sutlafk/iStock via Getty Images

By Kieran Trevor

According to numerous studies,1 having a gender-diverse board is a key indicator of good corporate governance.2 The gender diversity of a board of an investee company is also one of the mandatory sustainability indicators3 that financial market participants are required to assess and report on under the EU’s Sustainable Finance Disclosure Regulation (SFDR).4 Using the S&P Global SFDR dataset,5 we examine this metric in the context of the S&P ESG Indices.

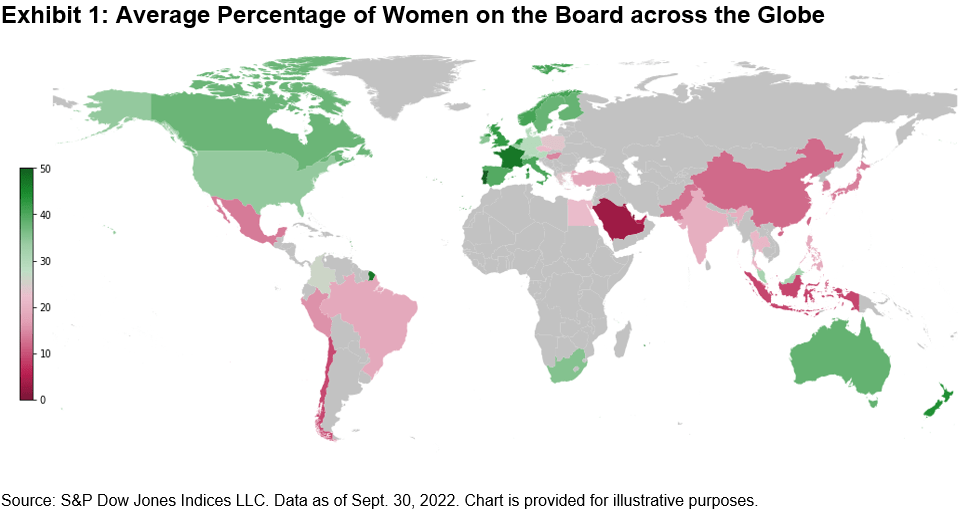

First, we observe how the proportion of women on boards varies across countries (see Exhibit 1). On average, French firms have the most gender-balanced boards. This is unsurprising, given that the French government enforces a minimum of 40% women on boards,6 a requirement that may follow across the EU.7 Meanwhile, all Qatari firms have an entirely male board.

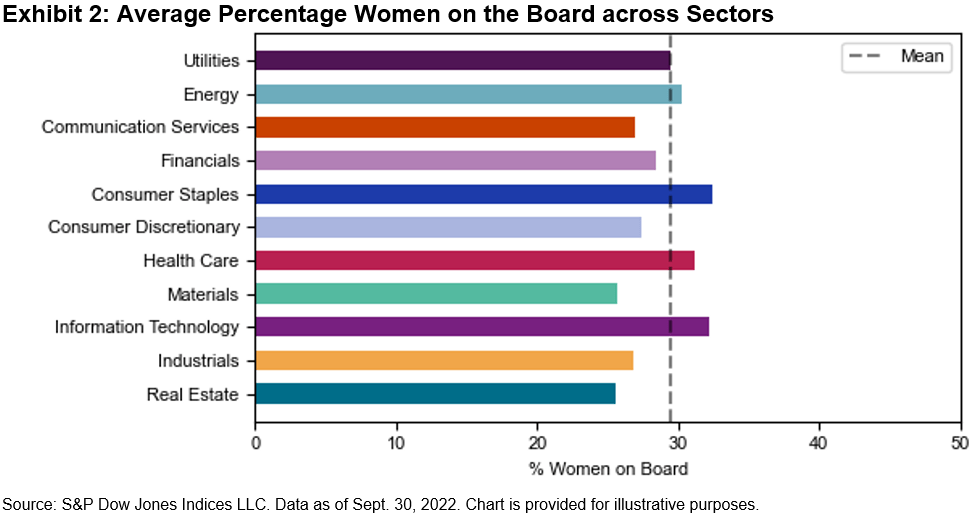

In terms of sectors, firms operating in Energy, Consumer Staples, Information Technology and Health Care have a greater-than-average number of women on their boards, while Materials has the lowest average (see Exhibit 2).

