Ninoon

The rising rate environment hasn’t been bullish for equities, and one of the hardest hit sectors has been REITs as the cost of capital continues to increase. The SPDR S&P 500 Trust ETF (SPY) has declined by -24.35% YTD why the Vanguard Real Estate ETF has fallen -33.15%. Medical Properties Trust (NYSE:MPW) has overwhelmingly underperformed the S&P 500, and VNQ, as it has fell -55.02% in 2022. MPW isn’t a profitless technology company, yet it’s seen an abundance of downward pressure throughout the year. In Q2 2022, MPW beat the consensus FFO estimates by $0.01 and missed its quarterly revenue number by $680,000. MPW maintained its FFO guidance for 2022, and roughly -20% of MPW’s decline has occurred since its last earnings call. Management must agree with many of the contributors on Seeking Alpha that shares are drastically undervalued, considering they just issued a press release announcing a buyback of up to $500 million. This buyback is the equivalent of 8.24% of MPW’s common shares based on the current market cap of $6.07 billion. I thought shares were undervalued at $17, and I have purchased the entire way down into the mid $11 range. I think shares of MPW are one of the best values for long-term income investors.

How bad can MPW really be doing as the Board of Directors approved up to $500 million for buybacks?

Shareholders of MPW, including myself, have been left holding a large bag as shares have yet to find a bottom. Many shareholders thought the rally off the June lows meant the bottom was in, but MPW’s stock took a turn for the worse post-Q2 earnings. Shares breached their June lows and have fallen to a level that is perplexing. It must have been just as perplexing to MPW’s board of directors as on 10/10/22, they released an announcement of a new stock repurchase program.

The board of directors has authorized the repurchase of up to $500 million of MPW’s common shares over the next year. Any repurchases that MPW conducts will be funded by cash on hand, operating cash flow, loan repayments, dispositions, and/or joint venture transactions. MPW isn’t required to repurchase a single share, but I believe this is a bullish signal, as leadership now has the ability to repurchase shares on the open market when opportunities present themselves. The board wouldn’t be authorized a buyback program if they didn’t believe it would be a positive use of corporate funds or beneficial to shareholders.

When I go back and look at the chart above, without knowing which company the MPW line represented, I would think that this is a company in financial distress and possibly a future chapter 11 candidate. Over half of the company’s value has disappeared in less than a year. I would automatically assume that I would find red flags within their financials to at least warrant the stock’s trajectory. Looking through the financials, I couldn’t find the red flags as MPW continues to grow in the correct direction YoY.

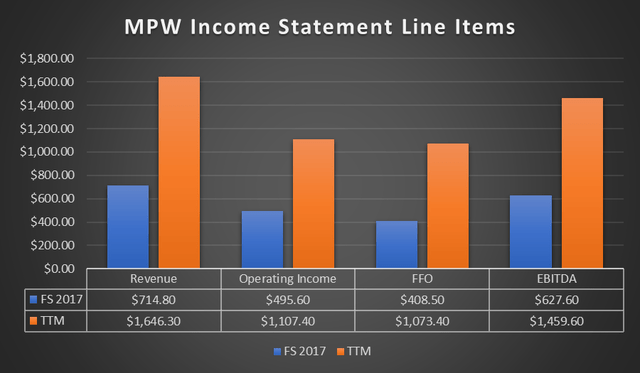

Over the past 5 fiscal years, which would include the trailing twelve months (TTM) as the 2022 fiscal year, MPW’s income statement is exactly what I would want to see. Its revenue has increased by $931.5 million (130.32%) from $714.8 million to $1.65 billion. MPW’s operating income increased by $611.8 million (123.45%), and its operating income margin is 67.27%. Two critical line items look for are funds from operations (FFO) and EBITDA when it comes to REITs. FFO is the equivalent of EPS when it comes to REITs. MPW’s FFO has increased by $664.9 million (162.77%), while its EBITDA has increased by $832 million (132.57%) over the previous 5 years. In each category, MPW has grown each of these metrics YoY, and after reviewing its income statement, I am not seeing why shareholders have panicked.

