SDI Productions

Medical Properties Trust Inc. (NYSE:MPW) has to be one of the most undervalued real estate investment trusts currently available to income investors.

The trust hit new lows in October amid growing market concern about interest rates, and it has only recently recovered.

Despite the fact that Medical Properties pays its dividend with cash from operations and has a well-diversified real estate portfolio, the dividend remains unpaid.

Furthermore, the trust’s stock is trading at an extremely appealing valuation, implying that the market is undervaluing Medical Properties’ funds from operations potential. MPW is an excellent investment.

Strongly Performing Real Estate Portfolio With Inflation Protection

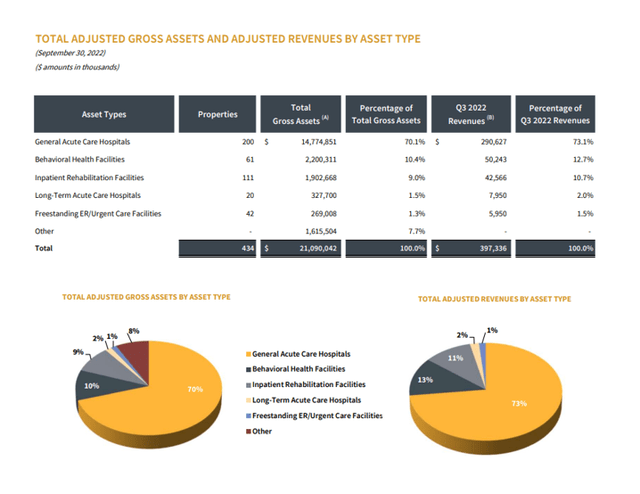

Medical Properties Trust generated $397.3 million in revenue from a portfolio of hospital and rehabilitation facilities.

The real estate investment trust invests primarily in General Acute Care Hospitals and Inpatient Rehabilitation Centers, which are the trust’s primary operating focus, and it is the world’s second-largest hospital owner. In the third quarter, these two asset types accounted for 84% of Medical Properties Trust’s revenue.

Portfolio Overview (Medical Properties Trust)

Hospital real estate investment trusts operate in a unique market, one in which customers have no choice but to spend money. As a result, demand for healthcare services (both inpatient and outpatient) is relatively stable, creating a strong growth outlook for Medical Properties Trust in the long run.

Furthermore, Medical Properties Trust has expanded into markets in Europe and Australia, which aids in mitigating the risks associated with the U.S. healthcare market.

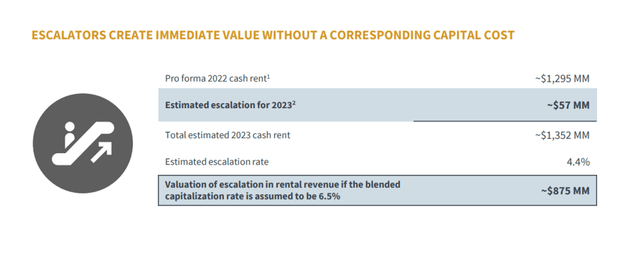

A compelling feature of Medical Properties Trust in today’s inflation-plagued world is that it provides investors with inflation-protected cash flows, which is a key selling point right now as inflation remains high at rates exceeding 8%.

Estimated Cash flow Escalation (Medical Properties Trust)

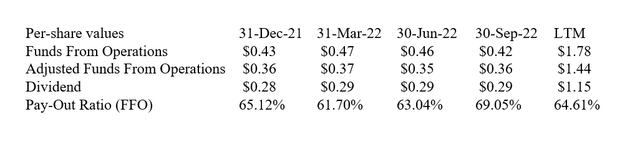

Updated Dividend Pay-Out Metrics

Medical Properties Trust covers its dividend with funds from operations, and the dividend is relatively safe, despite what the stock price suggests.

In the third quarter, the real estate investment trust earned $0.42 per share in funds from operations, translating to a pay-out ratio of 69%, allowing investors to rest easy with this high-quality company in their portfolios.

In the previous twelve months, the trust’s dividend pay-out ratio was 65%.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Financials)

Dividend Yield And Growth

Medical Properties Trust pays a quarterly dividend of $0.29 per share, or $1.16 per share per year, for a stock yield of 10.8% at the current price of $11.09.

Furthermore, Medical Properties has a history of increasing its dividend payout, implying that investors who take advantage of current fire sale prices will generate a higher dividend yield in the future.

Raised Guidance And Fire Sale Price Of 6.1x FFO

Medical Properties Trust increased and narrowed its 2022 funds from operations guidance from $1.78 to $1.82 per share to $1.80 to $1.82 per share.

The hospital trust sells for a 6.1x FFO multiple based on the current stock price of $11.09.

In my opinion, the valuation has a very high margin of safety, and I am still bullish on the healthcare real estate investment trust.

Why Medical Properties Trust Could See A Lower Valuation

Medical Properties Trust operates in the most recession-proof industry I can think of. It provides medically necessary healthcare facilities to hospital operators in key markets throughout the United States, Europe, and Australia.

People will continue to fall ill and require healthcare services, which bodes well for the trust’s funds from operations growth in the long run.

As I previously stated, the dividend is safe, but there are risks related to market sentiment.

Rising interest rates are frequently viewed as a threat to REIT profitability, which is incorrect, as I explained here.

A recession, on the other hand, poses a risk to trusts in general, and the emergence of one may be viewed as an excuse by investors to sell (REIT) stocks and redirect funds to lower-risk investments such as cash or bonds.

My Conclusion

Medical Properties Trust’s stock is available at a fire sale price of 6.1x FFO, and income investors who want to collect high-quality dividends that are covered by funds from operations should, in my opinion, take advantage of the opportunity to buy the trust’s robust 11% yield as long as the market allows.

Medical Properties Trust has also a history of increasing its dividend, and the pay-out ratio is low enough that investors don’t have to worry about the dividend or dividend growth.

Because the trust’s valuation is also too compelling to pass up the investment opportunity, I continue to recommend MPW as a Strong, Strong Buy.

Be the first to comment