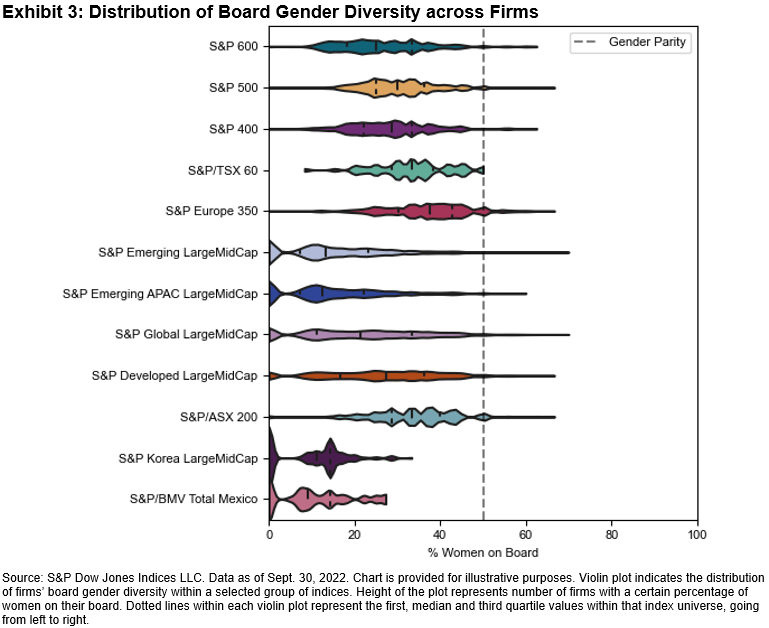

However, sector- and country-level metrics do not tell the full story, and the distribution within regional indices can vary dramatically. Exhibit 3 shows the range of values of board gender diversity across a selected set of investable universes.

While most firms in our selected U.S. benchmarks have about 20%-40% women on the board, European firms tend to have between 30% and 50%, and firms in Korea and Mexico average far fewer women on the board.

Canadian firms, meanwhile, have a comparatively tighter range of values than their developed counterparts, with all boards having at least one female member, but none exceeding 50%.

S&P ESG Indices

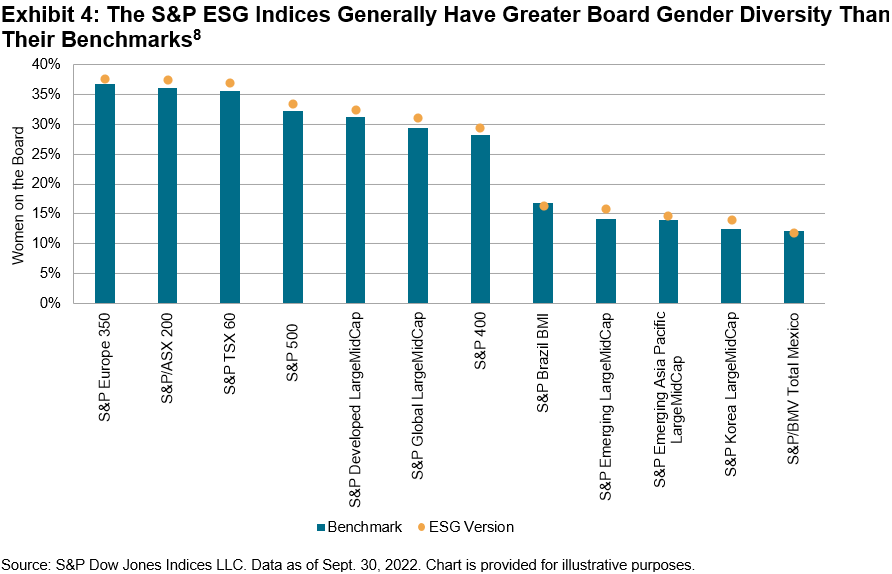

How could indices help those who are interested in companies with greater board gender diversity? Exhibit 4 illustrates the impact that the S&P DJI ESG Scores have within the S&P ESG Index Series to help improve the board gender diversity of constituents relative to the underlying index.