Steven Fiorillo, Seeking Alpha

Looking at MPW’s balance sheet, there are several things that stand out, and their not negatives. MPW has a market cap of $6.07 billion, and its total equity is $8.87 billion. MPW has $19.74 billion of total assets, and within its liabilities, there is $10.14 billion of long-term debt, of which $0 is due in 2022. At the close of Q2, MPW had a tangible book value of $14.80 per share. MPW is currently trading at a -31.57% discount on its total equity and a -29.8% discount on its tangible book value. MPW seems to be trading at a discount based on its balance sheet, and it’s accompanied by a strong income statement, which is probably part of the reason why the board has authorized a buyback program.

MPW has announced two sale agreements since the beginning of September

MPW has announced that it will be selling 3 Connecticut hospitals to Prospect Medical Holdings and 11 of its facilities to Prime Healthcare. On September 7th, MPW announced that it had successfully re-leased its Watsonville Community Hospital in Watsonville, CA , to Pajaro Valley Health Care District Corporation and sold 11 facilities to Prime Healthcare. As part of the transaction, MPW was repaid $30 million in financing. In early September, MPW sold 9 general acute hospitals and 2 related medical office buildings to Prime for net proceeds of $360 million. The proceeds from both transactions, in addition to roughly $200 million of loan repayments which are expected from the LifePoint Health planned acquisition of the majority interest in Springstone will generate roughly $600 million in near-term liquidity to MPW. This will be used to reduce leverage and execute select accretive acquisitions.

On October 6th, MPW announced that it would sell 3 Connecticut hospitals to Prospect Medical Holdings. The agreement establishes an aggregate sale price of $457 million, which is the amount MPW purchased the hospitals for in August of 2019. MPW plans to utilize the proceeds to reduce its debt and fund future acquisitions and investment opportunities. With the combination of the sales in September and October MPW used proceeds to reduce short-term debt in Q3 and has sourced over $1 billion in immediate liquidity.

MPW has become the most attractively valued healthcare REIT from a valuation standpoint

I will compare MPW to the following healthcare REITs:

- Healthpeak Properties (PEAK)

- Healthcare Realty Trust (HR)

- Physicians Realty Trust (DOC)

- National Health Investors (NHI)

- Sabra Health Care (SBRA)

- Omega Healthcare Investors (OHI)

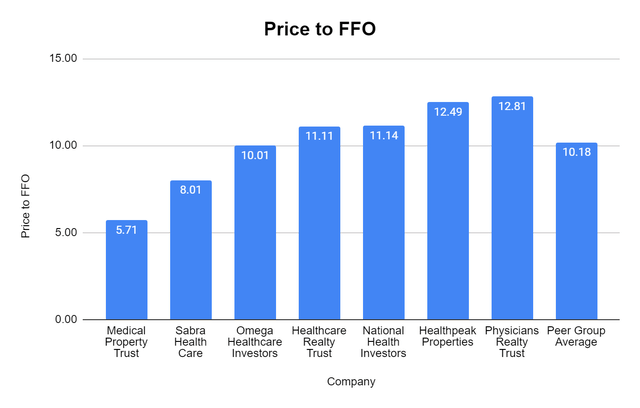

MPW is now trading at a price to FFO of 5.71x, which is the lowest in its peer group. This is almost half of the peer group average, which is 10.18x. Today you can purchase shares of MPW at a fraction of the price compared to other healthcare REITs based on their FFO.

Steven Fiorillo, Seeking Alpha

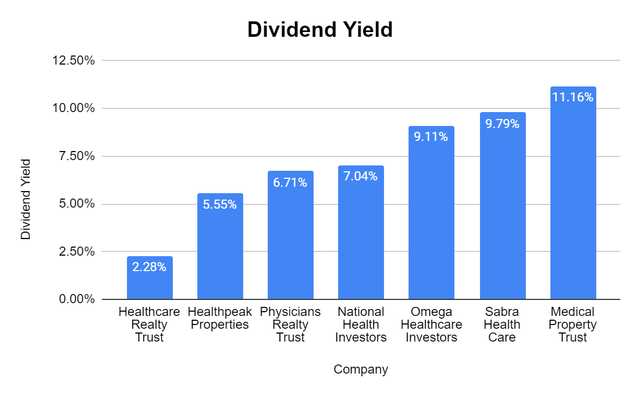

MPW is now the largest dividend payer of the group. MPW has a dividend yield of 11.16%, while the peer group average is 7.38%. The falling share price keeps pushing MPW’s yield higher.

Steven Fiorillo, Seeking Alpha

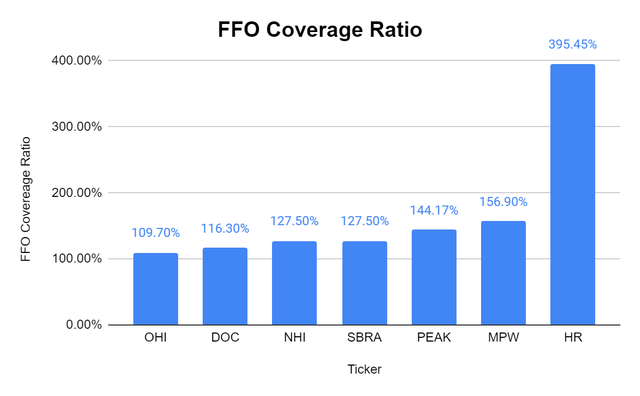

MPW’s dividend is fully supported by a 156.90% coverage ratio based on its FFO. MPW has a $1.82 forward FFO and pays a dividend of $1.16. While the dividend yield has been pushed higher, it’s not a dividend trap, as the coverage ratio is significantly larger than the dividend.

Steven Fiorillo, Seeking Alpha

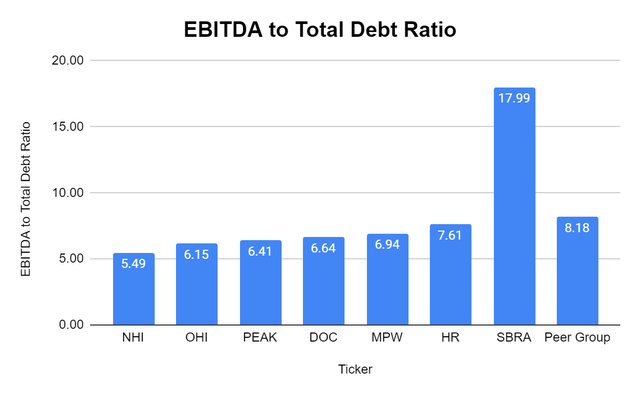

MPW has an EBITDA to total debt ratio of 6.94x, under the 8.18x peer group average. SBRA has a large EBITDA to total debt ratio of 17.99x, which isn’t optimal as this means it would take 17.99 years to repay its total debt from EBITDA. When SBRA is extracted, the peer group average falls to 6.54x, and MPW falls just above it. MPW has an attractive EBITDA to total debt ratio.

Steven Fiorillo, Seeking Alpha

Conclusion

I have been incorrect on MPW, but I am not panic selling. I am buying more shares on the way down. I think MPW is one of the most attractive REITs based on its valuation today, and its 11% yield won’t last forever. Nobody knows what will happen to REITs, and they could continue to fall when the Fed introduces future rate hikes. I believe that MPW falling further than most other REITs is unwarranted, and shares look like they are on the bargain rack. MPW’s financials and dividend are solid, and the board obviously believes in the company as they have authorized a buyback program. Regardless of what occurs, I am happy continuing to purchase shares and reinvest the dividends until the share price turns around.

Be the first to comment