Olivier Le Moal/iStock via Getty Images

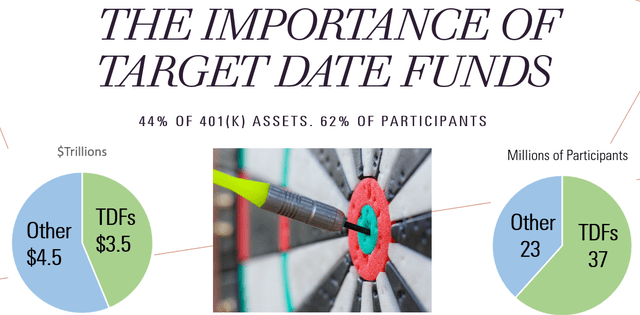

At $3.5 trillion and growing, target date funds (TDFs) are the big deal in 401(k) plans, yet the industry is not yet reporting the most informative performance results.

Target Date Solutions

Participants in TDFs receive the standard time-weighted returns (TWRs) that are designed to eliminate the effects of savings. Contributions have no effect on TWRs, so everyone in a particular TDF earns the same TWR. This makes it easy to calculate, but it misses a very important determinant of wealth, namely contributions.

But there is a way to incorporate the effects of contributions into the reported performance number. Dollar-weighted returns (DWRs) combine the effects of investment performance with the impacts of the amounts and timing of contributions.

A better rate of return measure for TDFs

Accordingly, DWRs are a more informative performance measure for TDFs because they help participants recognize the efficacy of savings. Each DWR is unique to the participant, so there are as many DWRs as there are participants.

There is a hierarchy of importance in wealth accumulation. When the horizon to the target date is long, investment performance matters more than contributions because there’s more time for compounding. But as the horizon shortens to less than 20 years, contributions are more important than returns.

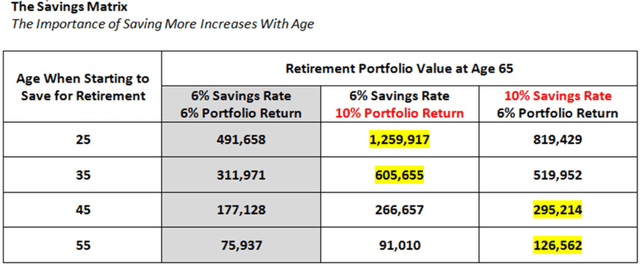

The following table produced by Professor Craig Israelsen shows that savings take on a critical role as we age. The older we get, the more important savings become, and returns become less important.

Craig Isrealsen

Most of us don’t save much when we’re young. Saving early is smart, but uncommon. Retirement starts to become real as we age. Contribution limits increase to encourage savings. As the table shows, our savings rate is the critical factor at the time that most of us begin saving in earnest for retirement, later in life. Returns matter less, until we stop saving – at retirement – at which time protection is critical.

As savings end and we move from working life to retirement, protecting those savings is imperative for retirement with dignity.

Risk might help you become rich as you accumulate wealth but protecting wealth at its peak keeps you rich.

TDF design ignores the importance of savings

Retirement researchers have identified two interrelated concepts – “Sequence of Return Risk” and the “Risk Zone.” Losses suffered in the 5 years before and after retirement (the Risk Zone) can undermine retirement with dignity. Because losses matter most in this time period , it’s called Sequence of Return Risk; it might also be called “Risk of Ruin.” In the absence of cash flows return sequence doesn’t matter, but withdrawals in retirement make early returns more important.

Most TDFs ignore these risks of loss by being 85% risky in the Risk Zone, with 50% in equities and 35% in risky long-term bonds. T. Rowe Price (TROW), one of the Big 3 TDF providers, defends this practice in their Target Date Investing: A Different Perspective on Sequence-of-Returns Risk Around Retirement. November 2018.

T. Rowe argues that participants can afford risk near retirement because they are wealthier for taking risk over their savings lifetime — their cumulative returns leading up to retirement are expected to be high. But TDF participants do not earn the returns reported by fund companies.

Designers of target date funds (TDFs) argue that participants can and should compensate for inadequate savings by earning higher returns on those savings – by taking risk. But an SEC report on “Perspectives on Retirement Readiness” says the solution is not to increase investment risk. Rather, the solution is modifying behavior by encouraging participants to save more. This is what plan designers are doing with these 4 plan features:

Savings are encouraged in four ways:

- Auto enrollment

- Auto escalation

- Education

- Contribution matches

Participants are encouraged to save early in life and to contribute generously and are given tools like this DOL calculator to determine how much they need to contribute to support a desired level of spending in retirement.

This video interview discusses the amount that needs to be saved to retire with dignity. A rule of thumb is that you need to save 22 times your desired spending, so for example $2.2 million supports $100,000 spending per year. A typical participant will want to save 10-15% of pay in a 401(k) plan and to start saving while young.

Of course, you want to earn a decent return on your contributions, but that’s not nearly as important as TDF providers would like you to believe.

Conclusion

The prescription for a retirement with dignity is simple: (1) save enough and (2) don’t lose those savings. Similar to the police motto “Serve and protect,” the retirement investor motto is “Save and protect.” Risking lifetime savings in the Risk Zone is a bad gamble, even though it has paid off over the past decade. The “Roaring 2010s” has set the stage for the “Depressing 2020s.”

The TDF industry is taking a lot of risk for those near retirement. The wisdom of that bet is changing. Interest rates are going up and stock market bubbles are bursting. We will see a repeat of the 2008 disastrous losses and this time it will be worse because bonds no longer defend and TDFs are now $3.5 trillion versus $200 billion in 2008.

There are a few TDFs that defend at the target date. The most notable is the $800 billion Federal Thrift Savings Plan (TSP). It is 70% safe at the target date in the government guaranteed G fund. Another example is the Office and Professional Employees International Union (OPEIU), one of the largest AFL-CIO unions ( the author manages this).

There are two distinct TDF designs with materially different objectives.

Some say that fiduciaries don’t know or care about TDF risk. That will change. Let the lessons begin. DWRs would help participants manage toward a retirement with dignity.

Be the first to comment