On average, for the majority of the indices studied here, the ESG version exhibited a greater percentage of women on the board than its benchmark, with only the Mexico- and Brazil-based indices as the exceptions.

S&P DJI ESG Scores

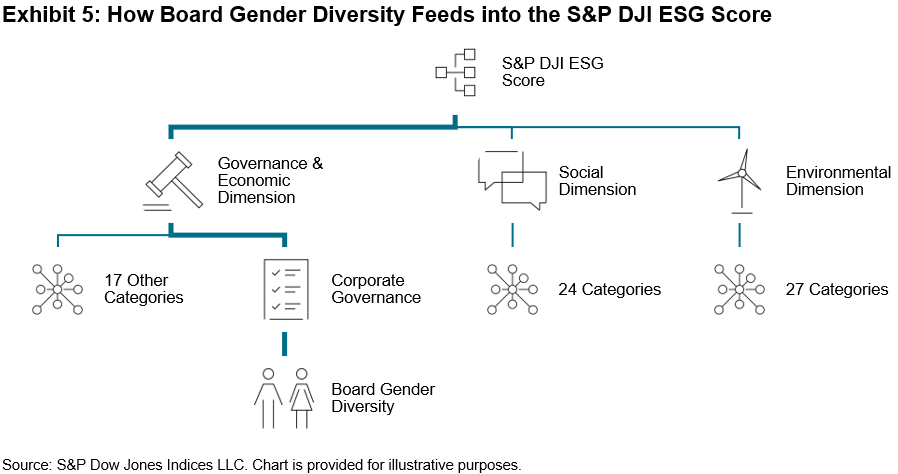

Board Gender Diversity forms a part of the Corporate Governance Score, a component of the broader S&P Governance and Economic Dimension Score – the “G” in the S&P DJI ESG Score,9 as reflected in Exhibit 5.

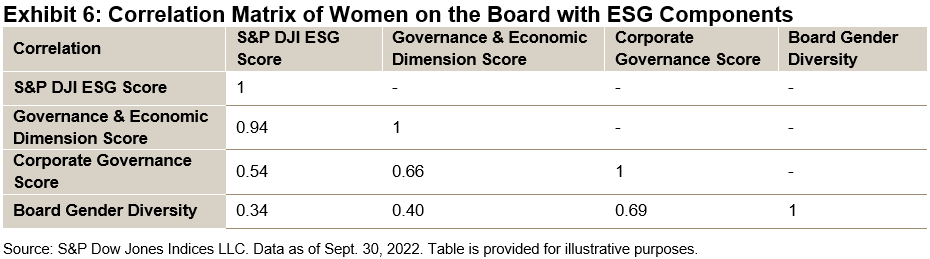

Exhibit 6 demonstrates the influence that women on boards of directors can have on each dimension of a firm’s S&P DJI ESG Score. Even at the overall ESG score level, board gender diversity still plays a part in a company’s overall sustainability rating.

1 FCA Report on the impact of diversity and inclusion in the workplace

2 The study “Corporate Governance, Board Diversity, and Firm Value” examined Fortune 1000 firms and found a significant positive relationship between the fraction of women or minorities on the board and firm value. Carter, David A., Simkins, Betty J. and Simpson, W. Gary, “Corporate Governance, Board Diversity, and Firm Performance,” March 2002.

3 Please refer to Commission Delegated Regulation (EU) 2022/1288 for a complete list of principal adverse impacts of investment decisions on sustainability factors. Financial market participants are required to disclose how they consider principal adverse impacts of their investment decisions on sustainability factors. Assessing principal adverse impacts of investment decisions on sustainability factors is also linked to the principle of “Do no significant harm.”

5 Visit www.spglobal.com/ for more information.

6 French law proposal No.4000: Proposition de loi nº 4000 visant à accélérer l’égalité économique et professionnelle

7 Press release on an EU directive to strengthen gender equality on boards: Member states adopt a general approach on an EU directive aiming to strengthen gender equality on corporate boards – French Presidency of the Council of the European Union 2022

8 The S&P ESG Index Series does not have an objective of selecting constituents with greater gender board diversity. However, board gender diversity is a component of the ESG scoring assessment.

9 For more information on the construction of our S&P DJI ESG Scores, please see the methodology.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment