interesting technical setup that leads me to give my opinion on possible entry points. More risk-tolerant investors could take advantage of these price levels not seen since 2016, by considering the mentioned elements that hint at a possible early reversal. As the bottom-building process could take some time, at this stage, it is of primary importance to implement a strict and systematic risk management, by also following a defensive position-sizing strategy. While this is irrelevant for short-term traders and has any influence on decisions based on technical analysis, long-term investors could also factor in that the stock offers an interesting dividend yield of 10.04%, with a 3.90% CAGR over the past 5 years.

Be the first to comment